Should Investors Brexit The Stock Market?

The long term economic and cultural fallout over Brexit is still very much up in the air. What is crystal clear, however, is that investors, economists, and market pundits overreacted (again) to the news of Britain’s departure from the European Union.

Stock markets took a sharp decline late last week and investors were treated to headlines such as; 5 things investors need to know after Brexit, post-Brexit market strategies Canadian investors should know now, why Brexit could take 10 years (and what investors should do), and the four Brexit outcomes smart investors need to prepare for.

But just a week later and markets are right back where they started before the Brexit vote even happened. Imagine that.

Stocks now higher than they were a week before Brexit. As you were.

— Morgan Housel (@TMFHousel) June 30, 2016

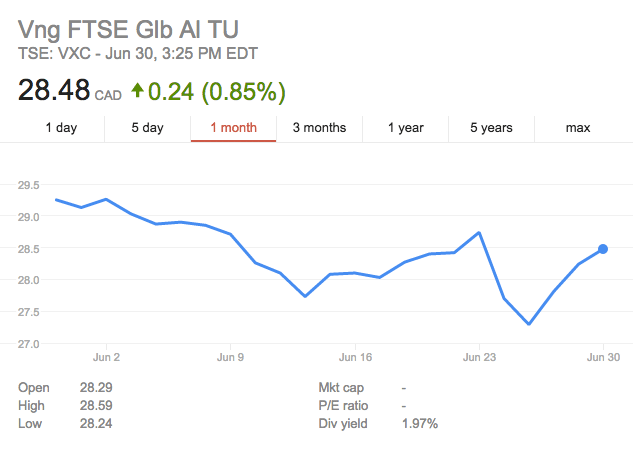

Indeed, when you look at the 1-month chart for Vanguard’s All World ex Canada ETF (VXC) – which holds over 8,000 stocks from around the globe – you’ll see a big drop last week followed by a steady path higher until markets closed Thursday.

I maintain that when faced with the latest ‘shocking’ world event or market turmoil investors would be better off taking a week-long nap instead of acting on the advice of pundits and ‘smart money’. The smart move is to do nothing except stick to your plan.

(And, yes, that includes advice about ‘buying on the dip’. Investors don’t need another reason to make emotional decisions or to become more active with their portfolios).

Buying on a market dip can be good advice, but dips happen all the time. How do you decide when it’s time to buy, and where do you get the money to make these bargain contributions?

Take a look at the 5-year chart for VXC. The Brexit sell-off is barely a blip on the radar, and certainly not the biggest drop in the last five years.

Final thoughts on Brexit

We haven’t scratched the surface of Brexit hot-takes this year. My take is simple: Ignore the noise and stick to your plan. Keep your costs low, broadly diversify across the globe, pick the right mix of stocks and bonds based on your age and risk tolerance, make regular contributions, and rebalance periodically.

Related: Is my two-ETF portfolio too simple?

Notice that none of this advice includes reacting to short-term market moves or Jim Cramer yelling about something on Mad Money. It requires something much harder for investors, and that’s the discipline to do nothing when everyone is screaming at you to do something.

Everyone is a buy and hold investor, until things get rough. I agree that there is so much noise out there, with so many opinions, it is sometimes unbearable.

I agree that the best thing to do is to essentially do very little. Your portfolio is like a bar of soap – the more you handle it, the smaller it gets.

I’ve always been surprised that people sell their stocks when prices drop. It literally doesn’t make any sense, which is frustrating because they teach us in economics that “people behave rationally”.

I like steak, so I’m going to use steak as an example. Let’s say I buy a steak for $10 one day, and then a week later it’s on sale for $5. Am I going to return the steak I purchased because the price dropped? Hell no – I’m going to buy some more steak!