I wish I had a playbook to follow when I first started investing. If I did, maybe I could’ve avoided some of the investing mistakes I made along the way. That journey had me investing in high fee mutual funds, narrowly concentrating on a handful of Canadian dividend paying stocks, and straying from blue-chip stocks to chase higher yields.

I figured things out, eventually. I ditched my expensive mutual funds in 2009 and opened a discount brokerage account. Not knowing anything about index investing, I latched on to a dividend growth approach and started picking individual stocks to hold for the long term.

It wasn’t a bad strategy. My portfolio of dividend payers saw returns of 14.79% a year from 2009 – 2014. That compared favourably to CDZ, the iShares ETF that also tracks Canadian dividend stocks, which returned 13.41% during the same period.

At the same time an enormous pile of evidence showed that passive investing with index funds or ETFs would outperform active investing strategies over time. The idea was simple enough. Just buy the entire market, for a very small fee, and reap the benefits.

I was finally convinced to pull the trigger and dump my dividend investing strategy in favour of a two-ETF indexing solution (which is now my one-ETF portfolio of VEQT).

One of the biggest catalysts for me to change my behaviour was the evolution of ETF products that made it easy to broadly diversify with just one or two ETFs. Not only that, but the advent of robo-advisors also makes it easy for investors today to get started without first falling for the big bank mutual fund trap.

That’s why I wanted to write this guide – to help new investors avoid the mistakes I made when the landscape was much different than it is today, and to be a playbook for experienced investors to get them through volatile times like these.

Here are my 5 investing rules to follow in good times and bad.

Investing Rule #1: Diversify

Nobel Prize winner Harry Markowitz said that, “diversification is the only free lunch in investing.” It’s easy to fall into the trap of chasing last year’s winners, whether those are individual stocks, ETFs, or top performing countries or regions. But last year’s best performer could just as easily be this year’s worst.

A diversified portfolio holds many stocks and bonds from across the globe and ensures you always capture the best performing asset classes each year.

Related: How to choose the right asset allocation ETF

Yes, that also means you’ll hold this year’s worst performers. But here’s the thing. No one can predict which stocks, bonds, ETFs, countries, or regions will outperform or lag behind. Anyone who claims they can is suffering from some serious hindsight bias.

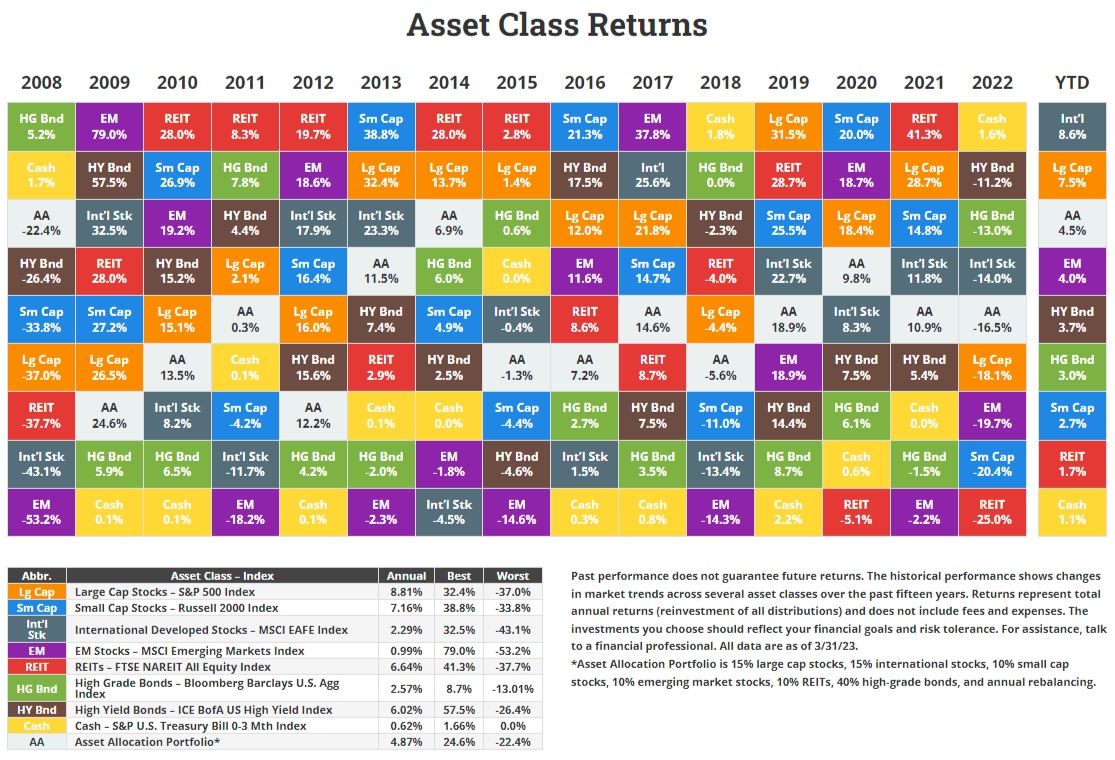

One clear way to visualize how and why diversification works is with the periodic table of investment returns. Each year it shows how different asset classes perform, and the results are often striking.

Last year’s winners often become this year’s losers (and vice-versa). International stocks have had a miserable decade of returns, but are leading the way so far in 2023. Emerging markets returned a whopping 79% in 2009 but have averaged a pitiful 0.99% per year for the past 15 years. The S&P 500 was the darling of the 2010’s, but suffered a lost decade in the 2000’s. REITs have had a wide range of outcomes, with the best year returning 41.3% and the worst year losing 37.7%.

The lesson? Diversify.

Investing Rule #2: Dollar Cost Average

There’s a compelling study from Vanguard that shows how investing a lump sum all at once outperforms dollar cost averaging two-thirds of the time. But don’t let that fool you into thinking dollar cost averaging doesn’t work. That study talks about investing a large amount – say, from an inheritance. What it says is that it’s best to put that money to work right away rather than over a period of time.

Most of us don’t have a large lump sum to invest. We’re putting away a few hundred bucks a month. The point of dollar cost averaging in this context is to invest small amounts frequently rather than saving all of that money up as cash and then making one lump sum contribution. So, effectively, you are investing a lump sum immediately – just like the study recommends. It’s just that your lump sum may be $500 every two weeks.

Dollar cost averaging works because you’re buying small amounts with every contribution. Think about it like buying gas for your vehicle. Some days the price is higher, some days it’s lower. But if you always put in the same dollar amount every time, you’ll buy more gas when prices are lower, less gas when prices are higher. That smooths out the effects of market fluctuation.

The best way to set up your dollar cost averaging system is with automatic contributions aligned with your pay day. This approach ensures you always pay yourself first, rather than trying to save and invest what’s left in your account at the end of the month.

Most banks, robo advisors, and discount brokerage platforms allow you to set up automatic contributions every week, two weeks, or once a month. Some will even automatically invest that amount into the investment(s) of your choice.

Investing Rule #3: Fees Matter

Global stock markets had a terrific run between 2009 and 2021, and during those good times investors are less likely to question the fees they pay for advice. Here’s why they probably should:

Research from Morningstar clearly shows that fees are the best predictor of future returns. Put simply, the lower the fee, the higher the expected return of a comparable product.

This shows up in my own analysis of the returns of big bank Canadian equity funds versus their index fund equivalents. Banks sell their expensive equity mutual funds to retail investors like you and me, even though they all have a lower cost index fund alternative in their line-up.

In every single case the lower cost index fund outperforms the higher cost mutual fund. The difference in returns is often equal to the difference in fees between the two products. Hmmm.

And, while new investors shouldn’t focus solely on fees, they should look for alternatives to pricey big bank mutual funds and look instead at index funds like TD e-Series, or to a robo-advisor platform, or to buy their own index ETFs with a low-or-no-commission trading platform. Whatever it takes to get you investing regularly in a low-cost diversified portfolio that you can stick with for the long-term.

A robo-advisor might charge a management fee of 0.50%, plus the cost of a portfolio of ETFs (add another 0.15% or so). They’ll automatically invest your money and rebalance it as needed, for a true hands-off investing solution.

Index funds can be purchased at any bank for a management expense ratio (MER) of around 1%. TD’s e-Series funds are the cheapest, where a diversified portfolio will cost around 0.40% (with the caveat that you’ll have to buy and rebalance the funds on your own).

If you opt for a self-directed approach, you can build your own diversified portfolio of ETFs (sometimes with just one ETF) for a fraction of the cost of a robo-advisor. Vanguard’s VBAL, for example, gives investors a portfolio of 60% stocks and 40% bonds from around the world at a cost of just 0.24%.

See my top ETFs for Canadian investors for more information.

Investing Rule #4: Save More

Many investors dream of huge Warren Buffett like returns driving their portfolios higher. In reality, it’s your savings rate that has the biggest impact on the growth of your portfolio, at least in the early stages of investing.

A good rule of thumb is to save and invest 10% of your paycheque for retirement. But that’s not a catch-all rule. Young investors have many competing priorities, such as debt repayment, short-term savings goals, a mortgage to pay, a family to raise, and so on.

Related: How to make saving a priority

Don’t put off investing for retirement just because you can’t meet an arbitrary 10% rule. The key is to get started and build the habit of saving and investing for the future. Start with 2-5% of your paycheque and set up those automatic contributions. You won’t even notice it coming off your paycheque or out of your chequing account, and meanwhile you’ll be well on your way to your first $1,000.

Then, as your budget allows for it, increase that savings rate over time until you can meet that 10% goal.

One important tip is to keep increasing your savings amount (in dollar terms) to align with any increases in income. For example, say you make $50,000 and save $5,000 per year. If your pay increases to $55,000 you should increase your savings contributions to $5,500 to maintain that 10% savings rate.

Finally, for many late starters, saving 10% won’t be enough. If you’re behind on your retirement savings, then you may need to aim for a 15 – 20% savings rate to meet your retirement goals and catch up on lost years of compounding.

Investing Rule #5. Stay the Course

Look in the mirror and you’ll find your own worst enemy when it comes to investing. Despite constantly being told to buy low and sell high, never to time the market, and to ignore market pundits and doomsayers, many investors continue to take the opposite approach to managing their investments.

My all-equity portfolio fell 34% in about a month during the March 2020 crash. Even as an experienced investor, I had to steel my nerves and try to avoid looking at my portfolio and reading all of the pessimistic investment news.

Thankfully, I held on and watched my portfolio recover the following month. It’s up about 62% since then (not including dividends). If I would have sold at the bottom of the crash (March 23), I would have locked in that 34% loss and also missed out on the fast and furious rally that followed.

That’s the point of staying the course. We don’t know what markets are going to do in the short term. But we have lengthy historical data that shows stock markets go up more than twice as often as they go down. Those are pretty good odds to stay invested, even in a severe downturn.

Final Thoughts

These five investing rules weren’t always my guide, and so they didn’t save me from making mistakes early on in my investing career. I’ve had to learn my lessons along the way.

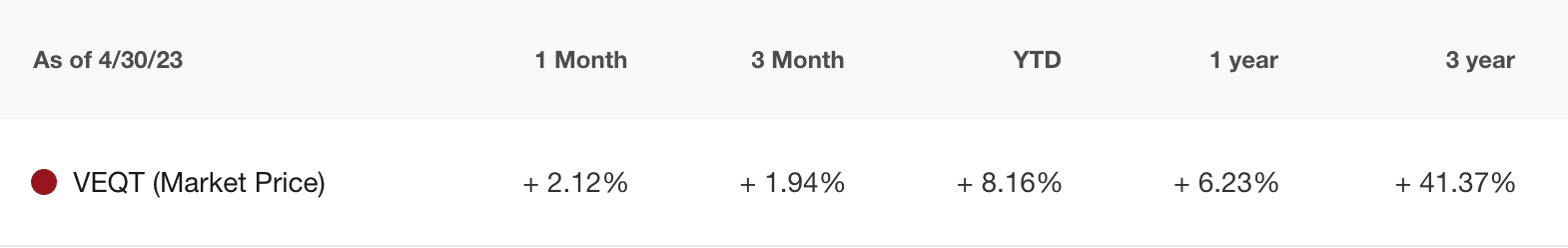

Today, I invest in a globally diversified portfolio (with Vanguard’s VEQT). I use dollar cost averaging, with frequent contributions going into each of my investment accounts every month.

I keep my costs low. VEQT has a management expense ratio of just 0.24%. I also switched to a low cost trading platforms like Wealthsimple Trade and Questrade to avoid paying transaction costs every time I bought units of VEQT.

I strive to save more every year, with the goal of maxing out the available contribution room in my RRSP, TFSA, my kids’ RESP, plus contributing regularly to my corporate investing account.

Finally, I stick to my plan and stay the course regardless of the market conditions. I’m investing with a long-term outcome in mind.

Need some help getting started? Check out my DIY Investing Made Easy video series where I walk you through exactly how to break up with your advisor and set up your own self-directed investing account.

Ever since inflation began its persistent climb two years ago investors have been nervous about the market and how it would react to rising interest rates and, presumably, falling corporate earnings. Indeed, we’ve been talking about an imminent recession for the past two years and many investors want to know how to position (or re-position) their portfolios to weather the storm.

This sentiment was never stronger than at the end of 2022, after a brutal year for both stocks and bonds. Many readers of this blog wondered if it made sense to abandon their sensible balanced portfolios and move to cash or short-term GICs to stop the bleeding and at least earn some interest.

My advice hasn’t wavered. We can’t time the market with any degree of reliability. Getting out while markets are falling might feel good, temporarily, but getting back in can be increasingly difficult. Historically, markets tend to rise quickly after a sharp decline. That’s why we shouldn’t change our investment approach due to current market conditions.

Related: 3 Investing Headlines To Ignore This Year

Similarly, earning 4-5% per year on a GIC may seem like a decent return, but when markets are up 6% in one month (see January) you might regret missing out.

So here we are, four months into 2023, with some economic indicators flashing warning signs while other metrics look to be back on trend. In the face of all this uncertainty, markets are…okay! Better than okay, really:

- A portfolio of 100% global equities represented by Vanguard’s VEQT is up 8.31% year-to-date.

- A growth portfolio of 80% equities and 20% bonds represented by Vanguard’s VGRO is up 7.49% year-to-date.

- A balanced portfolio of 60% equities and 40% bonds represented by Vanguard’s VBAL is up 6.62% year-to-date.

- A retirement income portfolio of 50% equities and 50% bonds represented by Vanguard’s VRIF is up 5.04% year-to-date.

- A conservative portfolio of 40% equities and 60% bonds represented by Vanguard’s VCNS is up 5.73% year-to-date.

Markets are extremely noisy in the short-term. But if you simply stopped checking your portfolio daily and zoomed out you might wonder what all the short-term fuss was even about.

This Week’s Recap:

I last posted about how to choose the right asset allocation ETF.

Since then I’ve been busy packing, moving, and unpacking as we get settled into our new home. It was a stressful few weeks (including a one-week period between house possessions carrying the biggest debt load of our lives), but we’re absolutely loving our new place.

I’ll write about our new mortgage decision in the coming weeks, but I’m glad to be rid of the previous mortgage debt and to start moving forward with our saving and investing goals for the rest of the year.

Promo of the Week:

American Express routinely has the most lucrative travel rewards offers on the market and the current promotions for their premium cards are strongly worth considering for travel hackers.

First up, the American Express Aeroplan Reserve Card where you can earn up to 120,000 Aeroplan points (that’s up to $2,400 in value).

Earn 50,000 Aeroplan points after spending $6,000 within the first 3 months. Plus, in the first 6 months, you can also earn 7,500 Aeroplan points for each monthly billing period in which you spend $2,000. That could add up to anther 45,000 Aeroplan points. Finally, you can also earn 25,000 Aeroplan points when you make a purchase between 14 and 17 months of Cardmembership – an incentive to keep the card beyond the one-year mark.

Next we have the American Express Platinum Card, where you can earn up to 90,000 Membership Rewards points when you charge $7,500 in purchases to your Card in the first three months. Membership Rewards can be transferred to Aeroplan on a 1:1 basis, so 90,000 points can be worth up to $1,800 in flight rewards.

Weekend Reading:

Morningstar’s Christine Benz says flexibility pays when it comes to retirement spending. Agree 100%.

Unique real-world data shows early retirement hastens cognitive decline. All the more reason to find your purpose in retirement.

Millionaire Teacher Andrew Hallam says this is when you should worry about your portfolio’s returns.

More advice from Andrew Hallam – what will the stock market do next?:

“There are two reasons we can’t predict the market. One is based on economics. We simply cannot see the future.

The second is based on how human beings respond to economic news. In other words, even if a Nostradamus could, with pinpoint accuracy, provide data on future interest rates, GDP growth, employment figures, individual company profitability and government policies, we still couldn’t predict how stocks will perform.

That’s because economics don’t move the stock market. Human beings do.”

For fans of the show, Succession. Who owns Waystar? What are the Roys worth? WTF is going on? And other pointless questions, answered.

Rob Carrick answers a question I get a lot: This is how much you should plan to spend on dental and medical costs in retirement.

A good episode of the Rational Reminder podcast where Ben Felix takes a deep dive into covered calls and finds them to be a losing proposition:

Who will give you the best mortgage advice? Here’s why a mix of voices is your best bet.

Erica Alini on why soaring rents mean living with roommates can cost $1,000 or more per person (subs).

Robin Powell explains why we’ll likely see another Bernie Madoff in our lifetime.

Investment advisor Markus Muhs shares his thoughts on dividend investing as a strategy and offers some wise words for yield-hungry investors:

“Dividends are a happy side-effect of a well-diversified investment portfolio. They should never be the goal in and of itself.”

A Wealth of Common Sense blogger Ben Carlson looks at concentration in the stock market as the top 10 companies now make up nearly 30% of the S&P 500.

Finally, the brilliant Morgan Housel shares some incredible nuggets of wisdom in this recent post.

Have a great weekend, everyone!

No, I’m not talking about investing in dividend paying stocks. Been there, done that, not going back. I’m referring to paying myself non-eligible dividends from my corporation instead of paying myself a salary.

A quick explanation: My wife and I incorporated our online business back in 2012, while I was still working a 9-to-5 job and Boomer & Echo was just a side hustle. As the business grew, we paid a modest dividend to my wife, who was a stay-at-home mom at the time, and left any remaining funds in the corporation to defer taxes.

Fast forward to 2019 and I quit my day job to focus on financial planning and freelance writing full-time. I took the commuted value of my pension, with the bulk of it going into a LIRA and the remainder paid out as taxable cash. That meant I did not need to take any money out of the business in 2020, while my wife took a small dividend that year.

We paid ourselves an equal amount of non-eligible dividends in 2021 and 2022 to meet our personal spending and savings goals, and to keep our finances simple. But I’ve always wrestled with the idea of whether to pay ourselves a salary, pay ourselves dividends, or to pay a mix of salary and dividends.

The downside of dividends is that you don’t generate new RRSP room, you don’t pay into CPP, and dividends are not a deductible business expense. One further downside is that when we decided to build a new house and apply for a mortgage, our personal income appeared to be much lower than it would have been if we paid ourselves a salary – which may have affected how much we could borrow from the bank.

On the plus side, non-eligible dividends are taxed at a much lower rate than salary. On $80,000 of dividend income I’d pay taxes of about $10,500 this year (13.1% average tax rate). On $80,000 of salary, I’d pay taxes of about $17,100 (21.4% average tax rate). I’d have to pay myself about $90,000 in salary to get the same net pay – and that doesn’t factor in paying the employee portion of CPP ($3,754).

Some business owners consider it a plus not to have to pay into CPP. I disagree. A guaranteed, inflation-protected, paid for life income stream is a wonderful addition to any retirement plan. The trouble is having to pay both the employer and employee portion of an expanding program (costing more than $7,500 per year). If you elect to pay yourself dividends just to opt-out of CPP, you better make sure you have robust savings elsewhere.

My hybrid solution is to pay ourselves a salary up to the CPP maximum ($66,600 this year) and top-up our income with dividends to meet our desired personal spending and savings goals. My plan is to make this switch in 2024, once we get through this complicated year of buying a new house and getting settled.

This Week’s Recap:

Last week I shared the why it’s important to retire with purpose.

Many thanks to Rob Carrick for linking to my tax deductions versus tax credits explainer in his latest Carrick on Money newsletter.

The sale of our house officially went through this week as the buyer’s financing condition was removed. We did it!

Now we have three weeks to get packed and organized for the big move. Fortunately, we have about a week between taking possession of our new house and the new buyer’s taking possession of our house.

Remember, one of my main financial goals for this year was to set aside $50,000 from the sale of our house for landscaping, window coverings, and some furnishings. No “some day, maybes”. That will leave us with about $100,000 in cash, which will either go towards the new mortgage, back into our TFSAs, or a mix of both.

Given where interest rates are today, I’m leaning towards the mortgage.

Promo of the Week:

My DIY Investing Made Easy course shows you exactly how to take control of your own investments by opening your own self-directed investing account, funding the account with new contributions, transferring over your existing accounts, and how to buy an all-in-one ETF that can reduce your investment fees by up to 90% or more.

Nearly every one of my clients who have taken this approach (firing their expensive mutual fund manager and investing in an all-in-one ETF) have told me they were surprised it was so easy to implement.

No more being scared to break up with your advisor. This is your step-by-step guide to moving your underperforming funds over to a self-directed account so you can invest in a globally diversified, risk appropriate, and easy to manage ETF.

Weekend Reading:

Gen Y Money discusses food inflation in Canada and lists some good tips to help stop the bleeding.

Why understanding your money scripts can be key to developing a healthier relationship with money and achieving your financial goals.

Not all loyalty point redemptions are the same. Travel expert Barry Choi explains how to calculate their value.

Deanne Gage lists four overlooked deductions to include in your tax return.

How the ‘tax’ on singles has people who live alone feeling the pinch.

Jesse at The Best Interest blog looks at overconfidence in investing:

“Instead, the “perfectly confident” investor knows how diversification, dollar cost averaging, and staying the course will help them in the long run…but doesn’t try to time the short run.”

Markus Muhs on why the vast majority of investors aren’t going to get rich by constantly jumping into “the next big thing”.

Last Week Tonight’s John Oliver nails this piece on timeshares, including how people get into them and why it’s so difficult to get out:

How to have the most tax-efficient retirement income plan without letting the tax tail wag all of your decisions.

Millionaire Teacher Andrew Hallam explains how much retirees can withdraw from their investments each year.

A first-person account from The Globe & Mail: How do I ‘do’ retirement and find the recipe for a happy, fulfilling life?

Finally, Jonathan Clements shares a wish list for how he’d like to spend his time in his 60s.

Happy Easter, everyone!