Retirees Can Sell Most Of Their Stocks As They Approach Retirement

Retirement can be a scary time for retirees who have considerable and even modest portfolios. We want to protect those assets. And certainly the risk tolerance level for most retirees will drop considerably. And that risk tolerance level will often drive the bus with respect to your allocation to bonds and cash and other risk management techniques you might put to work.

While the order of returns does not matter considerably in the accumulation stage, when we enter retirement we face that sequence of returns risk. Years of poor stock market returns early in the retirement funding stage can permanently impair your portfolio and your retirement. And in fact the risk to retirees begins well before that retirement start date. On Cut The Crap Investing I wrote on that with You Should Protect Your Retirement Portfolio Long Before Your Retirement Start Date. Have a read of that article and you’ll see that the Retirement Risk Zone is typically qualified as 5 years before retirement and your first 5 years in retirement. We have to be careful as we approach retirement and in those first few years.

Can a near retiree almost completely de-risk the portfolio and sell a large percentage of their stocks? Sure, it may be emotionally pleasing, but with less stocks in hand it may slightly compromise late accumulation stage portfolio growth. That said, the most important part of it all might be that comfort level and that stress reduction event that comes with greatly lessening that stock component. And let’s face it, some near retirees who’ve planned well and who are lucky enough to have a generous defined pension plan might not need much or any inflation-beating portfolio growth. We’re all snowflakes when it comes to retirement funding, we are all entirely unique in our needs and our situation.

But let’s look at a scenario where a retiree does need their personal portfolio to work very hard; they are counting on that portfolio to deliver a generous component of their ongoing retirement funding needs. It’s time for those hard-earned monies to work for them. On the ‘rule of thumb’ spend rate for portfolios see my Boomer and Echo guest post The 4% Rule: Is There A New Normal for Retirees? You’ll read that historically a retiree with a sensible mix of stocks and bonds can spend at the rate 4%-4.5% of the portfolio value each year, with an adjustment or increase each year to compensate for inflation.

Given that we want some growth in the later stages of accumulation and we need that growth component to potentially earn returns above that 5% range, we do not want to abandon that Balanced Portfolio model, we still need those stocks.

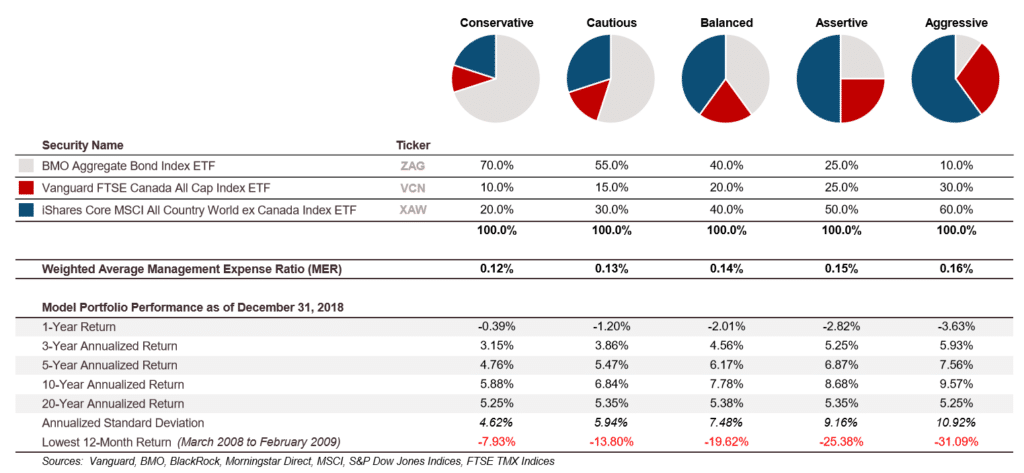

To manage the risks, we want to keep that nice mix of Canadian, US and perhaps International stocks to work in concert with that bond component. And the most conservative range that we might move to is 80% to 70% fixed income. That’s a very conservative mix of course.

The returns might be muted but you might be able to eek out 3% income from your fixed income component (a mix of bonds and GICs) and perhaps if stock markets continue to deliver 9-10% annual you must see a returns breakdown such as this:

- 70% of portfolio @ 3% = 2.1%

- 30% of portfolio @ 10% = 3%

That might give you a return in the 5% annual range if the stock market ‘rally’ continues and the bond market does not come under pressure.

Now it’s time to dollar cost average back into stocks

OK, so you’ve largely de-risked but you want and need your portfolio to work as hard as possible. When you hit that retirement date you can begin to increase your stock exposure over time. You might become a retiree stock ‘dollar cost averager’. Yup, you’ll employ the tried and true technique that many of us employ in the accumulation stage – you’re going to add to your stocks on a regular schedule.

You’ve de-risked and then you begin and continue to add risk. They call this an equity glide path. And this has been described and studied in detail by retirement funding rockstars Wade Pfau and Michael Kitces. Here’s their White Paper on the strategy.

That paper demonstrates that the bond percentage should equal your age mantra has no basis in math. In fact a very conservative de-risking with an eventual equity glide path even beats the typical static allocation approach of a classic 60/40 Balanced Portfolio. From that paper:

“Declining equity glide paths do not necessarily help support retirement success. Static allocations generally fare worse than more conservative starting allocations that rise in equity exposure throughout retirement. Depending on the underlying assumptions, the optimal starting equity exposures are generally around 20 percent to 40 percent and finish at around 40 percent to 80 percent.”

When should you de-risk?

Many financial planners would suggest that you ‘risk-down’ 5 to several years before you need to start harvesting those assets. That could mean many years of a conservative portfolio and the more modest returns that may come with the approach. That said, according to the Canadian Couch Potato site, the returns of the more conservative portfolios are very solid, historically.

If you embraced the de-risking equity glide approach, you might move to that range of 70% fixed income 5 years or more before your retirement date and the date that you need to start harvesting those assets. When you hit that retirement date you would then start adding more stock exposure. The examples used by Pfau and Kitces suggest a very gradual re-allocation to stocks even over a 30 year period. I’d suggest a quicker move to more stocks, perhaps over a 10 year or 15 year period. We typically move through market corrections every several years; using a 10 or 15 year timeline should present a market correction and allow you to grab those shares as they go on sale. This would be a situation where the retiree is taking advantage of lower prices for stock assets, just as would an investor who is in the accumulation stage.

With the de-risking strategy, we might be able to take on less risk and generate better retirement funding results. The study also suggests:

“In scenarios where equity returns are good early on, the retiree is so far ahead it doesn’t matter (relative to achieving the original goal). Rising equity glide paths create a “heads you win, tails you don’t lose” outcome in securing a starting goal. Of course, retirees who are far ahead may choose to decrease their equity exposure later simply because they have a significant amount of newfound wealth.”

Check-in with a retirement specialist

Keep in mind that de-risking and selling stocks creates tax consequences in your taxable accounts. And to discover the optimal order of asset harvesting (pensions to annuities to RRIF to TFSA to taxable) it may be more than beneficial to check in with an advice-only planner. Retirement funding is more than tricky business, there are many moving parts, and strategies and spending plans can change over time. For more on that please have a read of my review of Retirement Income for Life: Spending More Without Getting More.

Thanks for reading, and thanks to Robb for having me back on Boomer and Echo while he’s enjoying his fabulous trip. Leave a message, would you now consider de-risking for retirement? I’ll check in and answer any questions.

Great post Dale/Robb!

I’m a bit of a fan of a 3-year GIC ladder, plus a year in cash to provide downside protection of people in retirement. I think that is what I will do when the time comes to retire as it will allow me time to get through a ‘Black Swan’ event or just a poor period of stock market returns.

What do you guys think? How does it mesh (if at all) with the equity glide path?

Steve

Hi Steve and thanks. I would think that it would still work with GICs and cash, the idea is that you have de-risked. The main thrust of the strategy is that adding of risk and potential returns moving forward.

That said, we do lose that inverse relationship (potential) of bonds to stocks when we select GICs over bonds. Perhaps some bond exposure would be in order when the stock allocation hits a more generous level.

But I understand the attraction to GICs they pay greater income these days compared to a core bond fund.

Dale

one comment on GICS is that while they would likely equal a bond portfolio they too are at risk. While the interest is guaranteed the financial solvency is not. Most states provide little recourse if an insurance company fails. With that in mind you want to make sure the company is highly rated and if it it likely pays less interest. If I were in your situation I would recommend Vanguard VBILX intermediate bond fund I thin you would be better off. I am 73 and was fortunate to be 65% in bonds during the GFC and as a result dropped only 6%

Hi Dale, I’m retired with a pension, have $150,000 in RRSP, won’t need the money for about 10yrs. I was thinking of putting $100,000 in Vanguard All Equity ETF (VEQT) and the rest in a GIC at Motusbank 5yr. (3.25%). Any advice would be greatly appreciated. Thx. Sidd

Hey Sidd, sorry for the delay on this. It’s tough to make any reco’s in the dark of course. If you have a 10 year time horizon that Balanced Growth model should be appropriate, and even with using GICs instead of bonds.

You may need a different plan of course when it comes to the harvesting stage. I like covering sequence of returns risk with some bonds. Again, Balanced Growth can be a sweet spot.

Also, have you checked that not spending your RRSP is the most tax efficient order of asset harvesting? I am a big fan of getting advice on retirement funding.

Thanks, Dale

I am retired just last week and have no pension besides C.P.P., OAS which is $17,000 a year. Our RRSP’s came due and I never had money in mutual funds or other investments that fluctuate.

We have $700,000 in RRSP’s and $140,000 in TFSA’s that on August-5-2019, they are just sitting there and it seems that GIC’s at Ontario credit unions and Canadian banks I could get around 2.9% to 3.25% on average maybe 3.0% spread out. This money will all be compounded for 5 or 7 years as my wife still works at her full-time job making $40,000 a year. We have other shorter term money in regular, non-registered high interest savings accounts, cashable GIC’s of $155,000 for reserve and financial cushion.

We have no mortgage or any debts and we currently need roughly $2,000 a month for all our living expenses so our reserve fund would last 6 years or more without touching any other money and not counting my current C.P.P., OAS pensions and my wife’s C.P.P, OAS in the future.

If my wife retired tomorrow she would get C.P.P. of $725 a month but would have to wait 3 more years for OAS but she would get a $40,000 retiring allowance/severance package. We think we should put some money maybe 25% to 35% of our total investments in conservative, blue chip stock market type investments like banks and utilities but they have had such a run up and we are afraid of a possible 15% to 25% drop in the next few months.

I don’t want to end up having to go back to work because of a shortfall of maybe $100,000 to $200,000 down the road. Are we being too conservative and cautious with our money?