The future is always uncertain, but at this time last year my crystal ball was as murky as ever. We were in the middle of building a new house and still needed to sell our existing home. Stocks and bonds were down double digits, and interest rates were still on the rise. Investors were piling into high interest savings ETFs and GICs. A recession was all but certain.

So, of course global stocks soared more than 6% in the month of January and are closing in on all-time highs as of this writing. The Bank of Canada increased rates three more times, but paused at its last two meetings and is almost certainly finished hiking as inflation trends lower. And, while the economy is definitely slowing down (and we may be in a technical recession), we may have achieved the so-called soft landing after all.

Personally, we experienced four months of uncertainty as we finished the new house build and put our existing house on the market. When it comes to financial goal setting, it’s okay to take a pause until you have more information – especially for big transitions like moving houses, changing jobs, taking a year off for parental leave, etc.

That’s why our 2023 financial goals were fairly straightforward:

- Move into our new house

- Sell our existing house

- Set aside ~$50,000 from the house sale proceeds for window coverings, landscaping, and other “extras”

- New house is completely furnished, windows covered, yard landscaped in 2023. No “someday, maybes”

- Remaining proceeds from house sale go towards the new mortgage

- Max out RESP contributions ($5,000)

- Contribute $6,500 each to our TFSAs (late 2023)

- Invest excess profits in the corporate investing account (~$36,000)

- Maintain work-life balance – no increase in business revenue expectations

- Use accumulated travel points towards a one-week all-inclusive holiday somewhere sunny

We moved into our new house at the end of April, and sold our previous home at the beginning of May. We had enough from the proceeds of our house sale to pay for blinds, landscaping, and some new furniture.

We’ve been in our new house for seven months and are loving it! Best of all, no “someday, maybe” projects. We finished everything we intended to do.

Our new mortgage is larger than our previous mortgage, and at close to triple the interest rate (we took out a one-year fixed rate at 5.74%). Ouch!

We’ll max out our kids’ RESP contributions with one more monthly contribution in December. We have not contributed to our TFSAs this year.

We did, however, see a 40% increase in business revenue this year and were able to invest more in our corporate investing account ($50,000). We also gave ourselves a raise for the first time in a few years.

I’d say we were able to increase revenue without sacrificing too much work-life balance (I’ll have to ask my wife and kids about that!). I think it’s more of a function of having taken 9-10 weeks off to travel in 2022. This year we only went away for three weeks.

We did not use points to take an all-inclusive holiday this year. Instead, once we got settled into the new house and finished our landscaping, we decided last minute to go to Scotland and Amsterdam in August. I’m glad we did – it was an amazing trip!

I’m happy with how the year has gone, both financially and with our new house and lifestyle. We’re excited to see what’s in store for 2024.

With that in mind, here are my financial goals for 2024:

- Give ourselves another pay raise for 2024. Business is going unbelievably well and shows no signs of slowing down. We plan on increasing our wages by 10%.

- Reorganize kids’ RESPs to follow the Justin Bender RESP strategy. That means selling e-Series funds and setting up a risk appropriate ETF portfolio for each child. We’re also switching to annual contributions (January) and making one catch-up contribution for our oldest child. Total contributions of $7,500 in 2024.

- Revenge travel part two. We plan on taking a hot holiday in February, an epic trip through Europe in July (including a Taylor Swift concert in Zurich!), and a return to Scotland later in the year.

- Invest excess profits in the corporate investing account (targeting $90,000).

- Renew mortgage, taking the best of either a short-term fixed rate (1-2 years) or 5-year variable rate when it comes up for renewal in May.

I know, I know. What about our TFSAs? We prioritized the travel, concert, and RESP contribution top-up this year – but our plan is to each double-up on annual contributions starting in 2025.

This Week’s Recap:

I wrote about retirement assumptions and how to think about factors such as life expectancy, inflation, investment returns, wage growth, etc. in your financial plan.

From the archives: My pension decision – deferred pension or commuted value?

I was a guest on the Money Feels podcast with Bridget Casey and Alyssa Davies talking about when you need a financial planner.

Promo of the Week:

Earlier this year I launched an investing course for those looking to make a successful transition to DIY investing using low cost ETFs.

This investing course is for long-time holders of a big bank balanced mutual fund who want to save up to 90% in fees by switching to a low cost all-in-one ETF.

It’s also for fledgling stock pickers looking to reform, or brand new investors who just want to start off on the right foot with a sensible, easy to manage investing solution.

If this sounds like you, then head over to my DIY Investing Made Easy page and let’s get started!

Weekend Reading:

We need to talk about your retirement spending. Why big inheritances can be a sign of underconsumption and suboptimal planning.

Speaking of inheritances, don’t leave your kids a white elephant.

Here’s David O’Leary on why you might not be getting the financial advice you want or need.

Ben Felix answers a common question during “these times”: Should my investment strategy change during a recession?

“People spend so much time worrying about the next downturn that they miss out on market returns, which tend to be positive in the long-run.”

These Canadian ETFs are tickets to great balanced investment opportunities at a fraction of the cost of many similar mutual funds.

Advice-only planner Jason Evans took a deep dive into all of the free retirement calculators online and picked the best and worst of the bunch.

Anita Bruinsma says that university campus tours are in full swing, but even parents with RESPs lack an education financial plan.

Steadyhand’s Tom Bradley says to beware of bright shiny objects to avoid falling off your investment plan.

A really interesting post from Preet Banerjee: Could investing apps that allow you to start small encourage you to stay small?

Mark McGrath shares the tax implications of buying a rental property or investment property in Canada.

Ben Carlson on the magnificent seven stocks and power laws in the stock market:

“Outsized gains are normal. It doesn’t feel right for a handful of stocks to experience the biggest returns but this is the norm in the stock market over the long run.”

Seniors with large retirement accounts face a big tax-deferred liability. Jason Heath explains which tax and estate planning strategies might help.

Finally, for the travellers, Rewards Canada’s Patrick Sojka shares how to select the right Aeroplan flight award option to maximize the value of your points.

Have a great weekend, everyone!

Financial planners need to use assumptions about the future to paint a realistic picture for their clients. Since we don’t have a crystal ball, most rely on the projection and assumption guidelines put forward annually by FP Canada.

These assumptions include estimates about inflation, investment returns, life expectancy, wage growth, borrowing costs, etc. Note that these assumptions are meant to approximate an average over 10+ years. Forecasting any economic variable over a short period of time is pretty much impossible, but while the short-term may be volatile (hello 2020s), long-term trends are a bit easier to predict.

Take inflation. Sure, in the past two years we have experienced higher than normal inflation. It might be tempting, then, to increase the inflation expectations in your plan to match the present (or near past) environment. But that would be a mistake for two reasons:

- Nearly every central bank in the world is working to get inflation back down to a steady and predictable 2%. Canada is also an aging, developed, slower growth economy that lends itself to lower interest rates and lower inflation over time. Furthermore, in looking at two-year rolling averages over the past 60 years, the inflation rate was at 3% or lower nearly 75% of the time.

- Inflation affects other variables. Increasing the inflation rate in your retirement plan also means that your CPP and OAS benefits will increase at the same rate. Same for those with defined benefit pension plans that offer inflation protection. Higher inflation would also lead to sustained higher interest rates, which increase the rate of return for assets like cash, bonds, and equities. In summary, we can’t change one assumption in isolation.

FP Canada assumes that inflation will average 2.1% annually over the long-term, and I don’t have any reason to disagree.

This article explores other retirement assumptions used for financial planning projections and explains the rationale behind them. I’ll also share some common objections or misperceptions that I hear from clients about some of these variables.

Life Expectancy

FP Canada suggests using a projection period for clients where the probability of outliving their capital is no more than 25%. If we assume the average life expectancy is about 81 years for Canadian men and 85 years for Canadian women, then by definition half of men and women will live longer than the average.

Then there’s your probability of survival if you’ve already reached a certain age. For example, a 60-year old male has a 25% chance of living to age 94 and a 50% chance of living to age 89.

That’s why I run my planning projections to age 95 as a default (unless there are specific health or genetic reasons to move that age up or down). I want to stress-test your plan to make sure that you have enough resources to last a long and healthy retirement.

And, no, it’s not sensible to change your otherwise normal life expectancy to 75 in order to retire earlier and spend more money. Taking up smoking (or sky diving) is not a sound financial plan.

Investment Returns

I don’t ascribe to the Dave Ramsey approach to investment returns – thinking you can earn market returns of 12% per year indefinitely. FP Canada offers a more realistic estimate of between 6.2% to 7.4% per year before fees.

If we assume a globally diversified portfolio made up of 30% Canadian stocks, 62.5% US and International stocks, and 7.5% emerging markets stocks, we get a projected rate of return of about 6.5% before fees for an all-equity portfolio best represented by Vanguard’s VEQT.

FP Canada projects that aggregate bonds will return 3.2% annually (again, before fees). If we apply that to the classic balanced portfolio of 60% stocks and 40% bonds (best represented by Vanguard’s VBAL) we get a projected rate of return of 5% before fees.

This closely aligns with the investment return assumptions I use for planning purposes. I assume 6.1% net of fee return for equities, 3.1% net of fee return for bonds, and a 4.9% net of fee return for a 60/40 balanced portfolio.

For cash, I assume 1.6% – or inflation minus 0.5%. The idea is you keep your savings in a high interest savings account to capture the best rate of return on cash that you can. It’s not in a chequing account or big bank savings account earning nothing, and it’s not stuffed under your mattress.

By the way, it should go without saying that these returns represent a long-term average rate of return. Investment returns can be incredibly volatile from one year to the next. But you don’t abandon a perfectly sensible and diversified portfolio after one bad year. Similarly, you don’t get excited and prepare your resignation letter early after one good year in the markets.

Wage Growth

Clients still in their working years are often puzzled when it comes to forecasting their expected wage growth. They typically don’t want to assume that their income will increase at all, let alone by the rate of inflation.

They’re even more puzzled when I tell them that the typical wage growth is inflation plus 1% (or 3.1% per year). That’s right, in normal times your wages will outpace inflation. That’s a fact.

I get it. I went through five years of wage freeze hell in the public sector. But when you account for cost of living adjustments and potential promotions or increases from job switching throughout your career, it’s not out of line to think that your wages can grow by 3.1% per year on average over the long term.

Still, try explaining to someone making $100,000 today that they’ll be making $215,000 in 25 years and they’ll stare at you in disbelief.

Spending in Retirement

Many people have no idea what they’ll spend in retirement. A helpful starting point is to determine what you’re spending in your final working years. Most of my clients want to maintain their existing standard of living, if not enhance it with some extra money for travel and hobbies.

We also may have heard that retirement spending keeps pace with inflation during the “go-go” phase of retirement, then reduces during the “slow-go” phase (inflation minus 1%), and and then levels off during the “no-go” phase (no more inflation adjustments).

While this sounds intuitive, I’m not a fan of this approach to retirement spending because I don’t want to arbitrarily impose spending cuts for my clients at age 75 and 85 (for example). I can also easily see spending on travel and hobbies being replaced by in-home nursing care and mobility aids as you age.

For this reason, I keep spending increasing with inflation to age 95 when possible.

I also encourage clients to think about one-time expenses that will likely occur throughout their retirement. The big four items include new vehicles, home renovations and repairs, financial gifts to kids, and bucket list travel and experiences. We weave these expenses into the plan as needed.

Housing in Retirement

A big question for homeowners is what to do with their paid-off home in retirement.

Sometimes, it’s painfully clear that the client will need to access their home equity by downsizing, selling and renting, or using a reverse mortgage.

More often, the client has enough resources to maintain their lifestyle without selling the home and so we assume they remain in their home (or home of equivalent value) for their lifetime. There’s no use trying to predict their health situation at 85 or 90 and the need to move into a retirement facility. The home is there and equity can be tapped if needed.

Still, if the goal is to maximize spending or “die with zero” then clients should consider the eventual sale of their home to add the proceeds to their savings and investments for consumption.

Final Thoughts

There are a lot of unknown variables that go into a financial plan. We need to use reasonable assumptions to help understand how you’ll use your financial resources over time to achieve your goals.

Assumptions should be conservative, but realistic. You won’t do yourself any favours expecting 12% returns on your investments. On the flip side, there’s no need to be pessimistic about the future and expect persistently higher than normal inflation, Great Depression-like returns, or low to no wage growth.

Finally, know that these are assumptions about what the world is going to look like in the future, but the world is surprising and unpredictable (hello 2020s). Check in on your plan and projections from time-to-time to make sure you’re still on track and course correct as needed.

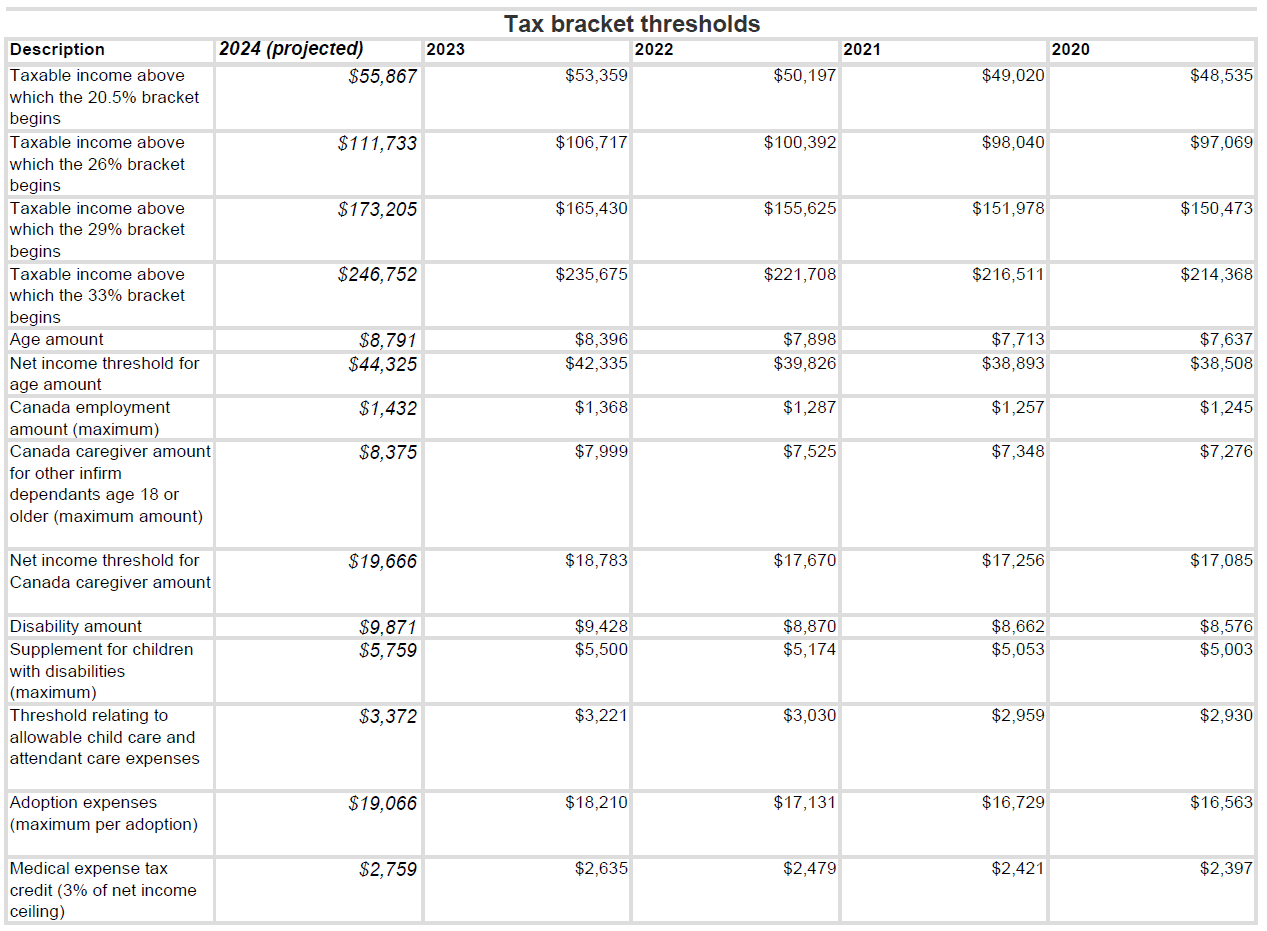

The federal government uses the inflation data for the 12-month period between October 1 to September 30 to determine a number of figures for the following calendar year. September’s inflation rate was announced earlier this month, so we now have the entire data set needed to calculate the indexing rate for 2024, which gives us a new TFSA limit, OAS clawback threshold, tax brackets, and more.

Thanks to Aaron Hector for doing the math to give us these important details.

The indexing rate for 2024 will be 4.7%. That’s down from 6.3% in 2023. If you are receiving a federal pension, expect your benefits to increase by 4.7% as of January 2024.

Note that the indexing rate for CPP is based on a different calculation (inflation data for the 12-moth period between November 1 to October 31), so the rate may be different. Last year’s CPP increase was 6.5% based on 2022 inflation data.

The TFSA contribution limit will increase to $7,000 (up from $6,500 in 2023). This marks the second consecutive increase in the annual limit. The TFSA lifetime limit for those eligible since 2009 will be $95,000.

The OAS clawback threshold will increase to $90,997 (up from $86,912 in 2023). That means those collecting OAS can earn up to $90,997 in taxable income in 2024 without fear of having to repay their benefits.

A host of tax bracket thresholds will be updated for 2024:

The year’s maximum pensionable earnings (YMPE), which is the maximum salary amount on which you need to contribute to the Canada Pension Plan, is increasing to $68,500 (up from $66,600).

Budgeting nerds like me can use these figure to update their spreadsheets and forecasts for 2024.

If you were planning to max out your TFSA next year, make sure to budget $7,000 instead of $6,500.

Of note for me and my wife, we aim to keep our taxable income at the top of 30.5% marginal tax bracket so we can safely increase our income (the amount we pay ourselves from our small business) by 4-5% next year.

The one small silver lining of higher inflation over the past two years is that our tax brackets and a bunch of other important figures are also indexed to inflation.

This Week’s Recap:

Earlier this month I updated my article on how to crush your RRSP contributions next year. It’s a reminder for those who contribute significantly to their RRSPs to use the T1213 form to request to reduce tax deductions at the source.

Despite the current interest rate environment I still come across many people who are interested in real estate investing as a source of passive income. Reality check: There’s nothing passive about owning a rental property, and with rates where they are right now the odds of your property being cash flow positive are vanishingly small.

Remember, you can’t go back in time and replicate the returns that your parents, friends, co-workers experienced over the past decade or more. Your starting point is now, in this current environment of sky-high real estate prices and higher interest rates. Adjust your expectations accordingly.

Who in their right mind is thinking right now, you know what – a couple of income properties might just be the ticket to financial freedom?

— Boomer and Echo (@BoomerandEcho) October 23, 2023

Promo of the Week:

A reminder if you want to up your credit card rewards game for better travel experiences then you should really be using American Express cards to maximize your points.

Even better if you can use American Express’s referral program to “activate your player 2” (e.g. your partner) to earn points faster. That’s what my wife and I have been doing over the past few years.

We use Aeroplan for our flights and Marriott Bonvoy for our hotel rewards. The best way to accumulate Aeroplan miles and Bonvoy points is to collect American Express Membership rewards points and then transfer the points to those respective programs.

Here’s our credit card line-up to get you started:

- The American Express Platinum card – Earn up to 100,000 Membership Rewards points.

- The American Express Aeroplan Reserve card – Earn up to Aeroplan points.

- The American Express Cobalt card – Earn up to 30,000 Membership Rewards points and 5x points on food and drink (this is my main every day credit card).

- The Marriott Bonvoy American Express card – Earn up to 55,000 Marriott Bonvoy points and a free night certificate.

And, for small business owners, even more lucrative rewards await:

- The Business Platinum Card from American Express – Earn up to 120,000 Membership Rewards points.

- The Marriott Bonvoy Business American Express card – Earn up 55,000 Marriott Bonvoy points and a free night certificate.

Happy travels!

Weekend Reading:

Overwhelmed by all the negative news? Here’s why you might need financial therapy.

Certified Financial Planner Shaun Maslyk explores what financial freedom means in Canada.

Anita Bruinsma writes about personal finance hogwash – five phrases you need to stop feeling bad about:

“The truth is that most people should be using traditional methods for achieving financial stability. Yes, it’s boring, yes, it takes time and yes, it takes sacrifice and self-discipline, but wealth and financial stability don’t come free and easy.”

If you knew when you were going to die and the money you would leave, what would you do differently?

Rising rates, inflation, and housing affordability aren’t the only reason early retirement plans don’t pan out.

Michael James on Money shares what experts get wrong about the 4% rule.

What you can expect from the Canada Pension Plan and why it won’t run dry anytime soon.

Advice-only planner Jason Evans explains the danger of using the CPP breakeven calculation.

Speaking of CPP, here’s a really informative Q&A on Alberta’s attempt to form its own pension plan (APP):

(🧵). In light of the major debate happening in Alberta, I thought I would try to put together a FAQ on a CPP/APP. As always, the answers here do not contain legal advice or personal views.#ableg #CPP

— Timothy Huyer (@tim4hire) October 27, 2023

Beating the stock market isn’t easy. So why do many Canadian investors act like it is? (subs).

Finally, in his latest Charting Retirement post Fred Vettese asks if dementia risk is part of your retirement plan. Some sobering statistics for those over 85 years old.

Have a great weekend, everyone!