Today I’m answering reader mail for a feature I call the Money Bag. I’ll answer questions and address comments from readers on a wide range of money topics, myths, and perceptions about money. No question is off limits, so hit me up in the comments section or send me an email about all the money things you’re dying to know.

This edition of the money bag answers your questions about cell phone and data options for travellers, a no-more air travel pledge, digital savings platforms, taking the commuted value of a pension, and dividends versus indexing.

First up is Peter, who reminded me that I promised to write about my experience with cell phone and data plan options when travelling overseas. Take it away, Peter:

Best Cell Phone and Data Options for Travellers:

“Hi Robb. I think you mentioned you would share info on your experience with cell phone options while travelling. I’m heading to Scotland for three weeks in September. Any thoughts?”

Hey Peter, thanks for your email. Three weeks in Scotland sounds amazing! We seriously didn’t want to leave, and even looked into an Ancestry visa to move there, it’s that stunning.

I did plan to write a post about this but hadn’t got around to it yet. My phone is with Bell and I found they had terrible global data options. My wife’s is with TELUS and they had a better plan – $8/day for unlimited data and that was capped at $180 (I think) for 30 days.

Instead, we went with a service called KnowRoaming. You buy a global SIM card (or sticker for your own SIM card) and then insert it when you get to your destination. Follow some basic instructions and purchase your desired plan and you’re good to go. I liked it because, well, it worked, and also because you preload it with $$ credits (like a prepaid Visa) so you can’t get into trouble if you mistakenly download an entire podcast series using data instead of wifi.

The packages were great. I bought 3 days of global unlimited data for $9.99 – and did that 10 times, so it cost about $100. There’s cheaper data options if you don’t need unlimited (Europe 5 GB 30 days is $39.99).

Finally, it assigns you a U.S. phone number, which was kind of odd but it worked. We also bought a local phone number in Ireland through the KnowRoaming app for $4.

They have a refer-a-friend option so you can get 30% off the global SIM sticker or SIM card using my referral code ROBEN46 at www.knowroaming.com.

No More Air Travel Pledge

Here’s Michael, who is concerned about the impact of air travel on the planet, but still wants to earn and use credit card rewards points.

“Hi Robb. Most travel cards are geared toward airlines, lounges and associated rewards related to air travel. Since we have decided to take the no more air travel pledge, except in emergencies to visit family, what card works best if we are now restricting ourselves to train travel and electric car travel.

As consumers are beginning an evolution towards a more planet conscious citizenry, there may be more of us looking for planet saving alternatives in our financial products. I would be interested to know what you think. And would further be interested in how to get the finance industry to create products for people like me. Or are they there and I am just not seeing them?”

Hi Michael, thanks for your email. Great question, by the way. And I applaud you for taking the ‘no more air travel’ pledge.

I think you still have a few options to earn rewards that have nothing to do with flying. One may sound contradictory, but it’s the

Another option is the PC Financial World Elite MasterCard, where you earn PC Optimum points that can be used instantly in-store at Loblaws stores and Shoppers Drug Marts.

You could get a hotel rewards card, like the

Finally, any card that allows you to charge a travel purchase (be it plane, train, car rental, hotel) and then clear it off your statement with your points balance is a good one because of the flexibility it offers. You can book on your own, likely saving money by shopping around, and then “erase” that charge off your bill by paying with points.

Some examples include the

So, to answer your final questions, I’d say these products are out there – it just takes some creativity to use them in the way that’s most beneficial and still fits with your values.

Digital Savings Platforms

Debbie wants to get my thoughts on a digital saving and investing platform called Mylo:

“Hi Robb, a lot of Millennials are using Mylo for investing purposes. I am just wondering about your thoughts on this service, as my daughter and her friends are quite enthusiastic about it.

Hi Debbie, thanks for your email. I don’t have any direct experience with Mylo but I understand it to be an app or platform that rounds-up your purchases and saves or invests the difference using a portfolio of low-cost ETFs (like a robo-advisor). I think it’s a pretty neat concept and anything that gets young people excited about saving and investing has my support!

I know some other services like Wealthsimple employ the round-up feature within their platform as well – which has proven to be popular.

Investing the Commuted Value of a Pension

Here’s Wayne, who wants to know how I’d invest the commuted value of my pension (assuming I’d take it over leaving it in the plan).

“Hi Robb, Like many, I’ve been following your progress. Well done! I am particular interested in the Commuted Value of your pension. I have been tracking mine for the last 10 years. Assuming that you take the cash as opposed to a pension, have you thought about how you would invest (safeguarding the principal and providing for many years of potential retirement)?”

Hi Wayne, thanks for the kind words. I’m torn about taking the commuted value versus the pension for life. It’ll all depend on when I leave my current employer. If that’s in the next 2-5 years then I’d be more apt to take the commuted value and just invest in something like VGRO inside a locked-in retirement account. If I stay longer then the pension becomes more attractive.

The pension is more attractive at that stage because you can eliminate stock market risk and never have to worry about your money running out.

On the other hand, pension valuations are extremely complicated and can vary widely depending on bond interest rates, among other things. I would not be surprised to hear about $200,000 swings in valuation depending on when you ask for an estimate. To me, that’s another good reason to take the pension rather than being subject to the whims of a calculation at the wrong time. At least with the pension you have a “defined benefit” and know exactly what you’re getting.

Indexing versus Dividend Investing

Finally, here’s Shawn who wants to know how indexing compares to dividend investing in a downturn.

“Hi Robb, you switched to index investing in 2015. Do you think index investing will beat dividend stocks during a recession? Also what percentage of bonds should someone in their 40s hold? Thanks.”

Hi Shawn, thanks for your email. I have no idea whether indexing will beat a portfolio of dividend stocks during the next downturn. The reason why I switched was because I believe the strategy will outperform over the very long term (20-30 years). I also prefer the simplicity of holding one ETF rather than keeping track of a portfolio of 25-30 stocks.

Most investors should hold bonds in their portfolio to lower the volatility with the goal of helping you stay invested during the bad times. Take a look at these statistics which show different portfolios from conservative to aggressive. The conservative ones performed very close to the aggressive ones over a 20-year period without the huge losses during bear markets:

There’s nothing wrong with a traditional 60/40 split between equities and fixed income, and you can get that with just one ETF from Vanguard’s VBAL product.

One of the great joys of running this blog is that I’ve been able to help so many Canadians take control of their finances and gain a greater understanding of their relationship with money. The blog comments, emails, and daily interactions on social media is what ultimately led to the start of my own fee-only financial planning business – to offer more comprehensive and personalized advice for Canadians at any stage of their financial journey.

The service has grown every year, and the majority of clients have been blog readers for many months, if not years. Still, not everyone is interested in, or even at the point in their lives when they’re ready for, a full comprehensive financial plan. Price can also be an obstacle, with a couples plan starting at $1,200.

Many readers and prospective clients are just looking to address one particular area of their finances, such as investing, cash flow management, debt management, estate planning, analyzing insurance needs, or running a retirement income projection.

I’ve wanted to create another service tier for some time to address these inquiries and help more people with their money decisions. Enter Money Gaps, an online financial planning platform developed by Preet Banerjee to bring low-cost, holistic financial advice to the masses.

With Money Gaps, prospective clients fill out a 15-question snapshot of their finances, and identify one area that is most important today (estate planning, life insurance, retirement planning, disability insurance, emergency fund, credit / debt, cash flow, education savings, investments, taxes, or more than one).

You’ll get a free financial snapshot that highlights potential ‘gaps’ or areas that may need to be addressed. I’ll also receive a notification that you’ve completed the questionnaire and will be prompted to follow up and discuss the results. We’ll then analyze your money gaps and generate an easy-to-understand report card with a grade for different categories.

My plan is to use Money Gaps to offer a ‘light advice’ service for those looking to address one or two areas of their finances, but who don’t require a full financial plan. I haven’t come up with a price for this service yet, but expect it to be much lower than the full comprehensive plan.

That’s where you come in. I’d love to have 20 readers join me to test the Money Gaps platform. You’ll get a free financial snapshot and the opportunity to address one area of your finances with me. I’ll use the experience and your feedback to design a new tier of financial planning service to launch in the fall.

If you’d like to participate please leave a comment below. I’ll email the first 20 people who respond with a link to the Money Gaps questionnaire. Thanks in advance for your support!

This Week’s Recap:

I managed one post this week where I compared Vanguard’s VBAL to Mawer’s Balanced Fund in a battle of one-stop investing solutions.

I’ve written a series of posts that look at when to take CPP. Now I’m getting questions about when to take OAS. I plan to tackle that subject soon, along with a follow up to answer reader questions about CPP survivor benefits and drop-out years.

I also have a draft post looking at the growing niche of sustainable investing, plus an interview with a Wealthsimple advisor on how the robo-advisor handles retirement withdrawals. Stay tuned!

Promo of the Week:

Speaking of Wealthsimple, the company had one of the more clever marketing campaigns I’ve seen lately when it sponsored a tiny stadium the size of a caesar salad in front of the Scotiabank Arena in downtown Toronto. The point of this stunt was to highlight that stadium sponsorships are expensive – the Scotia deal is worth $800 million over 20 years – and the money being thrown around by big banks comes on the backs of their customers who pay high fees for banking and investment products.

The robo-advisor also studied the painfully slow (and expensive) process to transfer funds from one bank to another. Nearly half of Wealthsimple’s clients fund their accounts this way – a process I wrote about here with how to transfer your RRSP to Wealthsimple.

They found the average transfer time was 19 days and cost $135 in transfer-out fees. Wealthsimple helps ease that process by:

- Promising to initiate transfers within 24 hours of receiving paperwork

- Paying other institutions’ fees on all account transfers >$5K

- Never charging fees to withdraw funds

Boomer & Echo readers get their first $10,000 managed free for one year when they open up a new Wealthsimple account.

Weekend Reading:

Another bit of marketing genius has been Questrade’s television commercials challenging investors to ask tough questions of their advisors. Dale Roberts takes a look at the industry response to these ads.

Why advice-only planner Shannon Lee Simmons offers no shame advice on getting rid of debt.

The Irrelevant Investor Michael Batnick tackles the topic of whether low interest rates are punishing savers. His take:

There are a lot of problems in this world, but the idea that savers are being robbed by lower interest rates, in my opinion, is not one of them. Here’s why:

-

Why should people be entitled to reward with no risk?

What’s so great about high interest rates? Be careful what you wish for.

Low rates are bad for risk-free investors, but they’re good for consumers.

Who are these “savers” everyone keeps talking about anyway?

Batnick’s partner in crime Ben Carlson looks at different ways to be rich in 2019.

A financial planner and retirement expert shared an interesting post on Forbes: Will retirement turn you into a liar?

In his latest Common Sense Investing Video, PWL Capital’s Ben Felix examines Real Estate Investment Trusts:

Of Dollars and Data blogger Nick Magguilli looks at the seduction of above average and how we can trick ourselves into trying to beat the market.

A cautionary tale on TFSA withdrawals and how to avoid getting dinged with a penalty.

Finally, Stephen Weyman at Credit Card Genius shares how he earned 11,172 Air Miles in one year and how he plans to use those miles to get maximum value.

Have a great weekend, everyone!

Investors could have done a lot worse over the past 30 years than investing in the Mawer Balanced Fund. Mawer, which epitomizes the art of boring investing, has been nothing short of consistently brilliant – with annual returns of 8.5 percent since the fund’s inception in 1988. Investment giant Vanguard doesn’t have the same longevity or track record here in Canada, but its launch of the Vanguard Balanced ETF portfolio (VBAL) gives investors another one-stop investing option.

This post will go under the hood and compare VBAL to the Mawer Balanced Fund for investors looking for a one-stop investing solution for the next two to three decades.

About Vanguard

Vanguard is legendary in the United States and is largely credited for pioneering low-cost index investing. It came to Canada in December, 2011 and now offers nearly 40 ETFs and four mutual funds to Canadian investors with a total of $17 billion in assets under management (Dec 2018).

VBAL was introduced by Vanguard Canada in January, 2018 as part of a new suite of asset allocation ETFs (including VGRO and later VEQT). These funds have proven popular among Canadian investors and have collectively gathered more than $1 billion in assets.

Before their introduction, investors did not have access to a one-stop ETF solution. Instead, they’d have to build multi-ETF portfolios to get exposure to Canadian, U.S., and International equities, plus another ETF or two for fixed income.

Vanguard turned that around with what I’ve called a game-changing investing solution. VBAL represents the classic 60/40 portfolio.

Vanguard Balanced ETF (VBAL)

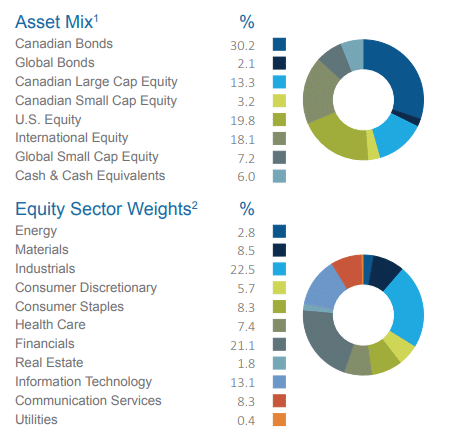

VBAL is a fund of funds. That means its underlying holdings are made up of other Vanguard funds. So rather than seeing a bunch of individual stocks and bonds in VBAL’s holdings, you’ll instead see these seven products:

- Vanguard US Total Market Index ETF

- Vanguard Canadian Aggregate Bond Index ETF

- Vanguard FTSE Canada All Cap Index ETF

- Vanguard FTSE Developed All Cap ex North America Index ETF

- Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged

- Vanguard US Aggregate Bond Index ETF CAD-hedged

- Vanguard FTSE Emerging Markets All Cap Index ETF

The fund’s mandate is to maintain a long-term strategic asset allocation of equity (approximately 60%) and fixed income (approximately 40%) securities. It’s as diversified, globally, as you can get – with a whopping 12,318 stocks and 15,412 bonds wrapped up inside this one-stop balanced ETF.

VBAL has net assets of $675 million (June 30, 2019). Its distribution or dividend yield is 2.58 percent (dividends paid quarterly). Its management expense ratio or MER is 0.25 percent.

Investors can purchase VBAL through a discount brokerage account and it is an eligible investment inside an RRSP, RRIF, RESP, TFSA, DPSP, RDSP, or non-registered account.

VBAL’s performance data only goes back to its inception date of January 24, 2018. It has returned 4.05 percent annualized since that time, and 10.44 percent year-to-date (July 30, 2019).

Justin Bender, a portfolio manager at PWL Capital, has simulated the returns as if the fund did exist for the past 20 years and found the following annualized returns (as of June 30, 2019):

- 1-year return – 5.09%

- 3-year return – 7.22%

- 5-year return – 6.62%

- 10-year return – 7.95%

- 20-year return – 5.34%

You can read more about VBAL and its fact sheet and prospectus here.

About Mawer

If Vanguard is legendary for pioneering low cost investing, Mawer has achieved cult-like status among active investors for an incredible track record of outperforming its benchmarks. Mawer was founded in 1974. It’s a privately owned, independent investment firm, managing over $55 billion in assets. Mawer has locations in Toronto, Calgary, and Singapore.

While its philosophy is ‘be boring’, Mawer’s performance is anything but. Of its 13 mutual funds, eight have beaten their benchmark index since inception – including the Mawer Balanced Fund, which trounced its benchmark over the last decade (9.9 percent to 7.8 percent).

Mawer gets its results from being different than the index – yes, this is not your average Canadian closet indexing fund. Its Canadian equity fund has just 41 holdings, compared to 239 in the benchmark S&P/TSX Composite Index. Mawer’s U.S. equity fund has 61 holdings and matches up well against the vaunted S&P 500.

Mawer discusses its boring investing approach in the Art of Boring podcast.

Mawer Balanced Fund

Mawer’s Balanced Fund (MAW104) is also a fund-of-funds. Its underlying holdings are made up of:

- Mawer Canadian Bond Fund Series O

- Mawer US Equity Fund Series O

- Mawer International Equity Fund Series O

- Mawer Canadian Equity Fund Series O

- Mawer Global Small Cap Fund Series O

- Cash & Cash Equivalents

- Mawer New Canada Fund Series O

- Mawer Global Bond Fund Series O

An actively managed product, the Mawer Balanced Fund invests in Canadian, US, and International equity securities, plus Canadian government and corporate bonds primarily through funds managed by Mawer.

The fund’s manager aims to buy companies at a discount to intrinsic value to construct the equity portion of the portfolio, while focusing on sector allocation, security selection, and trading strategies on the fixed income side.

The Mawer Balanced Fund has net assets of $4 billion (June 30, 2019). Its management expense ratio or MER is a reasonable 0.91 percent.

Investors can purchase Mawer Mutual Funds through most major online discount brokerages, with the exception of RBC Direct Investing. A minimum initial purchase of $5,000 per fund, per account is required. Once the initial minimum is met, there are no minimum requirements for additional investments.

As mentioned, Mawer’s Balanced Fund has returned 8.5 percent a year since inception in 1988. It has returned 10.4 percent year-to-date (June 30, 2019). The fund’s longer term performance is as follows:

- 1-year return – 7.0%

- 3-year return – 7.4%

- 5-year return – 7.8%

- 10-year return – 9.9%

You can read more about the Mawer Balanced Fund through its fund profile here.

Final thoughts

Mutual funds get a bad reputation from investor advocates like me, but to be fair they should not all be painted with the same criminally expensive brush. Mawer’s performance track record speaks for itself, and I think that’s a mark of being different than the index, AND keeping costs reasonable (under 1 percent).

True, investors in Mawer’s Balanced Fund have done extraordinary well for the past three decades. I’d argue, though, how much of that is skill and how much is attributable to other factors? We also don’t know what the returns of the next three decades will be. Fund managers at Mawer will retire or move on, and replacements might not deliver the same outcomes. Then there’s the reversion to the mean – a fund that’s outperformed for so long might find itself under performing for the next decade or more as their strategy falls out of favour.

Enter Vanguard’s VBAL – the one-stop investing solution for the next thirty years. Sure, it doesn’t have the same track record and historical performance of the Mawer fund. But VBAL is built on low cost, globally diversified principles that don’t need “conviction” and “skill” to succeed. All it needs to do is capture the market’s returns over an investor’s lifetime.

Where would you rather park your retirement savings for the next 20-30 years?