Nobel Prize winner Harry Markowitz famously said that “diversification is the only free lunch in investing.” For investors, that means diversifying their portfolio across different asset classes, different sectors, and different geographies. The goal is to reduce risk without sacrificing return. Sounds easy, right?

Investing can be simple, but it isn’t always easy. Think about building a globally diversified portfolio of stocks and bonds. You’d want to have Canadian equities, U.S. equities, plus stocks from international and emerging markets. You’d also want a mix of Canadian and foreign government and corporate bonds. That’s at least seven different funds to hold inside your portfolio.

Thankfully, there’s a better way for investors to build a balanced portfolio without sweating over the individual details. All-in-One ETFs, also known as asset allocation ETFs, hold all the building blocks of a diversified portfolio inside a single fund.

All of the major ETF providers have their own suite of asset allocation ETFs, including Vanguard, iShares, BMO, Horizons, TD, Mackenzie, and Fidelity.

Under the hood you’ll typically find seven or eight individual ETFs representing different asset classes and geographic regions. That means holding thousands of global stocks and bonds in one convenient basket, making it easy for investors to get their free lunch and eat it too.

By the way, the opposite of diversification is called concentration. It’s when your entire portfolio consists of meme stocks, or crypto, or Canadian bank stocks, or just Canadian stocks for that matter.

Sure, there’s always a tiny chance you’ll get lottery-like returns with a concentrated portfolio. But there’s also a better than average chance your portfolio will lose money, at least compared to the overall market. Stocks can go to zero (looking at you, Nortel).

Build a balanced, diversified portfolio with an all-in-one ETF and you’ll sleep easy at night knowing your investment strategy is likely to lead to the best long-term outcomes with less short term pain.

Holding a risk appropriate asset allocation ETF is like driving five kilometres per hour under the speed limit in the right lane of a highway during a winter storm. Sure, it might be boring. But there’s a good chance you’ll get where you need to go, on time, and without much risk of getting into an accident or getting a speeding ticket.

Meanwhile, the left lane may be full of traffic speeding, perhaps aggressively or erratically, towards their destination. Vehicles end up in the ditch, or pulled over for speeding, or paralyzed with fear and driving even slower than the vehicles on the right. Risks abound.

This Week’s Recap:

It’s been a minute since my last weekend reading update. Since then I’ve written the following articles:

- RRSP Loans: Why You Should (and Shouldn’t) Get One

- Lock-In or Ride It Out: The Variable Rate Mortgage Dilemma

- Tax Software For Your Unique Tax Situation This Year

- What Is A Non-Registered Account And How Does It Work?

I have four TurboTax codes to give away to four lucky readers who commented on that TurboTax review. A reminder that these can be used on any paid product (worth up to $279.99 if you go with Full Service Self-Employed).

The lucky winners are:

- Kathryn, who commented on February 24th at 11:00 a.m.

- JimG, who commented on February 24th at 4:01 p.m.

- Jamie, who commented on February 24th at 12:51 p.m.

- Jane Spratt, who commented on February 24th at 2:53 p.m.

Congratulations! I’ll send out your free product codes by email this weekend.

Travel Update

We recently got back from a seven night holiday in Maui. It was so nice to travel again and get a short reprieve from winter.

In just over a month we’ll head to Italy for three weeks, staying in Rome, Florence, and Venice (plus a week in a hilltop town in Tuscany). This is a re-booking of our cancelled 2020 trip.

Then we’ll travel to the U.K. in July, spending just over a week in England (London and Lake District) and two weeks in Scotland.

Finally, we plan to visit Paris for a week in October.

Yes, revenge travel season is upon us.

Promo of the Week:

One credit card that gets a lot of attention from travel and credit card comparison sites but does not get enough love from actual consumers is the American Express Cobalt Card.

This card has always paid 5x points on food and beverage, making it a must have card for groceries and dining out. But a recent change has made those points even more valuable. You see, American Express Membership Rewards points can be transferred 1:1 to other travel programs, including Aeroplan. Aeroplan miles are worth about 2 cents per mile.

Some quick math tells me if you spend $500 per month on groceries you can earn 2,500 points. In one year you can earn 30,000 Membership Rewards points from just $6,000 in spending.

Now transfer those 30,000 points to Aeroplan and you’ll have 30,000 Aeroplan miles. Redeem those miles for a flight at 2 cents per mile and you’ll save $600 on travel.

That $600 reward on $6,000 in spending is a 10% return – on spending you do anyway.

My wife and I each have a Cobalt card and try to charge $500 worth of food and/or beverage to the card every month. It’s an easy way to earn an extra 60,000 Aeroplan miles every year.

Sign up for the American Express Cobalt Card and start levelling up your rewards game.

Weekend Reading:

Our friends at Credit Card Genius have the goods on the new CIBC Costco Credit Card.

Few Canadian seniors are deferring their retirement benefits, even when doing so could mean tens of thousands of extra dollars:

If I recall correctly, the number of Canadians taking CPP at 70 used to be 1%, so I suppose 4% is a decent improvement.

Jason Heath continues his excellent series on what to do with money in a corporation – this one looks at corporate investments for retirees and how to withdraw with minimal tax implications.

Portfolio Manager Markus Muhs explains why dollar cost averaging is good for the soul.

A Wealth of Common Sense blogger Ben Carlson explains eight of the biggest investing myths.

Canadian Couch Potato blogger Dan Bortolotti says it’s a bad idea to retire with more money than you need.

Are you eager to start investing but also worried that the stock market might crash soon? Then you must watch this excellent video by Preet Banerjee to help you get started:

Morgan Housel shares the two things that must be experienced before they can be understood.

Are interest rates going to go up? Is the stock market going to crash? Michael James on Money answers big questions about personal finance and investing.

Millionaire Teacher Andrew Hallam explains how to find the right balance between happiness and spending:

“So here’s how to test whether a purchase might provide an experience that boosts your happiness or well-being. Ask yourself if it creates experiences you wouldn’t otherwise have. A new phone, purse, brand-name clothes, or car likely wouldn’t do it, simply because of hedonic adaptation.”

Erica Alini wrote that renting is supposed to offer mobility and flexibility. So why do so many tenants just feel stuck?

Canada’s housing market could crash or soar, but there’s a more likely third option that nobody is talking about (subs)

Finally, an absolute gem from Fred Vettese on which assets should be drawn down first in retirement (subs). Here’s the conclusion for those who can’t read behind the paywall: Retirees will generally be better off drawing down assets from multiple sources on an annual basis rather than trying to keep their RRSP intact for as long as possible.

Have a great weekend, everyone!

This is a sponsored post written by me on behalf of TurboTax Canada. All opinions are my own.

In my financial planning practice, I’ve seen the good, bad, and complicated ways that the pandemic has impacted the financial lives of Canadians.

One client works in air transportation and had been sidelined collecting CERB and CRB to stay afloat. Another works in an industry making plexiglass barriers and had a record year, collecting a fat bonus. One bought an investment property in cottage country and turned it into a short-term rental. Several have left their careers behind to start their own businesses. Another received stock options for the very first time.

Speaking of the stock market, many people got caught up trading stocks and cryptocurrencies, or they borrowed money to invest in their taxable investment accounts and now must deal with capital gains, losses, and calculate the adjusted cost base on their investments for the first time.

If any of these stories sound familiar, you know that your tax situation will likely look very different this year. I don’t file taxes for my clients, but I do encourage them to prepare their taxes early using what I call a “first 60 days” assessment.

From Free to Full Service

Use tax software to prepare your taxes for filing and gauge your tax situation. Will you be in a position for a refund, or will you owe money? Armed with that knowledge you can use the first 60 days of the calendar year to potentially make an RRSP contribution and reduce your taxes owing (RRSP deadline is March 1st).

TurboTax has an ever-evolving suite of products to not only help the basic T4 employee file their taxes, but also assist the growing complexities of the self-employed, the stock and crypto traders, the short-term rental owners, and more.

Online software has come a long way and there are options for every tax filer. In fact, you can file a simple tax return for $0 using TurboTax Free. This return includes employment income, pension income, tips, RRSP contributions, childcare expenses, and even COVID-19 benefits and re-payments.

Some returns are more complex, such as those involving donations, medical expenses, investment income and expenses, rental property income and expenses, and self-employed income and expenses.

There’s TurboTax Assist & Review Self-Employed, which gives you tax advice and a final line-by-line review from a tax expert to ensure you get every deduction you qualify for and that your taxes are filed correctly.

You can search for industry specific deductions, and the service covers income and expenses from ride sharing, online sales, consulting, real estate, and more.

This would be a good fit for the first time Airbnb host renting property in cottage country, or for someone that started an online side hustle selling products or courses. TurboTax Assist & Review Self-Employed costs $109.99 per return, and you only pay when you file.

If you’re self-employed and would prefer someone else do your taxes for you, but you’d rather not pay a pricey accountant to do it, then TurboTax Full Service Self-Employed would be a good option. For $249.99 per return, you can turn it over to a team of tax experts with an average of over 10 years’ experience in your specific industry who can find all the deductions to help reduce your taxes.

For those with more complicated tax issues arising from investment income and expenses, such as reporting individual stock, ETF, and cryptocurrency sales, or from rental property income, expenses, and refinancing, there’s TurboTax Full Service Premier.

Here you’ll connect with TurboTax experts with experience in investment and rental property taxes. Whether you’ve purchased your first investment property (or sold one), bought or sold stock in a taxable account, or invested in cryptocurrency (yes, selling crypto for cash or exchanging Bitcoin for Ethereum is a taxable event), your live tax expert will get to know your unique situation, search 400+ deductions and credits for you, and offer a full expert walkthrough before filing.

TurboTax Full Service Premier costs $149.99 per return ($179.99 as of April 1st) and your taxes will be done in just a few days, assuming you have all your documents ready. Your tax expert will help you report sales of stocks, ETFs, and cryptocurrency, calculate capital gains and losses, with adjusted cost basis missing identification and video guidance, and offer step by step guidance reporting rental property income and expenses.

Final Thoughts

While there weren’t a lot of changes to the Income Tax Act in 2021, that doesn’t mean your personal tax situation hasn’t changed.

If you started a new business or side hustle, bought or sold a rental property, traded stocks or cryptocurrencies in a taxable account, or had to deal with a new financial situation that will impact your taxes then I encourage you to assess your situation in this first 60-day window and use a tax software option that aligns with your situation.

TurboTax Giveaway!

Four lucky readers can enter for a chance to win a complimentary tax code, valid for ANY online tax product at turbotax.ca, valued at up to $279.99 each!

To enter, leave a comment below and share something (anything!) about your taxes this year. Are you an early tax filer, or a procrastinator? Will you owe money, or do you expect a big refund? Did your tax situation change over the past 1-2 years?

This contest is open until Sunday February 27th at 5 p.m. EST.

I’ve always been transparent about my mortgage strategy. I prefer to select a deeply discounted variable rate (prime minus 0.80% or better), but if that’s not available then I’m happy to take a 1 or 2 year fixed rate mortgage and wait for those discounted variables to return.

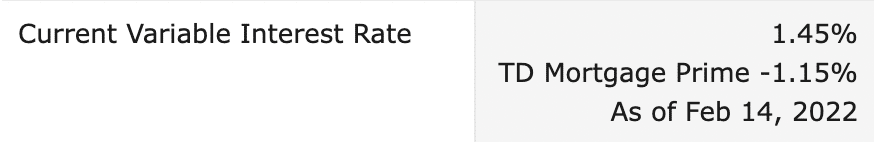

We’ve been in our house for 11 years. Our first mortgage term was a 5-year variable rate at prime minus 0.80%. When that term came up for renewal the best variable rate discount was prime minus 0.25%. Not good enough, so I opted for a 2-year fixed rate of 2.19%. That term came up for renewal in 2018 and sure enough the variable rate discount had come back in a big way. I ended up with a 5-year variable rate at prime minus 1.15%.

Of course, variable rate holders were treated to an unexpected series of rate cuts when the Bank of Canada slashed its trendsetting overnight rate by 0.75% at the beginning of 2020. That dropped the interest rate on my mortgage to an absurdly low 1.45%.

Fast forward to 2022 and the Bank of Canada is widely expected to increase interest rates this year, starting as early as March. I’m not in the rate prediction game, but we’d be foolish not to at least expect the 0.75% emergency rate cuts from 2020 to be restored.

Meanwhile, my mortgage term doesn’t come up for renewal until September 2023. If I believe the headlines from economists and other forecasters, we may be in line for six to eight rate hikes before then. What’s a variable rate mortgage holder to do?

The Variable Rate Advantage

Variable rates borrowers typically save money versus five-year fixed rate borrowers. That was true from 1950 through to 2000, according to a famous 2001 study by finance professor Moshe Milevsky. He updated the study again in 2008, with a similar conclusion that “the probability of coming out ahead with a variable rate had increased to just over 90%.”

Fixed rate mortgage holders pay a premium for certainty in their payments. The less talked about disadvantage to a 5-year fixed rate term is that they can be terribly expensive to break if you sell your home or need to refinance in the middle of the term.

Variable rate mortgage holders save money because of the built-in discount. On a deeply discounted variable rate mortgage, rates would need to rise at least three or four times before it climbed above a fixed rate alternative. Furthermore, variable rate holders have the advantage of only being charged a three-month interest penalty for breaking their mortgage early.

The Variable Rate Dilemma

Now to the dilemma for variable rate mortgage holders like me. Nobody likes to lose money. Faced with the near certainty of rising rates in the coming months, it’s a lot like knowing the stock market is going to fall and trying to decide if you should sell or stay the course (Ed. note: We can’t actually predict the direction of the market so just stay the course).

My gut tells me to take the same approach as I would with my investments. Stay the course. But I wanted to get an outside opinion so I reached out to mortgage analyst Rob McLister and asked him:

“With everyone screaming “lock-in” is there any merit to doing so with just 18 months left on my mortgage term? And what exactly does locking in entail for a variable rate holder?

He said that variable-rate borrowers have four main options:

- Do nothing and ride out rising rates

- This may be the best play for someone with financial stability, a good variable discount (prime -1% or better), a modest mortgage relative to income and/or a short (e.g., <10 year) remaining amortization (Ed. note: We check all of these boxes).

- It’s particularly appropriate for those who may need to increase or break their mortgage before their existing term is up. Variable-rate prepayment penalties are often significantly less than fixed-rate penalties.

- Cancel their existing contract, pay (usually) a 3-month interest penalty, and get a new variable rate

- This can work for financially stable borrowers with a reasonable debt load who want to float their mortgage, but have an inadequate discount on their existing variable.

- The lowest nationally-available variable rate for qualified borrowers is now 1.39%. That’s prime -1.06%. This rate applies to all mortgage types, including refinances. Purchase, transfer or insured rates are 0.10% to 0.30% cheaper.

- Convert their variable to a fixed rate

- It would take at least seven rate hikes in the next 18 to 24 months for the lowest widely-available fixed rate to beat the best 5-year variable, based on interest cost alone. The market is currently pricing in six hikes this year (source: Refinitive Eikon OIS rates).

- If a 2% increase would stress your budget too much, and you’ve got an adjustable-rate mortgage (where the payments floats with prime), you may want to grab 3-, 4- or 5-year fixed while you can still lock-in one under 3%.

- If you do lock-in, minimize your penalty risk. Chose a “fair penalty” lender and/or make sure you won’t need to increase or break your mortgage before the term is up. Meaning, don’t take a 5-year fixed if you may need to refinance or sell (and not re-buy) next year.

- Break their mortgage (pay usually a 3-month interest penalty) and get a new fixed rate.

- Occasionally a lender’s fixed rates will be too high relative to the competition. In that case it’s often more economical to pay the three-month interest penalty and move to the lender with the best fixed-rate on the market.

There are naturally exceptions to the above, especially for less qualified borrowers, so personalized advice can help.

You can lock in simply by contacting your lender and completing simple paperwork, online or in person.

One last thing: Too many people make binary decisions on their rate. You don’t need to pick between fixed or variable, you can choose both. Hybrid mortgages let you allocate half of your balance to a fixed rate and half to a variable rate, or any other combination. That provides valuable rate diversification, given no one can predict the future, and guarantees you won’t be more than half wrong. You can find hybrids at 2.17% or less from lenders like HSBC or Scotia eHOME.

Final Thoughts

Thanks to Rob McLister for providing these options for variable rate mortgage holders like me who may be nervous about interest rates rising in the near future. For me, I think about the money I’ve saved for the past two years when rates were slashed by 0.75%. I accept (and expect) that those rate cuts will be restored very soon. What happens after that is anyone’s guess.

In the meantime I will hold onto our existing variable rate mortgage at prime minus 1.15%. I know that our mortgage payment won’t change when rates do rise – the payments are fixed – but less of the payment will go towards principal and more will go towards interest. That’s okay. I’ve already saved a bunch of money over the life of this 5-year term.

When this term comes up for renewal in September 2023, I’ll do what I’ve always done. Look for another heavily discounted variable rate mortgage or, if that’s not available, take a short-term (1 or 2 year) fixed rate term.