I often recommend deferring CPP until age 70 to secure more lifetime income in retirement. It’s also possible to defer OAS to age 70 for a smaller, but still meaningful, increase in guaranteed income.

While the goal is to design a more secure retirement, there can be a psychological hurdle for retirees to overcome. That hurdle has to do with withdrawing (often significant) dollars from existing savings to fill the income gap while you wait for your government benefits to kick-in.

Indeed, the idea is still to meet your desired spending needs in retirement – a key objective, especially to new retirees.

This leads to what I call the retirement risk zone: The period of time between retirement and the uptake of delayed government benefits. Sometimes there’s even a delay between retirement and the uptake of a defined benefit pension.

Retirement Risk Zone

The challenge for retirees is that even though a retirement plan that has them drawing heavily from existing RRSPs, non-registered savings, and potentially even their TFSAs, works out nicely on paper, it can be extremely difficult to start spending down their assets.

That makes sense, because one of the biggest fears that retirees face is the prospect of outliving their savings. And, even though delaying CPP and OAS helps mitigate that concern, spending down actual dollars in the bank still seems counterintuitive.

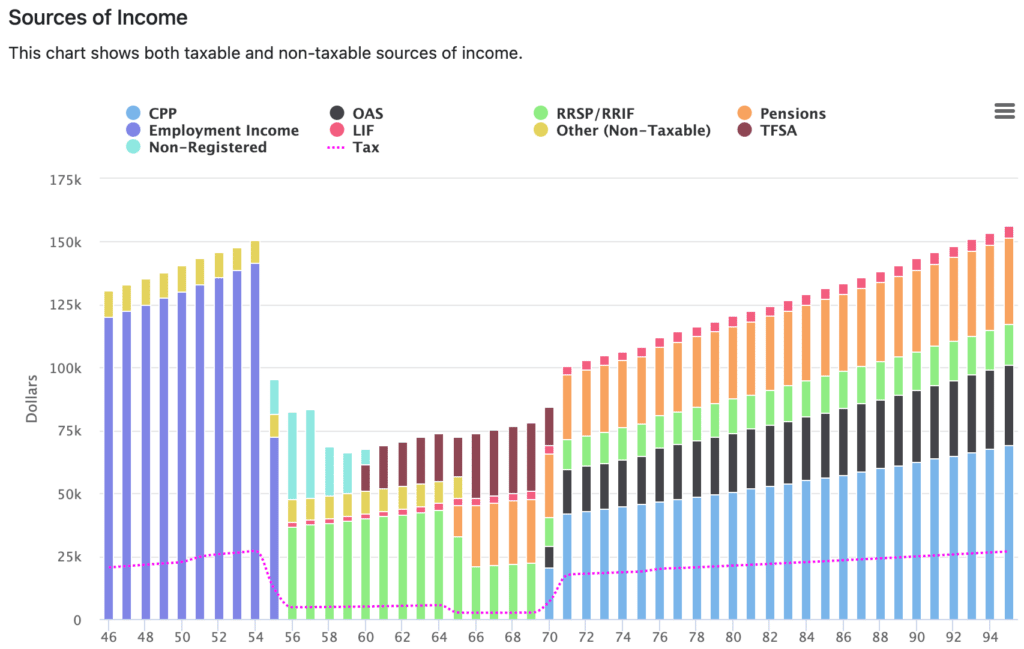

Consider an example of a recently divorced woman I’ll call Leslie, who earns a good salary of $120,000 per year and spends modestly at about $62,000 per year after taxes (including her mortgage payments). She wants to retire in nine years, at age 55.

Leslie left a 20-year career in the public sector to work for a financial services company. She chose to stay in her defined benefit pension plan, which will pay her $24,000 per year starting at age 65. The new job has a defined contribution plan to which she contributes 2.5% of her salary and her employer matches that amount.

Leslie then maxes out her personal RRSP and her TFSA. She owns her home and pays an extra $5,000 per month towards her mortgage with the goal of paying it off three years after she retires.

Because of her impressive ability to save, Leslie will be able to reach her goal of retiring at 55. But she’ll then enter the “retirement risk zone” from age 55 to 65, while she waits for her defined benefit pension to kick-in, and still be in that zone from 65 to 70 while she waits to apply for her CPP and OAS benefits.

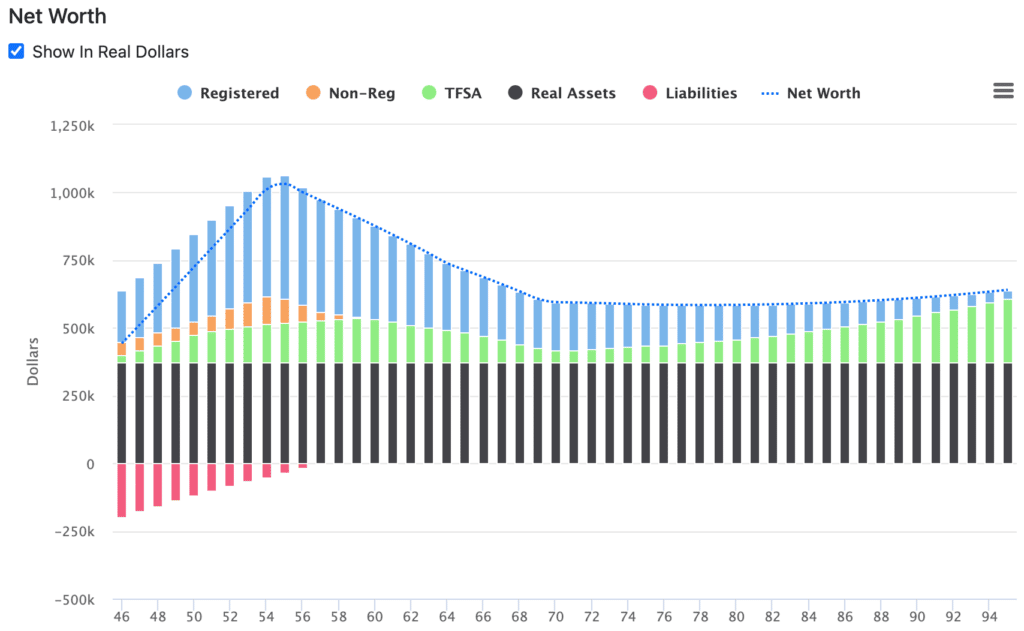

The result is a rapid reduction in her assets and net worth from age 55 to 70:

Leslie starts drawing immediately from her RRSP at age 56, at a rate of about 7.5% of the balance. She turns the defined contribution plan into a LIRA and then a LIF, and starts drawing the required minimum amount. Finally, she tops-up her spending from the non-registered savings that she built up in her final working years.

When the non-registered savings has been exhausted at age 60, Leslie turns to her TFSA to replace that income. She’ll take that balance down from $216,000 to about $70,000 by age 70.

Now, we know that withdrawing 7.5% of a portfolio is not sustainable over the long term. But Leslie has a magic trick up her sleeve. She can cut her RRSP withdrawals in half at age 65 when her defined benefit pension kicks in. By age 70, when CPP and OAS benefits begin, Leslie can start drawing the minimum amount required from a RRIF (5%).

Even with the reduction in RRSP/RRIF withdrawals, Leslie’s income from her pension and government benefits is now high enough to stop making withdrawals from her TFSA, and in fact start contributing to the tax-free account again.

This makes for a nice tax-free estate for Leslie’s only child, but also gives her a pot of money for any planned or unplanned expenses or spending shocks that may occur throughout retirement.

Finally, of note, once Leslie’s mortgage is paid off at age 58 she increases her after-tax spending by $5,000 to enhance her retirement spending. Her after-tax spending budget increases by 2.1% per year to keep pace with inflation over the long term.

Final Thoughts

While this is one unique example of the retirement risk zone, I see similar scenarios play out all the time for clients who retire between 55 and 65 and have a delay in taking their pension and/or government benefits.

It’s not even unique to those deferring CPP and/or OAS to 70. The retirement risk zone can happen anytime between retirement and the traditional uptake of government benefits.

Early retirees want to maximize their ability to spend and may also have one-time expenses like a new vehicle, home renovations, a bucket list trip, or financial support to their young adult children.

Related: Your Retirement Readiness Checklist

For these reasons it can be difficult, psychologically, to defer taking your pension and/or government benefits (even though it makes the most mathematical sense) while spending down existing savings.

That’s why it’s helpful to see the big picture with a retirement plan that shows how all of these different income puzzle pieces fit together over the long term.

The retirement risk zone can seem extremely risky until you see the pension and/or government benefit dollars kick-in and raise your income floor by a substantial amount.

So, while it’s tempting to take your pension and benefits early to ease the anxiety you face during this retirement risk zone period, know that by doing this you’ll actually be losing income in your later retirement years.

Instead, consider taking on some part-time work, or delaying your retirement by 6-12 months, or spacing out some of your planned one-time expenses (or easing asset depletion concerns by financing a large purchase over a few years), to help bridge the gap.

Better yet, as I say to my clients, it’s helpful to wrap your head around the idea of transferring risk from the market to the government and/or your company pension plan – trading your own riskier investments for a guaranteed, paid for life, indexed to inflation source of income.

The goal all along, even during the retirement risk zone period, is to generate enough income to meet your spending needs in retirement.

Take comfort knowing that by the time your CPP and OAS kicks in at age 70, you’ll often end up with more income than you need to meet your desired spending in retirement. Tuck that extra income away in your TFSA to create a tax-free estate, a source of funds for large planned one-time expenses, or as a safeguard against unplanned spending shocks.

Recent stock and bond market turmoil has many investors thinking about making changes to their portfolios.

Indeed, mutual fund investors may be wondering whether it’s the right time to switch from their expensive financial advisor to a low-cost portfolio of index funds using a robo advisor or online brokerage. DIY investors may be pondering changes to their investment strategy.

On the one hand, the market downturn presents a great opportunity to capitalize on buying investments “on sale” and can potentially take advantage of crystallizing a capital loss in taxable accounts.

On the other hand, you don’t want to panic-sell your existing investments and take a loss. Also, sitting in cash and waiting for the market to rebound could mean buying back in at a higher price.

So, should you move your investments, make a change, or stay put until the market rebounds?

Take a Breath

To be clear, investors shouldn’t change their investment strategy based on current market conditions. We know that investment risk means there’s a chance your portfolio can lose value in any given day, week, month, or even year. We also know, historically, that markets have twice as many ‘up’ years as they have ‘down’ years.

What we don’t know is in which order or sequence these events will occur. So that means staying the course and staying invested will give investors the best chance at capturing those up days and achieving a favourable outcome (i.e. making money).

Evaluate Your Portfolio

We also know that investors are emotional and prone to market timing, performance chasing, panic selling, and other bad behaviours that are hard-wired into our brains.

The past decade of strong returns has made us overconfident of our capacity for risk and led many investors to chase speculative returns from cryptocurrency, cannabis, disruptive technology, and other exploding fads. It has led us to invest short-term money that may have been better off in the safety of a GIC or high interest savings account. And, it has fooled us into believing that investment fees don’t matter, as long as the performance is strong.

The first thing investors need to do is take a hard look at their existing investments and determine if they still make sense. In other words, do your investments match your risk tolerance, your time horizon, and provide you with proper diversification? Are you paying an advisor to actively beat the market, and, if so, how did their performance stack up?

If you already have a sensibly constructed portfolio of index funds or ETFs, then it’s probably best to just hang on and weather the storm. That’s right – do nothing!

The rest of this article is aimed at investors who may need to make a portfolio change.

Reframe Your Thinking

Many investors find that a market downturn like we’ve recently experienced is an opportune time to change investment strategies. Maybe your advisor’s promise to ‘protect your downside’ didn’t pan out as your portfolio plunged in value. Perhaps your stock picking prowess wasn’t as good as you’d hoped. Or, you finally realize the old adage that nobody cares more about your money than you do.

Whatever the catalyst, you need to know if now is the right time to make a switch. And, if it is, where to move your money and how to invest it going forward.

First of all, forget the notion of selling low and buying high. Changing investment strategies simply means moving your already invested money into either a more risk-appropriate investment or to one with a higher expected return (due to lower fees or broader diversification).

I went through this myself during the last oil price collapse in 2015. At the time I held 20+ Canadian dividend paying stocks, and the handful that were in the energy sector got hammered and lost 30-50% of their value.

When I made the decision to switch to index investing, I had to sell all of my individual holdings, including the ones that were down in value. Most investors have the mindset to want to hold onto their losing investments until they recover. But I had to reframe it and think of my individual stock holdings as one large portfolio ($100,000 at the time). I was moving that $100,000 from 20 ‘riskier’ Canadian individual stocks to a more diversified two-ETF solution that held many thousands of stocks around the globe.

So, you’ll want to think about your portfolio as a whole lump sum instead of a collection of individual parts. You can move that lump sum to another platform, be it a robo advisor or self-directed discount brokerage. All the while you’re going to remain invested – outside of potentially a day or two when you sell your existing holdings and set up your new portfolio.

DIY vs. Robo: Decide on the Platform

Are you a hands-on investor who wants to take control of your investments and slash your fees to the bone?

Great, you’re a prime candidate to switch to a self-directed online brokerage. In the name of simplicity, I’d recommend one of the following three options:

- If you bank at one of Canada’s big banks (like TD or RBC) then just open an account at their discount brokerage arm.

- If your banking is scattered around at different places, or you bank at a credit union without a discount brokerage arm, consider opening an account at Questrade.

- And, if you’re just starting out and have basic investing needs such contributing regularly to an RRSP, TFSA, or non-registered account, then consider using Wealthsimple Trade.

But, maybe you find the idea of DIY investing is a bit intimidating. In that case you’ll want to consider a robo advisor.

With a robo advisor, you’ll get a hands-off experience where all you need to do is fund the account and contribute regularly. The robo advisor handles the rest, from setting up a portfolio of index ETFs, to automatically monitoring and rebalancing your investments. They can even automate withdrawals for retirees.

Building Your Portfolio

Investors who’ve chosen the robo advisor path need not worry about this section. When you open an account with a robo advisor like Wealthsimple you’ll answer some basic questions around your risk tolerance, experience, and investing time horizon. Based on those answers, you’ll get placed in a diversified portfolio of stock and bond ETFs.

For those who’ve chosen the DIY investing path, the investment choices are much more difficult. There are so many stocks and ETFs to choose from that it’s enough to confuse even the most knowledgable investors.

To make things simple, you should probably stick with a single asset allocation ETF. These all-in-one solutions hold a pre-determined mix of Canadian, US, international and emerging market stocks, plus Canadian, US, and international bonds. They automatically rebalances this mix when markets move up and down, so you don’t have to worry about tinkering with your portfolio.

Related: The Best ETFs and Model Portfolios for Canadians

You should avoid individual stocks as a general rule unless you simply cannot help scratching your stock picking itch, in which case you should limit individual stocks to a small portion (say 5%) of your portfolio.

The same goes for riskier ETFs that invest in specific sectors like oil & gas, cannabis, or biotech, or ones that trade in commodities and futures. And, please, steer clear of any ETF that has “Triple leveraged Bull/Bear” in the title.

It’s tempting to look at stocks or sectors that have been badly beaten up during the latest market turmoil, but these investments can be highly speculative and risky – they should not be the foundation on which your investment strategy is made.

Final Thoughts

The first half of 2022 was one of the worst six-month periods in history for stock and bond investors. Stocks and bonds have since rebounded, but plenty of economic certainty remains.

Investors may still be feeling angst about their portfolios. The ones who didn’t panic and stayed the course have likely seen their portfolios recover some losses. Passive index investors know they should accept the ups-and-downs of the market and not abandon their strategy as economic or market conditions change.

But the latest crash also may have also exposed the flaws in our portfolios. Our allocation to stocks may have been too high after years of strong returns. Many more have strayed into speculative investments instead of sticking with core broad-based indexes. New investors might have put short-term money (like for a house down payment) into the market expecting a quick profit. Still, others are paying too high of fees for their managed portfolio of investments.

For those investors, now is as good a time as any to re-evaluate your portfolio and consider changing investment strategies.

Just remember that changing approaches does not mean market timing or selling low and buying high. You’re simply moving your already invested money into a potentially more risk-appropriate, lower cost, and globally diversified investment portfolio with a robo advisor or self-directed online brokerage.

Have you moved your investments or changed strategies in 2022? Let me know in the comments.

The self-improvement market is estimated to be worth more than $10 billion in the U.S. and $40 billion globally. Indeed, there’s no shortage of books, blogs, and online courses designed to boost your productivity and life satisfaction.

Hey, if morning routines, vision boards, and setting smart goals gets you motivated to make positive changes in your life then knock yourself out.

I like to set goals every year for my personal finances and for my business. But the truth is my life changed for the better when I thought more about what I didn’t want my life to look like. I’m talking about anti-goals.

Think about your worst day. Is it packed with useless meetings? A soul-sucking commute? A never-ending list of household chores? Stuck at the office until 7pm? Missing your kid’s after-school activities? No time to exercise?

Unfortunately, that’s what almost every day looks like for so many of us.

Then we read self-improvement books and life hack blogs to help us squeeze extra time out of these dreadful days. Wake up at 4:30am. Set up phone calls or dictate emails during your morning commute. Spend your evenings cleaning and doing chores. Spending your weekends driving around for your kids’ activities.

What if we flipped the script and designed our life to reduce the time we spend doing things we hate, or avoid doing those things altogether?

- Living within walking / cycling distance from work. Or, negotiating a remote working arrangement.

- Blocking out time in your work calendar to do your actual work.

- Paying for a house cleaner. Hiring a handyman. Arranging a grocery or meal delivery service.

I recognize that I live a very unusual lifestyle compared to the average person. I am self-employed and work from home. I set my own hours, working as much or as little as I want. I have a home gym. I travel 8-9 weeks per year. I eat a plant-based diet.

I’ve used the power of anti-goals to help design this lifestyle. Some of my anti-goals include:

- No daily commute

- No meetings before 9:30am

- No meetings / work after 12pm on Fridays

- No Disney / Vegas / Stampede

- No truck / trailer / boat / vacation home

- No scheduled weekend activities for the kids

- No clutter in the garage or spare bedroom

I started to design my ideal lifestyle with these anti-goals in mind. I quit my job to focus on my online business. I set up a home office and a gym. I work out for 60 minutes every weekday morning. I use Calendly to block off early mornings, Friday afternoons, and travel days. We aim to travel 8-9 weeks per year, with emphasis on the U.K. and Europe. We enrol our kids in after-school activities (two each) during the week. We regularly declutter by donating or selling unused stuff.

Anti-goals have worked well for us to help design our weird but wonderful lifestyle. Let me know if they work for you.

This Week’s Recap:

We’ve returned home from an incredible 24-day trip to the U.K. We visited London, the Lake District, Stirling, Fort William, Inverness, St. Andrews, and (our favourite city) Edinburgh.

“This is a city of shifting light, of changing skies, of sudden vistas. A city so beautiful it breaks the heart again and again.” pic.twitter.com/AcplArqJ93

— Robb Engen (@RobbEngen) July 28, 2022

I got out of my comfort zone and rented a car for our three-night stay in the Lake District and for nine days as we explored the Scottish Highlands. I’m pleased to report that no side-mirrors were harmed during the road trip.

I managed to publish two posts while we were away. A Weekend Reading: London Edition, and a post about mental accounting.

Now that I’m back home I hope to post a bit more regularly here. And, stay tuned for my DIY investing course to be launched shortly.

Promo of the Week:

Repeating this from a few weeks ago –

The most frequently asked question about our travels this year? How did you earn enough points to fly a family of four to Europe / U.K. three times in 2022?

My wife and I each have our own American Express Cobalt cards and make sure to charge $500 per month in groceries (not hard these days!) to the cards to earn 5x points on groceries plus a 2,500 point monthly bonus for the first 12 months.

That adds up to 30,000 points for regular spending, plus the 30,000 bonus points for hitting the monthly spending target. There’s 120,000 points combined, which we transfer to Aeroplan to use for flight rewards.

We also signed up for the American Express Aeroplan Reserve Card, where right now you can earn up to 90,000 in bonus points when you spending $1,000 per month over six months ($3,000 in the first three months, and a total of six monthly billing cycles where you spend $1,000).

I know many people will balk at paying a $599 annual fee. But you need to look objectively at your net return after fees. You can earn up to $2,800 in travel rewards with the American Express Aeroplan Reserve Card in the first year of card membership. Subtract the annual fee and you’re still netting $2,200.

For me, as long as I can meet the spending requirements without making meaningful changes to my normal expenses, these cards can make good sense. For example, I just got our house insurance notice in the mail. It’s up 15% and will cost us about $2,600 this year. Fortunately, I can pay upfront with an Amex card.

Weekend Reading:

I should go away more often. After a brutal first half of the year for stocks and bonds, investors were treated to an exceptional month in July. The S&P 500 was up 9.1% for its best month since November 2020. Vanguard’s Balanced ETF (VBAL) was up 4.92%, while Vanguard’s All Equity ETF (VEQT) was up 5.96%.

It’s funny, I received several emails from clients and readers wondering if they should sell their balanced portfolio and buy a GIC at 4%. This is a reminder that the worst stock and bond returns are often quickly followed by strong performance.

Selling a balanced investment portfolio at a loss and locking in a 4% return may sound sensible if you expect your investments to continue losing money. But we don’t know when things will turn around, and the turnaround can often be lightning fast (see April 2020).

That’s why it makes sense to stick to your plan and ride out the temporary volatility. It’s the world’s best stock market tip.

Portfolio Manager Markus Muhs wrote an excellent primer on RRIFs – what they are, how they work, and how to convert your RRSP into one.

Millionaire Teacher Andrew Hallam explains how to retire early with less than you might think:

“Coupling a lower cost of living with lower taxes (or no taxes) can supercharge the buying power of the money you saved.

Not everyone will want to retire in a different country. Some might miss family and friends.

But in an age when adult children often scatter to different cities (even different countries) plenty of retirees in beautiful destinations report seeing their family more because they live abroad.”

Retirement ‘like winning the lottery’: How these retirees are enjoying the summer despite economic concerns.

Boomers are exiting the workforce in droves, leaving more job vacancies than there are people to fill them.

The hedonic treadmill of conspicuous consumption is difficult to escape. Ben Felix answers an important question on whether people with luxury vehicles actually enjoy their vehicles more:

Rob Carrick says it’s time to cancel the idea that a big mortgage is a noble burden because home prices will rise.

Finally, it’s an Andrew Hallam trifecta – here he explains why young ETF investors should be partying in the streets right now.

Have a great weekend, everyone!