The recent stock market crash and plunging interest rates may have some investors scrambling for safe havens. Stocks fell by as much as 35 percent (before recovering about half of those losses), while the interest rate on GICs and savings accounts in particular have dropped in lock-step with the Bank of Canada’s emergency rate cuts.

Everyone’s situation is unique. First, we all need to be mindful of our personal finances to ensure we have enough cash flow to get through this crisis.

Investors still in the accumulation stage with several years or even decades to go before retirement can confidently stick to a risk-appropriate investing plan.

Those nearing retirement should consider building a safety buffer of cash and GICs to cover their spending needs in the first years of retirement.

Retirees have different goals, such as balancing current income needs with the need to continue growing their portfolio to cover future spending.

One caution for investors of any age is to avoid chasing yield. We’re in extraordinary times, when banks and energy companies have dividend yields in the 7-10 percent range.

As attractive as those yields look to income-hungry investors, it’s not hard to imagine any of these companies, even our treasured banks, suspending, cutting, or even eliminating dividends at some point in the future. There’s a long list of nearly 50 companies that have already done so since March of this year.

On the fixed income side, we know that cautious savers want their money to at least keep up with inflation. One reader asked whether market-linked GICs were worth a look:

“With the GIC rates dropping again, and not being interested in investing in the stock market at our age, what is your opinion on market-linked GICs? Your principal is safe and there’s good upside potential if markets perform well.”

To be blunt, I’m not a fan of market-linked GICs. In fact, you’re most likely better off with plain vanilla GIC.

Remember you cannot have reward without taking risk. The promise of “some market upside” with these products is often mis-sold to investors who think they can have their cake and eat it too.

Banks have pushed market-linked GICs for years as interest rates plunged to historic lows. With this clever marketing gimmick, investors are guaranteed to get back their principal if markets go down, but also get to participate in some of the stock market growth if things go well.

The actual interest rate is linked to stock market returns through a complex formula that requires an advanced degree in mathematics to figure out.

Here’s an example from a few years ago that still holds true today:

This Week’s Recap:

Here are my posts from the past two weeks.

Should you postpone retirement amid the coronavirus crisis?

Last weekend I opened up the money bag to answer reader questions about moving to Questrade, investing in energy stocks, and more.

On Wednesday I listed the top ETFs and model portfolios for Canadian investors.

Over on Young & Thrifty I looked at whether now is a good time to invest in stocks.

The market crash last month may give investors an opportunity to crystallize capital losses in their taxable investing accounts. I’m working on a new piece with Wealthsimple to show how the robo advisor handles tax loss harvesting for its clients. Stay tuned for that in the coming week or two.

Promo of the Week:

I’ve received a lot of feedback from readers who are interested in switching to a discount broker like Questrade or Wealthsimple Trade.

You might want to do so if you’re already a self-directed investor with one of the big bank brokerages and are tired of paying fees for every trade (that’s why I switched from TD Direct to Wealthsimple Trade earlier this year).

Another reason to switch is to simply take control of your finances. Many investors are still heavily invested in expensive actively managed mutual funds with a bank sales person or investment advisor, paying 2 percent or more each year on their investments.

By switching to a discount broker and investing in low cost ETFs, investors can slash their fees to the bone.

Nervous to take the plunge? Try investing in an asset allocation ETF like Vanguard’s VBAL or VGRO, or iShares’ XBAL or XGRO. These one-ticket solutions take the guesswork out of investing because they are automatically monitored and rebalanced behind the scenes so you can focus your time and energy on other activities besides your investment portfolio. Truly a set-it-and-forget-it option.

Wealthsimple Trade is Canada’s first and only zero-commission trading platform where investors can trade stocks and ETFs for free in an RRSP, TFSA, or non-registered account. Sign up for Wealthsimple Trade today.

For most robust investing needs, including for LIRAs, Margin, and Corporate accounts, Questrade is still the king of low-cost investing in Canada. You can purchase ETFs for free and trade stocks for as little as $4.95. Take your savings further with a registered account at Questrade.

Weekend Reading:

Bank of Canada governor Stephen Poloz shares his thoughts on the current pandemic and laying a foundation for the road to recovery.

Rob Carrick is helping his readers through the pandemic with a weekly personal finance update. His latest explains why you should clean out your big bank savings account that’s paying next to nothing in interest.

My Own Advisor blogger Mark Seed explains how he’s preparing his finances for a global recession.

A stark reminder that home equity lines of credit are actually callable loans that can be taken away by your bank in times of trouble.

Carleton associate professor Jennifer Robson offers a great explanation to those of us asking why can’t the government just send everyone a stimulus cheque.

Preet Banerjee has done a great job keeping Canadians informed of federal government stimulus measures, including the most recent changes to the CERB:

Another Carleton professor, Frances Woolley, explains the behavioural economics of the Marie Kondo method. Marie Kondo is the guru behind the best-selling Life-Changing Magic of Tidying Up and Spark Joy.

Morgan Housel asks two big questions – one economic, one more social – that seem crucial to pay attention to as we think about recovery.

Here’s a brilliant thread on Twitter – a Q&A with Costco founder Jim Senegal:

for my marketing class this morning the founder of Costco(!!!) Jim Senegal is speaking & doing a Q&A. does anyone have any questions?

ps Jim is one of the sweetest and most humble people I’ve ever met.

— Paige Doherty (@paigefinnn) April 16, 2020

The latest Canadian Portfolio Manager podcast with PWL Capital’s Justin Bender sheds light on his “Light” model ETF portfolios that include the asset allocation ETFs offered by Vanguard and iShares.

Seniors who don’t need all of their RRIF money this year should consider this workaround.

Here’s Millionaire Teacher Andrew Hallam speaking to retired Canadian investors about what to do with the investments during the COVID-19 market crash:

Michael James on Money uses a personal example to explain how rebalancing does its job.

Finally, is it your dream to work from home full-time? Our friends at Credit Card Genius share 20 ways to work from home.

Have a great weekend, everyone!

Welcome to the Money Bag, where I answer questions and address comments from readers on a wide range of money topics, myths, and perceptions about money. No question is off limits, so hit me up in the comments section or send me an email about any money topic that’s on your mind.

This edition of the Money Bag answers your questions about moving investments to Questrade, investing in energy stocks, government bailouts, and managing investments during uncertain times.

First up is Lisa, who would like to move her investments to Questrade to lower her investment costs and take control of her portfolio. Take it away, Lisa:

Moving to Questrade

“Hi Robb, my investments are currently held in mutual funds at one of the big banks. I’m tired of paying fees, and want to take control of my own portfolio by opening a self-directed account at Questrade.

Can you tell me how to move my RRSP and TFSA investment accounts over to Questrade? Do I need to speak with my current advisor?”

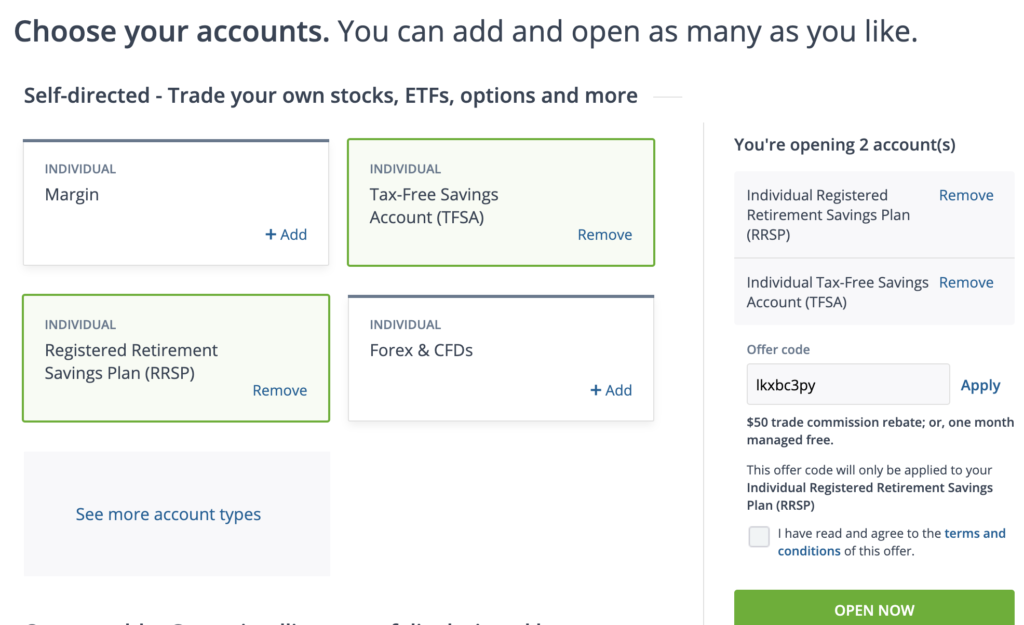

Hi Lisa, first of all, know that you don’t need to break up with your current financial advisor or even speak to him or her at all. Simply open an RRSP and TFSA account at Questrade, request the transfer, and they’ll initiate the transfer for you.

Here’s what I mean:

- Go to Questrade

- Click “Open an Account”

- Select ‘TFSA’ and ‘RRSP’

Click ‘Open Now’

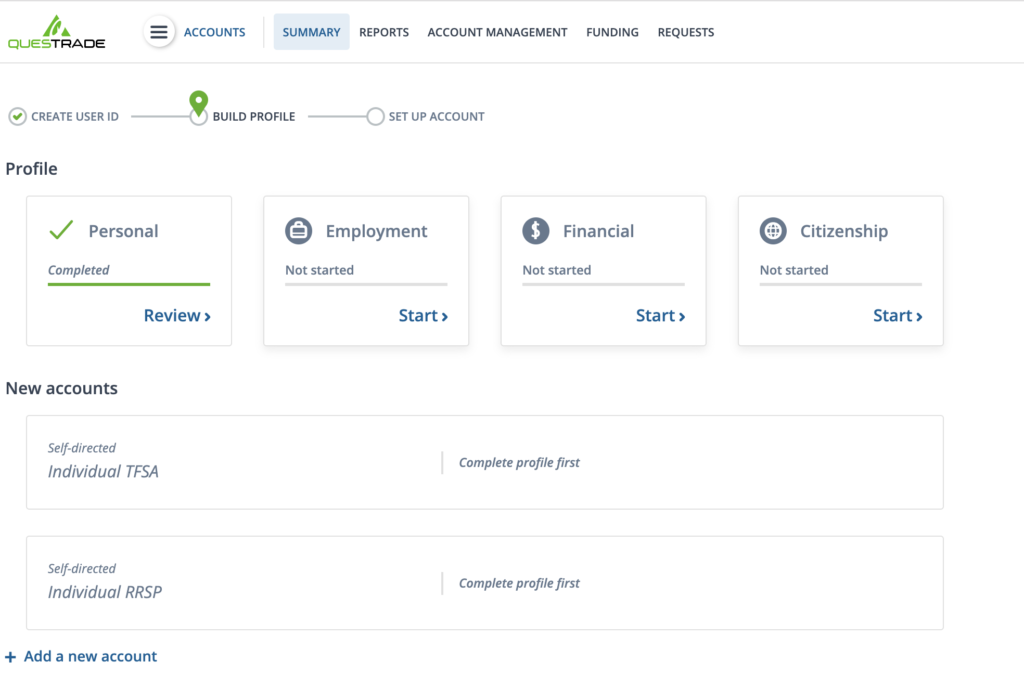

It’ll ask you to create a user ID and profile. Fill out your name, email, and phone number, and click ‘Continue’.

Create a user ID and password.

Once you’ve set up your individual profile and get to the main dashboard, you’ll want to click on ‘Account Management’ at the top of the screen:

- Then click ‘Upload Documents’

- Complete all fields. For Document type, select ‘Rebate’

- Click ‘Upload’

Questrade will even rebate any transfer fees charged from your current financial institution up to $150. To get your fee rebate, send a copy of the statement from your financial institution showing the transfer fee you were charged within 60 days of submitting your transfer request to Questrade.

One important note: As we covered in the last edition of the Money Bag, there are two types of account transfers.

- An in-kind transfer means your investments move over from your current institution to Questrade exactly as is.

- An in-cash transfer has your financial institution liquidate your investments and send Questrade the cash.

Another important note: Assuming you are transferring an account such as an RRSP or TFSA, the transfer will happen within those tax-sheltered containers. Meaning, there will be no tax implications at all. You’re simply moving money to another institution – you’re NOT making an RRSP or TFSA withdrawal.

That’s it. Questrade will initiate the transfer and you’ll have the money within two weeks or so (banks are slow at transferring).

Use my referral link to open your Questrade account. I’ll get a small commission, and you’ll get $50 in free trades.

Investing in Energy Stocks

Next up is Jeremy, who wants to take a flyer on some energy stocks and wonders about the best way to make this investment:

Hi Robb, I have a question. I would like to buy some energy stocks with some money I have sitting around. What is the cheapest, best way to do this?

I am aware of how energy stocks have done and I am also not a stock picker and believe in broad based investing. This is just a small amount of money and I am going to take a flyer on just a few energy stocks.

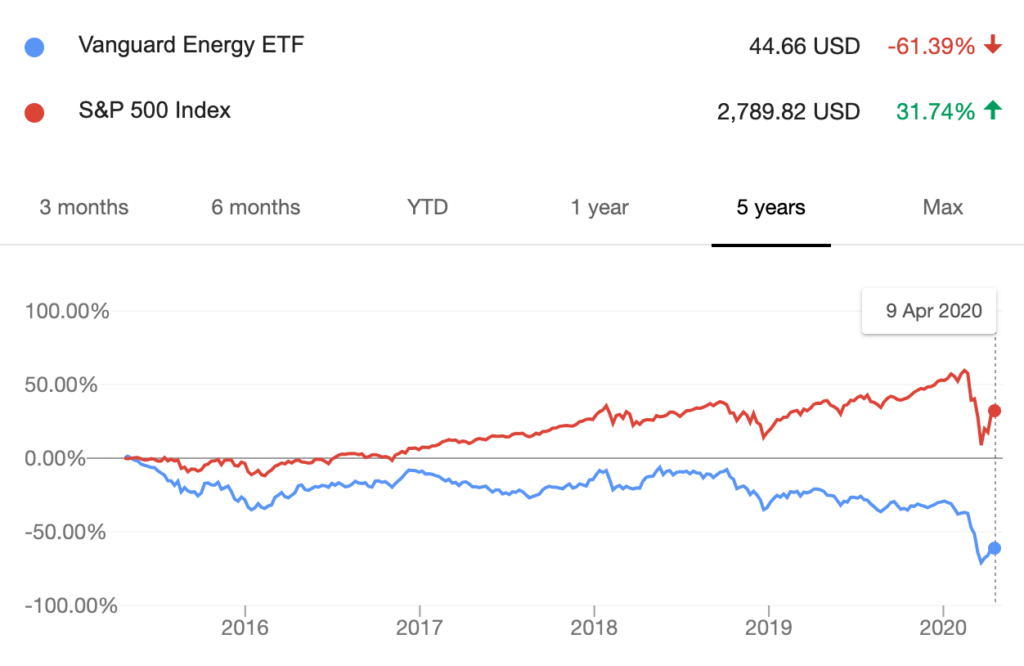

Hi Jeremy, I don’t advocate for buying individual stocks, and even if I did I’m not sure energy stocks would be at the top of my list. The past five years have not been kind to energy stocks compared to the broad market.

Vanguard’s energy ETF (VDE) is down 61.39 percent over the last five years. Meanwhile the S&P 500, despite its recent turmoil, is up 31.74 percent in that same period.

That said, I can’t begrudge an investor who wants to bet a small portion of his portfolio on individual companies or sectors. As long as it’s money you can afford to lose.

I get the appeal. It doesn’t take a huge stretch of the imagination to see a future where oil prices return to their previous highs.

Individual energy stocks:

Let’s say you want to take 5 percent of your portfolio and invest in energy stocks. A number of dividend paying energy stocks look attractive with yields above 8 percent (i.e. Canadian Natural Resources, Enbridge, Suncor).

Be careful about chasing high dividend yielding stocks. The company may choose to reduce, suspend, or eliminate its dividend, a move which often sends share prices down.

A safer bet might be to look at energy stocks whose price-to-earnings ratio has fallen. These stocks may or may not pay a dividend, so investors would be betting on share prices returning to their former oil-boom glory. Cenovus and Imperial Oil would fit the bill.

Energy ETFs:

How should you invest in energy with little money? Instead of picking one or two individual stocks, the smart play might be to invest in an ETF that tracks the energy sector.

There’s the iShares ETF called XEG. This ETF aims to track the performance of the S&P/TSX Capped Energy Index. If you want to invest in Canadian energy, this isn’t a bad way to do it.

This ETF, like the entire energy sector, has gotten killed over the past five years, but still has net assets of more than $426M. XEG also pays an attractive distribution of 5.6 percent. It comes with a MER of 0.61 percent, which is expensive compared to broad market ETFs but is a reasonably cheap way to invest in 22 Canadian oil and gas companies with just one fund.

Or, look at a similar ETF such as BMO’s Equal Weight Oil & Gas Index ETF (ZEO). It holds 11 large-cap oil companies using an equal weighted approach, rather than XEG’s market-cap weighting. It charges the same MER of 0.61 percent. ZEO’s concentrated approach has led to better returns than XEG, but it’s still down 66 percent over the past five years.

The most cost-effective way to invest in either energy stocks or ETFs is to open a self-directed investing account at either Questrade – which offers free ETF purchases – or with Wealthsimple Trade, a mobile-trading platform that offers zero-commission stock and ETF trading.

Unintended Consequences from Government Bailouts

Wilson would like to know what I think about the unintended consequences of government stimulus during this COVID-19 crisis:

Hi Robb, what are your thoughts on the massive amounts of government bailouts in both the U.S. and Canada? There are people like Ray Dalio and Charlie Munger who suggest that while it may be necessary, the end result is the rich get richer and the wealth gap widens, not to mention inflation, etc.

Ray Dalio was suggesting some kind of paradigm shift coming even before this pandemic.

Hi Wilson. That’s a tough question. In short, I’m in favour of governments doing everything possible to hand out stimulus to individuals and small businesses to help them through this crisis. It must be done, and it must be done quickly.

In fact, I’d be in favour of sending every single person a stimulus cheque, regardless of their circumstances, until the crisis subsides. We can sort out the consequences later, at tax time next year, by clawing back up to 100 percent of the stimulus for those who earn over a certain threshold.

*Note: Here’s a really good argument for why sending everyone a stimulus cheque would not be faster and would not actually reach everyone.

Central banks have proven they can keep inflation under control. Critics thought the massive amount of stimulus injected into the economy during the 2008 financial crisis would lead to hyper-inflation – but that never happened.

I do agree that the wealth-gap is only going to widen. That’s a big problem. But I think the paradigm shift is going to lead to more acceptance of a universal basic income and a larger investment in healthcare.

It’s not the time to worry about how we’re going to pay this bill. People need money now, and I’m glad a large portion of the bailout is going to regular people on Main Street rather than just to corporations on Bay Street and Wall Street.

Managing Investments in Uncertain Times

Finally, Meaghan wants to check in to make sure her personal finance and investing strategy still makes sense during the coronavirus crisis:

Hi Robb, I wanted to touch base with you about the current situation in financial markets. Our current strategy is:

- Keep our focus on our long term retirement goals and not worry (too much!) about short term losses.

- Ensure we have 6-12 month’s emergency cash savings

- Keep my regular diversified investments into RRSPs etc going (with the hope of reducing my cost average)

Is there anything obvious we are missing?

Hi Meaghan, I think you’ve hit the nail on the head. Don’t worry about short term losses. We’ve just seen the largest one-month decline in history. Markets hate uncertainty, but once we see the light at the end of the tunnel then markets should price in the eventual recovery and things could climb just as quickly (as we might be seeing already).

Cash is king, so you’re right to focus on a large emergency cash savings buffer.

One tip might be to divert anything you’re not spending on right now towards your cash savings. For example, we put our gym memberships on hold, saving $118/month. We’re likely not going to be spending as much on dining / take out and instead just preparing meals at home – which will likely save a few hundred bucks a month. We had prepaid a bunch of travel (trip to Italy in April) which has now been cancelled so that refunded money has been put into our emergency savings.

Avoid the urge to put a large amount of money to work in the market right now and instead stick to your regular contribution plan. I know it’s tempting when you see “stocks on sale” but no one has any idea how long this will last and putting a lot of money into the market right now goes against the idea of building up your cash savings.

Rebalance. I’m in the unfortunate position of being 100 percent invested in equities (VEQT) and having used up all of my RRSP contribution room. So I can’t rebalance by selling bonds and buying equities, and I can’t even add to my account because I am all out of room.

That’s okay. I’ve got a long time horizon and I know markets will recover eventually. But it’s a good reminder to be mindful of your true risk tolerance and to ensure you have an appropriate asset mix that you can live with in good times and bad.

Holding bonds, while reducing some of your upside in the long term, is certainly beneficial at times like this because you can rebalance “into the pain” and buy more stocks at lower prices without having to come up with more cash to invest. That’s a good thing.

I hope that provides some comfort. It sounds like you’re in a good position to ride out this period of uncertainty and come out in good shape on the other side. It’s just going to take some time.

One knock against passive investing is that while it’s great to match the market’s performance in good times, it’s not as fun to watch your portfolio drop when the outlook turns bearish. Indeed, index investors like me have seen their portfolios take a 20-25 percent hit in a relatively short period during the COVID-19 crisis.

Investors got real-time look at their risk tolerance as they watched their portfolios drop in value. Here are two things I’m doing to help keep my wits and stick to my plan:

- Avoid checking my portfolio too often: It’s tempting to sneak a peek at your portfolio value, especially after a bad day in the market. But it can be psychologically draining to see your portfolio lose money. I use Wealthsimple Trade, which is a mobile-only trading platform. I hide the app in a folder on my phone to limit the temptation to check on my investments.

- Stick with regular automatic contributions: You’ve probably heard all kinds of strategies to deal with these tumultuous times, from selling everything and waiting out the storm, to backing up the truck to go all in with your investments. As for me, I’m sticking with my regular investing schedule by having my contributions automatically taken from my chequing account. By doing this, I’ll avoid any regret that might come selling or buying too much during this market crash.

Bear markets don’t last forever. As a long-term investor, learn to tune out the noise and stick to your investing plan.

This is why investing with an appropriate asset mix is so important for index investors. My portfolio consists of one ETF – Vanguard’s 100% global equity ETF called VEQT. Year-to-date it’s down 20.93% (as of April 3, 2020).

Let’s compare that to someone who invested in Vanguard’s VBAL, which represents the more traditional 60/40 balanced portfolio. VBAL is only down 13.28 percent as of April 3, 2020. It has held-up remarkably well during this period of extreme volatility.

Active investors might prefer an ETF like Vanguard’s VDY – which represents high dividend yield stocks in Canada – since dividend stocks tend to be wide-moat, blue-chip companies that can theoretically weather a downturn better than most other businesses. That hasn’t been the case so far this year, as VDY is down 22.95 percent year-to-date.

Don’t let today’s turbulent market dissuade you from starting (or sticking with) your ETF investing journey. My advice is to think long and hard about your risk tolerance and the type of losses you’d be willing to accept. Find an asset mix that matches your risk profile, and then build your portfolio with an asset allocation ETF, or 3-4 ETFs that you can maintain and stick with over the long term.

Alternatively, you might prefer a more hands-off approach like what you’d get with a robo-advisor managing your investments.

One benefit of using a robo-advisor that doesn’t get a lot of attention is how they help remove human emotion from the investing process. It’s no secret that market crashes bring out the worst in investors. We sell when markets fall. We keep way too much cash on the sidelines. And we try to time the market to get back in (often too late).

Robo advisors help investors during market crashes by automatically rebalancing according to a pre-determined set of rules. This takes human judgement (and error) out of the equation and keeps the focus where it belongs – on your original investment plan.

Let’s say you have $100,000 invested in a 60/40 balanced portfolio. Stocks have fallen 20 percent or so, meaning your portfolio now looks something like this:

- $48,000 in stocks

- $40,000 in bonds

Your overall portfolio is down 12 percent, and, more importantly, your asset mix is out of balance. Stocks now make up just 54 percent of your portfolio while bonds are at 46 percent.

A robo-advisor will automatically rebalance by selling some bonds and buying more stocks to get you back to your 60/40 target mix. Your new portfolio will look like this:

- $52,800 in stocks

- $35,200 in bonds

This is a small example of something that’s going on behind the scenes with your robo-advisor all of the time. There’s a reason why rebalancing is called the only free lunch in investing.

How did Wealthsimple’s 50/50 balanced portfolio hold-up during the COVID-19 crisis? It’s down just 5 percent in the three months ending March 31, 2020. Not bad, considering broad stock market indices are down 20-25 percent over the same time period.

This Week’s Recap:

On Tuesday I wrote about how I’m managing my personal finances amid the COVID-19 crisis.

Over on Young & Thrifty I shared the best investments in Canada from across the risk spectrum.

From the archives: On Making Rational Financial Decisions

Promo of the Week:

We’re ordering more online to limit the number of times we leave the house for groceries and other essentials. If you’re in the same boat as me, make sure to first visit a cash back shopping portal like Great Canadian Rebates or Ebates (now Rakuten).

Become a member of Great Canadian Rebates and take advantage of online coupons and earn cash back rewards. GCR features over 400 merchants to satisfy all your shopping needs.

Rakuten pays you cash back every time you shop online, and it’s FREE to join. Sign up now and when you spend $25 you’ll earn a $5 cash back bonus.

Read my Great Canadian Rebates vs. Ebates Canada comparison guide here.

CERB Application Portal:

The application portal for the Canada Emergency Response Benefit opens on Monday (April 6). To help manage the application process, the CRA has set up specific days to apply:

- Monday April 6 for those born in January, February, or March

- Tuesday April 7 for those born in April, May, or June

- Wednesday April 8 for those born in July, August, or September

- Thursday April 9 for those born in October, November, or December

The CERB will be available to workers:

- Residing in Canada, who are at least 15 years old;

- Who have stopped working because of COVID-19 or are eligible for Employment Insurance regular or sickness benefits:

- Who had income of at least $5,000 in 2019 or in the 12 months prior to the date of their application; and

- Who are or expect to be without employment or self-employment income for at least 14 consecutive days in the initial four-week period. For subsequent benefit periods, they expect to have no employment income.

Other financial measures announced by the federal government include a special GST payment and a one-time enhanced Canada Child Benefit payment. Check out Preet Banerjee’s COVID-19 income support estimator to see how much you might be eligible to receive.

Weekend Reading:

PWL Capital’s Ben Felix takes us through the history of bear markets to explain how each downturn is different and why we eventually recover:

A Wealth of Common Sense blogger Ben Carlson shares some words of wisdom from his mentor William Bernstein.

This Toronto landlord told his renters, go ahead and skip the rent during the coronavirus pandemic:

“I really don’t care about money right now, I care about YOU … You shouldn’t be struggling to find a roof for your family.”

After years of hoarding housing supply, here’s why Toronto Airbnb hosts are panicking.

Credit Card Genius shares an incredibly thorough look at the latest coronavirus travel updates and advice for Canadians.

The Irrelevant Investor Michael Batnick with a smart take on when to rebalance your portfolio.

Humble Dollar writer Jonathan Clements gets personal and shares how he’s managing his finances and investments during the crisis.

Here’s two great posts from Michael James on Money:

- How a retirement plan responds to market volatility

- Why annuities are great in theory, but maybe not in practice

Finally, I enjoyed this take by Rob Carrick who describes six personal finance ideas that have been blown to pieces by the pandemic.

Enjoy your weekend, everyone. Stay safe!