Setting up the initial asset allocation for your investment portfolio is fairly straightforward. The challenge is knowing how and when to rebalance your portfolio. Stock and bond prices move up and down, and you periodically add new money – all of which can throw off your initial targets.

Let’s say you’re an index investor like me and use one of the Canadian Couch Potato’s model portfolios – TD’s e-Series funds. An initial investment of $50,000 might have a target asset allocation that looks something like this:

| Fund | Value | Allocation | Change |

| Canadian Index | $12,500 | 25% | — |

| U.S. Index | $12,500 | 25% | — |

| International Index | $12,500 | 25% | — |

| Canadian Bond Index | $12,500 | 25% | — |

The key to maintaining this target asset mix is to periodically rebalance your portfolio. Why? Because your well-constructed portfolio will quickly get out of alignment as you add new money to your investments and as individual funds start to fluctuate with the movements of the market.

Indeed, different asset classes produce different returns over time, so naturally your portfolio’s asset allocation changes. At the end of one year, it wouldn’t be surprising to see your nice, clean four-fund portfolio look more like this:

| Fund | Value | Allocation | Change |

| Canadian Index | $11,680 | 21.5% | (6.6%) |

| U.S. Index | $15,625 | 28.9% | +25% |

| International Index | $14,187 | 26.2% | +13.5% |

| Canadian Bond Index | $12,725 | 23.4% | +1.8% |

Do you see how each of the funds has drifted away from its initial asset allocation? Now you need a rebalancing strategy to get your portfolio back into alignment.

Rebalance your portfolio by date or by threshold?

Some investors prefer to rebalance according to a calendar: making monthly, quarterly, or annual adjustments. Other investors prefer to rebalance whenever an investment exceeds (or drops below) a specific threshold.

In our example, that could mean when one of the funds dips below 20 percent, or rises above 30 percent of the portfolio’s overall asset allocation.

Don’t overdo it. There is no optimal frequency or threshold when selecting a rebalancing strategy. However, you can’t reasonably expect to keep your portfolio in exact alignment with your target asset allocation at all times. Rebalance your portfolio too often and your costs increase (commissions, taxes, time) without any of the corresponding benefits.

According to research by Vanguard, annual or semi-annual monitoring with rebalancing at 5 percent thresholds is likely to produce a reasonable balance between controlling risk and minimizing costs for most investors.

Rebalance by adding new money

One other consideration is when you’re adding new money to your portfolio on a regular basis. For me, since I’m in the accumulation phase and investing regularly, I simply add new money to the fund that’s lagging behind its target asset allocation.

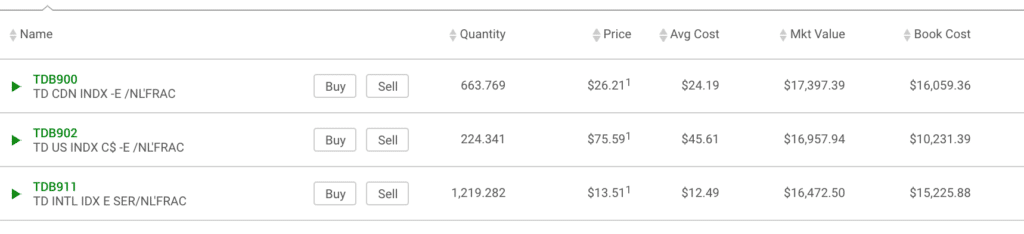

For instance, our kids’ RESP money is invested in three TD e-Series funds. Each month I contribute $416.66 into the RESP portfolio and then I need to decide how to allocate it – which fund gets the money?

My target asset mix is to have one-third in each of the Canadian, U.S., and International index funds. As you can see, I’ve done a really good job keeping this portfolio’s asset allocation in-line.

How? I always add new money to the fund that’s lagging behind in market value. So my next $416.66 contribution will likely go into the International index fund.

It’s interesting to note that the U.S. index fund has the lowest book value and least number of units held. I haven’t had to add much new money to this fund because the U.S. market has been on fire; increasing 65 percent since I’ve held it, versus just 8 percent each for the International and Canadian index funds.

One big household investment portfolio

Wouldn’t all this asset allocation business be easier if we only had one investment portfolio to manage? Unfortunately, many of us are dealing with multiple accounts, from RRSPs, to TFSAs, and even non-registered accounts. Some also have locked-in retirement accounts from previous jobs with investments that need to be managed.

The best advice with respect to asset allocation across multiple investment accounts is to treat your accounts as one big household portfolio.

That’s easier said than done if you’ve got multiple accounts held at various banks and investment firms. The goal in this case should be to simplify your portfolio and, if possible, hold the same portfolio across all accounts to avoid complexity and confusion.

This goes counter to the idea of keeping fixed income in your RRSP, and Canadian equities in your TFSA, for example.

In my experience, the simpler the portfolio, the easier it is to manage and stick to for the long-term. Imagine the nightmare of trying to rebalance multiple portfolios with different asset allocation targets whenever you add new money and as stocks and bonds move up and down.

Related: Top ETFs and Model Portfolios for Canadians

My investment accounts are super easy to manage today, with my RRSP, TFSA, and LIRA all invested in Vanguard’s VEQT. The beauty of these asset allocation ETFs is that they are a wrapper containing multiple ETFs, each representing different stock and bond indexes from around the world. The funds are then automatically rebalanced for you to always maintain their initial target mix.

If you prefer to hold multiple index funds or ETFs in your accounts, aim to keep the same asset mix across all of your accounts to avoid complexity. Follow a rebalancing strategy by date or by threshold and stick to it. And, when adding new money, contribute to the fund that’s lagging behind its target weight.

Ideally, you can avoid rebalancing altogether by using an asset allocation ETF (VBAL, VGRO, etc.), or by investing with a robo advisor where they automatically rebalance your portfolio for you.

Final thoughts

Your original target asset mix is arguably the most important decision when it comes to building your investment portfolio. Over time, as your investments produce different returns, your portfolio drifts away from that initial target, exposing it to risks that might not be compatible with your goals.

Rebalancing your portfolio reduces that risk exposure and increases the likelihood of achieving your desired long-term investment returns. The other benefit of a rebalancing strategy is that it forces you to buy low (i.e. the lagging fund) and sell high (or at least avoid buying as much of the high-performing fund).

Do you have a question about rebalancing your portfolio? Ask away in the comments below:

Canada Mortgage and Housing Corporation (CMHC) made headlines last week when its housing market outlook predicted that national housing prices would fall 9-18% over the coming months due to the coronavirus crisis. This week, Canada’s largest default insurer took significant steps to change its underwriting policies for insured mortgages.

The following changes, which take effect July 1, will apply for new applications for homeowner transactional and portfolio mortgage insurance:

- Limiting the Gross/Total Debt Servicing (GDS/TDS) ratios to our standard requirements of 35/42 (down from 39/44);

- Establish minimum credit score of 680 (up from 600) for at least one borrower; and

- Non-traditional sources of down payment that increase indebtedness will no longer be treated as equity for insurance purposes (no more borrowed down payments).

Rob McLister of RateSpy.com reports that CMHC’s new debt-ratio policy will cut homebuyers’ purchasing power by up to 11%.

“For example, someone earning $60,000 with no other debt and 5% down could afford approximately 10.9% less home under CMHC’s new rules.”

Despite crackdowns against zero-down mortgages and cash-back mortgage schemes, a Mortgage Professionals Canada survey reported that 20% of down payment funds from first-time buyers came from borrowed sources.

From CMHC:

“Starting July 1, 2020, borrowers must pay the down payment from their own resources. These eligible traditional sources of down payment may include savings, the sale of a property, non-repayable financial gift from a relative, funds borrowed against their liquid financial assets, funds borrowed against their real property, or a government grant.”

Not only is CMHC forecasting a major decline in house prices, it also sees the ratio of household debt to disposable income (already at record highs of 176%) climbing to more than 200% in 2021. In a statement, CMHC said these new measures are intended to curtail excess demand and household indebtedness.

The bleak housing outlook and tightened lending standards are all in response to the economic fallout from COVID-19 that saw Canadians lose more than 3 million jobs in March and April. Statistics Canada reported a bounce back in May, with Canada’s economy adding 290,000 jobs last month.

But University of Calgary associate professor Trevor Tombe says the effective unemployment rate, which includes the drop in hours and labour force participation, looks much worse than the official unemployment data suggests:

Effective unemployment rates in May. This captures the official unemployment + the drop in hours and labour force participation. Better measure of labour market slack post-COVID in #cdnecon pic.twitter.com/fw6MlabwPO

— Trevor Tombe (@trevortombe) June 5, 2020

The economy will recover. There’s no doubt about that. The question remains, what type of recovery will we see? An economy that rebounds as quickly as it crashed is known as a V shaped recovery and that would be considered an optimistic best-case scenario.

Other possibilities include a U shaped recovery, which includes a longer period of economic pain followed by a gradual improvement, or a W shaped recovery with starts and stops over many months as we struggle to contain the virus.

Finally, there’s the dreaded L shaped recovery that indicates a long and slow path back to normal. This path may be reserved for the hardest hit industries such as tourism and entertainment.

This Week’s Recap:

I wrote about tackling changes to your retirement income plan, using a real life case study from a Wealthsimple client.

Over on Young & Thrifty I answered the question: should I move my investments during the stock market turmoil?

In my debut writing for Greedy Rates I explained how to start investing for beginners.

I also wrote about how to start investing in oil.

Promo of the Week:

Big banks pay next to nothing on their so-called high interest savings accounts. Savers looking to keep pace with inflation often turn to promo chasing – moving their savings around to various online banks and credit unions who offer short-term teaser rates.

If you’re like me, though, you’d prefer to leave your savings in one bank that pays a high everyday interest rate. For me, that has been EQ Bank’s Savings Plus Account, which currently pays 2% interest.

EQ Bank recently reached $3 billion in deposits, and sign-ups for new accounts have tripled in the three months since the pandemic hit.

They’ve also introduced a refer-a-friend program where new customers will receive a $20 bonus when they set up and fund an account with $100 within 30 days. That’s like earning a full year’s interest on a $1,000 balance, just for signing up.

Open an EQ Bank Savings Plus Account with my referral link, get a $20 bonus, and start earning a higher everyday interest rate on your savings.

Weekend Reading:

Our friends at Credit Card Genius look at credit card trip cancellation insurance and how the author saved $1,282 by making a claim.

Five year fixed rate mortgages are the most popular mortgage term in Canada and, as one Ontario real estate agent learned, there are stiff penalties for breaking these mortgages – this one to the tune of $30,000.

The Globe and Mail’s Rob Carrick reintroduces his Real Life Ratio as a simple tool to help the next wave of home buyers from overspending.

If you follow the mortgage market then you’ve likely noticed HSBC often leading the way with some of the lowest rates in Canada. They’ve just introduced the lowest advertised five-year fixed rate ever at 1.99%.

Of Dollars and Data blogger Nick Maggiulli tackles the racial wealth gap in this deep look into economic inequality in America.

Why does this wealth gap exist between black and white households? Systemic racism is at the heart of the problem. This video explains what systemic racism is, how it affects all aspects of life in America (and, let’s face it, here in Canada too) and what we can do to solve it:

From panic buying to hoarding, Preet Banerjee shows us how COVID impairs our financial decisions.

My Own Advisor Mark Seed explains why the 4% rule is actually still a decent rule of thumb for drawing down your portfolio.

Why distinguished finance professor Ken French uses a financial advisor:

“It’s just somebody who can act as a sounding board — clarifying the trade-offs we encounter in lots of areas of our lives. It saves us time and an enormous amount of anxiety. There are lots of questions we wouldn’t even know to ask without the help from our adviser.”

The S&P 500 fell 34% in just 23 trading days, reaching its low on March 23. Since then, the market has rallied by 40%. What gives? A Wealth of Common Sense blogger Ben Carlson shares why massive up and down moves in the same year are more common than you think.

Ben’s Animal Spirits partner in crime Michael Batnick explains why automating your purchases is the simplest and most effective way to invest for your future.

Finally, Erica Alini of Global News looks at why dividend stocks have stumbled amid the coronavirus crisis. Indeed, the dividend aristocrats index (represented by iShares’ CDZ) is down more than 18% YTD compared to the broad market (TSX) which is down just 7.10% on the year.

Have a great weekend, everyone!

Spending money is easy. Saving and investing is supposed to be the difficult part. But there’s a reason why Nobel laureate William Sharpe called “decumulation”, or spending down your retirement savings, the nastiest, hardest problem in finance.

Indeed, retirement planning would be easy if we knew the following information in advance:

- Future market returns and volatility

- Future rate of inflation

- Future tax rates and changes

- Future interest rates

- Future healthcare needs

- Future spending needs

- Your expiration date

You get the idea.

We can use some reasonable assumptions about market returns, inflation, and interest rates using historical data. FP Standards Council issues guidelines for financial planners each year with its annual projection assumptions. For instance, the 2020 guidelines suggest using a 2% inflation rate, a 2.9% return for fixed income, and a 6.1% return for Canadian equities (before fees).

We also have rules of thumb such as the 4% safe withdrawal rule. But how useful is this rule when, for example, at age 71 Canadian retirees face mandatory minimum withdrawals from their RRIF starting at 5.28%?

What about fees? Retirees who invest in mutual funds with a bank or investment firm often find their investment fees are the single largest annual expense in retirement. Sure, you may not be writing a cheque to your advisor every year. But a $500,000 portfolio of mutual funds that charge fees of 2% will cost an investor $10,000 per year in fees. That’s a large vacation, a TFSA contribution, and maybe a top-up of your grandchild’s RESP. Every. Single. Year.

For those who manage their own portfolio of individual stocks or ETFs, how well equipped are you to flip the switch from saving to spending in retirement? And, how long do you expect to have the skill, desire, and mental capacity to continue managing your investments in retirement?

Finally, do you expect your spending rate will stay constant throughout retirement? Will it change based on market returns? Will you fly by the seat of your pants and hope everything pans out? What about one-time purchases, like a new car, home renovation, an exotic trip, or a monetary gift to your kids or grandkids?

Now are you convinced that Professor Sharpe was onto something with this whole retirement planning thing?

Changes To Your Retirement Income Plan

One solution to the retirement income puzzle is to work with a robo advisor. You’ll typically pay lower fees, invest in a risk appropriate and globally diversified portfolio, and have access to a portfolio manager (that’s right, a human advisor) who has a fiduciary duty to act in your best interests.

Last year I partnered with the robo advisor Wealthsimple on a retirement income case study to see exactly how they manage a client’s retirement income withdrawals and investment portfolio.

This article has proven to be one of the most popular posts of all-time as it showed readers how newly retired Allison and Ted moved their investments to Wealthsimple and began to drawdown their sizeable ($1.7M) portfolio.

Today, we’re checking in again with Allison and Ted as they pondered some material changes to their financial goals. I worked with Damir Alnsour, a portfolio manager at Wealthsimple, to provide the financial details to share with you.

Allison and Ted recently got in touch with Wealthsimple to discuss new objectives to incorporate into their retirement income plan.

Ted was looking to spend $50,000 on home renovations this fall, while Allison wanted to help their daughter Tory with her wedding expenses next year by gifting her $20,000. Additionally, Ted’s vehicle was on its last legs, so he will need $30,000 to purchase a new vehicle next spring.

Both Allison and Ted were worried how the latest market pullback due to COVID-19 had affected their retirement income plan and whether they should do something about their ongoing RRIF withdrawals or portfolio risk level.

Furthermore, they took some additional time to reflect on their legacy bequests. They were wondering what their plan would look like if they were to solely leave their principal residence to their children, rather than the originally planned $500,000.

What would their maximum attainable after-tax income be going forward under this new scenario? Lastly, they wondered about the risk of their assets being prematurely depleted if they were to follow this strategy.

Providing Alternative Strategies

Wealthsimple pairs human experience with artificial intelligence to produce an updated and tax-optimized withdrawal strategy that is tailored to their clients’ goals and ever-changing circumstances.

In this instance, Allison and Ted should withdraw the $50,000 required this year from their $150,000 non-registered portfolio, as well as the $50,000 needed next year from the same bucket.

“Luckily, the market downturn of December 2018 allowed us to systematically implement tax-loss harvesting strategies on Allison’s and Ted’s joint non-registered account, and the majority of the unrealized capital gains accumulated since can be offset using prior realized capital losses.”

Furthermore, the $100,000 which will be needed over the next 12-18 months can be temporarily parked in a Wealthsimple Cash account earning a competitive interest rate while eliminating any downside risk associated with funding of their new short-term goals.

This would allow Allison and Ted to fund their new expenditures without increasing their overall taxable income, therefore not risking any Old Age Security (OAS) clawbacks or sacrificing tax-preferred growth in their RRIF or TFSA accounts.

Despite being invested in a balanced portfolio at Wealthsimple, Allison and Ted felt uneasy during the most recent market pullback in March 2020. It was the velocity of the market downturn which took them by surprise.

Conversely, they were pleasantly surprised when comparing their performance with that of their previously owned bank brokerage portfolio.

“More importantly, however, their new estate goal allows them to explore some interesting options which may enable us to better align their true risk tolerance to their new aspirations.”

If they were to leave $280,000 in liquid assets to their children instead of the originally planned for $500,000, they would do just fine with a more conservative 35% equity and 65% fixed income portfolio. Alternatively, they could increase their annual after-tax spending from $80,000 to $90,000 per year with the same conservative allocation and deplete their investable assets by age 95.

Probabilities of Success

The first alternative would offer a higher probability of success, since the portfolio’s returns would be less volatile over Allison’s and Ted’s retirement horizon, due to the more conservative asset allocation.

This would reduce the dispersion of potential outcomes and lower the risk of experiencing a significant drawdown of investable assets, especially during their early retirement years.

A steep market correction in a retiree’s early days can have an amplified impact when examined over a 30-year retirement horizon (a concept known as sequencing risk).

Under the first scenario, the probability of success would be approximately 90% with a 10% risk of ruin (i.e. depletion of investable assets before the age of 95).

In the full asset depletion scenario, with a $90,000 after-tax retirement income, the probability of success would be closer to 70%. The latter may not be acceptable to Allison or Ted as they feel strongly about not having to rely on their principal residence to fund any shortfalls (aka the nuclear option).

Furthermore, they believe that the associated longevity risk is too high (i.e. living past age 95) – based on their family’s history of a long and healthy lifestyle.

Final Thoughts

Retirement planning can be hard enough in the initial stages. It also takes great care to tackle changes to your retirement income plan as you move through retirement.

In my conversation with Wealthsimple’s Damir Alnsour, we agreed that highlighting case studies and analyzing other scenarios can provide invaluable information – not only to clients like Allison and Ted, but also to any Canadian currently faced with the “nastiest, hardest problem in finance.”

He said risk-based insights help empower their clients to make more informed, educated, and statistically backed decisions, resulting in a set of clear trade-offs.

I agree, and when my own fee-only planning clients end up moving their investments to Wealthsimple I know they will be presented with options that are sensible and objective for their unique circumstances, enabling them to achieve what truly matters to them and their loved ones.

Curious about moving over to a robo advisor? You can book an appointment to speak with a Wealthsimple portfolio manager today about your personal retirement scenario.