Canada is in a full blown housing crisis. While much of the housing conversation centres around sky high prices in Toronto and Vancouver, affordability issues stretch across the entire country. The average home price in Canada was $650,140 as of August 2023. This is especially problematic for single Canadians.

Canada’s single population has increased steadily since 2000. According to Statista, there were more than 18 million singles living in Canada in 2022 (9.67M men and 8.60M women).

What’s a single with homeownership aspirations to do? It’s a difficult question without a lot of satisfying answers.

- Earn higher than average income consistently throughout your career

- Curb expectations for how much house you can realistically afford

- Be willing to sell the home to help fund retirement spending

- Find a partner with whom to share expenses

Easier said than done.

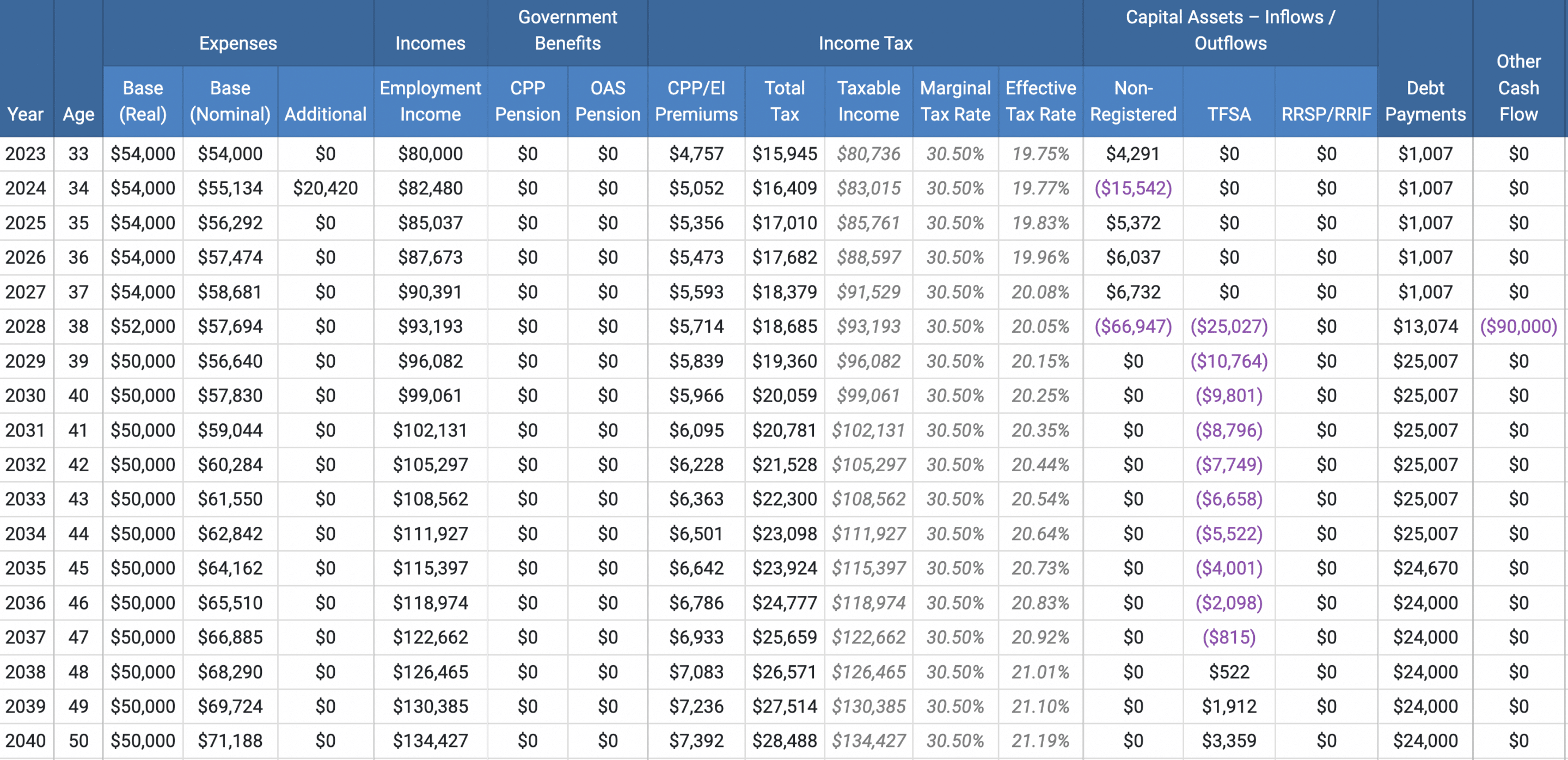

Let’s take a closer look at a real life situation. Katherine is 33-year-old single living in Calgary, Alta. She earns $80,000 per year working for a mid-sized company, with no pension and no employer matching savings plan. She plans to retire at age 65.

Katherine loves her apartment – it’s close to work and to all of her favourite amenities. Best of all, she pays just $1,600 per month in rent as a long-time tenant. Her total after-tax spending is $54,000 per year.

Despite her current situation, Katherine does feel pressure (FOMO) to buy a home and wants to know if home ownership is possible without derailing her finances. She opened a First Home Savings Account (FHSA) this year and plans to fund it with $8,000 before year-end. She’ll continue to prioritize the FHSA for the next four years, and aims to buy a home in 2028.

Price point matters, and Katherine is looking at condos in her area that are currently listed for $400,000. She thinks it would be realistic to budget $450,000 for such a condo in 2028. She’d prefer to put 20% down ($90k) to avoid CMHC premiums.

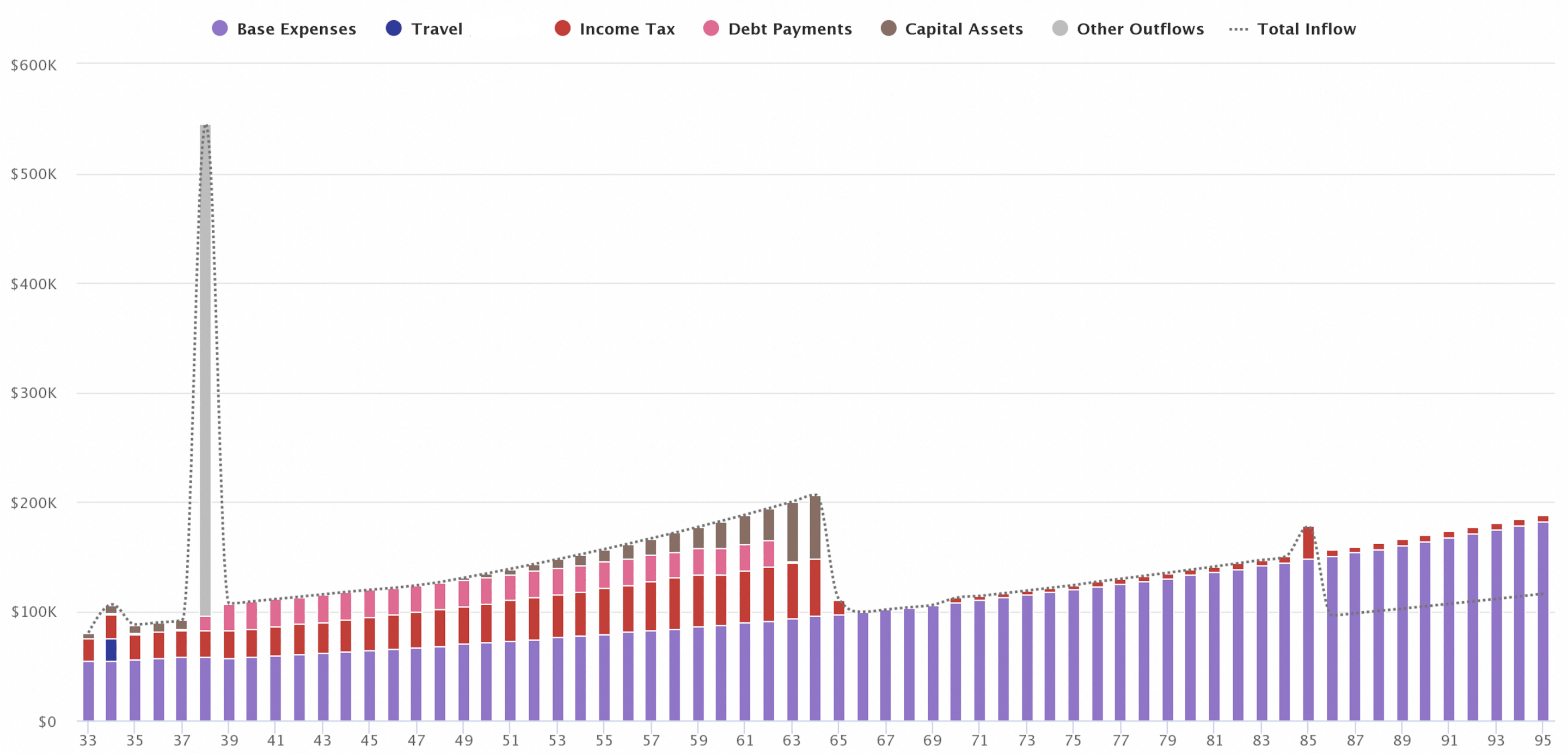

The numbers start to paint a picture as we model this out over Katherine’s lifetime.

First, we need to know how Katherine’s expenses will change when she becomes a home owner. We’d eliminate the rent expense of $1,600 per month ($19,200 per year), but then we must add phantom home ownership costs like house insurance ($2k), property taxes ($4.5k) and maintenance ($4.5k). So, Katherine’s after-tax spending goes from $54,000 down to $45,800.

But, she also expects to buy a new car around that time, so we should budget an additional $350 per month ($4,200 per year). That brings the after-tax spending back up to $50,000.

We also need to factor in the mortgage, which will come to $2,000 per month ($24,000 per year). At an average borrowing rate of 4.4% over the life of the mortgage, the home will be fully paid off by 2053 (25 years). That aligns with Katherine’s desire to enter retirement mortgage-free.

Let’s stop and think about the implications of buying a home. A straight “rent versus mortgage” comparison shows that Katherine would only need to increase her budget by $400 per month and she can happily own her own home instead of flushing rent money down the toilet.

A savvier evaluation shows that the total cost of home ownership is closer to $2,916 per month (mortgage + property taxes, insurance, maintenance) – an increase of more than $1,300 per month. Katherine is now spending $74,000 per year to live the same lifestyle as a home owner.

The implications here are massive. Remember, Katherine does not have a workplace pension or savings plan. She’s on her own to contribute to her retirement accounts, and the focus for the next five years will be on funding the FHSA so she can buy a home in 2028. She’s no longer contributing to her RRSP or TFSA.

Fast forward to 2029 (post home purchase) and Katherine is adjusting to her new reality of spending $74,000 per year. The painful reality is that Katherine will be in a cash flow deficit for nine years, where she’ll have to withdraw from existing savings to meet all of her spending needs. This assumes both spending and income increase by 2.1% annually.

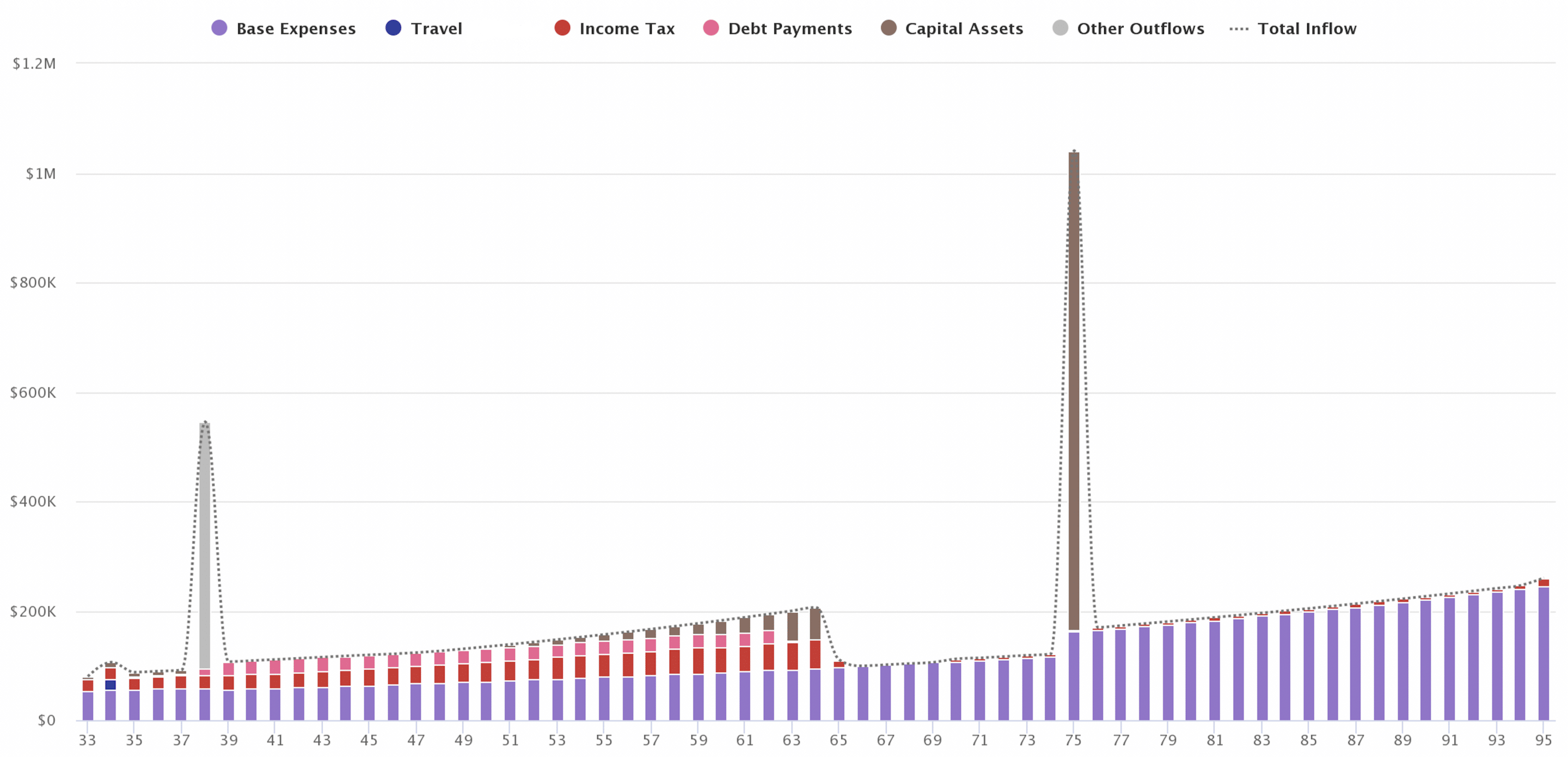

Katherine will need to ramp-up her savings big-time from age 50 to 64. Indeed, it’s possible for her to save and invest her way to about $780,000 across her RRSP and TFSA accounts by the time she turns 65. The house is also paid off, and is now worth nearly $800,000.

Is it possible for Katherine to retire and maintain her standard of living while remaining in her house? Unlikely.

In this scenario, Katherine runs out of money at age 85 and would need to unlock her home equity through an outright sale, a downsize (but she is already in a condo), or a reverse mortgage to maintain her standard of living.

That, or reduce her spending to $45,000 per year (a 10% reduction in today’s dollars) from age 65 onward. Not ideal, but certainly possible.

It might be wise to sell the house at age 75 and rent for the remainder of her life. Doing so allows Katherine to spend $67,415 per year in today’s dollars, which would be enough to pay for rent and still maintain the same (or better) quality of life to age 95.

Final Thoughts

This is just one example of a single woman buying a modest home in a major Canadian city by age 38. Katherine has above average income and lives in a city where condos can still be purchased for less than $500,000.

Still, things are tight. Katherine won’t have the cash flow to contribute to her retirement savings for more than a decade while she saves up a downpayment and then adjusts to the new and expensive reality of carrying a mortgage and other phantom costs.

She starts saving again (modestly) by age 48, but won’t even get her savings rate up to 10% of gross income until age 58. That’s a lot of heavy lifting to do in her final working years to build up an appropriate amount of retirement savings.

And, this assumes everything goes according to plan. Income continues to increase with inflation, and spending remains constant (in today’s dollars) throughout her working career. In reality, she may have multiple vehicle purchases, planned home renovations, unplanned home and auto repairs, income interruption of some kind, a bucket list vacation expense, etc.

Of course, the opposite is also true. It’s more likely that income increases by at least inflation + 1% each year (on average between merit, cost of living, and promotions over time). It’s also possible that Katherine finds a partner with whom to share expenses. This would significantly change Katherine’s cash flow throughout her working career and into retirement.

For singles in higher cost of living areas, home ownership is likely out of reach for all but the top 10-20% of income earners.

And there’s nothing wrong with that. Renting has a certain stigma, at least here in Canada, but more and more of my clients across Canada are realizing that “drive until you qualify” doesn’t lead to a higher quality of life. Indeed, a longer commute in a suburb far away from the vibrance and liveliness of the city may not bring you long-term joy (home ownership be damned).

One client quickly realized this and chose to sell the suburban home he bought just a year ago and move back to renting an apartment in the exact neighbourhood he wanted nearby his work and social life.

In any case, the home ownership dream for single Canadians is on life support and will require more careful analysis (case-by-case) in higher cost of living centres. Consider the trade-offs and whether they’re worth it to pursue your dream of buying a home as a single.

Humans aren’t wired to make rational decisions. Our lizard brain, responsible for satisfying all of our primitive survival needs – including safety, hunger and feeling as good as possible at all times – sabotages our behaviour every day. And it can sabotage our bottom line, too.

Lizard brain makes us do the same things – good or bad – over and over again so it’s the king of bad habits. If you’re chronically late to make payments on your credit card or always forget to transfer money to your savings account, your lizard brain could be to blame. That said, you can counter its reluctance to change its well-worn ways of doing things by automating your personal finances as much as possible. This blocks the lizard from making poor spend-or-save decisions.

Tricking Your Lizard Brain

First, make an unbreakable habit of paying yourself first. This is a powerful strategy that treats your savings like a high-priority fixed expense that automatically gets whisked away from your bank account on or around payday. The idea is that you’re more likely to stick to your plan when you make savings automatic.

Imagine if the government, instead of deducting federal and provincial tax from each paycheque, simply asked employees to send in a lump-sum payment at the end of the year. There’s a reason why government automatically deducts taxes from your paycheque – to make sure it gets paid!

So follow suit and pay yourself first through automatic contributions to your RRSP, TFSA, RESP or other savings vehicles and trick your lizard brain into thinking that money was never there to begin with.

Another tricky thing about the lizard brain is that it makes us act emotionally and live each day as if it were our last. Think of it as the original proponent of YOLO.

That impulse shows up in many of us when we’re shopping and can be exacerbated if we’re paying with plastic. Research shows that using a credit card activates the rewards centre of our brains, causing us to spend more. There’s also the pain of paying – we tend to feel more pain when we spend cash than we do when we use a card; therefore we’re less likely to part with a dollar bill.

Credit-card rewards can be enticing, however not at the expense of missing a payment and turning your 2% reward into a 19% penalty.

So what’s the rule? Use a credit card for recurring monthly payments such as your cellphone bill and Netflix subscription. The steady activity helps build your credit rating. Then arrange to have the full balance automatically debited from your account each month. Use cash for groceries, gas and entertainment – all the things the lizard badly wants – that you can’t automate and need to stay in control of.

Also be aware that lizard brain can be baited. Marketers are well practiced at using psychology to lure that part of our brain into making irrational decisions, constantly tempting us to spend money.

Use what behavioural experts call a commitment device – something you do today that restricts bad behaviour in the future. Ubiquitous examples include freezing your credit cards inside a block of ice to avoid an impulsive shopping binge, or not bringing junk food into the house when you know you’ll go on a late-night pantry raid.

A weekly meal plan can be a commitment device if it prevents you from getting takeout after work. See, this is easy!

Final thoughts

As for me, my lizard brain springs to life whenever my wallet is flush with cash. Apparently I turn into Mr. Generosity, over-tipping at restaurants, buying drinks for friends, giving in to my kids’ impulsive requests. It’s really quite pathetic.

My wife smartly suggested I stop carrying cash and simply use my debit or credit card when we go out. Hey, that’s a great commitment device, honey! But then when I pointed out all the money she could save by removing the Lululemon app from her phone, her cold stare nearly sent my lizard brain back to the ice age!

Investors often look to rules of thumb or mental shortcuts to help guide their decision making. Unfortunately, there aren’t many good rules of thumb that can help determine how much you will spend in retirement.

The 4% safe withdrawal rule, while a decent starting point, is not particularly useful. For one, investors don’t just have one pot of money labeled ‘retirement income’ that they draw from. We have RRSPs and RRIFs, LIRAs and LIFs, TFSAs, and non-registered savings and investments, each with different withdrawal rules and taxation. We may also have pension income, along with CPP and OAS benefits, to consider.

On top of that, life doesn’t just move in a straight line. We often have lumpy one-time expenses such as buying a new vehicle, renovating our home, gifting money to children, and spending on bucket list experiences throughout retirement.

It’s also the sequence of withdrawals that matters – how all of those puzzle pieces fit together over the years to create a tax efficient retirement income for your lifetime. That means a strategy of targeting a specific number, say $1M, in savings and investments and expecting that will pay you exactly $40,000 per year (rising with inflation annually) might fail to meet your spending needs in retirement.

Then there’s the percentage of income rule for retirement income – commonly cited as 70% of your final average pay. This rule assumes you’re no longer saving for retirement, kids have moved out of the house, and the mortgage is paid off. But what about single Canadians? Couples with no children? Lifelong renters?

Retirees who had a high savings rate throughout their careers may only spend 40-50% of their final average pay in retirement to maintain their standard of living. That’s because they may have saved 20% or more of their income, paid a high average tax rate, and don’t carry any debt. Assume they’re no longer saving, paying off their mortgage, spending on their children, and can benefit from income splitting and overall lower tax rates in retirement.

On the other hand, lower income earners who are lifelong renters may not have been able to save as much throughout their careers, but could easily spend 80% or more of their final average salary simply to maintain their current standard of living. Their tax rate may not change that much, so aside from no longer paying into CPP/EI their expenses would largely be the same.

Finally, you’ll need to consider your human capital and how long you plan to earn an income from employment (either full-time or part-time as you ease into retirement).

All of these nuances mean it’s essential to have a retirement plan – one that looks at your unique circumstances and doesn’t blindly follow rules of thumb.

I can say after working with hundreds of retirees it’s clear that the best predictor of your future spending is what you’re currently spending. Indeed, most of my retired clients want to maintain their existing standard of living, if not enhance it slightly for extra spending on travel and hobbies. An added bonus is if they can have a pot of money left untouched for unplanned spending shocks, one-time expenses, and healthcare challenges (often the TFSA, but mostly it’s their untapped home equity).

Another useful tidbit I’ve noticed is that for most retirees who have the ability to significantly increase their lifestyle, many just cannot bring themselves to do it. Call it a scarcity mindset, or just decades of practiced frugality, but it’s almost impossible to turn the spending taps on full blast after a lifetime of saving.

That’s useful because for those in their savings years now, thinking they’ll live on less today in order to live large tomorrow, it’s unlikely they’ll actually be able to bring themselves to do it. Better to allow yourself some lifestyle creep now and throughout your career so you can enjoy the journey.

Promo of the Week:

Today’s high interest rate environment is great news for savers who are looking to maximize the interest earned on savings deposits. My new go-to savings account is Wealthsimple Cash. It’s a hybrid chequing & savings account that pays 4% interest with no minimum balance requirements, plus 1% back on spending.

That’s not all. If you have $100,000 in assets at Wealthsimple (include large savings balances at Wealthsimple Cash) you’ll earn 4.5% interest. For Generation clients with $500,000+ in assets, you’ll earn 5% interest.

Even better, for those who loathe having to use multiple financial institutions to spread out their risk, Wealthsimple Cash offers an incredible $300,000 in CDIC deposit insurance coverage.

There are no account fees, you can send and receive e-Transfers for free, pay bills, and even direct deposit your paycheque into the account.

For travellers, you won’t pay conversion fees when spending money in a foreign currency.

What are you waiting for? Join Wealthsimple by Sept 13th and earn 4x the rewards when you open and fund any account — that could mean up to $12,000 (not likely, but there’s a chance)! Use my referral code: FWWPDW to qualify: https://www.wealthsimple.com/invite

Weekend Reading:

On the topic of saving for retirement, Fred Vettese shows how hard it is for regular Canadians to save enough to retire at age 60.

A Wealth of Common Sense blogger Ben Carlson explains why you probably need less money than you think for retirement.

PWL Capital’s Ben Felix explains why cash, even at 5%, is extremely risky for long-term investors:

If you’ve been using (or thinking about using) one of the Horizons’ all-in-one ETFs in a taxable account to avoid annual investment income, note these important changes to their funds. They’ll now look more like the Vanguard, BMO, and iShares’ versions and pay taxable income.

What are the world’s best performing stock market indexes right now? Andrew Hallam shares why you don’t want to chase the latest winners.

The always brilliant Morgan Housel compares the difference between intelligent and smart.

Fee-only financial planner Anita Bruinsma has a thoughtful post on managing our weaknesses.

If the media covered elevators like they cover the stock market, they’d re-name the up and down buttons as “soar” and “plunge”. Here’s Preet Banerjee on why we, and the media, have a fascination with market bears and their predictions:

You might be surprised by these reporting requirements – and tax breaks – on your interest-bearing investments like bonds and GICs.

Why do these investors want their portfolios to drop?

“Steve owns a globally diversified portfolio of index funds. For him, market drops are like low ocean tides. They are temporary. But they allow him to scoop additional ownership in thousands of companies with a lot less effort. It’s like plucking salmon or tuna from low tidal pools.”

Why everything and everyone underperforms, eventually.

Looking for travel deals? If you’re flexible on when or where you go, these tools can help.

Why couples should consider co-mingling their finances. Research shows that couples who merge their money are more likely to be happy and successful.

A good summary by Cullen Roche on the future of inflation and interest rates.

Finally, is this the most unaffordable time ever to buy a house? Not according to one metric (subs).

Have a great weekend, everyone!