Don’t Make This Life Insurance Mistake

Life insurance is a must if you have a spouse or children who depend on your income to get by. But asking a life insurance agent if you need more life insurance is like asking a barber if you need a haircut. Of course the answer is going to be ‘yes'. Indeed, the life insurance business has a long history of commission-hungry agents pushing expensive policies onto consumers who would be better off with simple term coverage.

While you should view any life insurance discussion with a skeptical eye, the reality is that many people are severely under-insured. Most group insurance policies at your workplace only provide coverage for one or two times your annual salary. You might need 10 or 15 times that amount if you have a young family at home.

The other challenge with group life insurance coverage is that it's not transferable – you can't take it with you when you leave your employer.

Ending My Group Coverage

That's the situation I find myself in right now. The group coverage I have with my employer is quite generous at 2.5 times salary. They also offer the voluntary option to add up to an additional $500,000 in coverage at favourable rates (each $100,000 in coverage cost just $4.50 per month). I took the maximum optional coverage and increased my overall life insurance coverage to approximately $700,000. My total premiums cost less than $35 per month.

The rational side of me knew that I'd eventually leave my job and would need to take out a private insurance policy. But I didn't get around to it. Then I quit my job.

Now I'm scrambling to get an insurance policy in place before the end of the year to avoid any lapse in coverage. First, I performed a life insurance needs analysis. A lot has changed in 10 years. My kids are older (11 and 8 next year). We have a lot more money saved. We have less debt. Do we still need $700,000 in coverage? Do we need more?

A needs analysis considers things like your survivor's income and spending needs, years of income replacement, personal and household debt, children's education, non-registered assets, and final expenses. My analysis found that a 15 year term with $600,000 in coverage would be sufficient.

Term Life Insurance Quotes

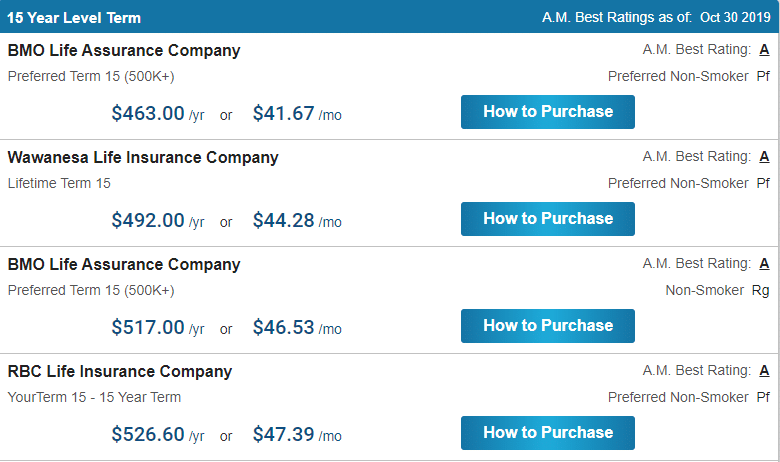

I shopped around for term life insurance quotes using the website term4sale.ca (no affiliation). I like the site because it offers unbiased comparisons from various life insurance providers, and I can obtain a quote within seconds (without entering an email address or phone number and risk being hunted down by commission-hungry agents).

Armed with a range of quotes from various insurers, I called my long-time auto and home insurance broker to see what he could do for me. He asked about the quotes and so I shared where I found them. He said his quotes might vary somewhat because the insurer will do a more rigorous interview and examination, which makes sense. After all, I filled out a quick five question form online to arrive at those other quotes.

We settled on one insurer who offered the 15-year, $600,000 term life policy at a price that seemed reasonable (less than $45/month). They set up a 20-minute phone interview, and then arranged to have a nurse visit my home to take blood and urine samples, and to take my blood pressure. Definitely more thorough than an online quote!

Final thoughts

As I await the results to see if 1) I qualify for coverage, and 2) I received an “excellent” health designation to qualify for the lowest premiums, I can't help but kick myself for making such a rookie personal finance mistake.

Topping up my life insurance with my group coverage provider was the easiest and cheapest option available to me at the time. But in hindsight I should have taken out a private insurance policy much earlier and held it in tandem with my workplace coverage.

Not that I could have predicted I'd be leaving my employment after 10 years and going to work for myself. But the lesson here is that insurance is cheap and plentiful when you're young and healthy, so you might as well buy as much as you need through a private policy – just in case. After all, isn't that what insurance is for?

Hey Robb,

I have a vague memory of reading something a long time ago where there is an option your group carrier has to allow you to transfer your group plan to a private one. Not sure if it that is true or at what cost.

Does your workplace insurer not offer post employment policy access? Manulife, for instance, offers a Follow Me plan that carries on the same coverage under employment terms at a different rate level from the employer but it’s pretty much slide over to private policy with no medical other qualifiers. This is because they consider you an ongoing client and give credit for the fact you have been paying premiums for, in your case, 10 years.

There is an option to convert group insurance to a personally held policy, but it is expensive, whole life-type insurance (hence expensive).

IF you can’t qualify for a new policy because of your health then one may consider it. If you’re healthy shop around. Term4sale.ca is a good starting point; its interesting how different the premiums can be for basically the same insurance.

Do you or your spouse belong to an organization related to your careers. Accounting,nursing,etcetera have policies through their groups.

Also if you graduated from a post secondary program they have policies for alumni.

In the U.S. one in four workers will be on disability at some point in their lifetime.

Have you considered getting disability coverage? Ignore if you’ve already covered this topic.

Great post Robb. I left my work coverage in June of 2018, but had private insurance. I now have less coverage, but as you note, as your assets and net wealth builds we can scale down the insurance requirements. As many are under insured. There are many who take on too much insurance.

I was always careful not to take on and pay for too much. The free cashflow can be invested to build insurance on the personal side. Net wealth.

Thanks, Dale

So what’s the reason for choosing 15 year coverage? Will you be shopping around again after 15 years? Wouldn’t it be very expensive at that time to get an insurance? I’m in my late thirties with kids same age as you and just trying to figure out what the best approach is.

The idea behind a 15-year policy is it will cover me til age 55, at which time the kids will be out of the house and hopefully finished post-secondary. Our savings at that point again “should” be enough to consider ourselves self-insured and no longer dependent on a working income.

I am not married and have no dependents so I am not concerned about life insurance but what I have thought about is long term disability insurance. I have a great plan at work but the rates could be very high now if I tried to covert it to private insurance.

I am rolling the dice a bit that I will be “self insured” by the time I leave my current employer but the consideration of all types of insurance that I have had access to through my group policy is daunting.

Speaking of group insurance – what about medical/dental?

Hi Pam, disability insurance is a whole other animal and I’ll likely have another post dealing with that topic soon.

I view health and dental to be more like ‘expenses to budget for’ rather than as insurance. It’s an employee benefit, not insurance.

If insurance is all about protection against catastrophic loss then a visit to the dentist doesn’t really qualify. That’s more like taking your car in for a tune-up or oil change.

That said, I am exploring health spending account options that will allow me to expense those items (up to, say $2k/year) through my business instead of paying personally. That can result in some tax savings.

Rob, myself and most other life insurance advisors would take offense with your introductory comments (answer being yes to all questions about coverage, “…long history of commission-hungry agents…”, “…view any life insurance discussion with a skeptical eye…”).

History is just that – history. The industry has come a long was – as has the financial planning industry in general. And what commission-based salesperson in practically any industry isn’t “hungry” for commission? Is there something wrong with me assuming you’re hungry for page views and clickthroughs? I guess any non-fee-based financial planner is just as unscrupulous as they rely on commission as well?

I work hard to understand a clients situation and to make recommendations based on their unique needs – and most other insurance advisors do too.

Hi Kevin, fair points – I’m sure there are good agents out there (just like there are good advisors) looking out for their clients. It’s not a knock against the people, it’s a knock against the system that’s designed to incentivize the wrong behaviour (i.e. commissions driving sales). You cannot deny that humans are influenced by incentives, and consumers need to be aware that *some* agents will not be looking out for their best interest. How are they to know who is and who is not? Hence the need for a critical eye.

Then why, Kevin, are so many young doctors, straight out of training with no financial assets and large education debt, and sometimes no dependants, still being sold very large whole life insurance policies as “investments”?

Robb,

While looking into life insurance you may want to consider researching a small rider for your children.

Recently a friend of mine went through a situation where his kid contracted an illness which made it impossible for her to ever have a life insurance policy. However, had she had an existing policy she would not be denied future coverage.

This situation caused me to look at my own family and put small insurance riders on my children for a very low cost.

Just something to consider.

I’m not aware of those statistics Grant – nor am I aware of the details of their financial situations, so it’s difficult for me to comment on the appropriateness of what’s being sold. For the benefit of all readers, perhaps you could share those statistics you refer to?

Well, I do know that several members, new grads, of my Dept. Anesthesia, all with large amounts of student debt, some with $1M+ mortgages, minimal financial assets, and some even with no dependants, have been sold large whole life policies ($40k a year and up). I don’t think you need to know much more about the details of their financial situation to know that whole life is not appropriate in those situations. In a recent podcast of Rational Reminder, at 13 minutes and on, Ben Felix comments that he sees physician clients coming in with large whole life policies and no financial assets. The Physician Financial Independence Facebook page, with over 15k members, has many stories of physicians in this predicament. Also many such horror stories at White Coat Investor blog. I think the sales material that agents are exposed to and the huge commissions agents receive for selling these products (50-110%) of the annual premium is a big part of the problem. Yes, there a a few limited and a few very specific circumstances when whole life makes sense. The situation I describe above is not one of them. The insurance industry needs to address this problem.

https://youtu.be/FqTmwQS3U08

I had a 10-year term policy for ~$450 a year that expired when I turned 65. Then they tried to sign me up for a new policy at 10x that amount. The agent called, full of bluster when I wouldn’t sign, and took major exception to the term “self-insure”. Well, like you, my net worth had increased. “But what about funeral costs for your poor destitute family?”. Sorry, done, all prepaid with a little set aside for a post-funeral party.