It has been five years since Vanguard introduced the first asset allocation or “all-in-one” ETFs in Canada. Simply put, these one-ticket solutions have been an absolute game-changer for do-it-yourself investors.

I’m on record to say that if investing has been solved with low-cost index funds, then investing complexity has been solved by using a single asset allocation ETF. Yes, it can be that easy.

I put my money where my mouth is by holding Vanguard’s All Equity ETF (VEQT) in my RRSP, TFSA, LIRA, and corporate investing account. Many of my financial planning clients also hold asset allocation ETFs in their portfolios.

Related: How I Invest My Own Money

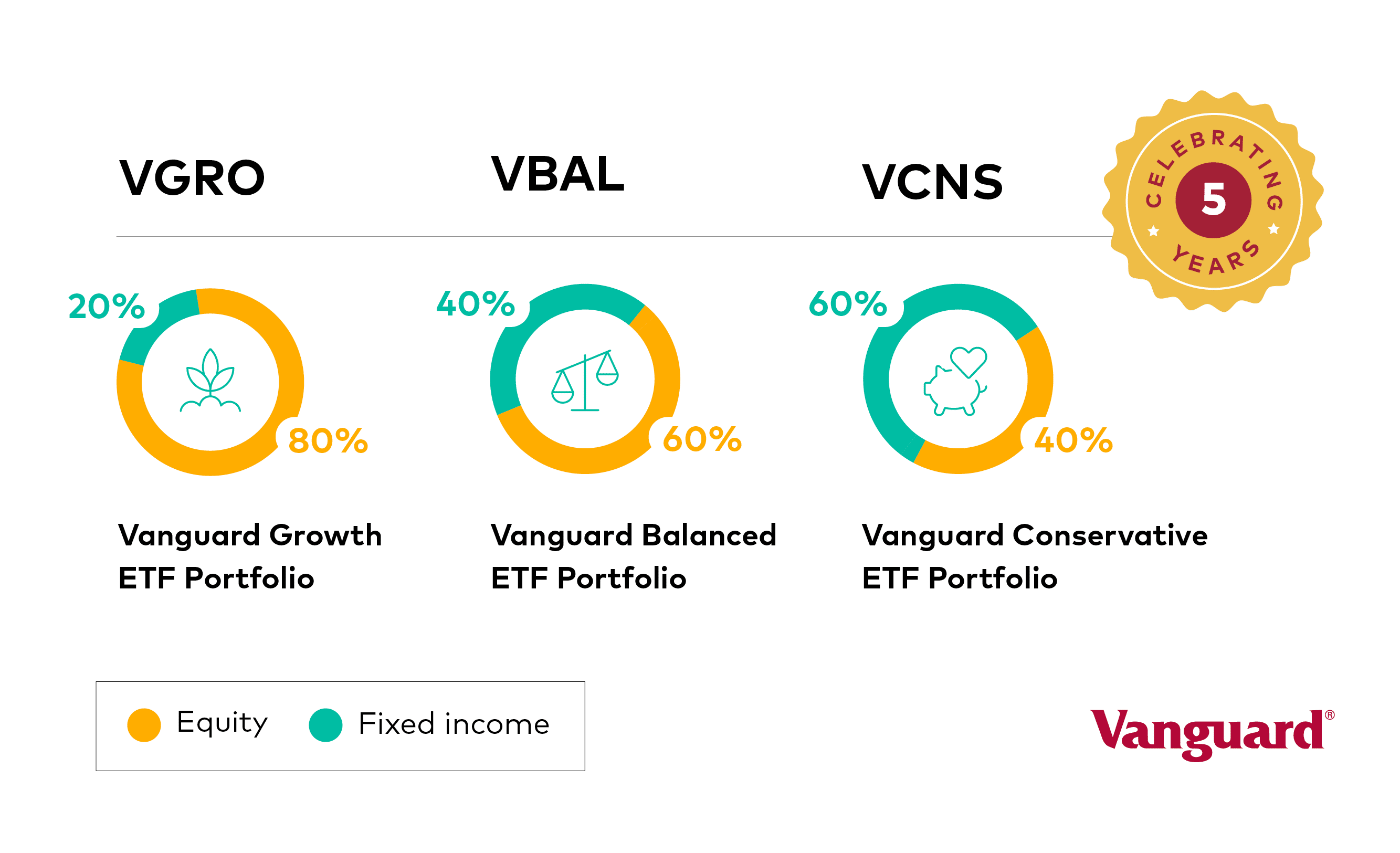

It started back in 2018 with the launch of three asset allocation ETFs; Vanguard’s Conservative ETF Portfolio (VCNS), Vanguard’s Balanced ETF Portfolio (VBAL), and Vanguard’s Growth ETF Portfolio (VGRO).

Vanguard later added an all-equity version (VEQT), a conservative income ETF (VCIP), and the retirement income ETF (VRIF) to complete what it calls the full range of risk profiles for investors and retirees.

In the last five years, Vanguard’s asset allocation ETFs have grown to almost $9 billion in assets under management – making it one of the fastest-growing investment products in Canada. VGRO is the most popular with $3.8 billion in assets, making it the 17th largest of the 1,000+ ETFs in Canada.

There’s a reason why “just buy VGRO” is the mantra for many enthusiastic DIY investors on Reddit.

I spoke with Sal D’Angelo, Head of Products for Vanguard Americas, about the impact Vanguard’s asset allocation ETFs have had on the Canadian investment landscape.

He said the company felt good about launching a brand new ETF category, given the appetite for balanced funds in Canada.

“Approximately half of the $1.89 trillion in mutual fund assets are held in balanced funds,” said D’Angelo.

The value proposition for asset allocation ETFs have certainly been enticing enough to (slightly) disrupt the balanced mutual fund market. After all, why pay nearly 2% MER for a balanced mutual fund when you could hold a balanced ETF for nearly 1/10th of the cost?

“We’ve definitely seen bigger growth than expected over the past five years,” said D’Angelo.

The Vanguard Effect on Asset Allocation ETFs

Imitation is the sincerest form of flattery, but nothing new for Vanguard. The so-called ‘Vanguard effect’ is real. Shortly after launching VCNS, VBAL, and VGRO many other asset managers launched their own suite of asset allocation ETFs.

The category is booming, with industry assets under management now at ~$14 billion dollars and growing. While that represents just over 4% of the ETF industry, the category is generating between 5-10% of industry flows (new money) over the past three years.

“We’re flattered that others have emulated the product,” said D’Angelo.

Vanguard believes, the more low-cost, simple-to-understand and broadly diversified products there are available, the better for Canadian investors.

Five years represents a significant milestone when it comes to benchmarking performance against its category peers, and Mr. D’Angelo was eager to highlight the performance of Vanguard’s asset allocation ETFs.

- VGRO beat 92% of category peers over 5yrs, 85% for VBAL, and 53% for VCNS.

- VGRO and VBAL were just awarded a FundGrade A+ Award in 2022, which is awarded for funds that demonstrated outstanding risk-adjusted performance. Only about 6% of eligible funds available in Canada win this prestigious award.

- VEQT was also a winner of the FundGrade A+ Award but was not part of the original three ETFs that launched back in 2018.

Is the 60/40 Portfolio Dead? Nope

While on the subject of performance, I asked Mr. D’Angelo about the 60/40 portfolio given its historically bad year in 2022.

He said the 60/40 portfolio is alive and strong and will continue to serve investors well over the long term.

“Past research has shown that these types of difficult years happen occasionally, but the benefit is that long-term valuations for stocks and bonds are attractive moving forward,” said D’Angelo.

- Stock-bond declines are not long-lasting: Looking back to 1976, simultaneous losses in both U.S. stocks and bonds have only occurred 0.4% of the time, on a 1-year rolling return basis.

- The 60/40 portfolio was negative only 14% of the time on a 1-year basis and 0.6% on a 5-year rolling return basis.

- The stock-bond correlation remains negative in the long-term – Our study of 60-day and 24-month stock-bonds rolling correlations from 1992 to 2022 suggests that over the long-term, the correlation between stocks and bonds remains negative. That said, long-term inflation is one of the determinants of correlation between the two asset classes.

Mr. D’Angelo says that bonds will continue to act as a ballast to the portfolio:

“High-quality bonds reduce the impact of a market downturn in a multi-asset portfolio, as seen in 2008 and more recently in 2020.”

Also, more than 90% of bonds’ total return is generated by coupons, not capital appreciation. In a rising interest rate scenario, negative returns generated by price declines can be more than offset by higher coupons if an investor’s time horizon is longer than their bond portfolio duration.

Finally, current interest rates / coupons are favourable, with high-quality bonds yielding 4-6%.

I agree with this assessment and remind VBAL investors that the balanced fund had outstanding returns from 2019 to 2021 before suffering losses in 2022:

- 2019 – 14.81%

- 2020 – 10.20%

- 2021 – 10.29%

- 2022 – (-11.45%)

“Vanguard research expects average annual returns of about 7% for a 60/40 balanced portfolio over the next 10 years,” said D’Angelo.

Final Thoughts

You won’t find a bigger fan of asset allocation ETFs than me. I invest my own money in VEQT. Many of my financial planning clients use asset allocation ETFs in their portfolios. Heck, the entire premise of my DIY Investing video series centres around how easy it is to hold a single asset allocation ETF so you can move on with your life.

I’m grateful to Vanguard for launching this category and making it easy for DIY investors to manage their own low-cost, risk-appropriate, and globally diversified portfolio.

The good news is, after five years, we’re still in the early innings of adoption for asset allocation ETFs. I fully believe that more and more investors and advisors will understand the importance of cost on investment returns over the long term and will continue to adopt low-cost asset allocation ETFs in their portfolios.

I’ve been looking for a phrase that captures the odd behaviour that investors exhibit when they change strategies based on current market conditions. Ben Carlson at A Wealth of Common Sense neatly summed up this behaviour as investors always fighting the last battle. It’s perfect:

“Not every investor does this but there is a tendency to invest money into the speculative stuff only after it rockets higher during a bull market and invest money into the defensive stuff only after it protects capital during a bear market.”

Investors pour money into the latest fads long after the incredible returns have been made. This happens at the micro level with individual stocks and sectors (think Tesla, or cannabis). It happens with star fund managers and thematic ETFs (Cathie Wood’s ARK funds). It happens when certain investment styles outperform (like the large-cap growth, technology-heavy NASDAQ), or a country or region outperforms (like the S&P 500). It happens with speculative investments (like crypto and NFTs).

I get why investors fall for the hype. There’s a potential paradigm shift or new normal, and they don’t want to get left behind. But it’s classic performance chasing that never ends well.

Out-sized returns don’t last forever, so when the bubble bursts, investors who loaded up on risky assets inevitably bailed out and looked for safety.

That reckoning came in 2022. The riskier the asset (or frothier the price), the harder it fell (crypto, thematics, tech stocks, NASDAQ, S&P 500).

Investors who ignored their risk tolerance from 2019-2022 have suddenly become ultra-conservative, loading up on short-term GICs and cash while they wait for the market to settle down (whatever that means).

On the flip side, retirees who saw the bond portion of their portfolios get hammered last year are moving into dividend stocks and the latest income fad, covered-call ETFs.

The problem is we’re always fighting the last battle. We see last year’s best performer and decide to follow that strategy. But that strategy may have only worked in that specific situation for that specific time period. You can’t go back in time and invest with perfect hindsight. You need to invest with future expectations in mind.

And because we don’t have a crystal ball to see how this all plays out, we need to follow a risk appropriate strategy that we can live with in good times and bad. That means having a bit of FOMO when other strategies are performing better, and having some degree of humility when your investments outperform.

It’s that long-term approach that leads to better, more reliable outcomes for investors. Not constantly fighting the last bull or bear market.

This Week’s Recap:

I’ve received a lot of great feedback from my post last week on the best uses for your TFSA. It’s nice to hear that so many of you acknowledge the many uses of a TFSA (not just to leave a pot of tax-free gold in your estate).

Many thanks to Rob Carrick for highlighting eight ways retirees can save on tax in his latest Carrick on Money newsletter.

Our new house build is coming along nicely. The cabinets were installed this week, and next week is the first round of finishing carpentry. We don’t have a possession date yet, but now it’s looking like mid-April.

Meanwhile, all is quiet on the home selling front. Hopefully with a conditional pause on rate hikes and some good news on inflation we’ll start to see some more activity in the coming month or so.

Promo of the Week:

If you’re looking to start DIY investing with ETFs, or looking to break up with your expensive mutual fund advisor, then you need to check out my DIY Investing Made Easy course.

You’ll find videos explaining why investing has been solved with low cost ETFs, and why investing complexity has been solved by using a single asset allocation ETF. You’ll learn all about these asset allocation ETFs, including which one is the most risk appropriate for you.

I’ll explain which online broker makes the most sense for your situation, and I’ll show you platform-specific videos on how to open your account, add new funds, transfer existing funds, and how to buy and sell an ETF.

You’ll have all the resources you need to become a successful DIY investor, including access to me by email if you need any extra guidance.

Weekend Reading:

A few of you asked what podcasts I listen to regularly. Here’s a list of my favourites right now:

- Rational Reminder – hosted by Ben Felix and Cameron Passmore of PWL Capital, this is hands-down the best podcast for investing and financial decision making.

- I Will Teach You To Be Rich – hosted by Ramit Sethi, this is a look into the lives of couples and money psychology. Every episode is fascinating.

- Cautionary Tales – hosted by Tim Harford, who has the best podcast voice in the business. Wonderful story telling, and there’s always a great lesson in each episode.

- Animal Spirits – hosted by Michael Batnick and Ben Carlson of Ritholtz Wealth Management. They’ve got a great formula to keep you up-to-date on what’s happening in the market and in their lives,

- Money Feels – hosted by Bridget Casey and Alyssa Davies, this is personal finance talk without the usual guilt or shame.

- Stress Test – hosted by Rob Carrick and Roma Luciw, this personal finance podcast looks at the real issues facing young Canadians today.

Speaking of Ben Carlson, congrats to Ben on 10 years of blogging at A Wealth of Common Sense. That’s a decade of consistently posting every weekday – absolutely incredible!

Where do millionaires keep their money? Of Dollars and Data blogger Nick Maggiulli says it’s not where you think.

The Measure of a Plan has updated the investment returns by asset class from 2010-2022. The best (or least bad!) asset in 2022 was short-term treasury bills at -5.2%. The worst? REITs at -31.1%.

Are Canadian dividend funds all they’re cracked up to be? Morningstar dives into the data and says the results are mixed:

“On a trailing 15-year basis, investors in dividend funds have ended up more or less in the same spot as those invested in Canadian equity funds.”

This is what I found in my investing multi-verse of madness post – I could have achieved a similar return had I stuck with my Canadian dividend stocks, but I would have done a heck of a lot more work to get the same outcome.

If 2022 wasn’t the worst year for investors, then when was? Millionaire Teacher Andrew Hallam has the answer.

Tim Kiladze on the high-yield, but defensive ETFs that Canadians can’t get enough of: Covered-call funds. (subs)

How to make the most of your investments in retirement? Why a long-term, cash-flow driven approach to your retirement portfolio is key to success.

Finally, here’s an opinion piece on the cruel and unusual torture of doing your own taxes.

Have a great weekend, everyone!

Sometimes I think I’m the poster child for what not to do with your TFSA. I opened an account immediately when the TFSA launched in 2009 and contributed the maximum annual amount for three years, investing those funds in a couple of dividend paying stocks. I cashed out in 2011 (with a tidy $4,500 profit) to top-up the down payment on the house we live in now. Then I went years without making a contribution because life happened – we bought a new vehicle and developed the basement in our home – so TFSA contributions went on the back burner.

Once we paid off the car and the basement renovation I got super aggressive with my TFSA contributions to make up for lost time. I finally caught up on my lifetime TFSA limit in 2020, and then contributed the annual maximum in 2021 and 2022.

Then I drained the entire balance again to use for a down payment on the house we’re building right now. Catching up again will take a herculean effort, but I can use some of the proceeds from our house sale and then double-up on contributions for several years to get there.

Come to think of it, this is exactly the type of thing a TFSA should be used for. When you need a large lump sum of money without any tax consequences.

Most personal finance experts agree that the TFSA should be used for long-term investing. Indeed, when I run retirement planning projections for my clients, we typically touch the TFSA funds last after draining the RRSP/RRIF and non-registered balances.

While that makes for a nice looking retirement plan with a generous (and tax-free) estate, I’m not sure the best use of your TFSA is to leave a pot of tax-free gold at the end of the rainbow.

Consider one-time expenses that may occur throughout your lifetime. It could be a new vehicle, a home renovation, a bucket list trip, a home “upsize” or a vacation property, financial gifts to your adult children, etc. Where else can you pull funds for these expenses without incurring tax and without impacting Old Age Security benefits? And, oh by the way, you get the contribution room added back the next calendar year.

It’s the TFSA, folks!

Listen, I’ve written a lot retirement plans where the client continues to contribute to their TFSA forever while still meeting all of their retirement spending needs. Hey, if you have more income than you need, then contributing to your TFSA all throughout retirement makes perfect sense.

A forever funded TFSA makes for a great hedge against surprise outcomes, spending shocks, healthcare scares, etc. There are a lot of unknowns in financial planning, so a fully funded TFSA can cover a lot of potential issues. But do you need $1M or more stashed away in your TFSA, just in case? I’d argue in some cases you might be saving just for the sake of saving.

We save to fund future consumption. So let’s start earmarking some uses for our TFSA funds. A great place to start is that list of one-time expenses (new vehicle, home reno, bucket list trip, home “upsize” or a vacation property, financial gifts for your adult children before the will is read). Heck, fund a year-long sabbatical with tax-free money. The point is to assign a purpose to the funds in this account rather than blindly saving forever.

I fully expect that I’ll fill-up my TFSA to the max again someday. But I also expect to drain it again for something intentional. I don’t know what that is just yet, but I know I’ll be glad to have a pot of tax-free money available.

Readers: What plans do you have for your TFSA? A forever investment account? Funding large one-time expenses? A bridge for your early retirement years? A “just in case” reserve? Let me know in the comments.

This Week’s Recap

I introduced my long-awaited DIY Investing Made Easy course to help investors set up and fund a self-directed investing account and buy a single asset allocation ETF.

It’s RRSP season, so I reminded investors about the two-step process of making RRSP contributions (contribute, then invest).

It’s also (almost) tax season, so here’s the difference between tax deductions and tax credits.

Finally, many thanks to Mark McGrath for this excellent piece on 8 overlooked ways to save tax in retirement.

Weekend Reading:

Morgan Housel nails it with this piece in the Globe & mail: The art of spending money – and what it reveals about who you really are.

The Fleischman Is In Trouble effect – on the plight of the so-called working rich.

Here’s Ben Carlson on the psychology of market tops and market bottoms.

A pandemic boom attracted scores of Americans seeking gains. Now amateur investors are retreating to the sidelines.

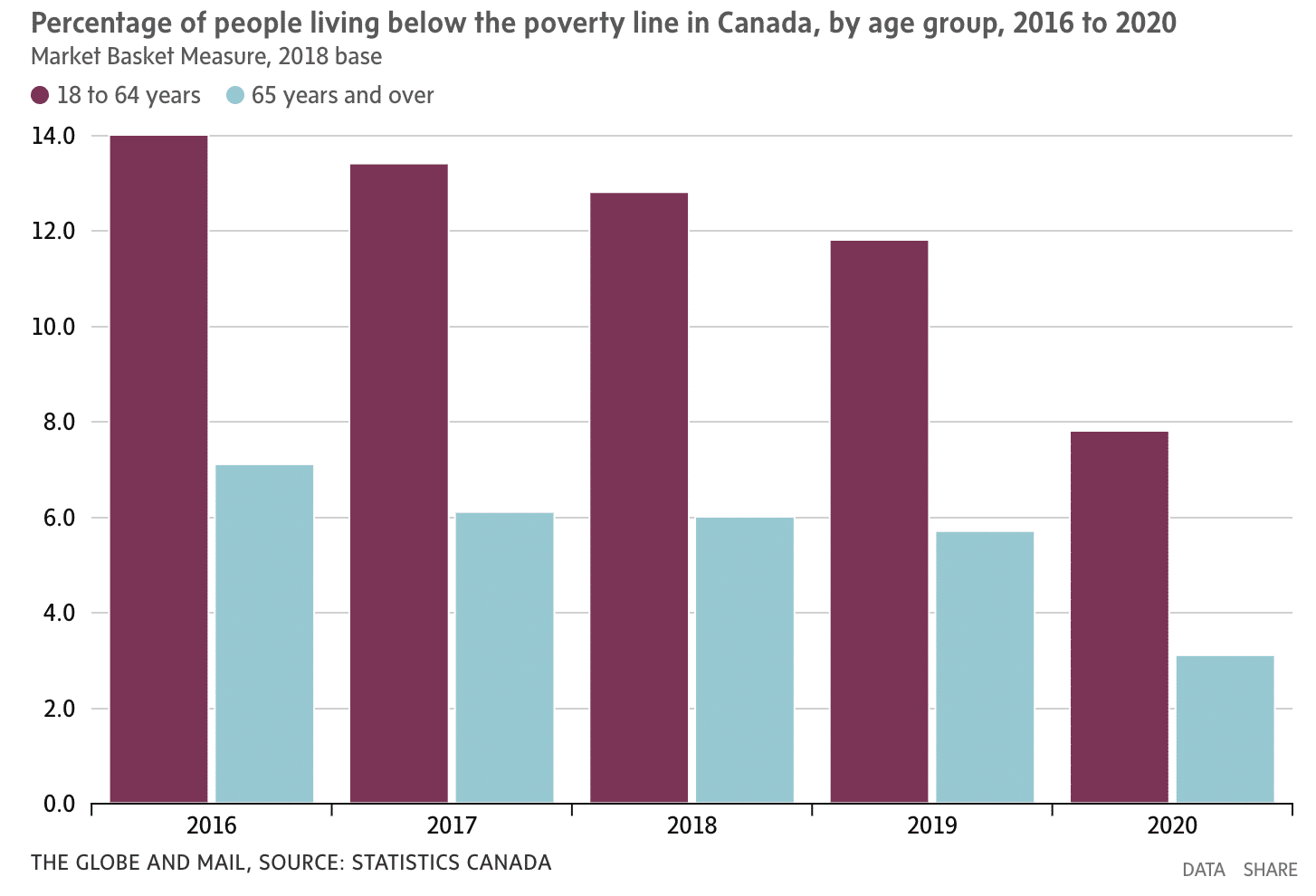

There’s an ongoing trope about poor seniors eating cat food in their old age. That couldn’t be farther from the truth, with just 3.1% of seniors living below the poverty rate (subs):

Andrew Hallam says predicting the stock market is impossible. Human emotions move asset prices, not economics.

Well-respected economics professor Trevor Tombe says the Bank of Canada did its job: Rising interest rates and inflation look to be ending.

Bob French answers the question, exactly how long is the long-term when it comes to investing?

Fred Vettese says future investment returns may be lower. That means younger Canadians will need to save more than their parents for retirement (subs).

Doug Boneparth looks at Gurus Gone Wild – three of the most dangerous types of content on social media.

Jonathan Clements looks at four financial planing and investing concepts that are helpful in theory, but may not work as intended in the real world.

PWL Capital’s Justin Bender shows DIY investors how to invest their kids’ RESP money over time using low cost ETFs:

Rob Carrick shares five tips for navigating an increasingly tricky GIC market (subs).

Here’s Mark McGrath again, this time on the My Own Advisor blog talking about the taxation of investment income in a corporation.

A hidden paradise. Andrew Hallam says this retirement location may be the world’s best kept secret.

Finally, FP Canada is lobbying the federal government for a financial planning tax credit. This is one of the most common questions I get from clients, as fees charged by fee-only financial planners are not tax deductible.

Have a great weekend, everyone!