When Should Early Retirees Take CPP?

When should you take your Canada Pension Plan (CPP) benefits? Like many personal finance decisions, the answer depends on your unique circumstances. In general, it makes sense to defer taking CPP until age 70. The caveat is that you need to have other resources to draw from while you wait for your CPP benefits to kick-in. After all, who wants to delay spending in their “go-go” retirement years just to shore up their income in their 70s and beyond?

I’ve written before about when it makes sense to take CPP at age 60, why taking CPP at age 65 is never the optimal decision, and why taking CPP at age 70 can lead to $100,000 or more lifetime income.

But one question I often receive from readers and clients is when should early retirees take CPP? Here’s a reader named Keith, who decided to retire at the end of last year at age 60:

“My understanding is that since I won’t earn any income from now to 65, those five years will add to the CPP average calculation and potentially lower my eligible monthly amounts. If that’s the case, should I apply for CPP right away, or choose to defer it to 65 or 70? If I apply today, will those five years of zero income still be included in the average CPP calculation?”

It’s a great question. CPP is a contributory program based on how much you contributed (relative to the yearly maximum pensionable earnings) and how many years you contributed between ages 18 to 65.

To receive the maximum CPP benefit at age 65 you would need 39 years of maximum contributions. You can drop-out your eight lowest years (more if you are eligible for the child rearing drop-out provision) from the calculation.

Related: How Much Will You Get From Canada Pension Plan?

You can see the problem for early retirees. They’re going to have more “zero” contribution years which will reduce the amount of their CPP benefits.

Not so fast.

You will always get more CPP by waiting, even if you’re not working.

CPP expert Doug Runchey says that your “calculated (age-65) retirement pension” may decrease if you’re not working between age 60 and 65, but the age-adjustment factor will always make up for that decrease, and then some.

“In that situation I use the expression that you will receive a larger piece of a smaller pie if you wait, but you will always get more pie,” he said.

CPP checklist for early retirees

Here’s what to do if you’re in the early retirement camp and want to know when to take your CPP benefits. Log into your My Service Canada Account online and click on “Canada Pension Plan / Old Age Security.”

Scroll down to the “contributions” section and click on “Estimated Monthly CPP Benefits.”

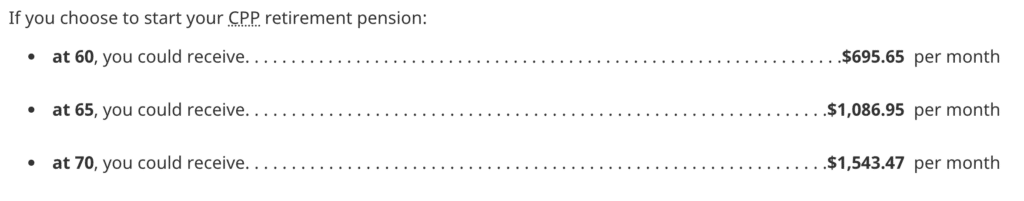

You’ll see your expected CPP benefits at age 60, age 65, and age 70.

Now take that calculation and throw it in the garbage because it’s completely useless. That’s right. The CPP estimates you see here assume that you continue contributing at the same rate until age 65. That’s problematic if you plan to retire at age 58 or 60 and will no longer be contributing to CPP.

Go back to the previous screen and click on your CPP contributions. There you will find a web version* of your Statement of Contributions – a history of your contributions dating back to age 18. Right click on this page and “save as” (format: webpage, HTML only).

*Note you can request a copy of your Statement of Contributions in the mail, but you won’t need that for the next step.

Now visit www.cppcalculator.com and sign up for the website with your first name and email address. You’ll receive a confirmation email from the site founder David Field (co-created by Doug Runchey) to activate your account, followed by another email to login to the site and run your own unique CPP calculation.

Upload the statement of contributions that you saved earlier (or manually enter your pensionable earnings year-by-year). The beauty of the CPP Calculator website is that it allows you to manually enter future years, including future “zero” years if you plan to retire early.

I ran this calculation for myself because, as of right now, I am paying myself dividends from our corporation and not making CPP contributions (it’s a decision I continue to wrestle with, as I’d have to switch from dividends to salary and then pay both the employer and employee portion of CPP each year).

The estimate I shared above from My Service Canada is my own estimate based on 15 years of max contributions, plus another eight years of lower than max contributions. I did not contribute to CPP in 2020 or 2021, but it looks like Service Canada assumes I will continue making contributions until age 65.

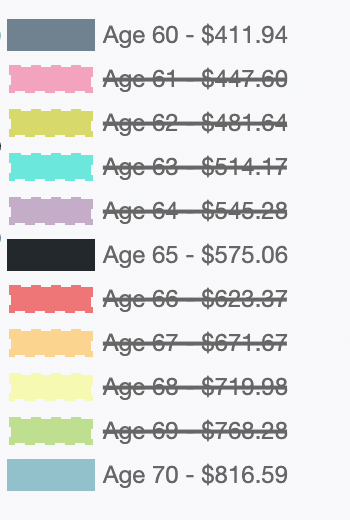

When I ran the numbers in CPP Calculator I assumed no more contributions to CPP from age 43 to 65. Look at the difference that makes for my CPP at ages 60, 65, and 70:

Instead of receiving $1,086.95 per month at age 65, I should only expect to receive $575.06 per month. That’s almost a 50% reduction in expected benefits. In other words, it’s a huge difference.

Final Thoughts

When should early retirees take CPP? There’s no definitive answer, but having the right data will help inform your decision.

The My Service Canada estimator assumes you work until 65. Use the CPP Calculator website and manually enter “zero” years if you plan to retire earlier than 65. That will give you a more accurate estimate of your CPP benefits.

Remember that you will always get more CPP by waiting, even if you retire early. Your calculated age-65 CPP benefit may decrease, but that will be more than offset by the age-adjustment factor or deferral credit (7.2% per year from 60 to 65, and 8.4% per year from 65 to 70).

Disclaimer: If at any time you stopped work to raise kids or recover from a disability, or you have been widowed, divorced or separated then the CPP Calculator will not provide you with an accurate calculation. It is recommended that you have your benefit amount manually calculated by Canada Pension Plan expert Doug Runchey, who charges a nominal fee but guarantees the accuracy of your estimate.

The only reason to defer claiming CPP is that you are absolutely certain you will live beyond the actuarial age used by CPP. Since no one can guarantee they will live beyond today it is playing roulette by deferring. CPP provides no minimum payout so if you died the day before you began claiming the deferred payments you and your estate will have paid into CPP and receive a zero payout. Just food for thought.

This articles never mention the money you earn from say age 62 to 67 or 68. My friend is going to start at 68. I started at 62. I get 900 a month. He will get 1150 a month. I have 60,000

In my bank account. He will make 250 more a month but it will take him 12 years before he catches up to me in total earnings. He’ll be 80 years old by that time. Good chance by that time money will be going to the manor,,,,or his survivors.

Hi Jim, this assumes that you save your CPP rather than spend it. I’d imagine the majority of retirees who take CPP early do so to spend the money.

The retirement plans I write for clients help to illustrate how you derive income from various sources each year to maximize your spending and optimize for taxes over your lifetime. It’s helpful to look at this (year-by-year) over the potentially many decades of retirement to see how all of the puzzle pieces fit together.

BTW, the CPP Calculator website has a neat looking chart to show the breakeven ages for taking CPP at different ages.

I understand the savings part.

Depends on how you look at life as I said. I enjoy the money now while I am healthy and can enjoy spending it. Having more money when I’m limping around at 80 looking out the window just isn’t me.

Hi Jim, I hear you. But I’m not saying spend less now. I’m just saying spend from a different bucket (assuming you have one) to accomplish two things:

1. To give you more lifetime income throughout retirement (as much as $100,000)

2. To ensure your 80-year-old self has guaranteed, paid for life, indexed-to-inflation income

Exactly so @Jim – it matters to know your breakeven age and how much you expect to live past that. Mine is 81 – how much longer do I expect to live past that age ? Who knows, so better do not leave money on the table.

By the same flawed reasoning Ron used, we should all spend all our savings as soon as possible to avoid the possibility of dying and not getting to spend it.

Agreed. A bird in hand as they say.

We should think about a person’s peace of mind when considering when to take CPP. This is often under-considered in financial articles. I think Robb tries to bring balance to this conversation and I appreciate it.

Thanks for the kind words, Mark. Ultimately, it is up to the individual and their preferences. The goal of this article, and for my previous pieces on CPP, is to help readers make that decision with the best information rather than using flawed numbers (from their My Service Canada Account), or listening to a conflicted financial advisor, or listening to their neighbour or work colleague who decided to take it early over fears of an early demise.

Hi Ron, I would actually flip that statement around and say one of the main reasons to take CPP at 60 is if you are absolutely certain you will die before age 69 (the breakeven age). And since no one can guarantee they will die before 70, it is playing roulette by taking CPP early.

@ Ron Fichter

I could be wrong but to be clear, I believe your estate can apply for up to 11 months in retro active CPP income. Also, if you are married/common-law and your spouse has deferred their CPP they will receive 60% of your “calculated” CPP (not your “adjusted” CPP), UP TO the maximum CPP that would be payable to you the year of your passing. This does not happen automatically and MUST be applied for. Note: if your surviving spouse expects to collect a smaller CPP it is even more important to consider having that spouse defer as long as possible. Reason: Once you start to collect CPP you no longer qualify to receive a 60% survivor benefit. It’s a convoluted calculation. Be aware: There are nuances with CPP survivorship that MUST be taken into consideration BEFORE making any final decisions as who benefits the most by deferring. Bear in mind the survivorship benefit is based on the “calculated” benefit of the spouse who passes and adjusted by the SURVIVOR’S adjustment (actuarial) factor. I am in full agreement with Mr Engen, consulting with Doug Runchey at DR Pensions Consulting would be money well spent.

There are other situations to consider other than trying to maximize your total at time of death.

My wife will get 60% of my CPP along with other income. My wife will not get CPP because we both decided that it’s best for the family for her to stay home and not have a job.

Our plan is to defer so that her 60% will be a bit higher if I kick off before her.

We will do fine with my union pension and OAS so why not defer for insurance?

Dying early seems to be a key concern when it comes to taking CPP early. Indeed, we’ve all had a neighbour, relative, colleague who died early and didn’t get a chance to enjoy retirement.

But rather than dealing in hypotheticals I’d prefer to deal in probabilities – and if you’ve already made it to age 60 there is a 25% chance you’ll live to 95 and a 50% chance you’ll make it to 90.

I know it’s hard to think our future selves might need the money more than we do, but I’d rather ensure that I have sufficient resources to cover my expenses in old age, which can be expensive with in-home care and assisted living.

As I wrote in the article, the key to deferring is making sure you have sufficient savings to meet your spending needs from age 60-70 (if you defer CPP that long). It doesn’t mean spending less in your early retirement years – you’re just getting the income from existing savings while you wait for CPP to kick in.

And, as Fred Vettese says, if you die early you’ve got bigger things to worry about than not collecting CPP – like not breathing!

Thanks for a great article Robb.

I must say I’m always a little surprised when I read this article, and similar articles that address the CPP timing issue. Presumably your readers are here to learn about how to best plan for a prosperous retirement and try to gain a better understanding on which approaches lead to a robust income plan in their after work years.

I recently read that only 2% of Canadians defer CPP to age 70. That is shocking to me. I completely agree that anyone who needs the money to live must make the right decision for their personal situation. But taking it sooner than 70 because of fears of an early demise (without substantial family history) defies logic. Taking it sooner to “get my money” is even more difficult to comprehend.

I plan to retire in 5-6 years around age 60. I’ve used the website mentioned in your post and I was surprised at how little my piece of pie will shrink. I was fortunate to have some good paying jobs while doing post secondary study and I had two “gap” years along the way as well.

I’ll eagerly melt my RSP from 60-70 as tax efficiently as I can to pave the way for that big CPP bonus. In today’s dollars I’d have to save almost a half million dollars to get the equal amount of CPP at age 70 with a 4% yield. Removing the burden of saving that sum of money gives me far more peace of mind than the fears of dying early ever could.

Hi James, my pleasure. It sounds like you have a good strategy in place for your retirement.

I believe the latest research showed 4% of retirees take CPP at 70. That’s up from what I think was 1% a while ago. Still a shockingly low number, but at least it’s on the rise.

The age credit for deferring CPP is still relatively new. That, coupled with the TFSA (which is also still fairly new) has changed the retirement planning landscape. Unfortunately, a lot of old retirement planning ideas, like keeping your RRSP intact for as long as possible, haven’t been updated to reflect these new opportunities.

I find it frustrating that the ‘CPP early or not’ subject is so often dealt with as if it was an island. No mention of OAS (which has similar calculations), or other retirement income (like interest earnings, investment earnings, RRIF, LIF, etc)… or the tax implications thereof. The CPP/OAS early/late decision CANNOT be effective if made in isolation of these factors… and articles like this should underline the potential impacts.

When I use the Canada.ca retirement income calculator (which does give a better view of other inputs), I see that I will have a hard time staying below the $90k annual threshold for OAS clawback (effectively, a sur-tax)… and taking CPP/OAS late makes the problem worse.

And again, tax implications need to be considered (short term and long term). CPP and OAS are taxable income..!! I wish there were a calculator, similar to the Canada.ca calculator, that also included tax implications. And I wish authors of articles like this addressed,, at least conceptually, the impact that higher retirement income has on the decision.

Keith, the answer to most specific financial planning questions is, it depends.

In general, it makes sense to delay CPP to secure more lifetime income and reduce lifetime taxes.

That answer could be different depending on your unique circumstances.

A couple, for instance, would most likely benefit from taking increased RRSP / RRIF withdrawals in their 60s and delaying CPP and OAS to 70. Because of the ability to split income, they could reduce or eliminate any OAS clawbacks.

A single doesn’t have that luxury, so more careful planning is needed to make sure they maximize lifetime income and reduce taxes.

Btw, you should research how delaying OAS actually leads to capturing more OAS because it increases the clawback threshold.

Hi Robb

I retired from teaching early at age 55 and am now 60 and have been taking my OTPP since I retired. (I just turned sixty) So I have not worked between age 55 and 60 years. Does this affect my Ontario Teachers Pension that has a bridge payment to age 65? Should I take CPP now or wait unti 65 to take it. I am super confused now. Thanks for any help. James

Hi James, there’s a lot of confusion around bridge benefits so you’re not alone with your question. The short answer is that it doesn’t matter when you take your CPP. Your bridge benefit will be paid until age 65 and then you’ll no longer receive it (whether you take CPP at 60, 65, or 70).

When a pension is “integrated” with CPP and you retire before 65 you’ll receive a guaranteed monthly pension for life, plus a bridge benefit from retirement age to age 65, when it’s presumed you’ll take CPP. The goal is to smooth out your income in retirement.

For example, instead of paying a flat monthly benefit of, say, $4,200 per month for life, you may get $4,800 per month until age 65 and then the bridge benefit goes away and you get $3,800 per month for the rest of your life.

Thank you Robb this is very helpful.

So if I take my CPP now at age sixty, whatever that amount is, it will be the same amount I receive the rest of my life correct, including when the bridge bwnefit ends at 66 years?

So if I wait until I am 65 to take CPP it will be the same amount if I start taking it now? If this is the case shouldnt I take it for the next 5 years?

Thanks again greatly appreciated!

James

I guess what I am asking is, apologies for taking so long, will my CPP be higher if I wait to take it until age 65 onward to take it as it is for everyone else?

I can wait to take CPP but if it will not increase over the next 5 years by holding off taking it then I might as well just take it now?

It will increase over the next five years, and also for the subsequent five years (to age 70) but, the calculation at age 60 will be on 42 years ( minus your dropout years) versus 47 years (minus your dropout years) at age 65. The addition of the five additional zero contribution years minimizes the increase you would experience. This is the bigger slice of a smaller pie that Fred Vitesse talks about.

Whether the smaller increase is worth it or not can vary greatly from person to person and would be guided by, amongst other things, what other sources of retirement income you have beyond your pension.

Hi James

Thanks for this!

My situation is I did not work from age 55 to 60 and I worked from 18 to 55 years of age.

I have no other income source.

Is it worth it for me to wait til 65 to take CPP and hope for an increase or based on my situation will I be getting less CPP?

Thanks again to you James and Robb this is all really helpful.

James

Hi James, your individual situation is too nuanced to make a big decision like this from the comment section of a blog post. Contact Doug Runchey at DR Pensions (https://www.drpensions.ca/dr-pensions-services.html).

For the most modest of fees ($30 to $125, depending on how many calculations you want to run) he can give you some more concrete numbers for your situation.

He’ll also tell you that you’ll always get more CPP by waiting, even if it means more zero contribution years. That is a verifiable fact.

Hi Robb

As you say, one key to deferring is having sufficient savings to bridge the deferral period. But although there is a small “probability” that one might live into their nineties or beyond, one still must have a plan to deal with that non-trivial “possibility”. Not doing so risks becoming a burden on family and society…something I hope we can all agree is not a desirable outcome.

The counter-intuitive and most poorly understood part of this whole discussion is realizing that deferring CPP allows one to “safely” spend more per year in retirement (even early retirement). Knowing that a significant portion of our spending needs will be covered by deferred CPP (inflation protected, implicitly government guaranteed, for as long as we live) reduces the need to carry a large savings balance. A bonus is that by spending down the nest egg sooner, we reduce the amount of time that our portfolio is exposed to all the significant risks of investing.

Jonathon Clements once said something along the lines of “Only those who fully intend to die young in retirement should take CPP as early as possible”.

Hi Garth, thanks for your comment. Great quote by Clements.

Yes, the $100,000 more lifetime income study was an attempt to move the discussion away from breakeven ages and emphasize the ability to spend more from all sources throughout your retirement.

Unfortunately, it’s difficult to get people to think outside of their mental accounting buckets (spend my CPP early, take my CPP and invest it in my TFSA, etc.) and think about all of the retirement income puzzle pieces as a whole.

Fred Vettese refers to the delaying of CPP until 70 as the annuitization of your income. Delaying CPP effectively transfers the risk from you (spending your retirement fund) to the government. And it, therefore, substantially reduces the risks of running out of money if you live longer than you expected to. CPP (and OAS) are annuities that are guaranteed income until your last day.

Hi David, that’s exactly right. The risk transfer is extremely important to understand. And, it’s even better than a traditional annuity because CPP is indexed to inflation.

The idea that you could take your CPP early and invest it in order to beat the guaranteed age-credit enhancement (7.2% from 60-65 and 8.4% from 65-70) is frankly laughable.

One more quick thought.

I think that it is a frequent occurrence that retirees get advice from financial advisors who benefit from clients who choose to take early CPP and then hold onto a larger investment portfolio for a longer period of time. Their compensation would be adversely impacted by their clients delaying CPP and drawing down their portfolios more quickly.

Hi James, you’re certainly right about this. I’ve heard that some banks’ (maybe all?) retirement planning software doesn’t allow their advisors to recommend drawing from a client’s RRSP before age 71. So you could see why they may recommend taking CPP early to help meet spending needs and preserve the RRSP as long as possible. But that is very likely a sub-optimal and perhaps ruinous strategy.

Of course the flaw in Michael James’ March 12, 7:53 pm, reasoning is that savings are passed on through an individual’s estate while the CPP benefits the individual has purchased, paid for, and is entitled to collect vanish at death. That’s a 100% death tax! Less harsh, more circumspect, please, Michael.

Yes, of course the goal is to have the largest possible estate when you die. It’s definitely worth it to live on less and risk poverty in old age to make sure you have the largest possible estate if you happen to die young.

I believe the 2nd set of CPP calculations are more realistic for many people who’ve never had high paying jobs, like over $40,000/year, especially for single women. If I take CPP at age 60 I’ll get about $400/month. If I wait until 65, I’ll receive around $600/month. That $200 a month could help with groceries but overall it’s not going to make much difference. This is why many people take CPP at age 60 because they need the extra money to live on right now. Waiting until age 70 its closer to $875 a month. Nice, but most people won’t be able to hold out that long. Including me!

Hi Cheryl,

Based on your numbers, to make up the $475/month difference between CPP at 60 and CPP at 70, you’d need to have $57,000 in savings available (after investment returns) to spend down during your 60s. This amount is above any amounts you need for emergencies or planned large expenditures. If you don’t have this much available, you’re right that you need to take CPP before you’re 70. To delay CPP to 65, you’d only need $12,000 in savings available (after investment returns).

Neither logic is flawed. They just solve two different problems. The “bird in hand” logic is looking for a way to extract as much money as possible from the government, before you die. The “delay until 70” logic is looking for a way to enjoy spending as much as possible in your everyday life, until you die (and not run out of money, while you are at it).

For a person with average life expectancy, “to extract as much money as possible from the government, before you die,” you’d wait until you’re 70 to take CPP.

Right. But that’s not the original problem. You’ve modified it when you implicitly introduced this additional assumption, “for a person with average life expectancy”. So, you’re are providing a solution for only a subset of the original problem. No wonder it doesn’t convince people who have this “what if I die early?” nagging question.

Hi SK, the problem with the bird in the hand logic is it too often relies on what’s called the availability bias – we think that examples of things that come readily to mind are more representative than is actually the case. Like, for example, a friend or work colleague dying shortly after retirement. We think, I don’t want that to happen to me so I will take my benefits as soon as possible. But you’re statistically more likely to live to 90 than die at 65.

Absolutely. I fully support the idea of delaying until 70, I’ll be doing it myself. What I am trying to say is, there is no universal algorithm that provides the guaranteed best strategy for everyone. Yet, people are looking for a simple, fixed answer to a very open-ended question “what is the best course of action, always and no matter what?” Heck, they don’t even agree on the definition of “the best outcome”, in the first place. Is it being able to spend more $$ daily, or is it leaving more to their kids, or just extracting more from the government over the rest of their life?

People will always object to the “delay to 70” strategy with examples like “Bob died at 70 and it didn’t work out for him, so the strategy is wrong”. It’s difficult to explain to them, that nobody said the strategy was 100% right, in the first place. The strategy only tends to be right on average, assuming the average life expectancy etc etc. But in the eyes of those people, even the statistically low chance of failure does discredit the strategy, anyway. That’s because they thought you were offering them a 100% winning formula, for any scenario in life. Which we all understand, you never claimed it to be.

The first “logic” is indeed flawed unless you fully intend to die young.

I retired at age 53.

My breakeven on CPP timing is 80.

If I live to 80+ then delaying CPP to 70 was a good idea.

Problem is, when I approach 60, I may need a crystal ball to tell me if I will live beyond 80.

I will let cash flow projections from my RSP meltdown dictate how long I delay CPP and OAS

Hi Jake, I like this approach. It’s not like you decided at age 53 to take CPP at 70 and that decision is set in stone. You plan to take CPP at 70 because that should lead to more lifetime income. But of course each year you evaluate your own circumstances (health and financial) to make sure that you can and should continue to defer your CPP. Maybe you take it at 68 or 69 just because you’re comfortable with your retirement plan and no longer need to “optimize” the income.

Great article Robb. I also retired at the end of last year at age 60. I am grateful to Michael James (I see he has posted here) for explaining to me a year ago that in my situation of having some “zero years” to 65, it would have little negative impact if I were to choose to delay CPP until age 70 – which I have. This is much in line to what you have mentioned Robb.

I personally know a number of people who have taken CPP early feeling that the government “owed them for paying in all of these years”. I look at it differently. To me it is Peace of Mind knowing that I will be receiving an increased amount of guaranteed income after age 70. To me that is much more important than worrying whether or not I get pay back for contributing throughout my working career. Of course Fred Vitesse’s book was my inspiration regarding this decision.

I do have one question though – the sustainability of CPP. The website certainly imply that it will be well-funded well into the future. My only concern would be whether or not this drastically changes should be we run into an extended depression-like bear market. Don’t get me wrong. I have more faith in our CPP compared to Social Security for our friends south of the border.

I hear this concern from time to time.

I think of it this way. If the markets are truly that bad then we will all have much bigger problems than how much CPP we are going to receive.

I trust the actuaries who have indicated CPP is solvent to at least 75 years out, and as I understand it, they are not permitted to look any further beyond that.

One scenario not mentioned in article or any of the comments: Suppose you have a DB pension plan and you plan to retire early (say age 56).

The DB plan – assuming it’s fully indexed – covers you for life. How would that factor in to what age to take CPP?

In this scenario, since your money would never run out, is it better to take it early and spend it while you’re still young enough to enjoy it?

You also lose 9 years of contributions – or rather you have 9 years at zero. That may curb the benefit to dealing CPP?

Also, RRSP income isn’t splittable until 65 so there may be tax implications?

Would welcome thoughts on any of these questions/variables.

Hi Bob,

Two important factors in your decision are 1) whether your pension is coordinated with CPP and OAS, and 2) whether you have savings you can spend while waiting for a delayed CPP.

Friends of mine with coordinated pensions took CPP at 60. They got used to the income boost and now fear turning 65 and facing an income drop of over $2500 per month.

I have an Ontario teachers’ pension that is blended with CPP. I decided to take my CPP at 60, primarily because there are no guarantees in life. I would rather have the cash now even though I hope to live past the age 72 “break even” point of early CPP versus waiting until 65.

Great Post Rob.

I appreciate the balance of your post. Just thought I’d offer my own thoughts and circumstance. I semi-retired in Nov 2020 at 45 years old (and consulting 2 days a week now). I ran my own CPP numbers, using the calculator, and my results were close to yours: $454 @ 60, $634 @ 65 and $900 @ 70. (Note that this is not counting the 2 days per week that I’m currently doing now and into the future). Personally, I’m planning to take CPP early at 60 simply because it’s “more money now” when I’m young. My spending will naturally go down as I age (less mobility), and indirectly the reduced CCP will have this effect. Along the lines of thinking, … I retired early to enjoy life to the fullest while I’m young, so it’s basically the same thought process of taking CPP early to enjoy what you can do now rather than later. The odds of dying increase exponentially after 50, (e.g., @ 50 – 4%, @ 60 – 11%, @ 70 – 25%, @ 80 – 50%, @ 90 – 85% so if you don’t need the extra money tomorrow, I just don’t see a point to holding on for more later.

Hi CanadianFI@45, thanks for sharing your approach.

I’m not sure that I’m comfortable deciding now that future me won’t need to spend as much money.

Besides, as I’ve said, delaying CPP doesn’t mean spending less in your early retirement years. It just means spending from a different bucket while you wait.

This counter intuitively can lead to more lifetime income – as in, the ability to spend more throughout your entire retirement.

Not sure if taking CPP early is partly because of the desire for instant gratification but I found this article interesting…..

https://positivepsychology.com/instant-gratification/ .

Again, it may or may not apply to all in this case, but I believe it applies to me. My mother always told me I was the type who had always waited for future gratification. So maybe that is why I’m one who choses to wait until 70 for my CPP. One thing I do believe for sure is that being the patient type makes me a better investor.

In reaction to Michael James posts of March 12 &13…

I’m disappointed. From harsh to sarcastic? Really? I think Robb’s readers deserve better. Let me try.

I’m sure there are Canadians who would benefit from the strategy you’re advocating but it’s unfair to suggest it’s a no-brainer. Many Canadian seniors will have no choice, they will have to start collecting the CPP benefits they have earned as soon as possible just to cover their day-to-day expenses. Others, those who do have a choice, those who CAN wait up to 10 years to receive any CPP benefit, may or may not WANT to wait. Some may want the extra income to fund luxuries (including travel) as soon as possible, while others will have other priorities, other interests, and other abilities (not to mention other life expectancies). It’s not ours to judge.

But what about the individual who, like you, apparently, doesn’t value additional income in his/her 60s but prefers to have that additional income available only at age 70. Deferring CPP is still just one option.

For simplicity’s sake, let’s use a scalable example. Say an individual’s age-65 CPP benefit would be $100 per year. At age 60, s/he has the option to receive $64 starting immediately or $142 starting 10 years later. That’s a difference of $78 but requires the individual to forgo the $64 benefit for 10 years, $640 in total. Since the Toronto Stock Exchange has achieved total returns at a compound annual rate of 9.6% over the last 50 years (while the US and European markets have done even better) perhaps this retiree should collect the $64 CPP benefits and invest them regularly in an all-in-one Exchange Traded Fund (widely available commission-free, some with negligible tax-drag) expecting to earn, say, 8% per year. After all, since the retiree in this example has not needed additional income (as you have assumed) and may not need cash from this investment in the future, it’s likely that the planning horizon and risk tolerance that should guide this investment are those of the retiree’s legatees/heirs.

10 years later, when our investor is 70, that CPP-funded ETF should be worth just over $1000 which, still growing at 8%, will more than make-up for the extra $78 per year s/he would be getting had s/he chosen to delay receiving CPP benefits until turning 70.

Moreover…

1) our retiree is wealthier now than s/he would have been following the “delay-CPP” strategy since s/he owns outright and irrevocably the ETF funded entirely by 10 years of CPP benefits;

2) had the retiree died before reaching age 70, her/his estate would have been worth more than if s/he had followed the “delay-CPP” strategy; and

3) whenever any part of that CPP-funded ETF is sold (or deemed to be sold) the capital gain will be taxed at just half the rate CPP benefits are taxed.

Together with one’s obligations to (dependent?) family members, the risks of dying young, living longer than anyone expects, potential incapacities, and how future legislative changes might affect our retirement finances, how an individual invests in retirement is just as important as it was before retirement and determines, to some extent, the range of viable retirement/CPP strategies.

Here’s to conscientious, licensed and experienced financial advisors who understand this.

I’m not a fan of the “take it and invest it” approach – there’s no guarantee for invested returns of any size (other than GICs), whereas the approach of waiting for CPP is as good a guarantee as one could hope for. I think if a retiree can live without the $64 in income then they should hold off and not assume that they can get as good as an inflation protected return (meaning one would need returns of around 9.25 – 11%) from investing that money themselves. This could be especially true if there is no TFSA or RSP contribution room to shelter the gains they might achieve. Plus, it should not be overlooked that $64 is pre-tax, and what the recipient actually ends up with to invest is less than that.

The crux of the matter, is if a retiree has enough RRSP / TFSA and non-registered savings to meet their needs from 60-70, deferring their CPP will in fact cause them to utilize their own investments a little more quickly. But, similar to above, I think this is a solid de-risking approach. I believe transferring the risk of providing the income “Post-70” to CPP is a very wise decision. Retirees own holdings are subject to sequence of returns risk, whereas there is no such risk to the deferred CPP amount.

“The Toronto Stock Exchange has achieved total returns at a compound annual rate of 9.6% over the last 50 years.” The relevant figures are real returns, which were only 5.5%. Robb has already refuted several of your other points.

“Here’s to conscientious, licensed and experienced financial advisors” looking past their own self interest to get the right answers for their clients.

When to commence CPP is always a great topic for discussion, and I’ve realized there are too many moving parts to come up with a rule that applies to everyone. So, I did my own analysis for starting at age 60 to age 70 for me and my wife.

As it stands today, we will each start CPP at age 64 + 1 month. The extra month takes us into January, picking up a bigger increase based on the YMPE five-year average vs CPI, but we’ll make the final determination nearer that day.

We only have 24 and 20 years of contributions, respectively, so with no more CPP eligible income before age 60, the increments for delaying CPP (up to age 65) after age 60 are less than someone who’s zero earning years falls within the drop-out provision. I engaged Doug Runchey to do our CPP calculations, however he only guarantees them to be 99.9% accurate! In our situation, starting at 65 vs 60 will provide 40% and 39% more, whereas someone who has their full compliment of CPP contributions will see 56% more starting at 65 vs 60.

My “when to start CPP” analysis assumes an annual inflation rate of 3%, a portfolio growth rate of 5% (3% over inflation) – the portfolio will be 80% equities, and a drop-dead age of 85 + 1 month, also, we’ll be leaving an inheritance for our children/grandchildren. The analysis takes into account everything you would consider when filing your taxes, adjusted for inflation, including federal and provincial tax credits (as they are today of course; my crystal ball was playing up).

Here are the results (CPP start age, portfolio value at death, the difference (in today’s dollars) in portfolio value from starting at age 64+1m):

60+1m $1,674,300 -17,900

61+1m $1,691,500 -$9,700

62+1m $1,703,800 -$3,800

63+1m $1,711,200 -$300

64+1m $1,711,800 $0

65+1m $1,708,200 -$1,700

66+1m $1,714,300 $1,200

67+1m $1,721,300 $4,500

68+1m $1,724,800 $6,200

69+1m $1,729,200 $8,300

70+0m $1,729,300 $8,400

So, my big take away from this is that, in our case, there isn’t much to worry about. Increasing inflation changes the slope in favour of a later start, and increasing portfolio growth changes the slope in the other direction. As an example, if we delay starting CPP until age 70, with an inflation rate of 5%, our portfolio at age 85+1m will be $21,900 ($74,000 in future dollars) more than if we had started CPP at age 64+1m, whereas increasing the portfolio growth rate to 7% will result in a portfolio at age 85+1m that is $6,600 ($13,900 in future dollars) less than if we started at age 64+1m.

The end.

“portfolio growth rate of 5% (3% over inflation)” should read “portfolio growth rate of 5% (2% over inflation)” – I couldn’t get the edit in quick enough.

My apologies to interrupt the “mike drop” Bob Wen, but I have to ask… what is signifcant for your choice of CPP start age of 64+1m?

Why not choose a CPP start age of 63+1m? It gives you essentially the same portfolio value at 85 while reducing some of the ‘leave it for later’ risks already mentioned.

Or, why not choose 69+1m as that achieves a higher legacy, enhanced even further by the (now very real) potenial of higher than modelled 3% inflation?

My questions are meant to point out that even with the best information and modelling (which are a must), there is still no exact “answer”, so how to choose?

BTW your analysis points out what Doug Runchey has been saying – it is usually NEVER BEST to start taking CPP at 65.

Hi David, Thanks for your thoughts on this.

Choosing 64+1m vs 63+1m was just to force myself to add a little more of a hedge against inflation and prolonged market stagnation (i.e. keeping the money growing in the CPP vs. doing nothing in the stock market).

Should the current situation the world finds itself in continue for some time, it may well encourage us to consider starting later. We have a few years to go before we need to make that final determination, but knowing how CPP fits into our particular situation gives me one less thing to fret over – my wife kindly leaves the fretting to me.

Gents, I think my takeaway is that for someone with significant assets, there is almost no difference between taking CPP at 60 vs 70…

Hello, I am now trying to figure out when to start CPP and read with interest both the article and the comments – thank you!

What I notice is that everyone points to how much more we get in monthly payment by delaying the start of CPP.

I do not see taken into calculation how much we loose in foregone amount when delaying.

There is a date from which delaying longer makes you lose money in a timeframe between 60 and 85 years old for example.

What are your thoughts in this respect?

@Maria, It is actally stated at the start of the article:

“To receive the maximum CPP benefit at age 65 you would need 39 years of maximum contributions. You can drop-out your eight lowest years (more if you are eligible for the child rearing drop-out provision) from the calculation. You can see the problem for early retirees. They’re going to have more “zero” contribution years which will reduce the amount of their CPP benefits. Not so fast.

You will always get more CPP by waiting, even if you’re not working.

CPP expert Doug Runchey says that your ‘calculated (age-65) retirement pension’ may decrease if you’re not working between age 60 and 65, but the age-adjustment factor [waiting longer to take it] will always make up for that decrease, and then some.

‘In that situation I use the expression that you will receive a larger piece of a smaller pie if you wait, but you will always get more pie,’ he said.”

[more pie $ per month; and more $ overall, unless you die too soon]

See this page for more details and have Doug Runchey do a personalized calculation for a small fee.

https://retirehappy.ca/how-to-calculate-your-cpp-retirement-pension/

I have been trying to find out information regarding when it might make sense to top up CPP contributions, particularly for early retirees. It seems to be a frustratingly elusive topic.

Might be a good adjunct to this very informative article!

Hi Peter,

I’m a little unclear on what you’re asking. It is not possible to “top up” CPP contributions. There are no options to voluntarily contribute to the CPP above and beyond what is calculated on your employed income. It is only based on income earned and automatically contributed on your behalf through payroll deduction.

The only way to “top up” would be to invest your own money – in an RSP, a TFSA, or in a non-registered account. As for when to do that – I think it’s a personal decision driven by all kinds of data points, but generally “earlier is better” 🙂

Thanks James, I guess that would explain why it is difficult to find information…! 😉

Perhaps I should have led with “Is it possible….”, rather than assuming.

In any case, you have answered my question, which gives me one less thing to worry about.

(In my own defense, it appears the idea of voluntary contributions has come up periodically but apparently has never been implemented. A few dated articles have led me astray.) Thanks again for the quick reply!

Thanks so much for writing this article! Our CPP payments are very similar to each other. I’m 52yrs old and I left my career in 2011 to care for my autistic step-son. Now that my husband is only 3-4yrs away from retirement we’re running the numbers again. I was shocked to see how much the ‘Estimated Monthly CPP Benefits’ and the CPP Calculator differed from each other. I’m definitely going to open up our financial plan and see what the advisor wrote down for my CPP income. Thanks again!