Charitable giving is often an important part of a sound financial plan. In fact, philanthropy is one of the top four characteristics of wealthy people (the others are – spending wisely, investing for the future, and having multiple streams of income).

Many people have a cause they care deeply about – specific charities, research organizations, educational institutions, amateur athletics, animal shelters, etc. Charitable giving is a great way to make a difference.

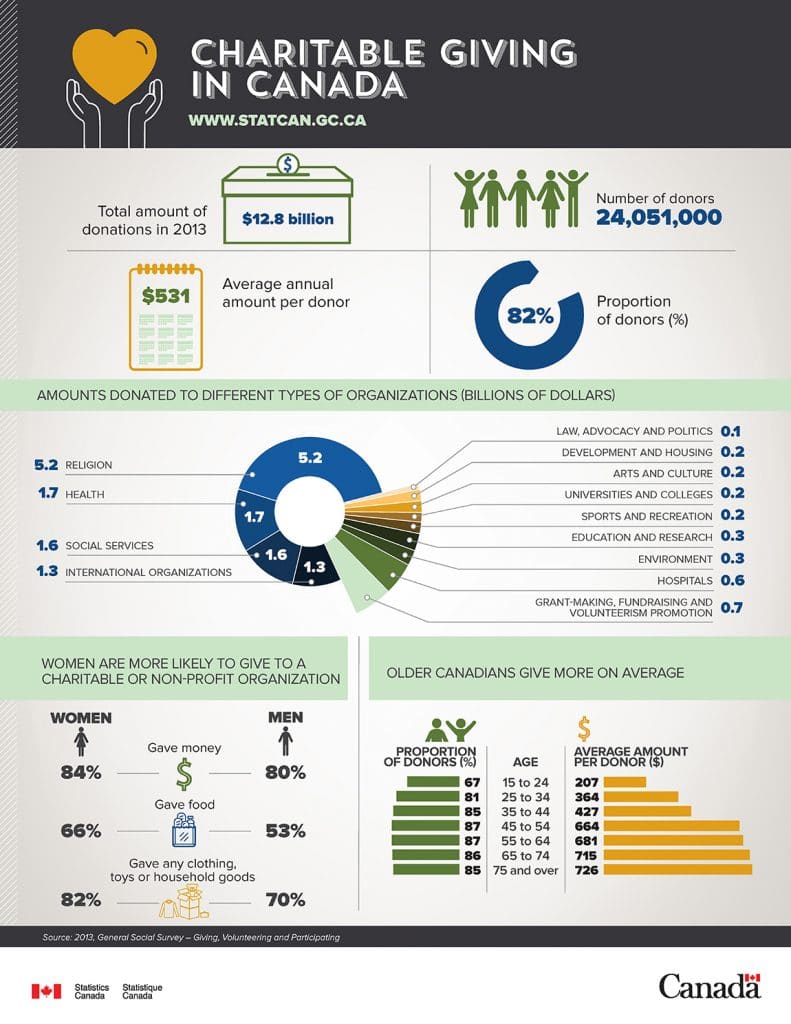

Charitable Giving in Canada

Giving can often be a challenge when money is tight. But, philanthropy is not just about giving money. You can give away unwanted items from around your house. Many people give goods such as toys, clothing, furniture, and food. In general, don’t expect a tax receipt for these donations. You may, however, be able to get a receipt for more valuable items.

People often drop a few coins into a collection jar at the cash register, or buy cookies, chocolate covered almonds or various other items as part of a fundraiser.

Volunteering is another form of donation. According to an Ipsos Reid survey, 25% of Canadians say they volunteer at least four hours a month.

Tax advantages

Donations to a registered charity are eligible for both federal and provincial tax credits for up to 75% of your net income for the year.

The federal tax credit is 15% for the first $200 and 29% for donations over $200. Provincial tax credits vary by province. The credit can be claimed by either spouse, or can be split. It can also be delayed and claimed in any of the five years following the one in which you donated.

A number of tax incentives have been introduced to encourage giving:

- There is a new high-rate for the federal tax credit of 33% for taxable income over $220,000 in 2016, which applies to donations made in 2016 or later.

- First time donors can claim an additional 25% “super tax credit” on the first $1,000 they donate, which supplements the usual tax credit. Only donations of money qualify. This credit is temporary and will not be available after 2017.

- There can be significant advantages to donating marketable securities as opposed to cash. In this case, the CRA will not tax capital gains.

Planned giving

The eligible donation for tax credits is 100% of net income in the year of death and the preceding year and is claimed on the final return.

Related: Leave a legacy before the will is read

Donations can be bequeathed in a will, or a person could designate a qualified charity as the beneficiary of an RRSP, RRIF, TFSA, or life insurance policy.

Final thoughts

There are a lot of good reasons to make donations to charity, but the simple fact is that giving makes you feel good. Many studies have shown that charitable giving creates greater satisfaction and happiness.

What do you think?