Weekend Reading: Stock Market Volatility Edition

The month of October was not kind to investors. A volatile stock market erased all of 2018’s gains and then some. My own portfolio plunged 5.72 percent in October after being up 4.73 percent from January to September. Time to panic? Not a chance.

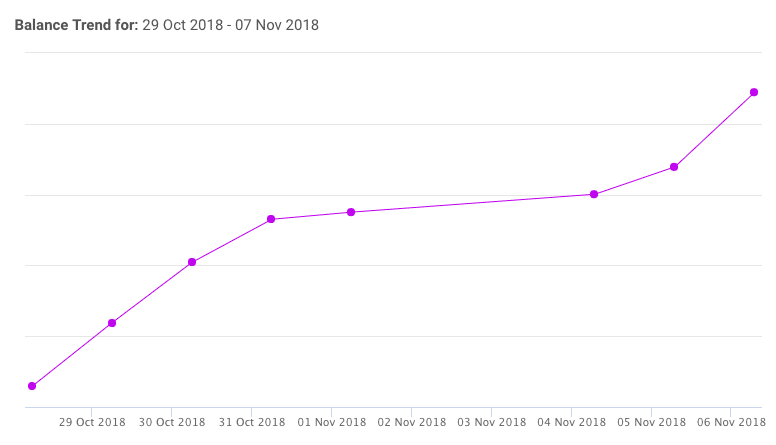

In yet another example of why it’s best to ignore the headlines and stick with your plan (or why I say investors would be better off taking a Rip Van Winkle like 20 year nap) the market quickly returned all of those losses in just eight trading days.

Investors who panicked at the bottom of that dip locked in losses of nearly six percent, while investors who rode out the stock market volatility saw their portfolios get back to even.

A chart showing market returns over a few days, weeks, or even months can look like a stomach-churning rollercoaster. But as the months turn to years, and the years turn to decades, those returns smooth out and trend upwards. Yesterday’s headlines become ancient history, and ‘worst days ever‘ for the stock market become tiny blips on the radar over the long term.

The point is not to panic when markets get rocky. If your investing plan has a long term focus then it’s best to ignore the daily headlines and stick to your plan.

Here’s the power of ignoring the day-to-day market fluctuations and headlines, and sticking to your investing plan. Portfolio balance as of Oct 8: $231k. Balance as of Nov 8: $232k. Ignored in between: a low of $214k. pic.twitter.com/lBl4Xna9Va

— Boomer and Echo (@BoomerandEcho) November 8, 2018

This Week’s Recap:

On Wednesday I wrote about why past performance is not a good predictor of future investment returns. In fact, costs are a better predictor of returns.

In light of CBC’s recent coverage of the pitfalls of credit card insurance I looked at four big rip-offs that consumers should avoid.

Promo of the Week:

I’ve highlighted this before but if you have some upcoming spend planned for the holidays then this is an excellent opportunity to earn up to $200 cash back on your holiday spending.

That’s right, when you apply and get approved for the Scotia Momentum Visa Infinite Card you’ll earn an incredible 10 percent back on everyday purchases for the first three months, up to $2,000 in total purchases. Plus, your first-year annual fee is waived. This is a limited time offer so make sure to take advantage of it soon.

Weekend Reading:

The surprising retirement goal that 41 percent of Americans have? It’s to own a vacation home.

Will baby boomers destroy the stock market as they retire en masse? Ben Carlson examines some interesting trends and time lapses.

How Shane Parrish, a former Canadian spy, helps Wall Street mavens think smarter:

“Every world-class investor is questioning right now how they can improve,” he said. “So, in a machine-driven age where everything is driven by speed, perhaps the edge is judgment, time and perspective.”

Jonathan Chevreau highlights three online programs to help plan out your finances in retirement.

Personal finance 101: Some Canadian universities are offering practical personal finance courses.

Studies show that as we age, our brain becomes less able to detect fraud. Here’s a thoughtful post on how to safeguard your finances and protect your retirement savings.

Jason Heath explains how to avoid RRSP tax on your estate when you die.

Michael James has an excellent post explaining the value of delaying CPP and OAS until age 70. More people need to hear this message.

Last week I shared the “new rules” of personal finance. Million Dollar Journey blogger Frugal Trader looks at how these rules apply to his thinking on personal finance matters.

Dale Roberts explains the many lessons learned from a chart detailing the returns history of Tangerine’s five investment portfolios.

Finally, here’s Michael James again on whether it makes sense to hold U.S.-listed ETFs to save on MER and foreign withholding taxes. I’ve been thinking a lot about this lately and how it applies to my own two-ETF portfolio, in which I’ve chosen simplicity over cost savings. I’ll soon be at the point where the pendulum will swing towards cost savings.

Have a great weekend, everyone!

Very good article

Keep up the great wok

Love seeing them in my inbox

Hi Dan, thanks so much for the kind words!