Welcome to another edition of Weekend Reading. I continue to receive a ton of emails from readers and clients about investing, retirement, real estate, and more. I’ll answer some of those questions here in this special Money Bag column.

We’ll look at investing in a rental property, rebalancing RESPs for older children, the limitations of Wealthsimple Trade, dabbling in cryptocurrency, and how much should you invest in your own company stock.

Buying an investment property

From Dennis:

“Hi Robb. We live in a small city outside of Toronto, where house prices continue to increase significantly. We are thinking of investing in a 2 bedroom condominium in the city, using $100,000 of our own savings plus a mortgage of $400,000, but have some reservations: (1) The rental income may not be quite enough to cover mortgage payments, condo fees etc. (2) We will have the hassle of dealing with tenants and tenancy issues (3) The housing bubble may burst and prices may stagnate. I wonder if we would be better off investing in REIT’s or something similar.”

Hi Dennis, do you already own your own house in that area? If so, you already have plenty of real estate exposure.

I think you’ve highlighted three really good reasons not to buy a rental property (regardless of the current market conditions).

And by investing in a low cost and globally diversified portfolio of index funds you’ll automatically have some exposure to REITs in an appropriately weighted allocation.

My experience working with clients who do own investment properties is that they don’t spin off as much income as you’d think, they can be a pain to manage, and you’d be better off selling them at some point anyway to top-up your investments before you retire.

Rebalancing RESPs for older children

From Shonna:

“Hi Robb, I really enjoy your blog and have been motivated to start my own journey into DIY investing. I plan to follow your lead and invest in VEQT for the foreseeable future. My question is about RESPs for my daughters, who are in grade 6 and grade 4. At what point should I reduce the equity exposure in this account? I have zero confidence in the bond market right now.”

Hi Shonna, I’m in the same boat when it comes to RESPs. My family RESP (two kids, 11 and 8) is still in 100% equities using TD’s e-Series funds. My original plan around this age was to simply start introducing the TD Canadian Bond Index fund with my regular monthly contributions. I still might do this, but I’ll likely wait another year and see what happens with bond prices.

I realize this is market timing and I should simply follow a rules-based approach, but the time horizon is still pretty long at 7-10 years so I feel confident holding 100% equities for another year or two.

Here’s a great explainer from the Million Dollar Journey blog on how he manages his own kids’ RESP portfolio:

You could also consider Justwealth’s target education date (robo-advised) RESP portfolio. They’ll automatically adjust the portfolio allocation in much the same way that the MDJ post describes, except they use a rules-based approach to take away our decision making from the process (that’s a good thing).

If you want to avoid bonds but still want to stick with an 80/20 portfolio you could use VEQT for 80% of the balance and then perhaps open another RESP on the banking / mutual fund side of your financial institution and simply buy GICs. The interest rates will be terrible but you won’t be at risk of losing principal.

Or, go with a short-term bond fund which is less sensitive to interest rate movements (Vanguard’s VSB, for example).

Limitations of Wealthsimple Trade

From Parvinder:

“My spouse and I have an RRSP, a spousal RRSP, and a personal, joint investment account at CIBC. I’d like to transfer them over but don’t think that spousal RRSP is an account available in Wealthsimple Trade right now. Is this correct? If so what’s the best choice to handle this?”

Hi Parvinder, as you’ve discovered, Wealthsimple Trade has its limitations – mostly due to the account types it offers (only personal RRSPs, TFSAs, and non-registered investment accounts). Wealthsimple Invest, the robo advisor, does offer more account types but you wouldn’t be able to select your investments.

If you prefer to self-manage your investments and want everything in one place then consider Questrade, which offers all the account types you need. Questrade also offers free ETF purchases, so if you’re in the accumulation phase of life and just buying a single asset allocation ETF then this would work out very nicely for you.

Here’s a quick explanation on how to open a Questrade account and transfer your existing investments.

Dabbling in cryptocurrency

From Danielle:

Hi Robb, I have a question about Ripple (XRP) as an investment. I’m thinking of throwing $500 into it through the bitbuy app. My friend invested in it and has made quite a bit of money. I’ve been researching the price predictions for the next 10 years and it looks solid. What do you think?

Hi Danielle, if it’s $500 you can afford to lose then there’s nothing wrong with making a speculative bet on it. But, treat it more like casino money and not as an investment.

Price predictions are usually made by those who are heavily invested in seeing the price move up or down, so take any of that research with a huge grain of salt. Cryptocurrency is a hugely speculative asset class. It doesn’t have an expected return because it doesn’t produce anything or have any value beyond trying to sell it to someone else at a higher price.

These speculative plays tend to crash and burn hard, so getting in after an enormous run-up in prices probably doesn’t leave you with much upside. Meanwhile, there’s a LOT of downside.

Finally, beware that most cryptocurrency exchanges are largely unregulated and prone to hacks and fraud. If you want to invest a small amount just to cure your FOMO then consider using Wealthsimple Crypto, which is actually a regulated exchange in Canada. You can only buy Bitcoin or Ethereum, but it’s insured and you don’t have to mess around with digital wallets.

Telus stock versus indexing

From Jeff:

“Hi Robb, I know you are a proponent of index investing, but we buy shares of Telus every paycheque, due to the employee matching program. Telus matches us 12% (and no fees for purchasing or participating in the DRIP).

I know it may risky to have a large holding in just one company, but do you think it’s better for us to continue to invest in the Telus shares, due to the fact that Telus just spun-out Telus International and is planning to do the same with Telus Health, Telus Agriculture, Telus Security?

Also, Telus is heavily investing in 5G technology and in the internet of things, making it effectively a company that owns other companies, in the future.”

Hi Jeff, are you asking if investing in a single company in Canada, a country that makes up 3% of global financial markets, is the same or better than investing in a globally diversified portfolio made up of thousands of companies?

It’s generally not wise to have any significant amount of your retirement savings invested in the company that also employs you. Ask any former Nortel or Enron employees about that.

By all means, take advantage of employer-matching programs and discounted stock purchase plans. But once your shares exceed 5% or so of your overall portfolio, it’s probably best to move them to a more diversified basket of investments.

Weekend Reading:

Our friends at Credit Card Genius share the best credit card offers, sign-up bonuses, and deals for April.

Check out my interview with My Own Advisor Mark Seed about my journey to financial independence through entrepreneurship.

Barry Choi at Money We Have explains how to invest in index funds.

Jason Zweig at the Wall Street Journal says investors shouldn’t be fooled by the stock market’s newest magic trick:

“What happened? Did hundreds of fund managers start popping genius pills? No, although marketing departments are probably gearing up to tout their brilliance. Instead, the ghastly losses of early 2020, when stocks fell by 34%, have just disappeared from trailing one-year returns.”

A Wealth of Common Sense blogger Ben Carlson looks at what happens after the stock market is up big.

Global’s Erica Alini takes a look at average incomes relative to average home prices across markets over the last 40 years.

On The Evidence Based Investor blog, Larry Swedroe explains why older investors handled last year’s volatility worst.

PWL Capital’s Justin Bender explains how to calculate your money-weighted rate of return:

Jason Heath says Canadian inheritances could hit $1 trillion over the next decade, and both bequeathers and beneficiaries need to be ready.

Here’s why retirees should avoid being frugal with their savings:

“Having a comprehensive financial plan that considers assets, cash flow, taxes and lifestyle needs and wants is recommended for people to worry less about money in retirement, and maybe spend more.”

The always insightful Morgan Housel shares the big lessons of the last year.

Finally, a great reminder to stop thinking about what you’re retiring from and start thinking about what you’re retiring to.

Enjoy the rest of your weekend, everyone!

Retirees face a myriad of questions as they head into the next chapter of their lives. At the top of the list is whether they have enough resources to last a lifetime. A related question is how much they can reasonably spend throughout retirement.

But retirement is more than just having a large enough pile of money to live a comfortable lifestyle. Here are some of the biggest questions facing retirees today:

Should I pay off my mortgage?

The continuous climb up the property ladder means more Canadians are carrying mortgages well into retirement. What was once a cardinal sin of retirement is now becoming more common in today’s low interest rate environment.

It’s still a good practice to align your mortgage pay-off date with your retirement date (ideally a few years earlier so you can use thee freed-up cash flow to give your retirement savings a final boost). But there’s nothing wrong with carrying a small mortgage into retirement provided you have enough savings, and perhaps some pension income, to meet your other spending needs.

Which accounts to tap first for retirement income?

Old school retirement planning assumed that we’d defer withdrawals from our RRSPs until age 71 or 72 while spending from non-registered funds and government benefits (CPP and OAS).

That strategy is becoming less popular thanks to the Tax Free Savings Account. TFSAs are an incredible tool for retirees that allow them to build a tax-free bucket of wealth that can be used for estate planning, large one-time purchases or gifts, or to supplement retirement income without impacting taxes or means-tested government benefits.

Now we’re seeing more retirement income plans that start spending first from non-registered funds and small RRSP withdrawals while deferring CPP to age 70. Depending on the income needs, the retiree could keep contributing to their TFSA or just leave it intact until OAS and CPP benefits kick-in.

This strategy spends down the RRSP earlier, which can potentially save taxes and minimize OAS clawbacks later in retirement, while also reducing the taxes on estate. It also locks-in an enhanced benefit from deferring CPP – benefits that are indexed to inflation and paid for life. Finally, it can potentially build up a significant TFSA balance to be spent in later years or left in the estate.

Should I switch to an income-oriented investment strategy?

The idea of living off the dividends or distributions from your investments has long been romanticized. The challenge is that most of us will need to dip into our principal to meet our ongoing spending needs.

Consider Vanguard’s Retirement Income ETF (VRIF). It targets a 4% annual distribution, paid monthly, and a 5% total return. That seems like a logical place to park your retirement savings so you never run out of money.

VRIF can be an excellent investment choice inside a non-registered (taxable) account when the retiree is spending the monthly distributions. But put VRIF inside an RRSP or RRIF and you’ll quickly see the dilemma.

RRIFs come with minimum mandatory withdrawal rates that increase over time. You’re withdrawing 5% of the balance at age 70, 5.28% at age 71, 5.40% at age 72, and so on.

That means a retiree will need to sell off some VRIF units to meet the minimum withdrawal requirements.

Replace VRIF with any income-oriented investment strategy in your RRSP/RRIF and you have the same problem. You’ll eventually need to sell shares.

This also doesn’t touch on the idea that a portfolio concentrated in dividend stocks is less diversified and less reliable than a broadly diversified (and risk appropriate) portfolio of passive investments.

By taking a total return approach with your investments you can simply sell off ETF units as needed to generate your desired retirement income.

When to take CPP and OAS?

I’ve written at length about the risks of taking CPP at 60 and the benefits of taking CPP at 70. But it doesn’t mean you’re a fool to take CPP early. CPP is just one piece of the retirement income puzzle.

The research favours deferring CPP to age 70 if you have enough personal savings to tide you over while you wait. This may or may not apply to you.

One reader comment resonated with me when he said, “my plan is to take CPP at age 70 but that doesn’t mean the decision is set in stone. I’m going to evaluate my retirement income plan every year and determine whether or not I need it.”

There’s less incentive to defer OAS to age 70 but it’s still sensible if you’re still working past age 65 or if you have lived in Canada less than 40 years.

Otherwise, the bird in the hand approach is reasonable – taking OAS at age 65 while deferring CPP up to age 70.

When to convert to a RRIF?

You must convert your RRSP to a RRIF in the year you turn 71 and then begin withdrawals the next calendar year. But you can convert all or a portion of your RRSP into a RRIF before then. Here’s when it might make sense:

If you are between age 65 and 71 and don’t have any pension income, you could convert some of your RRSP into a RRIF and start drawing $2,000 per year from the RRIF. This strategy will allow you to claim the pension income tax credit.

Another potential advantage of converting to a RRIF earlier than 71 is that your financial institution won’t withhold tax on the minimum withdrawals. Of course, it’s still taxable income and you’ll pay your share at tax time.

This Week’s Recap:

Earlier this week I told investors that it would be ludicrous to invest in complicated model portfolios. Twitter agreed:

New | Why It Would Be Ludicrous To Invest In These Model Portfolios https://t.co/qpdn6TNrS8

— Boomer and Echo (@BoomerandEcho) March 27, 2021

I also answered some basic (but common) investing questions I get from readers and clients.

The MoneySense guide to the best ETFs in Canada is out again and I was once again pleased to join the panel of judges and share my thoughts on the top ETFs for investors.

Promo of the Week:

The American Express Cobalt Card is arguably the best ‘hybrid’ rewards card in Canada. Earn 5x points on groceries, dining, and food delivery, plus 2x points on transit and gas purchases.

New Cobalt cardholders can earn 30,000 points in their first year (2,500 points for each month in which you spend $500) plus, you can earn a welcome bonus of 15,000 points when you spend a total of $3,000 in your first 3 months.

Sign up for the Cobalt card here.

I use the Amex Cobalt card and transfer the Membership Rewards Select points to the Marriott Bonvoy rewards program.

Weekend Reading:

Our friends at Credit Card Genius share a great tip that you can convert your Air Canada Buddy Pass into 30,000 Aeroplan miles. An awesome perk since it’s unlikely we’ll get to use those Buddy Passes in the near future.

A great post by Nick Maggiulli (Of Dollars and Data) on the downsides of the FIRE lifestyle. Once you achieve it, then what?

In his latest Evidence Based Investor column, Larry Swedroe explains the risks of buying individual stocks.

Downtown Josh Brown doesn’t pull any punches when it comes to investing in SPACs, digital currencies, or non-fungible tokens:

“The grotesque spectacle of broke twenty-somethings lining up to buy a pointless digital trinket invented out of thin air by the World’s Richest Man prompted this post.”

PWL Capital’s Justin Bender shows do-it-yourself investors how to calculate their time-weighted rate of return.

Here’s the accompanying video:

Michael James on Money shares an incredible roadmap for a lifelong do-it-yourself investing plan.

Could you retire on $300 a month in Mexico? Andrew Hallam takes a look at international living on the cheap.

Morgan Housel says that virtually all investing mistakes are rooted in people looking at long-term market returns and saying, “That’s nice, but can I have it all faster?”

Morningstar’s Christine Benz looks at another burning question facing retirees: How much should you worry about inflation in retirement?

Here’s writer Sarah Hagi’s misadventures in trading stocks on Wealthsimple Trade.

A nice segue into William Bernstein saying that free stock trading is like giving chainsaws to toddlers:

“Pray that you don’t get really lucky, because if you get really lucky, you may convince yourself that you’re the next Warren Buffett, and then you’ll have your head handed to you when you’re dealing with much larger amounts later on.”

Indeed, as Robin Powell writes, there’s more to life than trading stocks.

Experts caution investors to lower their future expected returns based on today’s high stock valuations and low bond yields. The Monevator blog offers some suggestions for investors to focus on instead of blindly sticking 12% into your calculations and praying you get that return.

The caring economy is the chokepoint of recovery: So, what’s the plan to value the people we know are essential to our well-being?

Morgan Housel is back with a list of five investing super powers. Ok, the fifth one is not really a super power.

Finally, a wild recap of the time when Home Capital Group almost went bankrupt, only to be saved by Warren Buffett.

Have a great Easter weekend, everyone!

I write a lot about investing and always try my best to use plain language and real life examples to explain investment strategies, describe different products, and identify best practices. But I fully recognize that investing is a foreign concept to many people, especially if you’re new to investing or have always handed over your savings to a mutual fund sales person at the bank.

I answer reader questions about investing every day and have heard variations of the same basic questions over and over again. That’s totally fine, it’s better to ask a ‘stupid’ question than pretend you already know the answer (or worse, make a mistake with that lack of knowledge).

This article aims to answer many of these investing questions in hopes we can use it as an FAQ of sorts for new investors.

Q. What’s the difference between management fee and MER?

Mutual fund and ETF investors will notice two different costs listed on their fund fact sheet. One is the management fee, which is the amount paid to the fund manager. The second is the management expense ratio or MER. This includes the management fee, plus operating expenses for marketing, legal, auditing, and other administrative costs.

When a new ETF is introduced, the management fee will be published but the total MER will not be known for 12 months.

What’s not included in the MER is the fund’s trading costs, which are identified separately as the trading expense ratio or TER. The TER may be very small, even zero in the case of some ETFs, but it could also be quite large.

VEQT charges a management fee of 0.22%. Its MER is 0.25%, and its TER is 0%. Total fee = 0.25%

Compare that to Horizons’ HGRO, which has a management fee of 0%, an MER of 0.16%, and a TER of 0.18%. Total fee = 0.34%.

Q. Asset allocation ETFs like Vanguard’s VEQT are “funds of funds”. Will I pay two levels of MER: One for VEQT and one for the underlying ETFs?

No. Vanguard’s All Equity ETF (VEQT) charges a management fee of 0.22% and has a MER (total fee) of 0.25%. From the VEQT ETF fact sheet:

“This Vanguard fund invests in underlying Vanguard funds and there shall be no duplication of management fees chargeable in connection with the Vanguard fund and its investment in the Vanguard fund.”

VEQT’s management expense ratio of 0.25% is higher than if you were to hold the four underlying ETFs on their own. But the advantage of holding an asset allocation ETF like VEQT is that it automatically rebalances its holdings so that you don’t have to.

The confusion about double-dipping fees likely comes from the robo-advisor model, where the robo-advisor charges a management fee of, say, 0.50% plus the MER of the ETFs used to build your portfolio.

That’s why a DIY investor who is comfortable opening a discount brokerage account and executing a trade can reduce their investment fees by holding an asset allocation ETF instead of using a robo advisor.

Q. Should I diversify outside of an asset allocation ETF?

An asset allocation ETF is designed to be a one-ticket solution. Indeed, it may be the only investment product you need in both your accumulation and decumulation phase.

We’re taught not to put all of our eggs in one basket. But consider Vanguard’s Balanced ETF (VBAL). It holds 12,642 stocks, plus another 16,553 bonds from all over the world. That’s a pretty big basket!

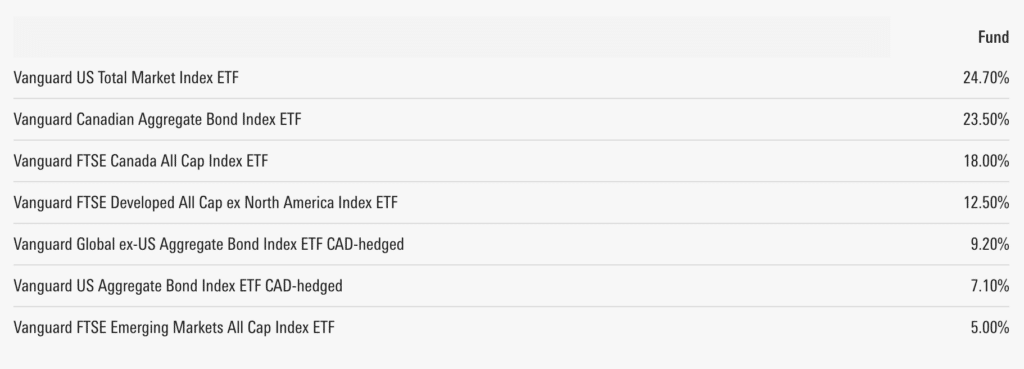

Let’s look at the underlying Vanguard funds and their allocations:

This is an extremely well diversified portfolio all wrapped up into one easy-to-use product. So, the question is more about which asset allocation ETF is most appropriate for your risk tolerance and time horizon – not whether you should add even more diversification to this investment.

When does it make sense to hold more than one asset allocation ETF? When you’re trying to reach an asset mix that isn’t available in a single balanced ETF. For example, if your risk profile suggests a 50/50 balanced portfolio you could hold equal amounts of VBAL and VCNS (Vanguard’s Conservative ETF). Similarly, to reach a 70/30 asset mix you could hold equal amounts of VGRO (Vanguard’s Growth ETF) and VBAL.

Q. These asset allocation ETFs don’t have a lengthy track record or performance history. Should I invest in a relatively new product?

Asset allocation ETFs were first introduced by Vanguard in 2018. But the concept isn’t new.

First of all, balanced mutual funds have been around for decades. Second, the underlying ETFs used to build an asset allocation ETF likely have a much longer track record. Finally, the stock and bond indexes tracked by these ETFs have been around for a long time and so the fund can be back-tested to determine how well it would have performed had it existed for the last 25 years.

In fact, PWL Capital’s Justin Bender has done exactly that on his Canadian Portfolio Manager blog. There, you’ll find the theoretical annualized returns of each of the Vanguard and iShares asset allocation ETFs dating back 25 years.

One reason this question comes up so often is because the mutual fund industry has taught us to look up a fund’s long-term performance to determine its quality. But this was done (ineffectively) to help investors identify top fund managers. We compared the performance to that of other mutual funds – not to its benchmark index.

With an ETF that’s passively tracking an index there’s no need to see a lengthy track record of performance. It’s designed to mirror the performance of a specific market index, which should have a long history of its own.

Instead, what investors should be looking at in an ETF is its tracking error, or the difference between the ETF returns and the benchmark index returns.

For example, Vanguard’s Total Market Index ETF (VUN) has annualized returns of 16.12% since inception. Its benchmark is the CRSP US Total Market Index, which returned 16.53% annually during the same period. VUN has a cost (MER) of 0.16%, which leaves a tracking error of 0.25%.

A high tracking error (after fees) means the ETF may not be reflecting the returns of its underlying index very well. If an investor was trying to decide between two ETFs tracking the same index, the one with the lower tracking error could be the better choice.

Q. Are robo advisors safe?

Canadians know and trust that our big banks are financially stable. But what about upstart robo advisors? Will your money be safe if you move to a digital investing platform?

The short answer is, yes. Robo advisors use what’s called a custodian broker to hold onto your money. For example, the robo advisor Nest Wealth uses National Bank Independent Network (NBIN) to hold your assets in your name. Nest Wealth only has the right to issue trading instructions and cannot access your money other than to receive its monthly advisory fee.

Your account is also protected by the Canadian Investor Protection Fund (CIPF) for up to $1 million per eligible account in case of member insolvency.

Finally, robo advisors use bank-level security measures and encryption to ensure your data is collected and stored safely.

Q. Can I pick my own investments at Wealthsimple?

It depends on which Wealthsimple platform you’re referring to.

Wealthsimple Invest is the robo advisor platform that offers its clients a pre-packaged (and risk appropriate) portfolio of ETFs that are automatically monitored and rebalanced. Clients cannot choose their own investments within this platform. All you can control is the risk level or asset mix used to build your portfolio.

Wealthsimple Trade is the commission-free self-directed trading platform where clients can buy and sell stocks and ETFs without paying fees.

One is a digitally managed portfolio that you can’t change (outside of your risk level), the other you’re on your own to trade and build your own portfolio. The other key difference is that Wealthsimple Trade does not have as wide a variety of account types, with only RRSPs, TFSAs, and taxable accounts available at this time.

Q. I have a large lump sum to invest. Should I invest it all at once or spread it out over a period of time?

The mathematical answer says that it’s best to invest the lump sum immediately and all at once. Vanguard studied this in a 2012 paper and found that immediate lump sum investing beat dollar cost averaging about 66% of the time. That’s because markets historically increase about two out of every three days. Having the money invested for a longer period of time improves the odds of capturing positive returns.

However, we’re not all emotionless robots and, behaviourally, it’s much more difficult to invest a large sum of money all at once. Loss aversion tells us we’d prefer to avoid losses rather than acquire an equivalent gain. The pain of losing is about twice as strong as the pleasure of winning. There’s also the fear that our decision may turn out to be wrong in hindsight, making us more averse to taking on risk.

Even though investing smaller amounts gradually over time is a less optimal way to invest a lump sum, it might feel better from a behavioural perspective.

If you decide to take this approach it’s best to design some rules around your gradual entry into the market. Set a pre-determined investing schedule so that you avoid relying on your intuition around when markets ‘feel’ safe.

What that looks like in practice could be taking a $100,000 lump sum and investing $20,000 per month for five months until you’re fully invested. Take that one step further by selecting the specific day of the month when you’ll deploy each tranche (e.g. the 15th of every month).

Finally, if you’re nervous about investing a lump sum perhaps your risk tolerance isn’t as high as you think. Instead of waiting, or dollar cost averaging, go ahead and invest the lump sum all at once but reduce your allocation to stocks (say, a 40/60 asset mix instead of a 60/40 mix) to make investing the lump sum feel less risky.

Final Thoughts

There are no stupid questions when it comes to investing. We’re all learning and trying to navigate our way through an often confusing and noisy environment.

That’s one reason why I prefer a simple investing approach using the following principles:

- Low cost

- Broadly diversified

- Risk appropriate

- Automated where possible (deposits, withdrawals, rebalancing)

- Holding the same asset mix across all of my accounts

You can do this on your own with a single asset allocation ETF, with help from a robo-advised portfolio of ETFs, or with your bank’s own index mutual funds.

That said, we all have our own unique circumstances or legacy portfolios that aren’t exactly easy to untangle. If you have an investing question, leave it in the comments below so we can all learn together or send me an email and I’ll respond to you directly.