Weekend Reading: 2024 TFSA Limit, OAS Clawback, and More

The federal government uses the inflation data for the 12-month period between October 1 to September 30 to determine a number of figures for the following calendar year. September’s inflation rate was announced earlier this month, so we now have the entire data set needed to calculate the indexing rate for 2024, which gives us a new TFSA limit, OAS clawback threshold, tax brackets, and more.

Thanks to Aaron Hector for doing the math to give us these important details.

The indexing rate for 2024 will be 4.7%. That’s down from 6.3% in 2023. If you are receiving a federal pension, expect your benefits to increase by 4.7% as of January 2024.

Note that the indexing rate for CPP is based on a different calculation (inflation data for the 12-moth period between November 1 to October 31), so the rate may be different. Last year’s CPP increase was 6.5% based on 2022 inflation data.

The TFSA contribution limit will increase to $7,000 (up from $6,500 in 2023). This marks the second consecutive increase in the annual limit. The TFSA lifetime limit for those eligible since 2009 will be $95,000.

The OAS clawback threshold will increase to $90,997 (up from $86,912 in 2023). That means those collecting OAS can earn up to $90,997 in taxable income in 2024 without fear of having to repay their benefits.

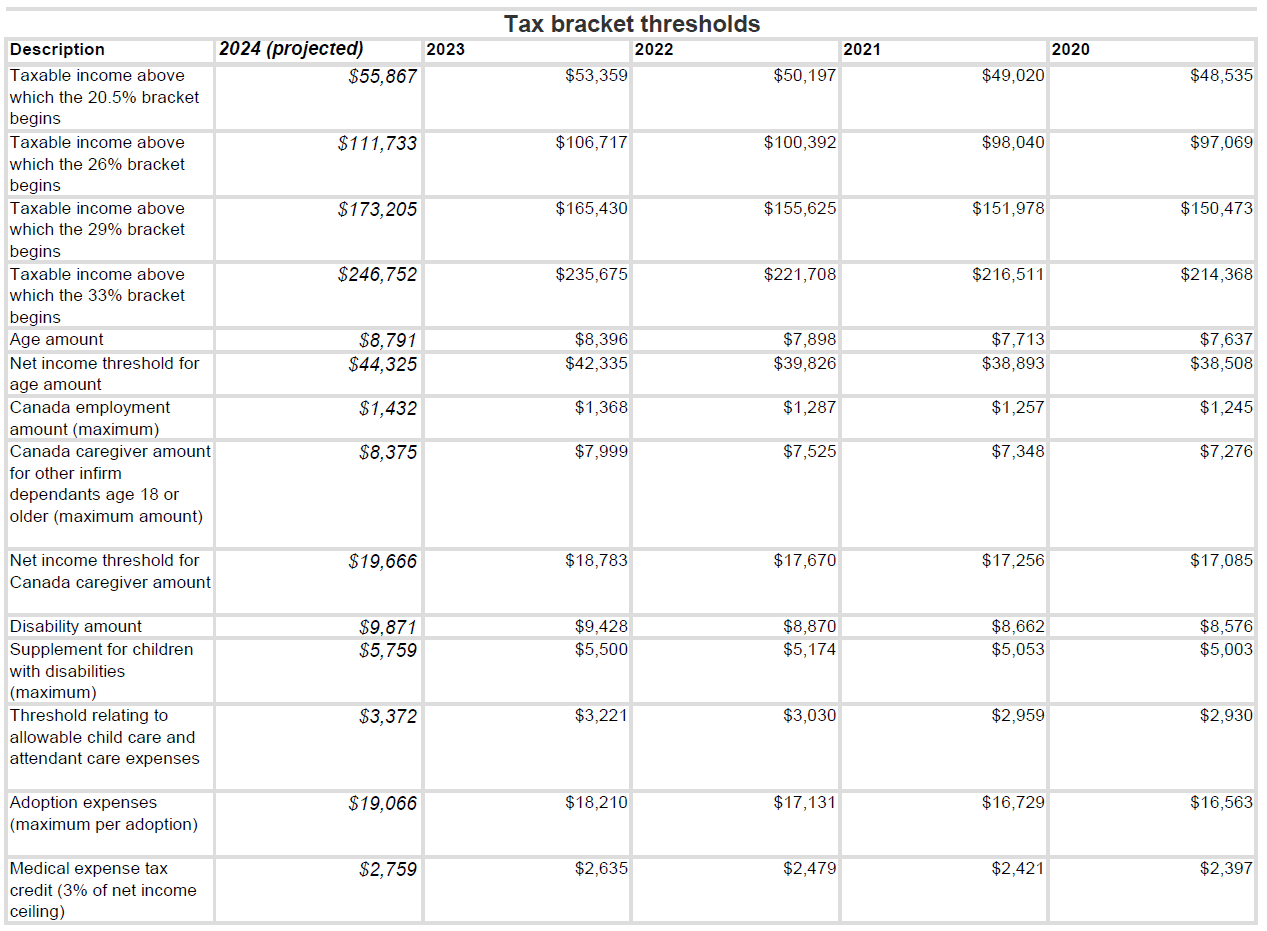

A host of tax bracket thresholds will be updated for 2024:

The year’s maximum pensionable earnings (YMPE), which is the maximum salary amount on which you need to contribute to the Canada Pension Plan, is increasing to $68,500 (up from $66,600).

Budgeting nerds like me can use these figure to update their spreadsheets and forecasts for 2024.

If you were planning to max out your TFSA next year, make sure to budget $7,000 instead of $6,500.

Of note for me and my wife, we aim to keep our taxable income at the top of 30.5% marginal tax bracket so we can safely increase our income (the amount we pay ourselves from our small business) by 4-5% next year.

The one small silver lining of higher inflation over the past two years is that our tax brackets and a bunch of other important figures are also indexed to inflation.

This Week’s Recap:

Earlier this month I updated my article on how to crush your RRSP contributions next year. It’s a reminder for those who contribute significantly to their RRSPs to use the T1213 form to request to reduce tax deductions at the source.

Despite the current interest rate environment I still come across many people who are interested in real estate investing as a source of passive income. Reality check: There’s nothing passive about owning a rental property, and with rates where they are right now the odds of your property being cash flow positive are vanishingly small.

Remember, you can’t go back in time and replicate the returns that your parents, friends, co-workers experienced over the past decade or more. Your starting point is now, in this current environment of sky-high real estate prices and higher interest rates. Adjust your expectations accordingly.

Who in their right mind is thinking right now, you know what – a couple of income properties might just be the ticket to financial freedom?

— Boomer and Echo (@BoomerandEcho) October 23, 2023

Promo of the Week:

A reminder if you want to up your credit card rewards game for better travel experiences then you should really be using American Express cards to maximize your points.

Even better if you can use American Express’s referral program to “activate your player 2” (e.g. your partner) to earn points faster. That’s what my wife and I have been doing over the past few years.

We use Aeroplan for our flights and Marriott Bonvoy for our hotel rewards. The best way to accumulate Aeroplan miles and Bonvoy points is to collect American Express Membership rewards points and then transfer the points to those respective programs.

Here’s our credit card line-up to get you started:

- The American Express Platinum card – Earn up to 100,000 Membership Rewards points.

- The American Express Aeroplan Reserve card – Earn up to Aeroplan points.

- The American Express Cobalt card – Earn up to 30,000 Membership Rewards points and 5x points on food and drink (this is my main every day credit card).

- The Marriott Bonvoy American Express card – Earn up to 55,000 Marriott Bonvoy points and a free night certificate.

And, for small business owners, even more lucrative rewards await:

- The Business Platinum Card from American Express – Earn up to 120,000 Membership Rewards points.

- The Marriott Bonvoy Business American Express card – Earn up 55,000 Marriott Bonvoy points and a free night certificate.

Happy travels!

Weekend Reading:

Overwhelmed by all the negative news? Here’s why you might need financial therapy.

Certified Financial Planner Shaun Maslyk explores what financial freedom means in Canada.

Anita Bruinsma writes about personal finance hogwash – five phrases you need to stop feeling bad about:

“The truth is that most people should be using traditional methods for achieving financial stability. Yes, it’s boring, yes, it takes time and yes, it takes sacrifice and self-discipline, but wealth and financial stability don’t come free and easy.”

If you knew when you were going to die and the money you would leave, what would you do differently?

Rising rates, inflation, and housing affordability aren’t the only reason early retirement plans don’t pan out.

Michael James on Money shares what experts get wrong about the 4% rule.

What you can expect from the Canada Pension Plan and why it won’t run dry anytime soon.

Advice-only planner Jason Evans explains the danger of using the CPP breakeven calculation.

Speaking of CPP, here’s a really informative Q&A on Alberta’s attempt to form its own pension plan (APP):

(🧵). In light of the major debate happening in Alberta, I thought I would try to put together a FAQ on a CPP/APP. As always, the answers here do not contain legal advice or personal views.#ableg #CPP

— Timothy Huyer (@tim4hire) October 27, 2023

Beating the stock market isn’t easy. So why do many Canadian investors act like it is? (subs).

Finally, in his latest Charting Retirement post Fred Vettese asks if dementia risk is part of your retirement plan. Some sobering statistics for those over 85 years old.

Have a great weekend, everyone!

Jason Evans makes a good point about the CPP breakeven calculation. I’ve tried to reframe it from “can you imagine dying before age X?” to “are you so certain you’ll die before age X that you’re willing to spend down all your savings before age X?”

Thanks Michael. Credit goes to Bonnie-Jeanne MacDonald for highlighting this issue. I’m just trying to spread the word so Canadians can better evaluate this important decision.

in 2022 below 50,197 is 15% , above is 20.5 %

2023 below 53,359 is 15%, above 20.5% is that right ???

Hi Wilbon, yes that’s right.

Did anybody calculate at what income level will OAP be entirely clawed back?

Hi Rob, it should be $149,311.62

Hi Robb, I have a couple of questions about credit card points:

Does the Amex Cobalt get you more points than the Platinum? I am curious why you have 2 Amex cards.

And do you have an alternative for places that don’t take Amex?

Hi Amrita, Cobalt does have a higher earn rate than Amex Platinum. I hold the Platinum card for the airport lounge access and because it automatically gives me Bonvoy gold elite status.

Yes, unfortunately you must keep a VISA or MC for those stores that don’t take Amex. I keep a TD Aeroplan VISA Infinite card (among a few others).

Thanks for the clear and concise information. I intend to drawdown RRSP funds over the next few years to even out the withdrawals before age 65, so your chart is very helpful. Question on the medical tax credits shown in the chart. How does this work?

Hi Robb, Great article.

1. Do you as a self employed individual contribute to the CPP and do you find that worth doing so (given it is x2 employer and employee parts for us SE)

2. Are you aware of CPP be commuted to a withdrawal amount like say a government DB pension plan? Assume someone decides to leave Canada and files an exit return with the CRA before age 50 can that be a reason to withdraw commuted CPP?

Rick

Reply in reference to: “Thanks to Aaron Hector for doing the math to give us these important details. The indexing rate for 2024 will be 4.7%. That’s down from 6.3% in 2023. If you are receiving a federal pension, expect your benefits to increase by 4.7% as of January 2024.”

I do my own calculations each year and get a January 1, 2024 PSSA pension indexation rate 4.8% which results from 4/5 rounding as opposed to truncating the 2nd significant decimal (i.e 4.77% becomes 4.8%, not 4.7%)

Hi Stephen, (Robb tagged me for comment)

The unrounded figure is 4.725……

Given I’m not sure where you are sourcing your numbers, I’ll refer you to a post I made and you can follow the math along for yourself.

https://x.com/AaronHectorCFP/status/1714354151214498302?s=20

Thanks!

Aaron

Sorry for the late reply… other personal buisiness interfered. I went back and checked my source data and my spreadsheet (especially for hidden entry errors which may not show up in formatted displays.) My data sources are Statistics Canada “The Daily – Consumer Price Index” for each reported month. This has been my source since retirement in 2015. I went back and checked all my entries for the 2024 indexation calculation as used by the Federal PSSA for Retirees, plus I confirmed the CPI 2022 of 148.8 giving a 2023 indexation of 6.3%. My spreadsheet calculations are essentially the same as Richard Viens describes below…

RESULT: my calculations show the Federal PSSA pension indexation for January 1, 2024 as 4.8%.

Treasury Board should be out with its analysis shortly… We may have to wait and see.

I totally agree with Stephen Bedingfield and my MS-Excel sheet has been 100% accurate for the last 10 years. It is all about the round up. Average of CPI for 2022 is 148.8 and for 2023 is 155.9. So (155.9 minus 148.8) divided by 148.8 multiply by 100 = 4.77150537….. therefore 4.8%

Hi Richard, here’s another article to support the 4.7% indexing next year (for what it’s worth): https://www.advisor.ca/tax/tax-news/inflation-to-trigger-another-rise-in-tfsa-limit/

Ontario Teachers Pension Plan is fully indexed for early retirees and the increase they just announced for 2024 is 4.8%.

Aaron, I will refer you this Canadian Government webpage that will show how they round up and calculate: https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/retired-members/rate-pension.html

Thanks Richard.

I am familiar with that website (if you look at the post on twitter I linked to above in my reply to Stephen, you will see a screen shot of the exact same page that you provided to me).

The issue here is you are rounding the figures when calculating the average for the year. Yes, I understand that on the website that you linked, they have rounded the figured down to 140.0 and 148.8 in the example that they provided to calculate the 2023 index rate. I believe that for illustration purposes, the website is keeping it simple and illustrating the data to one decimal point. If you were to read the Public Service Superannuation Act (PSSA) and the Supplementary Retirement Benefits Act I do not think you would find reference to this rounding anywhere.

The unrounded figures last year were 139.983… and 148.8417…. last year, it didn’t matter, you still end up with a 6.3% index.

This year, it does matter, with the result ending up with 4.8% (rounded) vs 4.7% unrounded.

You may find the math interesting for the index rate for the year 2020. The unrounded average for the year ending September 2018 was 132.716667 and for Sept 2019 was 135.283333. Applying the math to get the index rate results in 1.93%, which then works out to an index rate of 1.9%. However, if you take the rounded approach you would be working with 132.7 and 135.3, which they provides an index rate of 1.96, rounding up to 2.0% for the year…… if you look back, the 2020 index rate was indeed 1.9% (based on the unrounded math).

I’m confident that you will find the same to be true for the 2024 index rate, which I expect will be 4.7%.

Fun exercise to chat through.

Oh well, I disagree with you. For the retired federal employees it was 2.0% but for CPP, QPP and Veterans it was 1.9. Do you agree with the site ? https://www.federalretirees.ca/en/news-views/news-listing/november/pension-indexing-rate-for-2020#:~:text=At%20the%20end%20of%20each,2020%2C%20is%20two%20per%20cent.

https://www.tpsgc-pwgsc.gc.ca/remuneration-compensation/bapr-samb/2020/bapr-samb-2020-001-eng.html

2.6 Pension increase under the Supplementary Retirement Benefits provision of the Public Service Superannuation Act

Part III of the PSSA provides for annual pension increases based on the cost of living index, for all pensions payable to former public servants or their survivors.

The pension increase authorized under Part III of the PSSA is 2.0% effective January 1, 2020 – 0.2% decrease from prior year 2019.

Hi Richard,

Honestly after re-reading everything, it sounds like we are talking about two different things.

This whole time I’ve been talking about the index rate that’s applied to the indexation of tax brackets, OAS clawback thresholds, TFSA annual limit increases, etc.

It sounds like you are referring to the index rate on your pension related to your prior employment with the federal government.

It’s possible that the calculations are different, I’ve never dug deep enough into the indexation of federal employee pension indexation to know.

I’ll stand by my math as it relates to the above items that I’ve been talking about, and I’ll stand by my comment that the 2020 index rate related to tax brackets, OAS, etc, was 1.9% and not 2.0%.

Seems like we are both right, and we’re just talking about two very similar calculations.

Oh my comment were made of this and I quote: “If you are receiving a federal pension, expect your benefits to increase by 4.7% as of January 2024.” and my disagreement with you was about that, as I expect it to be 4.8. It would be fun to discuss this face to face with a drink, be it a glass of water, coffee, tea or glass of wine. I have zero formation in finance but I have been a super fan of MS-Excel and MY own indexation as I retired in 2004 after 34 years in the Armed Forces. I maintain my investment with Excel. Concerning TFSA I will wait but my view on this is simple: “It makes rich people – richer ” “

The PSSA indexing for Cdn Federal public service retirees was 2.0% for Januray 1, 2020: that was Treasury Board’s calculation, my calculations confirmed that, the Treasury Board public notice stated 2.0%, and 2.0% indexation on the gross amount was actually received by myself.

The way I have developed my Excel sheet, as soon as the Cost Price index (CPI) is released, I put it on it and right away I have the next year indexation. Because the Canada pension Plan and Veteran Affairs Canada (I am a veteran) don’t use the same time period (Nov to Oct instead of Oct to Sep) the indexation will defer most of the time buy not always. On 21st November the CPI will be released I will right away have the indexation for next year. I will admit it took me a while to find out how they round up number.

Like Aaron Hector, the those two sites arrived at 4.7 and all three are using 3 decimal roundup.

https://www.investmentexecutive.com/news/from-the-regulators/inflation-to-trigger-another-rise-in-tfsa-limit/

https://www.taxtips.ca/taxrates/canada.htm

However, the gouvernment, and those 2 sites arrived at 4.8% and all three are using 1 decimal roundup, the way I do my own calculation

https://www.optrust.com/publications/factsheets/inflation-protection-for-your-pension.asp#:~:text=Starting%20January%202024%2C%20your%20pension,of%20former%20and%20divested%20members.

https://www.optrust.com/publications/factsheets/inflation-protection-for-your-pension.asp#:~:text=Starting%20January%202024%2C%20your%20pension,of%20former%20and%20divested%20members.

https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/retired-members/rate-pension.html

So it will be 4.8%

sorry for posting twice the same site. The other one was from the Ontario Teacher association: https://www.otpp.com/en-ca/members/life-events/living-in-retirement/inflation-protection/#:~:text=Your%202024%20inflation%20adjustment,by%20Canadian%20households%20each%20month.

Regarding the OAS claw back threshold, could you direct me to an article, or maybe write one, that discusses ways to mitigate the risk of having OAS clawed back after the death of a spouse? I haven’t been able to find any discussion, on any financial blog, of the impact of the death of a spouse on the financial resources of the survivor. I believe it is good to be proactive and plan for the inevitable. As it stands now, when a spouse dies the income for the surviving spouse vs the couple will be decreased by one OAS and most of the second CPP, if a pension is involved then it will be reduced by 40% with a 60% survivor pension. Any RRIF assets will be handled by the successor annuitant, the surviving spouse, which on top of their own RRIF withdrawals could put the survivor over the OAS claw back threshold. How can one plan for that ahead of time? One strategy might be to reduce the RRIF balances by withdrawing the maximum amount each year to stay under the OAS claw back threshold and investing that amount in a TFSA or an unregistered account. Hopefully the RRIF balance is low enough before one spouse dies to avoid the loss of both OAS benefits. Are their other ways to mitigate the loss of income after losing a spouse?

The best way to plan for that would be to:

1. If it’s not too late, consider 100% survivor pension instead of a 60% survivor pension when making that selection for your work pension plan.

2. Life insurance so that when the first spouse dies, the second spouse has additional dollars to fund their lifestyle. If there is a similar reduction in after-tax income, then you could look at a joint-first to die policy to keep costs down. If the amount of need is different, then individual insurance policies could be considered.

Our system is unfortunately pretty painful for widows/widowers.

My wife and I are not yet 65 and I’m trying to figure out how the OAS works. I’ve read that for 2024 (for example) you can make 90,997 before OAS claw-back starts happening. Is that 90,997 each or for a family? I assume the 90,997 includes the OAS?

Also trying to understand how much each of us will get at 65? For example what would we each get if we turned 65 this year?

Thanks