Many people are saying that since all stock markets went down in 2007 – 2009, international diversification doesn’t work anymore. How is it supposed to help you when everything is falling apart? Does it even work? Is it worth the trouble? I’ll show you a few examples from recent years so you can see for yourself.

Related: How I turned $100 into a six-figure portfolio

Do All Markets Crash Together?

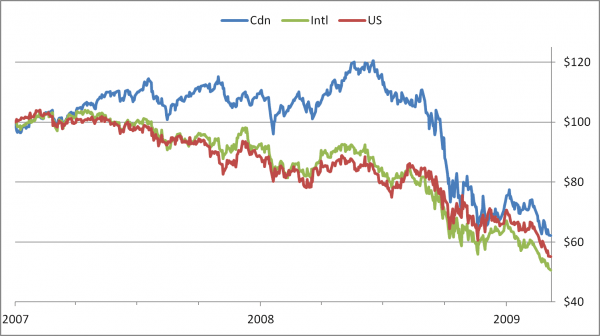

Take a look at what Canadian investors saw if they invested $100 in three major stock indexes at the start of 2007:

You can see that diversification was not dead. The markets behaved differently. It’s true that US and international markets followed each other down step for step. But the Canadian market actually rose for over a year and a half after the others passed their peak. That doesn’t mean the Canadian market is always the safest — it just happened to do a little better this time.

Related: Market efficiency: A glaring oversight in passive strategies

A disciplined investor with a rebalancing plan could have taken advantage of this to sell some Canadian stocks and buy others cheaply. Even without rebalancing the portfolio losses would be more limited at first because the Canadian market would hold it up and limit the worst effects of the crash.

Diversification protected portfolios during the crash and created opportunities even in the worst of times.

What Happened After the Crash?

Here’s what each market did if you invested $100 on March 9 2009, when they all reached the bottom at the same time:

This time the differences are even bigger. Each market takes turns accelerating and decelerating.

Diversifying worked here too. At almost any time over the last 6 years, at least one market was doing well. Once again this created opportunities for rebalancing and protected investors from losses.

When Does Diversification Fail?

If you paid close attention you’ll notice one way that diversification didn’t work. For 6 months around the end of 2008 all three indexes were falling to similar levels relative to the start of 2007.

Related: How behavioural biases kept me from becoming an indexer

Even more surprisingly they all reached the bottom on the exact same day. If things like this happened all the time then diversifying your portfolio would be a waste of time.

But the important lesson here is how exceptional these events were. It wasn’t rational connections between markets that made them stop falling on the same day. The real reason is because that was the day when investor panic reached its peak around the world and everything was being sold whether it was good or bad.

An unusual situation like this tells us a lot. It was only when people thought the world was ending that markets started to behave the same and diversification started to break down. As soon as that fear passed it started working again.

Any time we don’t have a worldwide panic where investors expect the financial system to collapse any day, you know that each market will perform differently and betting your whole portfolio on one market is too risky.

Why I Diversify

Diversified investors will be protected from the worst surprises. That makes it easier to take advantage of opportunities. And they do all of this without having to predict economic growth or quantitative easing. They will be prepared for anything, at any time.

Related: Why investors should embrace simple solutions

There may be rare occasions where diversification does not work perfectly. But I’m not going to throw away the idea because it “only” works 99% of the time!

In these examples I only looked at three major stock market indexes. If you diversify to other types of assets like bonds and REITs then you get even more protection. Bonds kept making money through the crash and recovery in the stock market. Canadian REITs crashed in 2008 but then had a great run for the next four years.

For another example that includes more asset classes take a look at the chart here. Notice how each market bounces around from best to worst with no pattern. Some of them literally go from best to worst in one year. I’m not going to bet my portfolio on the idea that I can guess where they will end up next year.

But that’s ok because no matter what happens I can take advantage of it thanks to a diversified portfolio. That’s why the Canadian stock market is only a small part of my portfolio. And it’s why you shouldn’t cut important asset classes out of your portfolio just because they haven’t done well for the last few years or the media is saying they’re in trouble (usually when it’s too late).

Related: How to get started with an index portfolio

Diversifying your investments will always be important. In the past Canadian investors were restricted in what they could put in their RRSPs but now there is nothing holding us back except our own decisions.

Richard is an investor who teaches other Canadians how to build a safe diversified portfolio at Master Your Portfolio.