Weekend Reading: 2020 Portfolio Returns Edition

Mr. Market is the imaginary investor described in Benjamin Graham's book, The Intelligent Investor. Driven by fear, greed, or apathy on any given day, Mr. Market invests according to his mood rather than rational analysis. It's fair to describe Mr. Market as manic-depressive, randomly swinging from optimism to pessimism.

Last year's wild stock market ride could also fit that narrative. From all-time highs in February, to the fastest and deepest market crash in March, to the just-as-speedy recovery in the spring, 2020 ended up delivering shockingly high returns for those with the patience and discipline to stay in their seats.

Here's a look at the performance of some balanced and growth portfolios in 2020:

- Vanguard's balanced (60/40) ETF portfolio (represented by VBAL) posted returns of 10.24% for the year.

- Vanguard's growth (80/20) ETF portfolio (represented by VGRO) posted returns of 10.89% for the year.

- Vanguard's all-equity (100/0) ETF portfolio (represented by VEQT) posted returns of 11.29% for the year.

- Horizons balanced (70/30) TRI ETF portfolio (represented by HBAL) posted returns of 14.86% for the year.

- Horizons growth (100/0) TRI ETF portfolio (represented by HGRO) posted returns of 17.29% for the year.

Vanguard ETFs are weighted by market capitalization, with the exception of their allocation to Canadian equities.

Horizons TRI ETFs take a different approach, allocating about half as much to Canadian equities while also including a 20% allocation to technology through the NASDAQ 100. That asset mix led to their funds' outperformance as technology stocks soared in 2020.

Those are time-weighted returns, which don't take into account the effect of an investor's contributions or withdrawals. A money-weighted return includes the impact of any inflows or outflows from the portfolio.

My own portfolio saw the following ‘money-weighted' investment returns:

- RRSP (100% VEQT at WS Trade) – 10.24% (<– as of Jan 16, 2020)

- TFSA (100% VEQT at WS Trade) – 12.10% (<– large deposit April 25, 2020)

- LIRA (100% VEQT at TD Direct) – 22.53% (<– as of May 1, 2020)

- RESP (100% equity TD e-Series) – 10.69% (<– contribute $500/month)

- Corporate (100% VEQT at Questrade) – 9.04% (<– as of July 3, 2020)

- Wife's RRSP (80/20 at Wealthsimple Invest) – 8.50%

As you can see, the timing of your contributions can have a significant impact on your portfolio returns.

Also, if you're taking a more active approach with your investments, it's important to compare them to a risk-appropriate benchmark (like the index-tracking portfolios above) to see whether your active decisions are adding any value over a low cost, globally diversified, passive indexing approach.

How well did your investments perform this year? Were you able to ride out the volatile markets and stick to your plan?

This Week's Recap:

My beloved Cleveland Browns made the NFL playoffs for the first time since 2002. I may have shed a tear or two. I'll be cheering them on against the Steelers this Sunday night.

At the end of the year I shared my latest net worth update where I reached the million dollar milestone. Onward and upward.

Earlier this week I updated and re-published my TFSA overview and contribution limit guide.

I've also updated and re-published my guide to CPP payments and how much you will receive from Canada Pension Plan.

Promo of the Week:

If you find your investment returns lacking and you're ready to make a switch to low cost index investing, here's what I'd recommend:

Wealthsimple Invest (robo advisor): Get a $50 bonus when you open and fund your first Wealthsimple account (min. $500 initial deposit).

- Here's exactly how to transfer your RRSP or TFSA to Wealthsimple.

Wealthsimple Trade (self-directed): Canada’s first and only zero-commission trading platform where investors can trade stocks and ETFs for free in an RRSP, TFSA, or non-registered account. Sign up for Wealthsimple Trade today and get a $10 cash bonus.

- Read my Wealthsimple Trade review.

Questrade (self-directed): For most robust investing needs, including for LIRAs, Margin, and Corporate accounts, Questrade is still the king of low-cost investing in Canada. You can purchase ETFs for free and trade stocks for as little as $4.95. Take your savings further with a registered account at Questrade.

- Here's exactly how to transfer your RRSP or TFSA to Questrade.

Weekend Reading:

Time to switch rewards credit cards? Our friends at Credit Card Genius share 2021's best credit cards in Canada.

Erica Alini looks at when you are actually allowed to travel (and how will the government check?).

Rob Carrick and Tom Drake had a great conversation to recap the year on the Maple Money Show.

Morningstar looks at the stocks that soared in the pandemic.

The price of Bitcoin has exploded in recent months, reminiscent of its last run-up at the end of 2017. Ben Carlson explains why Bitcoin is a call option on human nature:

“I laugh when I hear people talk about the “fundamentals” of bitcoin. Fundamentals?

There are no fundamentals. Trust, faith, hope, technology and human nature are the only true fundamentals of cryptocurrencies.”

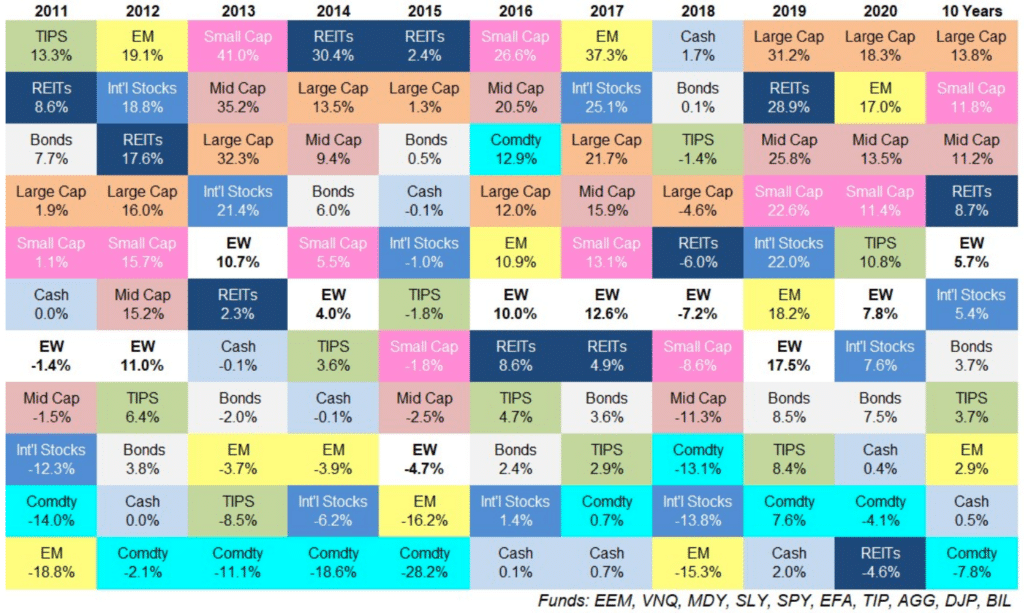

Ben Carlson also updated his favourite performance chart for 2020. The periodic table of investment returns:

Another great year for large-cap stocks, which have led the way for the second consecutive year (and for the past decade). Commodities have been the biggest loser over the last 10 years.

Congratulations to Kerry Taylor for launching SquawkfoxTV and The Cash and Kerry Podcast. Her first episode was dynamite, with world renowned behavioural economist Dan Ariely.

The Get Smarter About Money website shares an important message about where to find information about your annual investment fees.

My Own Advisor Mark Seed interviews Mark Noble from Horizons ETFs about their tax efficient TRI ETFs.

Patrick Sojka says this very popular Canadian travel rewards credit card is due for a major overhaul.

The Globe and Mail reports how the COVID-19 pandemic has fuelled a boom in Canadian stock promotion scams (subscribers):

“Since the global outbreak of COVID-19 last winter, there has been a boom in pump and dump scams, in which shady promoters use any means necessary to push up the price of a company’s shares, then sell their stakes at huge profits just before the stock collapses. Those promoters often focus on a hot sector, be it mining, bitcoin, cannabis – and now, bogus coronavirus therapies.”

Finally, Michael Kitces looks into Monte Carlo analysis and explains why a 50% probability of success is actually a viable Monte Carlo retirement projection.

Have a great weekend, everyone!

Self managed portfolio up 44% in 2020, partly due to owning AAPL, MSFT, and FB. Sold half of the growth stocks mid year and bought Cdn banks, thinking mostly of dividend income; they have since increased 20%.

Annualized return on equities of 29% since I started four years ago.

Cash held in Tangerine HIS currently earning 1.6%

Just checked the Tangerine website and this account appears to be currently paying a pathetic 0.10% (perhaps you are referring to a 1.6% promo offer) – switched to Peoples Trust years ago for this reason.

Hi Joel, yes – Tangerine is notorious for its short-term promo interest rate offers. Same reason I switched to EQ Bank for the everyday no gimmick rate.

For anyone looking for a short-term promo here’s the landing page for Tangerine’s offer: https://www.tangerine.ca/en/landing-page/special-offer

I moved back the money I owe to CRA in April so I can get that high interest for now and have left the rest in my wealthsimple account.

I call Tangerine a few days before the higher rate expires, ask if they will give me a better rate than current basic rate. For the last 2 or 3 years they always have, sometimes for 5 or 6 months, other times for a year. Last call was in Dec, now have 1.6% until May, better than EQ’s 1.5%. I just tell Tangerine I will move to EQ if they won’t give me a better rate, I have already set up EQ accounts.

Thanks for the article. Would an investment in Wealthsimple Trade be protected by CDIC?

Hi Ritchie, Canadians have two different levels of protection for their money.

1. CDIC is for savings deposits (chequing, savings, GICs). Each account is protected up to the $100k limit.

2. CIPF is for investment accounts (RRSP, TFSA, non-registered) and the coverage limits are up to $1M combined across these accounts.

Note that these protections are in place in case the member financial institution becomes insolvent. In the case of CIPF, it does not cover losses resulting from a drop in value of your investments, for example.

Wealthsimple is a registered portfolio manager in Canada and your account is protected up to the $1M coverage limits provided by CIPF.