Welcome to my latest edition of Weekend Reading. I’m writing from our flat in London, whilst enjoying a coffee on this beautiful Saturday morning. We’re on day four of our 24 day trip to the U.K. that will soon take us up to the Lake District and then into and around Scotland.

London is an expensive city, especially when you consider the foreign exchange into British Pounds. Thankfully, the Canadian dollar has strengthened versus the British Pound over the last year. As of today, 1 CAD will get you 0.64 Pound Sterling. That’s up from 0.58 Pound Sterling last summer.

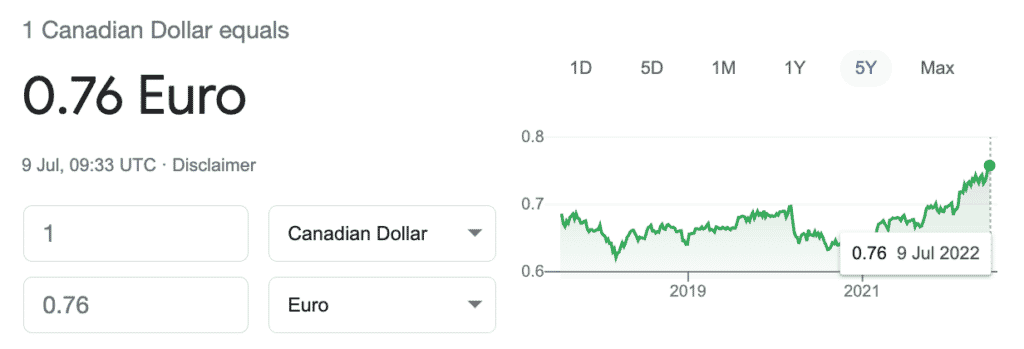

The Loonie is doing even better versus the Euro. Last summer 1 CAD would get you 0.63 Euro, but as of today 1 CAD will get you 0.76 Euro.

Travel is definitely back and the city is absolutely packed with tourists. We tried booking the Warner Bros. Studio Tour London – The Making of Harry Potter, and it was sold out until the third week of August.

Still, we managed to see Wicked at the Apollo Victoria Theatre on our first night here (bucket list experience for my wife and oldest daughter), and braved the heat and endless queue to ride the London Eye.

More exploring of London today before heading to the Lake District for the more relaxing part of our vacation.

This Week’s Recap:

A few weeks ago I recapped the investment performance of various asset classes and sectors so far this year.

I updated our net worth for the year. Portfolio is down, house value is up. An overall small decline from the end of 2021.

Finally, earlier this week I explained why a financial navigator might come in handy at different stages of your life.

I’m putting the final touches on a new course for DIY investors where I’ll walk you through the exact steps to leave your bank managed mutual funds behind and invest on your own using a single asset allocation ETF.

It’ll be like me sitting in your living room, patiently walking you through the process of opening a discount brokerage account, opening the appropriate account types, setting up new contributions, buying an ETF, and transferring over your existing accounts.

Stay tuned for more details soon.

Promo of the Week:

The most frequently asked question about our travels this year? How did you earn enough points to fly a family of four to Europe / U.K. three times in 2022?

My wife and I each have our own American Express Cobalt cards and make sure to charge $500 per month in groceries (not hard these days!) to the cards to earn 5x points on groceries plus a 2,500 point monthly bonus for the first 12 months.

That adds up to 30,000 points for regular spending, plus the 30,000 bonus points for hitting the monthly spending target. There’s 120,000 points combined, which we transfer to Aeroplan to use for flight rewards.

We also signed up for the American Express Aeroplan Reserve Card, where right now you can earn up to 90,000 in bonus points when you spending $1,000 per month over six months ($3,000 in the first three months, and a total of six monthly billing cycles where you spend $1,000).

I know many people will balk at paying a $599 annual fee. But you need to look objectively at your net return after fees. You can earn up to $2,800 in travel rewards with the American Express Aeroplan Reserve Card in the first year of card membership. Subtract the annual fee and you’re still netting $2,200.

For me, as long as I can meet the spending requirements without making meaningful changes to my normal expenses, these cards can make good sense.

Weekend Reading:

A good piece in MarketWatch on why index funds beat stock picking.

Does (fill in the blank) belong in my portfolio? Dimensional offers a general framework for you to assess the merits of a new investment opportunity.

Jonathan Chevreau on why rising rates are good news for near-retirees seeking longevity insurance.

I loved this post by Morgan Housel on the power of staying the course with your investment strategy:

The most important investing question is not, “What are the highest returns I can earn?”

It’s, “What are the best returns I can sustain for the longest period of time?”

PWL Capital’s Ben Felix explains why the “good company is a good investment” fallacy is something that every investor needs to understand:

Dimensional founder David Booth asks about your investing plan for the bear market.

Travel expert Barry Choi explains how to calculate the value of your reward points.

Jason Heath explains what to consider before selling your home or getting a reverse mortgage. The math reveals the real costs for retirees.

Why big banks are blocking online sale of cash ETFs that compete with bank savings products (G&M subscribers).

Finally, a fascinating case of the missing $46 million – the untold story of historic crypto heist.

Have a great weekend, everyone!

I get really nervous when driving in strange places. The anxiety comes from my poor sense of direction – I could get lost in a phone booth. My wife, on the other hand, makes a fine navigator. She could be trapped in an underground cave and still tell which way is north.

We didn’t plan on renting a car during our trip to Scotland and Ireland. We thought we’d mostly get around by walking and taking public transit. That worked out well in a big city like Edinburgh, but after a few days in the Scottish Highlands it was clear that a car would give us more freedom to explore our surroundings.

It’s fair to say I was scared out of my mind, not only to navigate through a foreign land but also to drive for the first time on the opposite side of the road. Still, the prospect of discovering new sights and experiences was too great to pass up, so I steeled my nerves and hired a car from the Inverness airport.

I gripped the wheel tightly, and with my wife deftly guiding us through roundabouts, across narrow roads, and underneath breathtaking viaducts, we discovered new castles, stone circles, and famous battlefields throughout the Scottish Highlands. It was a road trip to remember.

Brimming with confidence, and a newfound sense of freedom, we thought nothing of hiring a car again in Ireland and driving across the country for two-days of sightseeing.

If I were travelling solo, given my lack of navigational skills, I would’ve been forced to use technology to guide me through the journey. But GPS isn’t always fool-proof. Ask the countless number of drivers who’ve followed their car’s GPS directions only to end up in a lake.

Sure, my wife also used Google Maps to help guide us to our destinations. But instead of blindly following the voice commands (like I would do), she would use the satellite view and her keen sense of direction to keep us on course.

Having an expert navigator along for the ride gave me the confidence to do something I never thought I’d be able to do. I’ll be honest, driving in Scotland and Ireland was nerve-racking at times. But it was also a lot of fun, and I’m grateful for the experiences we had thanks to getting out of our comfort zone.

It’s because of those experiences that we had no qualms about renting a car in Italy when we visited in April. We picked up a car in Arezzo and drove to a little hilltop town in Tuscany to stay for a week. Like in the Scottish Highlands, we thought a car would be a must so we could explore all the medieval towns and villages in the region. Unlike in Scotland, we could drive on the right side of the road in Italy.

How Does This Apply To My Finances?

Some people are blessed with a strong sense of direction (like my wife). Others, like me, need help from technology and/or a trusty navigator to guide them to their destination.

When it comes to personal finance and investing, some people have a knack for it, while others need a helping hand.

Related: Your financial plan is a compass

Those with a strong financial compass understand exactly where their money goes, know how much to save, and have enough knowledge to invest on their own.

Unfortunately, some people either have no desire to learn about personal finance, or simply cannot comprehend how to make their money work for them. Like the poor traveller who’d get lost in a phone booth (me again!), those lacking in financial acumen likely need a trusted guide to help them reach their retirement destination, and navigate through all of life’s financial milestones along the way.

Most people, however, seem to fall somewhere in between. They know enough to nail the basics:

- Spend less than you earn

- Save a percentage of every paycheque

- Prioritize your financial goals

- Invest for the future

One solution for these in-betweeners is to pair technology – in this case a robo-advisor, with a navigator – in this case an unbiased fee-only financial planner.

The robo-advisor acts as the GPS, automatically monitoring and even rebalancing your investments to ensure you meet your retirement goals. Robo-advisors aren’t perfect, so while they may not steer you into a lake, most charge a fee in the 0.50% range to take the wheel and manage your investments.

Alternatively, those with a little more confidence in their investing prowess can save money by opening a discount brokerage account and purchasing a single ETF (an asset allocation ETF). With this approach, investors can build a low cost, globally diversified, and mostly hands-off investment portfolio.

So that’s how to manage your investments, leveraging technology to save on fees and build a diversified portfolio. But your investments are really just a small part of your financial plan.

A Financial Navigator

The bigger picture means asking yourself questions like, what are my financial goals for the short and long term? When should I retire? When can I afford to retire? How much do I want to spend in retirement to allow me to live comfortably? Should I take CPP at 60, or wait until 65 or even 70? Do I want to sell my house at some point and downsize, or even rent in retirement?

For answers to these questions you might find comfort talking to an unbiased financial planner. Someone who charges you by the hour or by the project, not based on how much you invest with them.

This type of accountability relationship is a lot like having a trusted navigator by your side. Someone to point you to a potential shortcut, or to avoid the road construction ahead. Perhaps someone to point out when you’re about to turn into a lake.

Are you blessed with a clear sense of direction when it comes to your finances? Or do you need a financial navigator to help guide the way?

Stocks went down. Real estate went up. Yet I sold stocks to buy real estate. Welcome to 2022, where things no longer make sense.

That’s right, we made a big decision earlier this year to purchase a lot and build a new house. Once we decided we were serious about taking this step (as in, we found a lot, builder, and floor plan that we liked at a price we could comfortably afford), we sold all of the investments in our TFSAs and moved them to a high interest TFSA at EQ Bank.

We also secured financing so that we could meet the builder’s draw schedule without having to sell our existing house before the final draw. We’ll use a mix of our existing savings, plus a line of credit from our home equity.

The building process should take about 10 months. We haven’t done much yet, other than select our appliances (supply chain!), decide on exterior colours, and pick out windows. We’re eager to see more activity this summer and into the fall.

It has been a weird start to the year, with inflation soaring and stock and bond markets crashing. We’re focusing on what we can control – earning enough in our business to meet our spending and savings goals – and trying not to sweat the markets or the price of gas, avocados, and coffee.

Our business earned as much as we expected in the first six months of the year. We intentionally planned to earn a bit less this year due to our revenge travel tour that included trips to Maui, Italy, the U.K, and Paris. So far, so good.

I planned to invest about $40,000 in our corporate investment account this year, but I’ve front-loaded most of that to take advantage of lower stock prices. We’ve already contributed $32,000 so far this year.

We’re no longer contributing to our RRSPs (due to paying ourselves dividends for now), so those accounts are just sitting there taking a beating this year.

Indeed, it turns out that selling stocks in January was fortuitous timing in our TFSAs because global stocks are down about 17% on the year.

Finally, we had our house appraised so we could increase our home equity line of credit. If you’ve followed these updates you’ll know I’ve kept our house value at around its purchase price for many years. Well, the Lethbridge market finally took off last year and our appraisal came in at $530,000. Comparable homes are selling in the $560,000 range.

I’m comfortable moving up our home value based on the appraised value, and that gives us some wiggle room in case home prices fall in the coming year.

Now, let’s look at the numbers.

Net worth update: 2022 mid-year review

Total Assets – $1,461,979

- Chequing account – $5,000

- Savings account – $60,000

- Corporate investment account – $205,313

- RRSPs – $250,705

- LIRA – $166,225

- TFSAs – $170,586

- RESP – $74,150

- Principal residence – $530,000

Total Liabilities – $164,712

- Mortgage – $164,712

Net worth – $1,297,267

This report is going to look very different at the end of the year. Our draw schedules will begin soon, which will deplete our existing savings. We’ll end up with more debt due to carrying the line of credit for several months before we sell our house. Hopefully, by March 2023, we’ll end up with our “new normal”, which will be a more expensive principal residence, a bigger mortgage, and empty(ish) TFSAs.

Our 10-year plan is to stay in the new house while our kids finish school and decide where they want to go for their post-secondary education. We’re open to the possibility of moving to be closer to them, or to do our own thing. We’ll see when the time comes. In any case, the new house will better suit our needs and we’re excited for this next chapter of our lives to begin.

Now let’s answer a few questions about the way I calculate net worth:

Credit Cards, Banking, and Investments

We funnel all of our purchases onto a few different rewards credit cards to earn points on our everyday spending.

Our go-to card is the American Express Cobalt Card, which we use for non-Costco groceries and gas. I’m also using the HSBC World Elite MasterCard, which came with an incredible 100,000 point welcome bonus. Finally, we look for the best credit card sign-up bonuses and time our large annual spending (car and house insurance) around these offers. One I’m using currently is the American Express Aeroplan Reserve Card.

Our joint chequing account is held at TD, along with our mortgage and kids’ RESPs. My wife has her own chequing and savings accounts at Tangerine. Our high interest savings account is held at EQ Bank, which pays 1.65% interest.

My RRSP and TFSA is held at the zero-commission trading platform Wealthsimple Trade. My LIRA is held at TD Direct, and the corporate investment account is held at Questrade. My wife’s investments are held at Wealthsimple. You know all of this from my post about how I invest my own money.

RRSP / LIRA / RESP

The right way to calculate net worth is to use the same formula consistently over time to help track and achieve your financial goals.

My preferred method is to list the current value of my RRSP, LIRA, and RESP plans rather than discounting their future value to account for taxes and distributions.

I consider a net worth statement to be a snapshot of your current financial picture, so when it comes time to draw from my RRSP/LIRA and distribute the RESP to my kids, my net worth will decrease accordingly.

Principal Residence

We bought our home in 2011 for $424,000 and developed our basement a few years later, increasing its value to ~$450,000. The next year I bumped up the market value by 2% (which is still less than its city-assessed value), but the local real estate market has since flattened – with nothing selling in our price range – and so I’ve left the value at $459,000 for the past three years. As I explained, we recently had a property appraisal and I have increased the value to match that appraisal at $530,000.

Final Thoughts

I’ve been warning readers for several years that we should probably lower our expectations for future returns. Trees don’t grow to the sky, as they say. That’s why I’m not surprised at all to see global markets fall this year after three years of exceptional returns.

Focus on things you can control, like your savings rate. Your investment portfolio and net worth will fluctuate up and down in the short-term, but what you want (at least in your accumulation years) is to keep the needle moving forward over the long-term.

Money invested today has a higher expected return than it would have 6-12 months ago. Take comfort in that. I know I do.

We’ll continue following our plan, investing what we can in our corporate investment account while preserving cash on our personal side of the ledger for upcoming house expenses. We want to put a sizeable down payment onto the new house and have money left over to do the landscaping, etc. Then we’ll transition into that new chapter, with a new (larger) mortgage payment, and start to fill up our TFSAs again.