Weekend Reading: Warren Buffett’s Annual Letter Edition

It never gets old. I'm talking about Warren Buffett's annual letter to Berkshire Hathaway shareholders. The famous Oracle of Omaha beat the market again, increasing the market value of Berkshire by 2.8 percent versus the 4.4 percent loss suffered by the S&P 500 in 2018.

Buffett's letter always includes a good dose of wisdom and humour, and this year's letter is no exception. I'll share some quotes below, but you can read the full letter here:

On stock buybacks: “It is likely that – over time – Berkshire will be a significant repurchaser of its shares, transactions that will take place at prices above book value but below our estimate of intrinsic value.”

On holding cash: “Berkshire will forever remain a financial fortress. In managing, I will make expensive mistakes of commission and will also miss many opportunities, some of which should have been obvious to me. At times, our stock will tumble as investors flee from equities. But I will never risk getting caught short of cash.”

On acquisition prospects: “In the years ahead, we hope to move much of our excess liquidity into businesses that Berkshire will permanently own. The immediate prospects for that, however, are not good: Prices are sky-high for businesses possessing decent long-term prospects.

That disappointing reality means that 2019 will likely see us again expanding our holdings of marketable equities. We continue, nevertheless, to hope for an elephant-sized acquisition. Even at our ages of 88 and 95 – I’m the young one – that prospect is what causes my heart and Charlie’s to beat faster. (Just writing about the possibility of a huge purchase has caused my pulse rate to soar.)”

On buying gold: “Those who regularly preach doom because of government budget deficits (as I regularly did myself for many years) might note that our country’s national debt has increased roughly 400-fold during the last of my 77-year periods. That’s 40,000%! Suppose you had foreseen this increase and panicked at the prospect of runaway deficits and a worthless currency.

To “protect” yourself, you might have eschewed stocks and opted instead to buy 31⁄4 ounces of gold with your $114.75. And what would that supposed protection have delivered? You would now have an asset worth about $4,200, less than 1% of what would have been realized from a simple unmanaged investment in American business. The magical metal was no match for the American mettle.”

On debt: “We use debt sparingly. Many managers, it should be noted, will disagree with this policy, arguing that significant debt juices the returns for equity owners. And these more venturesome CEOs will be right most of the time. At rare and unpredictable intervals, however, credit vanishes and debt becomes financially fatal.

A Russian roulette equation – usually win, occasionally die – may make financial sense for someone who gets a piece of a company’s upside but does not share in its downside. But that strategy would be madness for Berkshire. Rational people don’t risk what they have and need for what they don’t have and don’t need.”

This Week's Recap:

Just a single post this week and it was a controversial one with many readers weighing in on why you should take CPP at age 70.

It's always an honour to be included in Rob Carrick's weekly newsletter. This week's Carrick on Money linked to two of my recent posts; the one about giving away your possessions with a modern day potlatch ceremony, and the one that gave reasons why you should (and shouldn't) get an RRSP loan.

Promo of the Week:

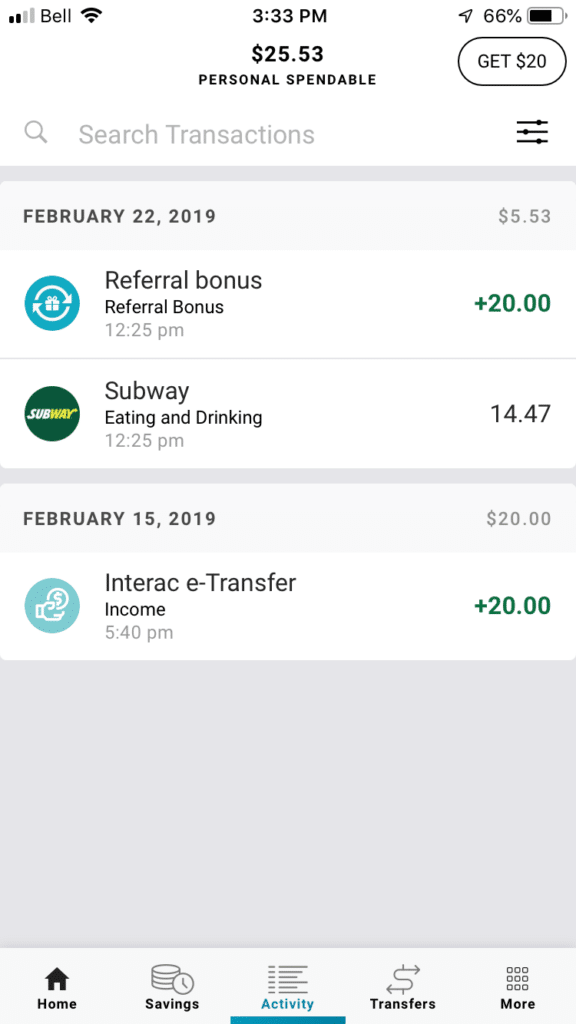

Earlier this year I signed up for KOHO. Basically it's a no-fee, prepaid, reloadable Visa card that comes with some unique features that act like a full-service bank account. It's ideal for those on a budget who want to limit their discretionary spending to a pre-set limit. Simply transfer an amount to your KOHO account and then use the pre-paid Visa card for those purchases.

You get instant 0.5 percent cash back on every purchase, which is a nice bonus over using your debit card. With its “RoundUps” feature you can round-up every purchase to the nearest $1, $2, $5, or $10 and save the difference.

Join KOHO and use the referral code BOOMECHO to get up to $60 ($20 when you make your first purchase, and an additional $40 when you add a direct deposit (payroll, government cheque, etc.).

Weekend Reading:

Critics of the overhauled Canada Pension Plan say it's a bad deal. Rob Carrick explains why they're wrong.

Michael Batnick of the Irrelevant Investor shares how to un-complicate your investment portfolio:

“Look, I tried for years to beat the market, couldn’t do it. Then over time I came around to the idea that trying to beat the market, in the words of Charlie Ellis, is a loser’s game. Then I came to realize that just getting market returns is no walk in the park.”

Where did investors put their money in 2018? Check out this cool infographic by Visual Capitalist.

Brent Esplin at the Micawber Principle shares why behaviour is more important than brilliance.

Here are 29 short money rules from Morgan Housel of Collaborative Fund.

How to invest a lump sum? Nick Magguilli does a deep dive into investing large amounts of money:

“I hope you come to the conclusion that you should just invest your cash now and move on with your life, because you are very likely to lose more money (in missed growth) if you don’t.”

Let's talk about one decision asset-allocation ETFs. Vanguard was first to launch these all-in-one balanced ETFs with a suite of products (VCNS, VBAL, and VGRO). Now investors can find similar one-ticket products through iShares, BMO, and Horizons.

Here's PWL Capital's Ben Felix explaining why these new ETFs are even more simple than my easy four-minute investing solution:

Meanwhile, Dan Bortolotti of Canadian Couch Potato fame shares his take on the new all-in-one diversified portfolios from Vanguard, BMO, and iShares with a side-by-side comparison.

Not to be outdone, My Own Advisor Mark Seed also weighs-in on the best all-in-one exchange traded funds.

I liked what Dale Roberts from Cut The Crap Investing had to say about how to create a retirement portfolio with ETFs. It's one of the most frequently asked questions on this blog.

Upstarts in the banking space, like KOHO and EQ Bank, are pushing for the concept of “open banking” where consumers would have access to all of their banking data across multiple institutions. In the current environment, budgeting apps like Mint can access your data, but using it actually violates your banking terms of service.

Michael James shares a detailed review of Larry Swedroe's new book, Your Complete Guide to a Successful and Secure Retirement.

Jason Heath shares the RRSP strategies every investor in their 60s should know to help reduce tax, increase retirement income and maximize their estate.

Global News shared the best and cheapest cellphone plans in Canada for 2019.

A scathing take on why Canadians need to smarten up when buying new cars:

“If I told you, with a straight face, that my kid was 96-months-old instead of saying he was eight, you’d think I was nuts — and you’d be right. But this is the swirling weasel-speak of car sales regarding loan terms.”

Finally, it's no secret that many professional athletes run into financial trouble after retiring from their short playing careers. Here's a look at the challenges athletes face.

Have a great weekend, everyone!

I wonder what Berkshire Hathaway’s succession plan is for Warren Buffet? He’s 88… nobody lives forever. Pretty sure he’s still hands on in their strategies. All you need to do is look at Apple post Steve Jobs. You either got it or you don’t.

@Frito – He announced the succession plan in last year’s letter. It’s down to these two:

“In early 2018 Ajit Jain was put in charge of all insurance activities and Greg Abel was given authority over all other operations. These moves were overdue. Berkshire is now far better managed than when I alone was supervising operations. Ajit and Greg have rare talents, and Berkshire blood flows through their veins.”

Charlie takes over. He’s only 95

Jain and Abel! 😀

Great post Robb. Love the Buffett quotes you picked out. BRK.B one of my 3 US picks. Had to invest alongside the Oracle.

Thanks, Dale