Much has been written about the financial side of retirement – do you have enough saved, how much can you spend, will your money last a lifetime? But retirement is part financial and part psychological.

More than just a number in your bank account, retirement is also how you feel about moving on to the next chapter of your life. Indeed, it’s not what you’re retiring from, but what you’re retiring to.

A few weeks ago, financial planner Mark McGrath shared an absolutely gut-wrenching story about his father – a long-time business owner who sold his business, retired, and lost his identity and purpose. The story does not have a happy ending, but Mark felt it was important to share the lessons he learned from this heartbreaking experience:

“We learn about the financial side of retirement but not enough about its emotional and psychological aspects. About how our identities can be intertwined with our careers and our businesses.”

Make sure you know what you’re retiring to.

This was a hard post to write.

I almost didn’t write it in fact. I’ve started and trashed this story many times.

But I believe there are important lessons in this story we can learn from.

Warning: this does not have a happy ending.

— Mark McGrath (@MarkMcGrathCFP) March 14, 2023

The story hit home for many people and has been viewed an incredible 5.1 million times on Twitter. Mark later stopped by the Rational Reminder podcast to talk about the emotional story and why people need to start thinking about retiring with purpose.

I’m grateful that Mark was brave enough to share this cautionary tale as it has forced me to think about my own retirement plans and helped shape conversations I will have with my retired or soon-to-be retired clients.

This Week’s Recap:

You might also remember Mark from this excellent guest post here – 8 overlooked ways to save tax in retirement.

Earlier this week I wrote about building if/then statements into your financial plan.

We had an eventful week – first getting a firm possession date on our new house for the end of April, and then accepting an offer to purchase our existing house.

The timing could not have worked out better, as we’ll have about a week to move and clean-up our house before the new owners take possession.

That beats the last time we moved, when we had to sell early to secure funding for the new house and ended up renting for three months in between.

The financial planner in me has been craving certainty in our situation for more than a year. I can’t wait to get settled in our new house, tally up the final costs, and then get back to our other financial goals – including filling up our TFSAs again and contributing to our corporate investing account.

Promo of the Week:

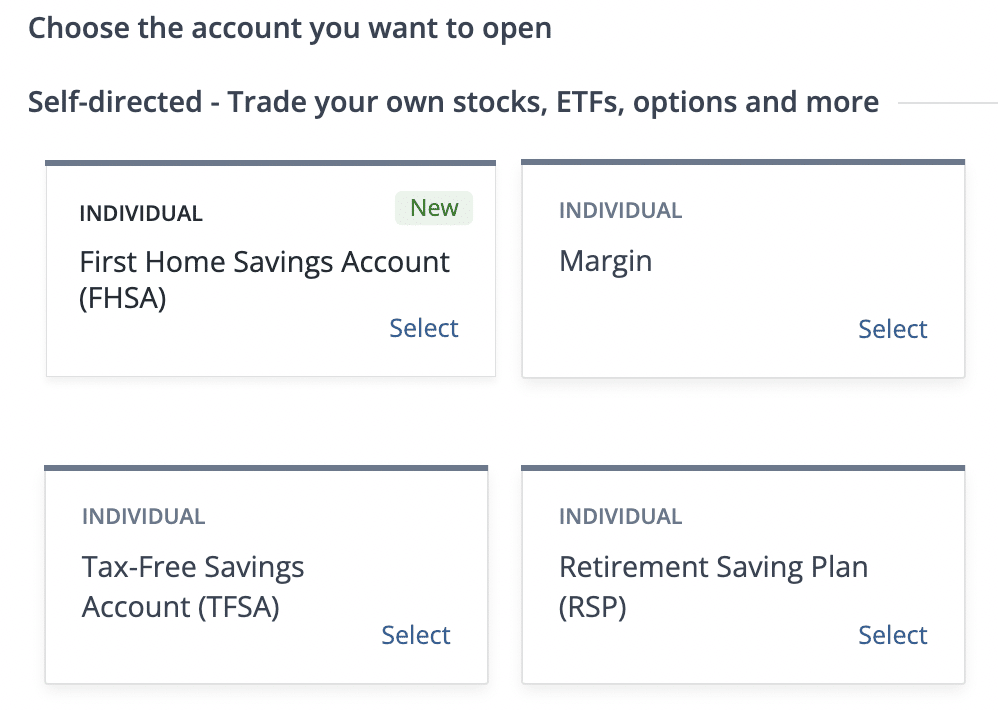

In case you haven’t heard, the new First Home Savings Account launched today. While most banks aren’t ready to administer the accounts yet, Questrade got a head-start on the competition and has the FHSA available to open and fund today.

Remember, the FHSA combines the best of the RRSP (tax deductible contribution) with the best of the TFSA (tax-free withdrawal for a first home purchase). Contribute up to $8,000 per year, to a lifetime limit of $40,000.

Many of my clients have been eagerly awaiting the account to launch, to either use for themselves or to gift money for their adult kids to start saving towards a first home.

Questrade is the first out of the gate if you want to open and fund a First Home Savings Account today.

Weekend Reading:

Speaking of the FHSA, financial planner Anita Bruinsma explains everything you need to know about the new account.

Erica Alini shares how the CRA resuming child benefit clawbacks has some parents scrambling.

An inside look at how the Bank of Canada sets interest rates. A really good read.

I’ve enjoyed Fred Vettese’s Charting Retirement series in the Globe and Mail. His latest looks at whether older retirees should trust their financial judgement:

“The results show that as people age, there is a decline in their ability to make good financial decisions that is not consistent with their own confidence in managing their money. This suggests the need to automate retirement planning as much as possible, especially after 75.”

Canada Pension Plan expert Doug Runchey explains whether it makes sense to contribute to CPP after age 65 if you’re still working.

Why Canadian bank stocks might not be as special as we think.

A Wealth of Common Sense blogger Ben Carlson answers a reader question about consumption smoothing and whether young people should be saving less.

Prompted by french pension protests, economics professor Trevor Tombe answers the question: How secure is the Canada Pension Plan? The answer: Very.

Finally, the always brilliant Morgan Housel compares the Silicon Valley Bank run to fears about the Brooklyn Bridge collapsing back in 1883:

“You never know what the American public is going to do, but you know that they will do it all at once.”

Have a great weekend, everyone!

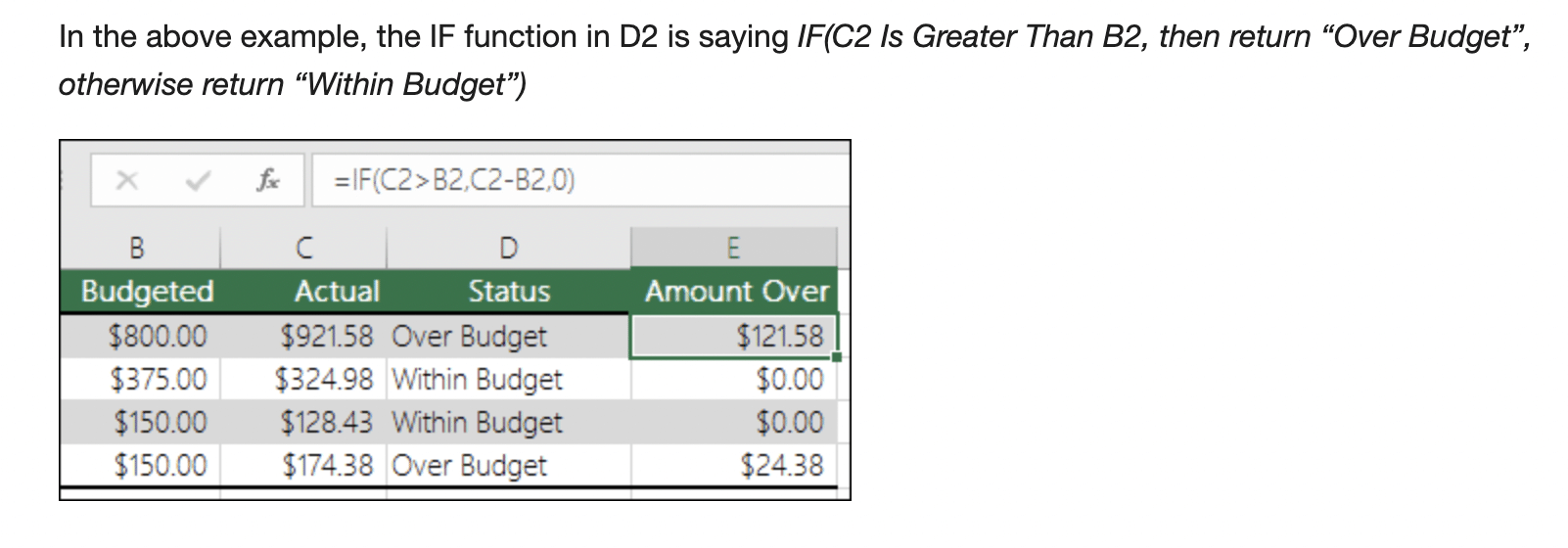

Anyone familiar with Microsoft Excel knows how useful “if/then” statements can be to make comparisons under certain conditions. An IF statement can either be true or false.

An if/then statement can be extremely useful in financial planning. Here are three examples of how to build “if/then” statements into your financial plan.

When your income is variable

Many of my financial planning clients are conservative in their income projections because a good chunk of their compensation comes from a bonus or from working overtime.

I think it’s reasonable to be conservative with your future income projections (i.e. using cost of living adjustments), but you should strive to be as realistic as possible within the current year to help guide your financial decision making.

Adding an if/then statement helps determine how much you can save or spend for the year. For instance, if your income is $100,000 then you might aim to contribute $10,000 to your RRSP. If your income increases to $120,000 due to a bonus, then you might aim to contribute $20,000 to your RRSP.

In reality, you might be saving for more than one financial goal at a time. This is true for most of my financial planning clients.

In many cases, we aim to optimize RRSP contributions at the marginal tax rate, maximize TFSA contributions up to the annual limit, and then prioritize another goal such as extra mortgage payments, saving towards a short-term one-time expense, investing in a taxable account, or increase spending on a fun category like travel or hobbies.

So, here’s an “if/then” statement in action:

If my projected gross income equals $100,000, then I will contribute $10,000 to my RRSP and $6,500 to my TFSA.

Total taxes plus CPP/EI deductions comes to ~$25,000, leaving me with $58,500 for personal spending.

If my projected gross income equals $120,000, then I will contribute $20,000 to my RRSP and $6,500 to my TFSA, plus an extra $5,000 lump sum payment onto the mortgage and $5,000 to top-up our vacation budget.

Total taxes plus CPP/EI deductions still comes to ~$25,000, leaving me with $58,500 for personal spending plus an extra $10,000 to allocate towards other goals.

The if/then statement allows you to maintain a good savings rate at your base income level and allows you to accelerate those goals (or add others) as your income increases.

When variable income means variable spending

One mistake I see people making when it comes to variable income is they have the tendency to base their spending rate as if they’ll always earn a full bonus or high variable salary.

I get it. When you’ve made bonus for three years in a row it’s tough to envision a year in which you don’t reach your targets and earn a bigger cheque.

But anchoring your spending to an unrealistically high income can cause major cash flow problems if your Christmas bonus ends up being a one-year membership to the Jelly of the Month Club.

The trouble arises when you lock yourself into fixed payments like a bigger mortgage, bigger car loan, private school or expensive activities for the kids, etc.

That’s why an if/then statement should also apply to your spending.

The if/then statement in this case might be:

If I receive my full bonus this year, then 20% of it will go into a high interest savings account as a “just in case I don’t get my bonus next year” fund.

Doing this allows you to smooth out lifestyle consumption so you don’t get used to living on a full bonus every single year.

By the way, this also applies to saving.

Imagine planning to contribute $30,000 per year to your RRSP because you’re sure you always make around $200,000 after bonus. So, you automate a $2,500 per month contribution to your RRSP.

Then September comes around and you’re wondering why there’s no money in your chequing account to pay off your credit card bill. A quick calculation shows you’re only on pace to earn $160,000 this year and there’s no bonus chance of a year-end bonus. Meanwhile, you’ve already put $20,000 into your RRSP, severely impacting your cash-flow for daily living expenses.

The lesson is to set an if/then statement for your savings with a lower income base in mind:

If my income is $160,000, then I’ll contribute $18,000 to my RRSP.

Now you’re only committing to $1,500 per month.

If income increases, then increase RRSP contributions via lump sum later in the year (or before the deadline).

Retirement spending floor and ceiling

Most of my retired clients want to enjoy the same standard of living they had in their final working years, if not enhance it a bit with extra money for travel and hobbies, or to help out their adult children.

But one of the best ways for retirees to reduce sequence of returns risk (receiving poor investment returns early in retirement) is to have a variable spending strategy.

What that means in practice is determining a comfortable spending floor and a safe spending ceiling.

That comfortable spending floor might be exactly how you lived in your final working years.

Consider a year like 2022, with rising and persistently high inflation and rising interest rates crushing stock and bond returns. Those years will happen from time-to-time and when they do it might feel better to skip the extravagant vacation, the home renovations, or the new vehicle upgrade.

No need to withdraw more from your portfolio than necessary in a year like that.

In a normal year (is there ever a normal year?), you might boost spending by $5,000 to $10,000 to take that trip, or remodel the bathroom, or upgrade your appliances.

And in really good times, where perhaps you’re sure you won’t ever touch your TFSA for your own consumption needs, you might give your kids an early inheritance gift of $50,000 to $100,000 to use for a down payment or to start a business, or take a dream vacation yourself.

An if/then statement for retirement spending might look like this:

If last year’s investment returns were negative, then I’ll only make minimum RRIF withdrawals in addition to any pension or government benefits, and withdrawals from non-registered savings and investments – and I won’t contribute to my TFSA.

If last year’s investment returns were between 0% to 6%, then I’ll increase withdrawals from my RRIF and/or non-registered accounts to boost spending – and I will contribute the annual maximum to my TFSA.

If I’m comfortably meeting my retirement spending needs, and I’m confident I have more than enough resources to last a lifetime, then I’ll use the proceeds from my TFSA to give an early inheritance to my kids / take the family to Hawaii / fund my grandkids’ RESPs / renovate the house / buy a new car / travel more, etc.

Final Thoughts on if/then statements

Life is surprising and doesn’t always move in a straight, predictable line. We often have variable income (up or down), lumpy spending needs, years of poor investment returns, years of strong investment returns, or periods of higher interest rates and/or inflation.

Building if/then statements into your financial plan can give you a playbook for how to treat unpredictable times in your life.

If/then statements can help you accelerate your goals and ensure appropriate balance in your life when it comes to saving and spending.

If/then statements can help save you from setting your spending (or savings) bar too high and getting into trouble with your day-to-day cash flow.

Finally, if/then statements are crucial for your retirement plan to help plan your expected withdrawals from year-to-year. Setting a comfortable spending floor and a safe spending ceiling allows you to make the most of your available resources in a responsible way throughout your retirement.

The federal budget plan is set to be delivered on March 28th, and that means it’s time for pundits to speculate about potential tax changes. We already know that the First Home Savings Account (FHSA) will be introduced and available at financial institutions some time this year. This account combines the best traits of the RRSP (tax deduction up front), with the best traits of the TFSA (tax-free withdrawal for a qualified home).

But what about other potential tax changes that we seem to talk about every year?

Capital Gains Inclusion Rate

Changes to the capital gains inclusion rate, currently set at 50%, have been discussed for many years and the federal NDP had proposed an increase to 75% in its previous election platform. Those with a good memory might recall the capital gains inclusion rate was reduced from 75% to 50% back in 2000.

I have no insight into whether or not this will happen, but if you think there’s a good chance the capital gains inclusion rate will increase then I suppose you have a short window to trigger a capital gain in your taxable account.

Also, there’s a lot of confusion around the capital gains inclusion rate because we see big numbers like 50% or 75% thrown around. This doesn’t mean that you pay a 50% tax on a capital gain. It means that 50% of the gain is treated as taxable income at your highest marginal rate.

For example, if you have an income of $100,000 in Alberta then your marginal tax rate is 30.50%. Let’s say you trigger a capital gain in your taxable investment account, selling shares of your S&P 500 index fund for $30,000 more than you paid for it. $15,000 of that gain (50%) would be taxable and added to your income, giving you a total taxable income of $115,000.

In Alberta, income above $106,718 is taxed at 36%. That means you’ll pay taxes of $2,981.52 on the income between $106,718 and $115,000 ($8,282 x 36%), plus taxes of $2,048.69 on the income between $100,000 and $106,717 ($6,717 x 30.50%), for a total tax of $5,030.21 on that $30,000 capital gain. Not too bad.

Top Federal Tax Bracket

Another federal NDP platform policy would see the top federal tax rate increase from 33% to 35%. Currently, that rate kicks-in for income above $235,675.

This would push the combined top provincial and federal marginal tax rates to about 56% in provinces like B.C., Quebec, and Ontario.

A similar proposal was recently announced by U.S. President Joe Biden when he called for the top federal rate to increase by 2.6%.

RRIF Age and Minimum Withdrawals

Industry groups are lobbying the federal government to raise the mandatory RRIF conversion age and delay minimum withdrawal requirements to better reflect a lower interest rate and return environment and reduce the risk that Canadians might outlive their savings.

Note that a proposal is being reviewed by the Department of Finance but they are not expected to report its findings and recommendations until June.

The Investment Industry Association of Canada argued:

“The existing rules date back to 1992 when interest rates were higher and seniors were not living as long. Today, it’s unlikely real returns on safe investments will keep pace with the withdrawals.”

While I agree that we should review and modernize programs from time-to-time, a proposal like this stands to benefit wealthy individuals the most. The concern about minimum mandatory RRIF withdrawals triggering OAS clawbacks sounds very much like a first-world problem, and so I don’t suspect this proposal will gain much traction with a government that’s looking for more tax revenue from the wealthy, not less.

Finance professor Moshe Milevsky suggested an interesting alternative: repealing the mandatory RRIF withdrawal, and instead taxing the entire holdings at a rate of 1% every year, following the system that Australia uses.

This Week’s Recap:

I wrote about the five year anniversary of Vanguard’s groundbreaking asset allocation ETFs. An absolute game changer for DIY investors.

Earlier this week I shared a detailed post about OAS payments and how much you can expect to get from Old Age Security. Interestingly, this article went absolutely viral with 20x more views than a new article would normally receive. It got picked up by Google news, and I suspect a lot of seniors have also been searching for facts about OAS due to a now repealed change that was supposed the take effect April 1, 2023 (raising the minimum age from 65 to 67). This is not happening, so if you’re turning 65 this year you can confidently expect to receive your OAS if you plan to take it.

Promo of the Week:

With Air Miles making news for all of the wrong reasons (again), many readers have reached out looking for rewards credit card alternatives.

The best credit card depends on your shopping habits and what you’re looking for in terms of rewards. For me, the American Express Cobalt Card is my go-to card for groceries, dining out, and take-out. You get 5x points on “eats and drinks” and those points can be transferred to Aeroplan on a 1:1 basis where you can redeem for flight rewards at a rate of ~2 cents per mile.

That means you’re getting a mouth-watering 10% back on your credit card spending for that particular category.

Sign up for the Amex Cobalt card and you can earn up to 30,000 bonus points (2,500 Membership Rewards points per month that you spend $500 in your first year as a new Cobalt cardmember). That means if you spend $500 per month in the “eats and drinks” category, you’ll earn 2,500 points per month on the spending, plus 2,500 bonus points per month, for a total of 60,000 points for the year.

Transfer those 60,000 points to Aeroplan and redeem them for a flight reward at 2 cents per mile. That’s like getting a $1,200 value.

Weekend Reading:

Rob McLister warns that when your bank suggests you lock in your variable rate mortgage, it has an angle:

“If you’re a mortgage shopper who can qualify for any term, the message is simple. Don’t let anyone talk you into a 5-year fixed at today’s rates,” says McLister.

Dan Hallett explains why his investment firm avoided trendy investment themes like cannabis, bitcoin, and covered call writing, and has no regrets.

The Millionaire Teacher Andrew Hallam unveils the surprising key to longevity in retirement. A must read.

Of Dollars and Data blogger Nick Maggiulli explains why concentration is not your friend when it comes to investing.

Speaking of diversification, PWL Capital’s Ben Felix explains why international diversification is crucial, both theoretically and empirically, to sensible portfolio construction:

Tim Cestnick shares a cautionary tale on choosing your RRSP or RRIF beneficiaries carefully.

Michael James on Money discusses the benefits of giving with a warm hand instead of leaving a larger inheritance in your estate.

With yields at their highest levels in many years, investors may be wondering whether it makes sense to invest in stocks, bonds or CDs (GICs to us north of the border). Here’s a great discussion on how to decide.

Related, here’s Andrew Hallam again explaining why savings accounts can put your retirement money at risk.

An 85-year Harvard study on happiness found the No. 1 retirement challenge that ‘no one talks about’:

“When it comes to retirement, we often stress about things like financial concerns, health problems and caregiving. But people who fare the best in retirement find ways to cultivate connections. And yet, almost no one talks about the importance of developing new sources of meaning and purpose.”

Here’s Jason Heath answering a question about starting to draw down your investments in retirement – should you sell your non-registered or TFSA stocks, or both?

A basic understanding of bond math can help investors stay the course. Here’s what to expect from bond total returns when interest rates rise.

Frugal, or miserly? Why is it that when rich folks are tightfisted, people call them eccentric, but—if you aren’t rich—people tag you as cheap?

Should the minimum age to receive CPP (currently age 60) be increased? Some arguments for and against.

Wondering where to get your rewards points? Barry Choi compares Canada’s grocery store loyalty programs.

Finally, an excellent post-mortem on the Silicon Valley Bank debacle – credit risk happens fast.

Have a great weekend, everyone!