VBAL vs. Mawer Balanced Fund For One-Stop Investing

Investors could have done a lot worse over the past 30 years than investing in the Mawer Balanced Fund. Mawer, which epitomizes the art of boring investing, has been nothing short of consistently brilliant – with annual returns of 8.5 percent since the fund's inception in 1988. Investment giant Vanguard doesn't have the same longevity or track record here in Canada, but its launch of the Vanguard Balanced ETF portfolio (VBAL) gives investors another one-stop investing option.

This post will go under the hood and compare VBAL to the Mawer Balanced Fund for investors looking for a one-stop investing solution for the next two to three decades.

About Vanguard

Vanguard is legendary in the United States and is largely credited for pioneering low-cost index investing. It came to Canada in December, 2011 and now offers nearly 40 ETFs and four mutual funds to Canadian investors with a total of $17 billion in assets under management (Dec 2018).

VBAL was introduced by Vanguard Canada in January, 2018 as part of a new suite of asset allocation ETFs (including VGRO and later VEQT). These funds have proven popular among Canadian investors and have collectively gathered more than $1 billion in assets.

Before their introduction, investors did not have access to a one-stop ETF solution. Instead, they'd have to build multi-ETF portfolios to get exposure to Canadian, U.S., and International equities, plus another ETF or two for fixed income.

Vanguard turned that around with what I've called a game-changing investing solution. VBAL represents the classic 60/40 portfolio.

Vanguard Balanced ETF (VBAL)

VBAL is a fund of funds. That means its underlying holdings are made up of other Vanguard funds. So rather than seeing a bunch of individual stocks and bonds in VBAL's holdings, you'll instead see these seven products:

- Vanguard US Total Market Index ETF

- Vanguard Canadian Aggregate Bond Index ETF

- Vanguard FTSE Canada All Cap Index ETF

- Vanguard FTSE Developed All Cap ex North America Index ETF

- Vanguard Global ex-US Aggregate Bond Index ETF CAD-hedged

- Vanguard US Aggregate Bond Index ETF CAD-hedged

- Vanguard FTSE Emerging Markets All Cap Index ETF

The fund's mandate is to maintain a long-term strategic asset allocation of equity (approximately 60%) and fixed income (approximately 40%) securities. It's as diversified, globally, as you can get – with a whopping 12,318 stocks and 15,412 bonds wrapped up inside this one-stop balanced ETF.

VBAL has net assets of $675 million (June 30, 2019). Its distribution or dividend yield is 2.58 percent (dividends paid quarterly). Its management expense ratio or MER is 0.25 percent.

Investors can purchase VBAL through a discount brokerage account and it is an eligible investment inside an RRSP, RRIF, RESP, TFSA, DPSP, RDSP, or non-registered account.

VBAL's performance data only goes back to its inception date of January 24, 2018. It has returned 4.05 percent annualized since that time, and 10.44 percent year-to-date (July 30, 2019).

Justin Bender, a portfolio manager at PWL Capital, has simulated the returns as if the fund did exist for the past 20 years and found the following annualized returns (as of June 30, 2019):

- 1-year return – 5.09%

- 3-year return – 7.22%

- 5-year return – 6.62%

- 10-year return – 7.95%

- 20-year return – 5.34%

You can read more about VBAL and its fact sheet and prospectus here.

About Mawer

If Vanguard is legendary for pioneering low cost investing, Mawer has achieved cult-like status among active investors for an incredible track record of outperforming its benchmarks. Mawer was founded in 1974. It's a privately owned, independent investment firm, managing over $55 billion in assets. Mawer has locations in Toronto, Calgary, and Singapore.

While its philosophy is ‘be boring', Mawer's performance is anything but. Of its 13 mutual funds, eight have beaten their benchmark index since inception – including the Mawer Balanced Fund, which trounced its benchmark over the last decade (9.9 percent to 7.8 percent).

Mawer gets its results from being different than the index – yes, this is not your average Canadian closet indexing fund. Its Canadian equity fund has just 41 holdings, compared to 239 in the benchmark S&P/TSX Composite Index. Mawer's U.S. equity fund has 61 holdings and matches up well against the vaunted S&P 500.

Mawer discusses its boring investing approach in the Art of Boring podcast.

Mawer Balanced Fund

Mawer's Balanced Fund (MAW104) is also a fund-of-funds. Its underlying holdings are made up of:

- Mawer Canadian Bond Fund Series O

- Mawer US Equity Fund Series O

- Mawer International Equity Fund Series O

- Mawer Canadian Equity Fund Series O

- Mawer Global Small Cap Fund Series O

- Cash & Cash Equivalents

- Mawer New Canada Fund Series O

- Mawer Global Bond Fund Series O

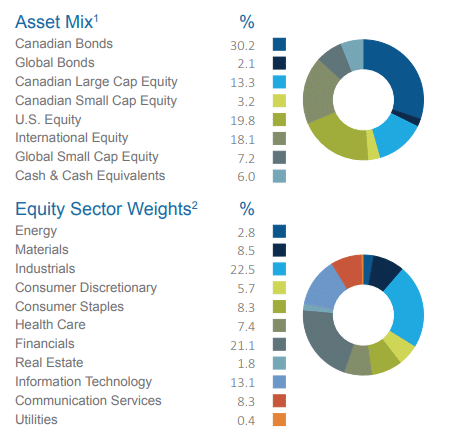

An actively managed product, the Mawer Balanced Fund invests in Canadian, US, and International equity securities, plus Canadian government and corporate bonds primarily through funds managed by Mawer.

The fund's manager aims to buy companies at a discount to intrinsic value to construct the equity portion of the portfolio, while focusing on sector allocation, security selection, and trading strategies on the fixed income side.

The Mawer Balanced Fund has net assets of $4 billion (June 30, 2019). Its management expense ratio or MER is a reasonable 0.91 percent.

Investors can purchase Mawer Mutual Funds through most major online discount brokerages, with the exception of RBC Direct Investing. A minimum initial purchase of $5,000 per fund, per account is required. Once the initial minimum is met, there are no minimum requirements for additional investments.

As mentioned, Mawer's Balanced Fund has returned 8.5 percent a year since inception in 1988. It has returned 10.4 percent year-to-date (June 30, 2019). The fund's longer term performance is as follows:

- 1-year return – 7.0%

- 3-year return – 7.4%

- 5-year return – 7.8%

- 10-year return – 9.9%

You can read more about the Mawer Balanced Fund through its fund profile here.

Final thoughts

Mutual funds get a bad reputation from investor advocates like me, but to be fair they should not all be painted with the same criminally expensive brush. Mawer's performance track record speaks for itself, and I think that's a mark of being different than the index, AND keeping costs reasonable (under 1 percent).

True, investors in Mawer's Balanced Fund have done extraordinary well for the past three decades. I'd argue, though, how much of that is skill and how much is attributable to other factors? We also don't know what the returns of the next three decades will be. Fund managers at Mawer will retire or move on, and replacements might not deliver the same outcomes. Then there's the reversion to the mean – a fund that's outperformed for so long might find itself under performing for the next decade or more as their strategy falls out of favour.

Enter Vanguard's VBAL – the one-stop investing solution for the next thirty years. Sure, it doesn't have the same track record and historical performance of the Mawer fund. But VBAL is built on low cost, globally diversified principles that don't need “conviction” and “skill” to succeed. All it needs to do is capture the market's returns over an investor's lifetime.

Where would you rather park your retirement savings for the next 20-30 years?

I guess I would go with VBAL based on the Vanguard track record! But I might split between the two since MAW104 has such a great individual record.

Maybe a blend of 75% passive and 25% active.

The pro to the one fund solution is that it is super easy and the auto rebalance. The con is that they fail to allow you to allocate investments for tax efficiency. This of course starts to matter once accounts get larger, and particularly once rrsps and tfsas are maxed out and you have the need for non-reg accounts.

Mawer is indeed a top notch firm and Vanguard has been a game changer (our firm utilizes both)… But I wouldn’t set it and forget it for 20 or 30 years! Got to keep paying attention!

My wife and I each have company RRSPs/pensions with matching, and those are in target date funds. For the remainder of our retirement savings, we use a TFSA that is 50% TD e-series funds and 50% Mawer Balanced Fund. Since we contribute every month, I still think low cost funds are a better choice than ETFs for us. YMMV

No question. VBAL. The data is clear on this. Given that you are comparing funds with similar characteristics, the best predictor of future performance is the MER. In addition, if you own actively managed funds in taxable accounts, they are less tax efficient than index funds because of the higher turnover, so you have an added tax cost with Mawer.

Mawer Balanced is for RRSP, so taxes are irrelevant. Mawer Tax Effective Balanced is for non-registered accounts.

The question is: is active dead? No. Rebalancing is an active risk management tool which VBAL uses. Mawer uses a different risk management approach which has been working for them. Only time will tell whether VBAL’s approach will be superior.

Mawer tax effective balanced attempts to reduce taxable transactions, but it it still more active than an index funds, so therefore less tax efficient.

Of course VBAL is rebalanced to maintain risk, but that has nothing to do with attempting to pick stocks or time the market, the essence of active management.

The data is very clear that the lower the MER, the better the outcome.

Hi Robb,

Very interesting and timely article as I was just reflecting on a similar comparison in regards to two “competing” 100% equity products such as Vanguard’s VEQT vs. Tangerine’s Equity Growth mutual fund. As VEQT is much newer its difficult to compare historical performances to justify which product is superior despite the differences in asset allocation and MER, your thoughts would be much appreciated on this topic!

Would it be safe for a retired couple to put everything in something like VBAL or VCNS? And when I say “everything” I mean all-in, taxable, RRSP, TFSA, LIF and what-have-you. Would that be “safe”?

I hold both Mawer and Vanguard products in my RRSP account and have been very happy with the performance of both to date. The MER on Mawer funds, though on the lower side for a mutual fund was still a big driver to incorporate more ETFs into my contribute and don’t touch accounts. Robb’s many articles on the topic of MER and indexing must be sinking in.

Mawer’s 20 and 30 year track record over 7% for 20 years and 8% for 30, NET of fees. It is OK to admit some fund managers DO beat the index.

Yes, a few do, but it’s going forward that matters and we know that past performance does not predict future performance.

You also need to make apples to apples comparisons. It turns out that when exposure to small cap stocks and value stocks are taken into account, the outperformance disappears.

https://www.canadianportfoliomanagerblog.com/active-funds-exposed/

If I wasn’t already invested with a simple ETF portfolio I would absolutely consider the new all-in-one ETFs. Its an incredible way to create a diversified portfolio and so easy to manage.

The thing I will always worry about with actively managed funds is that there is always someone trying to be “smart” and sometimes even smart people can make stupid mistakes.

Really great comparison, thanks Robb!

I’m a big fan of both but if I were starting today I think I would go with VBAL.

Steve

This would be a good time to revisit this comparison. On a six month chart it looks to me like VBAL has dropped twice as much as MAW104.

I’ve held the Mawer Balanced for about 10 years now. For me, the value is in the fact that you also get the skill and expertise of the mangers of the various individual funds at minimal cost. Also, you have a portion of their well regarded New Canada Fund which has been closed to new investment for some time. I also hold TD e-series index funds.

Re: ETFs – they have their place in a portfolio, but Michael Burry’s comments about there (still) being only a limited number of exits pertains. The risks in an ETF of ETFs seems to more than offset the benefits.

Maw104 has been a dog for 2 years straight. It seems the fund managers have changed, and the new guy is more of a monkey

I know this is very late (2023), but some of my mawer funds are really not doing well, and on top of that the MER is like 2%, so a fund that is sinking still takes 2%, and leaving me with 0% or worse (in the red). I sold half of the mawer funds this week.

Own both like both. MAW 104 provides (very small) monthly re-investment. Try NOT to withdrawal funds until “after” year end Capital Gains incorporated in December. Also No fees to withdrawal from MAW 104. Whereas VBAL pays cash dividend. Brokerage fees required to buy / sell.