Weekend Reading: London Edition

Welcome to my latest edition of Weekend Reading. I'm writing from our flat in London, whilst enjoying a coffee on this beautiful Saturday morning. We're on day four of our 24 day trip to the U.K. that will soon take us up to the Lake District and then into and around Scotland.

London is an expensive city, especially when you consider the foreign exchange into British Pounds. Thankfully, the Canadian dollar has strengthened versus the British Pound over the last year. As of today, 1 CAD will get you 0.64 Pound Sterling. That's up from 0.58 Pound Sterling last summer.

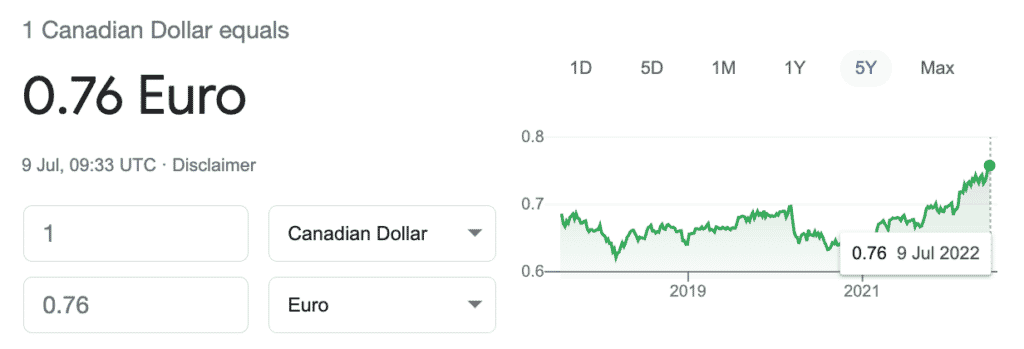

The Loonie is doing even better versus the Euro. Last summer 1 CAD would get you 0.63 Euro, but as of today 1 CAD will get you 0.76 Euro.

Travel is definitely back and the city is absolutely packed with tourists. We tried booking the Warner Bros. Studio Tour London – The Making of Harry Potter, and it was sold out until the third week of August.

Still, we managed to see Wicked at the Apollo Victoria Theatre on our first night here (bucket list experience for my wife and oldest daughter), and braved the heat and endless queue to ride the London Eye.

More exploring of London today before heading to the Lake District for the more relaxing part of our vacation.

This Week's Recap:

A few weeks ago I recapped the investment performance of various asset classes and sectors so far this year.

I updated our net worth for the year. Portfolio is down, house value is up. An overall small decline from the end of 2021.

Finally, earlier this week I explained why a financial navigator might come in handy at different stages of your life.

I'm putting the final touches on a new course for DIY investors where I'll walk you through the exact steps to leave your bank managed mutual funds behind and invest on your own using a single asset allocation ETF.

It'll be like me sitting in your living room, patiently walking you through the process of opening a discount brokerage account, opening the appropriate account types, setting up new contributions, buying an ETF, and transferring over your existing accounts.

Stay tuned for more details soon.

Promo of the Week:

The most frequently asked question about our travels this year? How did you earn enough points to fly a family of four to Europe / U.K. three times in 2022?

My wife and I each have our own American Express Cobalt cards and make sure to charge $500 per month in groceries (not hard these days!) to the cards to earn 5x points on groceries plus a 2,500 point monthly bonus for the first 12 months.

That adds up to 30,000 points for regular spending, plus the 30,000 bonus points for hitting the monthly spending target. There's 120,000 points combined, which we transfer to Aeroplan to use for flight rewards.

We also signed up for the American Express Aeroplan Reserve Card, where right now you can earn up to 90,000 in bonus points when you spending $1,000 per month over six months ($3,000 in the first three months, and a total of six monthly billing cycles where you spend $1,000).

I know many people will balk at paying a $599 annual fee. But you need to look objectively at your net return after fees. You can earn up to $2,800 in travel rewards with the American Express Aeroplan Reserve Card in the first year of card membership. Subtract the annual fee and you're still netting $2,200.

For me, as long as I can meet the spending requirements without making meaningful changes to my normal expenses, these cards can make good sense.

Weekend Reading:

A good piece in MarketWatch on why index funds beat stock picking.

Does (fill in the blank) belong in my portfolio? Dimensional offers a general framework for you to assess the merits of a new investment opportunity.

Jonathan Chevreau on why rising rates are good news for near-retirees seeking longevity insurance.

I loved this post by Morgan Housel on the power of staying the course with your investment strategy:

The most important investing question is not, “What are the highest returns I can earn?”

It’s, “What are the best returns I can sustain for the longest period of time?”

PWL Capital's Ben Felix explains why the “good company is a good investment” fallacy is something that every investor needs to understand:

Dimensional founder David Booth asks about your investing plan for the bear market.

Travel expert Barry Choi explains how to calculate the value of your reward points.

Jason Heath explains what to consider before selling your home or getting a reverse mortgage. The math reveals the real costs for retirees.

Why big banks are blocking online sale of cash ETFs that compete with bank savings products (G&M subscribers).

Finally, a fascinating case of the missing $46 million – the untold story of historic crypto heist.

Have a great weekend, everyone!

What course platform did you decide on?

Wish – something? I’m not sure, I’ll have to consult my web guy.

Hi Robb

Great read and hope you enjoy your trip! Keep us posted.

I have a quick question – what are your thoughts on pre-paying about 30k (15%) of a variable mortgage?

Current balance is about 194k, variable interest rate of 2.58% – which is subject to another 50-100bps or more increase in the coming weeks.

Not sure how long the equity, REIT, Gold ETF markets are to remain volatile or bottom out. Bonds seem to be in the trash (except some short term ones). Considering currency (cash) is loosing value, I see prepaying debt may be right? Or should I hold off cash for potential market upside when time is right?

Hi Rick, it’s impossible to say without knowing a lot more information about you, your goals, your age, your risk tolerance, etc.

It depends on why you had the $30k in cash in the first place. Emergency savings? I’d say that isn’t cash sitting idly, it has a purpose in case you lose your job. If you put it onto your mortgage and then lose your job it will be a lot tougher to get it back from a line of credit.

If it’s part of your investment portfolio, and you’re “waiting” for an opportunity, I’d argue you’re better off deploying that cash into a sensible and diversified portfolio now. You’ll never time the bottom correctly, and in waiting for a rally you might miss the biggest up days.

If it is indeed just extra cash that could be allocated towards accelerating any of your financial goals, then putting it onto the mortgage can certainly make sense.

I like a balanced approach, so maybe it’s $10k each in cash, investments, and mortgage pay down!

With the jump in interest rates again, does this change your answer at all? Do you think it would be beneficial to increase our biweekly payments instead of a lump sum? I am in a similar situation as Rick.