Canadians started piling on the debt after the financial crisis in 2008. Back then our household debt-to-income ratio was sitting around 150 percent ($1.50 owed for every dollar of disposable income). Today that number hovers around 177 percent. We are kicking debt down the road, instead of kicking it to the curb.

It can be reasonable to take on debt for big ticket items such as a mortgage, vehicle, education, or for an investment. We often do so because it’s easier to pay off a loan over time than it is to save enough to pay the full cost upfront. That’s life.

But the pain of debt can be masked by the cheap cost of borrowing. Low monthly payments, interest-only payments, and long amortization periods give the illusion that our debts are manageable. We think a long overdue raise, promotion, tax refund, or some other windfall will solve our money problems, but until then the debts keep piling up.

We get trapped in an unending cycle of minimum monthly payments and creditors are happy to oblige if it means getting you into a bigger house with a new SUV and an annual trip to the Dominican.

Here are four ways we keep kicking debt down the road:

1.) Minimum payments on your credit card

A cardinal sin of personal finance. We’ve all seen the disclaimers on our credit card statements that say if we only make the minimum payment each month it’ll take a lifetime to pay off your balance in full.

My latest American Express statement had an outstanding balance of $1,086 and the minimum monthly payment was only $10. At that rate it would take 9 years and 1 month to erase the $1,086 debt, and I would have paid another $1,000 in interest charges along the way.

Yet many people do this every single month. It’s easy to see why when you’re living paycheque-to-paycheque and there’s no wiggle room in your budget. A $10 payment gets the credit card company off your back and gives you some breathing room today. Unfortunately it’s your future self who’s forced to pay the bill.

The average credit card debt is hovering around $4,200, according to TransUnion. Most credit cards charge 19.99 percent interest or higher, making this one of the most expensive forms of debt to carry over from month to month.

That’s why I recommend treating credit card debt like a four alarm fire emergency. Slash your spending, pause any savings plans, and divert any extra cash you can towards your credit card balance until it’s gone for good. This is one debt you cannot afford to kick down the road.

Related: Debt avalanche vs. Debt snowball

2.) Interest-only payments on your line of credit

The run-up in housing prices over the last decade has fueled a borrowing frenzy with Canadians tapping into their home equity at a record pace. Canadian home equity line of credit balances reached $230 billion earlier this year. That’s more than 3 million HELOC accounts open at an average outstanding balance of about $65,000.

One insidious feature of a HELOC is that it only requires a monthly interest payment. In fact, about 40 percent of HELOC borrowers don’t regularly pay down the principal.

Let’s say you have a $70,000 balance and the interest rate on your HELOC is 4 percent. Your monthly interest payment would be about $233 and each month that amount would be taken from your chequing account and applied to the HELOC balance.

But unlike other loan repayments there is nothing stopping a borrower from transferring that $233 right back to his or her chequing account – a move called “capitalizing the interest.” Also known as kicking debt down the road forever.

A big line of credit balance tends to linger until the mortgage comes up for renewal, in which case the borrower tries to roll the HELOC balance back into the mortgage, or until the homeowner sells the home and the balance is paid off from the sale proceeds.

A HELOC is not an ATM. It can be useful for a specific purpose, such as a home renovation or to buy a car. Using it to supplement your income, though, is a bad idea that will catch up with you eventually.

If you find yourself with a lingering line of credit balance make a plan to pay it off over a reasonable amount of time. Set up automatic transfers from your chequing account each month to match your target pay off date and start whittling down that balance today.

3.) Extending your amortization

You bought a house and took out a mortgage amortized over 25 years. When it comes time to renew in five years, instead of sticking with your amortization schedule at 20 years, your mortgage broker talks you into extending the amortization back to 25 years to keep your payments low.

While it might sound good in theory to give yourself the flexibility of a low payment in case of emergency, it’s too tempting to use that option to free up extra cash flow for lifestyle inflation and spending.

Extending your amortization means never getting any closer to paying off your mortgage. It prioritizes today’s cash flow over tomorrow’s freedom – not something your future self will appreciate when you have to delay retirement until that damn mortgage is paid off.

The smart move is to not only stick to the original amortization schedule on your mortgage but also to reduce it further by changing your payments to bi-weekly instead of monthly, increasing your payment by $50 or $100 when your budget allows it, and taking advantage of your pre-payment privileges when possible.

Making mortgage payments is automation at its finest – forced savings that you won’t miss once it has left your account.

4.) Long-term car loans

Canadian auto debt continues to grow as the average consumer’s auto-loan balance climbed to $20,160 last year. I’m on record saying that Canadians’ obsession with having two brand-new trucks or SUVs in the driveway is killing our finances.

Blame the fact that six and seven year car loans are now the norm.

The trend towards longer term car loans is problematic for two reasons. One, people are getting talked into buying more expensive cars at the dealership. That’s because the focus is about the monthly payment rather than the total cost of financing the vehicle. Longer term loans keep monthly payments affordable and increase the chances of selling an expensive vehicle.

Two, consumers get trapped in a negative equity cycle when they want to trade-in their vehicle before it’s paid off. The existing loan balance gets rolled into the new car loan, and the now more expensive car loan cycle begins.

Related: Why does my car dealer want to buy back my car?

Breaking the cycle takes sacrifice. Drive your cars longer (10 years+), buy used, only buy as much car as you need, reduce your household vehicles from two to one, and save up and pay cash for your next one.

Final thoughts

Successful money management starts with being smart about debt. Kicking it down the road only prolongs the inevitable.

Tackle your credit card balance first, and be relentless. You’ll never get a better guaranteed return than paying down debt at 20 percent interest. Stop treating your home equity like an ATM and start paying down the principal. Don’t wait until you sell your home.

Stick to your amortization schedule and try to pay off your mortgage in 15-25 years. Extending your amortization or taking payment vacations is not a path to prosperity.

Finally, break that auto-loan cycle. Long term financing might make your monthly payments more affordable today, but it’s awfully expensive in the end, especially if you keep trading in your car every 3-5 years.

The last quarter of 2018 was a miserable time for investors. The S&P 500 had reached an all-time high on September 21, 2018. Three months later it had fallen nearly 13 percent – erasing 18 months of gains along the way. The TSX also fell more than 13 percent. Panic ensued, with many pundits predicting the beginning of the next stock market crash.

That didn’t happen. Instead, the S&P 500 proceeded to climb to new all-time highs. At market close on Friday, the U.S. market had gained an incredible 27.72 percent since its December 21st low. Not to be outdone, the TSX gained a healthy 24.15 percent in that time.

Welcome to market volatility.

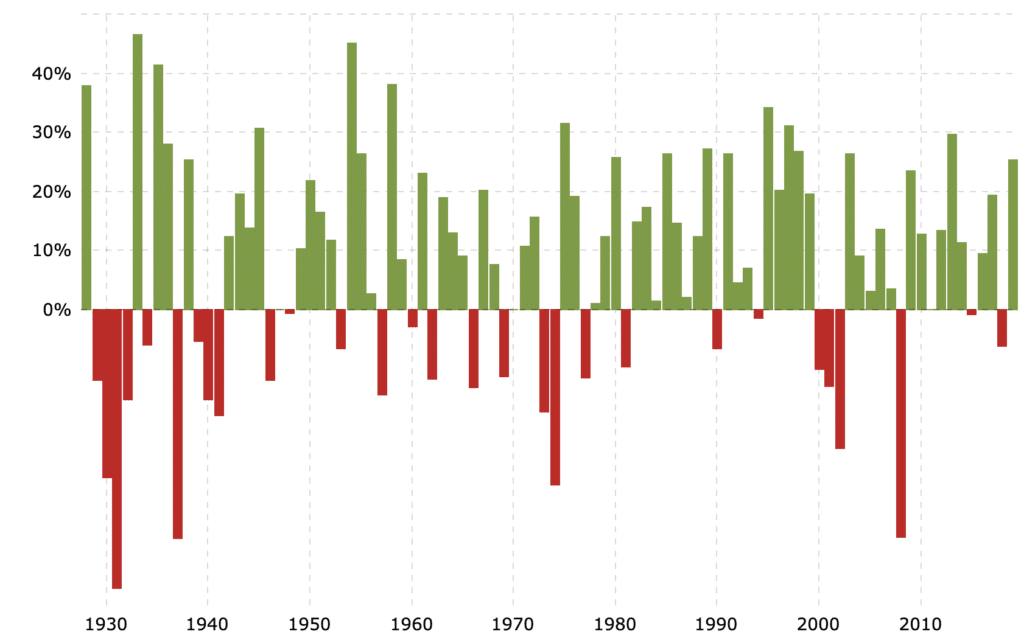

Most reasonable investors, depending on the make-up of their portfolio, can expect to earn market returns of 6-10 percent over the long term. But the dispersion of those expected returns can vary wildly, from 47 percent losses (1931) to 47 percent gains (1933) and everything in between.

Exactly how volatile is the stock market? From 1928 to 2019 (91 years), the S&P 500 posted annual returns of between 6 and 10 percent exactly six times (1959, 1965, 1968, 1993, 2004, 2016).

The market lost ground in 29 of those 91 years (roughly one-third of the time), with six of those years posting losses of 20 percent or more.

Investors should accept this volatility to capture the market risk premium – the difference between the expected return on a market portfolio and the risk-free rate – over the long term.

But, behaviourally, we’re prone to panic when markets fall and to feel elated when markets rise. We know this behaviour is to our detriment, yet we do it time and time again. Markets fall, investors sell. Markets rise, investors buy back in.

The winning investor is the one with the fortitude to stay invested during turbulent times. Yes, markets can fall. They tend to do so one-third of the time. This is fully expected. But panic-selling at the bottom also tends to miss the inevitable recovery, which often comes quickly.

How do we curb our bad investing behaviour? We start with an appropriate asset mix of stocks and bonds. How do you know what’s appropriate? Take a close look at the above chart and decide how much money you’d be prepared to lose in a given year.

Adding bonds smooths out market volatility and delivers a tighter dispersion of returns.

The biggest one-year loss posted by a portfolio with 40 percent stocks and 60 percent bonds has been -11.82 percent. The classic balanced portfolio of 60 percent stocks and 40 percent bonds lost 19.61 percent in its worst year, while an all-equity global portfolio has posted a one-year loss of -34.85 percent*.

*Source: CPM Model ETF Portfolios

Another trick is to simplify your portfolio to the point where you can ignore it for long periods of time. That’s why Rip Van Winkle would have made a great investor. Automate contributions and rebalancing whenever possible. This can be done through a robo-advisor or, for DIY investors, an asset allocation ETF.

That’s exactly where I’m at with my all-in-one investing solution (VEQT). I didn’t even realize markets were down last quarter until I heard it on a podcast in mid-December.

Finally, making smaller, more frequent contributions helps eliminate the desire to hold off until things “settle down” or “feel safer”. Automate and ignore.

This Week’s Recap:

Speaking of bad behaviour, this week I wrote about how to trick your lizard brain into saving more money.

Over on Young & Thrifty I went back to my dividend roots and looked at the pros and cons of a dividend investing strategy.

It’s my last official day of work next Friday! I’ll continue to keep you posted on my transition to full-time entrepreneur. My life insurance policy was approved and is now in place. That means an overlap in coverage and twice the death benefit if I die in December. My wife is weighing her options.

Next up is a look at my pension, and the decision whether to leave it in the plan and take a deferred pension at 55 (or older), or transfer the commuted value of the pension into a LIRA. I have a good idea what I’d like to do, but I’m waiting for the official documents from the pension board before I make my decision.

Promo of the Week:

I’ve fielded quite a few questions from retirees about moving their portfolio to Wealthsimple to save on fees and to help with automating retirement income withdrawals. First, I send them to this excellent case study on using Wealthsimple in retirement.

Transferring to Wealthsimple is about as easy as it gets. I know because I’ve helped my wife transfer her RRSP to Wealthsimple and it was a breeze.

Finally, to open a Wealthsimple account, use this referral link and you’ll get your first $10,000 managed free.

Weekend Reading:

The federal government announced the new TFSA contribution limit in 2020 will remain the same as 2019 at $6,000. That brings the total contribution limit to $69,500 for an eligible Canadian who has never contributed to his or her TFSA.

I’m sure many of you have seen the Laurentian Bank’s digital arm (LBC) offering a 3.3 percent high interest savings account. Rob Carrick asks if you should jump on this rate, while cautioning readers that this rate is highly unlikely to remain this high, despite what the bank says. We’ve seen this movie before from EQ Bank, which entered the market at 3 percent before eventually settling in at a still reasonable 2.3 percent.

Did you shop on Black Friday? Here’s why lawmakers in France are trying to ban Black Friday to help stop waste.

Why the pain of a failed investment can be the best teacher of all:

Those who have never experienced large market declines are at a distinct disadvantage to those who have. Many investors today don’t even remember the near-collapse in 2008, the bear market of 2000 to 2002 or the white-knuckle abyss of 1987.

A Wealth of Common Sense blogger Ben Carlson explains why market all-time highs are both scary and normal.

Carlson and his Animal Spirits podcasting cohort (Michael Batnick) debate whether day care is the next student loan crisis:

As people live longer than ever, there’s danger in counting on an inheritance to fund retirement.

Rob Carrick has a message to the 42 percent of credit-card holders who do not pay their balance in full every month: Stop using your card and switch to debit.

Dale Roberts explains why you don’t have to be the perfect investor trying to build the perfect portfolio. It’s more than OK to be a great investor.

On the My Own Advisor blog, Mark Seed and Steve Bridge debate whether the 4 percent safe withdrawal rate still makes sense.

Finally, credit expert Richard Moxley explains how your cell phone bill can keep you from getting the best mortgage rate.

Have a great weekend, everyone!

My investing philosophy is pretty straightforward. Invest in a low cost, globally diversified portfolio of index funds or ETFs. Add bonds to help smooth out the volatility in your portfolio. Contribute regularly to meet your savings targets. Ignore everything else.

This approach comes from the belief that investing has become largely commoditized. Index tracking ETFs can be purchased and held for close to zero dollars. Furthermore, the academic research and empirical evidence clearly suggests that active management (stock selection and market timing) does not add value after fees.

I’m crystal clear about my philosophy to readers of this blog and to the clients in my fee-only financial planning service. Still, there’s more than one way to build a diversified portfolio of low cost index funds or ETFs.

I need to understand my clients before I can make an appropriate recommendation. I want to determine the client’s current needs and future goals, the rate of return required to achieve those goals, their ability and appetite to invest on their own, and their desire for simplicity versus cost savings.

I’ll use that assessment to recommend one of three investment strategies and model investment portfolios that align with my indexing philosophy and meet clients where they’re at based on those factors.

1.) The Low Cost DIY Approach

Some investors feel confident investing on their own and want to cut fees to the bone. In this case, a simple solution is to open a discount brokerage account at Questrade, which offers free ETF purchases, and then set-up a model portfolio of ETFs. That might look like this:

- BMO Aggregate Bond Index ETF (ZAG) – 40%

- Vanguard FTSE Canada All Cap Index ETF (VCN) – 20%

- iShares Core MSCI All Country World ex Canada Index ETF (XAW) – 40%

*Source: Canadian Portfolio Manager model portfolios

One alternative low cost DIY approach is to simplify your portfolio and purchase one of the asset allocation ETFs offered by Vanguard (VBAL, VGRO), iShares (XBAL, XGRO), or BMO (ZBAL, ZGRO).

Clients using this approach can expect to pay around 0.25% in annual management fees.

2.) The Robo-Advisor Approach

Some investors understand they’re paying too much in fees for their current managed portfolio of mutual funds. They still want a managed solution, but they want to save as much as they can on fees. It makes sense to match these investors up with a robo-advisor.

These online portfolio managers take the guesswork out of investing, putting clients into a portfolio of index funds and ETFs and automatically rebalancing whenever markets move too far or when client’s add new contributions.

But which one to pick? They all have their own strengths and weaknesses, but here’s a quick summary based on fees:

- Wealthsimple is best for portfolios under $250,000

- Nest Wealth is best for portfolios greater than $250,000

- Justwealth is best for RESPs

Clients using this approach can expect to pay between 0.50 and 0.70% in management fees.

Worth noting is RBC InvestEase, which is best for RBC clients who want to switch out of more expensive RBC mutual funds. That’s a good segue into the next approach.

3.) The Stay-At-Your-Bank Indexing Approach

I want clients to save as much as possible, but some investors don’t have the time or skill to become a DIY investor, and some aren’t comfortable with a robo-advisor. That’s okay – there’s still a low cost solution that allows you to stay at your existing bank.

All of Canada’s big banks offer index mutual funds. TD has the most popular and cheapest set of index funds, called TD e-Series funds. Investors who switch to e-Series funds can expect to pay roughly 0.45% for a portfolio containing Canadian, U.S., and International equities, plus Canadian bonds.

RBC clients have the InvestEase option I mentioned earlier, or they can invest in RBC’s suite of index funds for a cost of less than 1% a year.

Scotia, BMO, and CIBC also carry index mutual funds that cost 1% or slightly higher. Still better than their actively managed (or closet index) funds that come with MERs of 2% or higher.

Clients who opt for this approach may need to meet with a bank advisor and demand to switch their mutual funds to these index funds. Expect all the typical rebuttals from your advisor, but stand your ground and insist on the index portfolio.

This Week’s Recap:

On Wednesday, I wrote about my life insurance mistake – not taking out a private policy before leaving my employer group plan.

I published two posts over at Young & Thrifty:

From the archives: Coping with stock market losses.

Finally, on Rewards Cards Canada, what happened to my credit score when I applied for 13 credit cards last year?

What I’m Listening To, Reading, and Watching:

In this new segment I’ll share what podcasts I’m listening to, which books I’m reading or have read, and what I’m watching on TV or YouTube.

Here’s my current weekly podcast lineup:

- Animal Spirits with Michael Batnick and Ben Carlson

- Rational Reminder with Ben Felix and Cameron Passmore

- Freakonomics Radio

- Solvable

- Throughline

Published less often, but still on my list:

- Against The Rules with Michael Lewis

- Mostly Money with Preet Banerjee

- The Knowledge Project with Shane Parrish

- Revisionist History with Malcolm Gladwell

Books I’ve read this year and recommend include Range by David Epstein, Talking to Strangers by Malcolm Gladwell, and Thinking in Bets by Annie Duke.

My favourite personal finance book of the year was Happy Go Money by Melissa Leong.

With two kids (10 and 7) it was a given we’d subscribe to Disney+ when it launched last week. My kids have surprisingly been enjoying the National Geographic content more than the Disney / Pixar content. That’s cool.

My wife and I watched the first three episodes of Star Wars: The Mandalorian – and it’s excellent. I kind of like the release of one episode a week to build the anticipation.

Weekend Reading:

What’s better than a no-fee credit card with up to 4% cash back bonus? It’s stacking a free $75 Amazon.ca e-gift card on top.

Dale Roberts at Cut the Crap Investing looks at living off the dividends and that 4% rule.

Dan Kent at Stock Trades put together a monster post on the 2019 Canadian Dividend Aristocrats List.

Why thinking you’re ‘bad with money’ can become a self-fulfilling prophecy.

Should you roll the dice with an all stock portfolio in retirement?:

“But in retirement the order of stock market and portfolio returns do matter. That’s called sequence of returns risk. A bad year or a few bad years early in retirement can permanently impair your portfolio and your retirement.”

As many as one quarter of Canadians are finding that retirement is not all it’s cracked up to be. It’s so important to ‘find your why’ in retirement.

Rob Carrick says parents are increasingly willing to help their children with the cost of post-secondary and says, don’t blame parents for the student debt problem in Canada.

Nick Maggiulli on Renaissance Technologies and the Medallion Fund: The greatest money making machine of all time.

In his latest Common Sense Investing video, Ben Felix explains why some home country bias is a good thing for Canadian investors:

My Own Advisor’s Mark Seed and PlanEasy’s Owen Winkelmolen do a retirement case study for a couple with $1.2M invested and no pensions.

Tim Cestnick offers five ideas to reduce the clawback of OAS benefits.

Canada’s rental costs are climbing due to strong demand and lack of new supply. This is leading to an increasing affordability problem in Canada’s major cities.

Finally, Scotiabank refused to honour two decades-old GICs until CBC stepped in.

Have a great weekend, everyone!