This is the story of why we ditched our Endy mattress and chose Novosbed for our remodelled bedroom.

Four years ago, my wife and I wanted to replace our 12-year-old Sealy Posturepedic mattress. We heard about the bed-in-a-box trend – dozens of brands were selling foam mattresses online and shipping them directly to consumers – and so we decided to investigate. We pored over countless reviews and comparisons before testing out three different queen mattresses: one from Endy, Casper, and Bear. Ultimately, we chose the Endy mattress and slept comfortably on it for the next three-and-a-half years.

We remodelled our bedroom late last year (because who hasn’t renovated something during these times) and decided to upgrade to a king bed. That meant we needed a new mattress and, naturally, Endy was our first choice.

We paid $950 for an Endy king mattress and received it within a few days. After unboxing the mattress and letting it form to size, we laid down and something didn’t feel right. We had a horrible sleep that night! The mattress was not as firm and did not feel like the same material that was used in our old Endy queen mattress.

Of note, Endy was purchased by Sleep Country in November 2018. I reached out to Endy’s customer care team, and they confirmed that something had indeed changed:

“Yes, we did change the materials from a few years ago to now, we use air capsules whereas before we were using a cooling gel.”

In addition, the quality did not seem the same. It wasn’t as firm, or as thick as our previous mattress. The Endy ‘specs’ said the mattress was 10” thick but ours didn’t even reach 8” thickness after 48 hours. Also, the corners of the king mattress didn’t lie flat, they curled up.

Novosbed Review

Disappointed with our new king mattress we returned the Endy and started the shopping process all over again. We heard great things about Novosbed, which is another Canadian-owned and operated company selling mattresses online.

In fact, Novosbed launched the world’s first risk-free sleep trial back in 2009. They expanded their line-up of mattresses over the years to include brands like Douglas, Logan & Cove, Recore, and Brunswick to name a few. Now rebranded as GoodMorning.com, they’re one of Canada’s largest independent online-only mattress retailers.

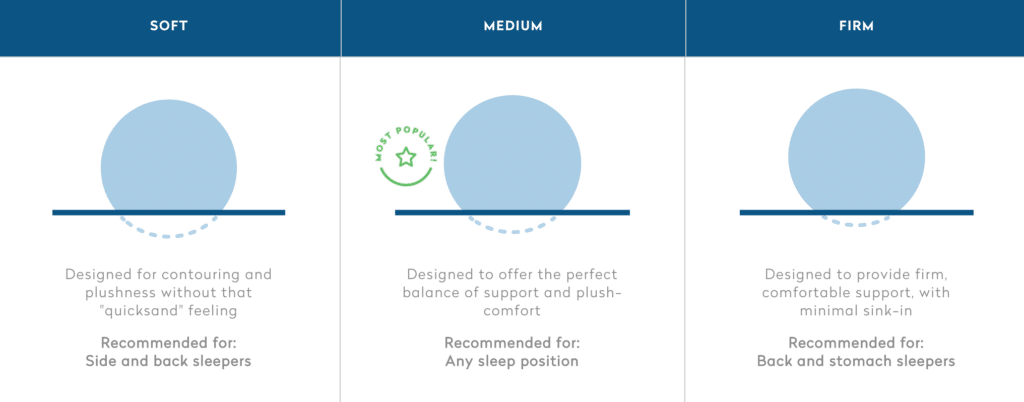

What we liked immediately about Novosbed is that they offered three choices of firmness instead of a one-size-fits-all choice like Endy and most other foam mattress retailers offer.

To select the appropriate firmness option Novosbed has a handy questionnaire and recommendation tool online. It includes the following questions:

- Do you sleep by yourself or with a partner?

- Height and weight of you and your partner

- Are you a side, back, or stomach sleeper?

My wife and I prefer a firmer mattress and so we chose The Novosbed – Firm.

Novosbed Pricing:

Novosbed describes itself as an affordable luxury mattress. It’s made of premium, high-density memory foam and is made in North America. Their mattresses come in the following sizes and price points:

| Size | Price |

| Twin | $999 |

| Twin XL | $1,099 |

| Full / Double | $1,199 |

| Queen | $1,399 |

| King | $1,599 |

| California King | $1,599 |

Shipping is free and usually takes 1-7 business days within Canada. Each Novosbed comes with a machine-washable cover. Shoppers can choose from three ‘firmness’ options (soft, medium, or firm) and the mattresses are 11” thick.

Sleep Trial

Novosbed has a generous 120-night sleep trial, one of the longest in the industry. If you don’t like your Novosbed mattress you can return it within the 120-night sleep trial and Novosbed will issue a full refund and make arrangements for the mattress to be picked up (typically gets donated to a local charity).

Novosbed also lets you fine-tune the firmness. After 30 nights, if you’re not in love with your mattress, Novosbed will send you a free Comfort+ kit to make your mattress firmer or softer.

Our experience with Novosbed

We ordered our Novosbed King mattress through GoodMorning.com and received it within three business days. The mattress-in-a-box is heavy and took two of us to lug it up the stairs and into our bedroom.

We unboxed it, removed the plastic wrap, and rolled it out onto the bed frame. The mattress decompresses within about 30 minutes but takes around 24 hours to reach its full intended comfort.

It can take some time to adjust to a foam mattress if you’re used to sleeping on a spring mattress. For us, since we had slept on a foam mattress for four years, we knew after the first night that this mattress was “the one”.

We’d say the Novosbed firm mattress is slightly firmer than our old Endy queen mattress, but not as firm as the Bear mattress that we tested out years ago. The Novosbed mattress provided the firmness we were looking for with a comfortable ‘sink’ that hugs you while you sleep.

We’re thrilled with our Novosbed king mattress and are now enjoying our remodelled bedroom. If you’re looking to make a mattress change or upgrade your sleep experience, I’d highly recommend checking out Novosbed.

*GoodMorning.com provided product in exchange for my honest review. All opinions are my own.*

It’s hard to put into words the impact Vanguard has made on the investment industry and for individual investors. Perhaps Warren Buffett described it best when he paid tribute to the late Vanguard founder Jack Bogle in 2019:

“Jack did more for American investors as a whole than any individual I’ve known.”

Vanguard brought its famous low-cost investing products to Canada 10 years ago. To say they’ve made a positive impact north of the border would be a tremendous understatement.

Since 2011, Vanguard Canada has launched 37 ETFs that have attracted nearly $47 billion in assets under management (AUM). They’re the third largest ETF provider in Canada by AUM and have captured nearly 14% of the ETF market. This, despite offering fewer than 4% of the total number of ETF products on the market.

More impressively, since Vanguard’s entrance into the Canadian market, the average MER for its ETFs in Canada has gone down significantly– from 0.27% to 0.17%. And the average MER of all ETFs in Canada is now at 0.37%. This is known as the Vanguard effect – where competitors take notice of Vanguard’s low-cost approach and tend to reduce their fees accordingly.

Clearly Vanguard has been a catalyst for change and has helped transform the Canadian investment landscape for the better.

Vanguard Canada highlights

Vanguard’s most popular ETF is the Vanguard S&P 500 Index ETF (VFV), which has attracted more than $6.5 billion in assets. It’s the sixth largest ETF in Canada overall (as of December 31, 2021).

That’s followed closely by Vanguard’s US Total Market Index ETF (VUN), which has $5.3 billion in assets and is the 10th largest ETF, then Vanguard’s FTSE Canada All Cap Index ETF (VCN), with more than $4.7 billion in assets, and Vanguard’s Canadian Aggregate Bond Index ETF (VAB), with more than $3.6 billion in assets.

Vanguard launched a game-changing suite of asset allocation ETFs in 2018 (VCNS, VBAL, VGRO), followed by the addition of VCIP, VEQT, and later VRIF. These unique products have proven to be enormously popular among DIY investors, led by Vanguard’s Growth ETF Portfolio (VGRO), with nearly $3.3 billion in assets (as of December 31, 2021).

Imitation is the sincerest form of flattery, and Vanguard’s main competitors have all launched their own line-ups of asset allocation ETFs, giving Canadian investors even more choice when it comes to building simple, low cost, globally diversified portfolios.

Tim Huver, Vanguard Canada’s head of intermediary sales, told me that the firm is pleased with the interest in VRIF, Vanguard’s Retirement Income ETF. This fund invests in a balanced portfolio of 50% global stocks and bonds and targets a 5% annual return with a 4% annual distribution.

I asked Mr. Huver how VRIF has performed, and he said the fund returned 7.56% in 2021 and met its target payout of 4%. Vanguard increased the per unit distribution on VRIF by 3.65% for 2022.

With niche ETFs such as space innovation, clean energy, and cryptocurrency proliferating across the landscape, I asked Mr. Huver if Vanguard plans to launch any thematic or sector specific funds in the near future:

“We’re focused on providing core building blocks for investors at a low cost. There are no crypto ETFs on the horizon for Vanguard.”

Good to know.

Vanguard’s Impact On My Investing Journey

My own investing journey has been positively impacted by Vanguard’s entrance into the Canadian ETF market.

Prior to 2015, I invested in Canadian dividend paying stocks. ETFs started becoming more and more popular among DIY investors, but a globally diversified portfolio required an unwieldy number of ETFs. I recall some of the Canadian Couch Potato model portfolios including 8-12 individual products.

Then in mid-2014 Vanguard introduced its FTSE Global All Cap ex Canada Index ETF (VXC). This product gave investors exposure to U.S., international, and emerging market stocks with just a single ETF. It was the catalyst for me to switch from dividend investing to index investing.

In January 2015 I sold all my individual stocks and set up my two-ETF portfolio of VCN (Canada) and VXC. I called it my four-minute portfolio.

Four years later, Vanguard launched the all-equity VEQT. I sold my two-ETF portfolio and consolidated into VEQT. That’s exactly how I invest to this day, holding VEQT inside my RRSP, TFSA, LIRA, and Corporate Investing account.

Investing in a single-ticket ETF has simplified my life for the better. VEQT holds more than 13,000 global stocks and rebalances regularly to maintain its target asset mix.

I can honestly say I pay little to no attention to my portfolio or even to broader day-to-day market movements. Contrast that with my individual stock portfolio, which had me tracking the daily ups-and-downs and stressing over company-specific news. Or even with my two-ETF portfolio, which had me tinkering over the appropriate home country bias.

Readers and my fee-only financial planning clients have asked me why I chose Vanguard products over other comparable ETFs. The answer is that I’ve always admired Vanguard, from their founder Jack Bogle’s folksy wisdom to its ownership structure (the parent company Vanguard Group is effectively owned by its mutual fund investors), to the Vanguard effect on reducing mutual fund and ETF fees in whatever market they enter.

Yes, some competitor-launched ETFs may cost slightly less than Vanguard’s offerings. But Vanguard is not known for being the second lowest cost investment provider. Fees on core products will continue to decrease in the coming years as Vanguard continues to grow and their products scale.

Thanks to Vanguard Canada for the insight into its impact on the Canadian ETF market over the last decade. Their success means that their investors, including me, have also succeeded in reaching their investing goals.

A good portion of my financial planning clients are in what I’d call the retirement readiness zone, meaning they are 1-5 years away from retirement. They want a check-up on their financial situation and answers to big burning questions like, when can I retire, how much money can I spend, how long will my money last, and how to withdraw from my savings and investments to create the retirement income I need.

Here is a checklist of things to consider when you find yourself in the retirement readiness zone:

How much do I spend?

I get that many people are turned off by budgeting and tracking expenses, but it’s important to understand what it costs to live your life.

Instead of relying on rules of thumb, like you’ll spend 70% of your final salary in retirement, I find that most of my clients want to maintain their current standard of living, if not enhance it with additional spending on travel and hobbies.

Determine your true after-tax spending, including items like property taxes and home & auto insurance that will be with you for life. Add in your desired annual spending on travel and hobbies, and build in a buffer for small unplanned expenses such as replacing an appliance or doing modest home improvements or repairs.

This spending amount is what will drive the decisions around how much to withdraw from your investments, when to take CPP & OAS, and how long your money will last at that spending rate.

Plan your one-time expenses

Besides your regular after-tax spending, you should also factor one-time expenses into your plan. In my experience, the majority of these expenses will include vehicle replacement, travel beyond the ordinary (ex. bucket list trip to Europe), home renovations, and monetary gifts to adult children or grandchildren.

It’s not practical to assume your spending will stay static every single year. Build these one-time expenses into your plan over the next 10-20 years so you have a better and more realistic understanding of what you can afford and how to access these funds.

What you’ll find is that instead of static spending of, say, $65,000 per year, you’ll have several years of spending $75,000 to $85,000 (or more) to cover these one-time costs.

Estate planning

Make sure to update your will and estate planning documents, including the beneficiaries on your insurance and investment accounts.

Consider giving with a warm hand (otherwise known as give while you live) to your children or favourite charity. What I mean is rather than leaving hundreds of thousands, or even millions, in your estate at 90 years old, consider making smaller gifts to your beneficiaries throughout your lifetime.

Some examples include a gift towards a downpayment, help funding the grandkids’ RESPs, and footing the bill for a family vacation with adult kids and grandkids.

In case I die file

It’s common for one spouse to take the lead on financial matters for the household. But this can be problematic if something happens to the chief financial officer of the house – if they predecease their spouse or become cognitively impaired and can no longer manage the finances or investments.

The biggest risk is when the household CFO is an older, male spouse who self-manages the entire portfolio of investments. Men are statistically more likely to die earlier than women. If the surviving spouse has never been involved in the finances or investments, they could be left with an unwieldy mess.

Make an “in case I die” file that includes a checklist of items like notifying Service Canada of your death (for CPP and OAS), transferring registered accounts to the surviving spouse’s name, cancelling credit cards, removing your name from joint accounts and other bills, to name a few.

One recommendation for DIY investors to consider is if their non-financial spouse would be able to manage the investments on their own. Often there are several accounts to manage and certain “systems” in place that the DIY investor has managed for years but may not be easily picked up by the non-financial spouse. This is doubly true for retired clients who are drawing down their portfolios in a particular order.

If the non-financial spouse would just as soon take everything and hand it over to the friendly banker, then the years of careful investing and monitoring may be quickly undone.

In this case I strongly recommend using a robo advisor in your later retirement years. The robo advisor will assign you a risk appropriate, low cost, globally diversified portfolio. They’ll automatically rebalance the portfolio and set up automatic withdrawals linked directly to your bank account to meet your monthly income needs. Best of all, you do have access to human advice to make changes and ask questions about your investments. It’s really a hidden gem of an investment management service for retirees.

Psychologically switching from saving to spending

If you’ve been a diligent saver throughout your career you may find it difficult to turn off the savings taps and turn on the spending taps in retirement.

I’ve helped build retirement plans for clients with reasonable after-tax spending assumptions. Several years later and they’ve never come close to those spending projections, instead continuing to squirrel away money in their TFSA and non-registered savings.

More than just the numbers, retirement is about designing the lifestyle you want to live. It would be a shame not to use the resources you’ve saved over many years to build your ideal retirement. Yet many retirees who have more than enough resources will agonize over buying an RV or small vacation home, renovating their home, or travelling abroad.

What you’ll end up with is the Scrooge McDuck retirement plan, swimming in money in your 80s and 90s instead of spending a sensible amount to build your desired lifestyle.

When to take CPP and OAS

There’s good evidence that shows how deferring CPP to age 70 leads to more lifetime income. Yet the most common ages to take CPP are at 60 and at 65.

If you have sufficient access to other financial resources (pension, RRSP, non-registered savings) you should strongly consider deferring CPP to lock in a 42% increase in your benefits (more like 50% when you factor in inflation adjustments).

It’s at the very least worth understanding your options. I’d recommend using www.cppcalculator.com to get an accurate estimate of your CPP benefits at different ages, and reaching out to Doug Runchey at the same website if you have a more complicated CPP scenario to calculate.

There’s less of an incentive to delay your OAS benefits, so taking it at the earliest age of 65 is perfectly reasonable. However, this depends on when you plan to retire, how large of an RRSP/RRIF you have, whether you plan to sell a rental property or have large unrealized capital gains. It makes sense to defer OAS if your income will push you into OAS clawback territory.

Being tax aware

One comment I hear a lot from prospective clients is how they want to pay as little tax as possible in retirement. While we should all be tax aware and strive to be as tax efficient as possible, we shouldn’t let the tax tail wag all of our financial decisions.

For one, the vast majority of us will pay much less tax in retirement than we did during our working years. Retirees are able to split eligible pension income with their spouse (defined benefit pension income, or RRIF withdrawals starting at age 65). They’ll also qualify for the pension income tax credit.

We also spend from already taxed non-registered savings, and capital gains are taxed favourably. TFSA withdrawals are tax-free, which can be handy for larger one-time expenses throughout retirement. We also get that contribution room added back to our TFSAs the following calendar year.

It’s quite common for me to see average tax rates below 5% for early retirees (before 65), and around 10-12% once they start collecting government benefits and withdrawing more from their RRIFs. And that’s for clients who were paying average tax rates of between 18-25% during their working years.

Final Thoughts

As you can see, there’s a lot to think about when it comes to planning your retirement. When you are 1-5 years away from retiring, a checklist like this can be helpful to get yourself into the retirement readiness zone.

One important decision I didn’t address is how to decide on an actual retirement date. By going through a checklist like this early enough, and potentially getting help from a financial planner, you’ll find out how prepared you are both psychologically and financially for retirement.

You might find you need to delay your retirement by a year or two to shore up your finances. Or, you might find that you can meet all of your retirement goals and can retire much earlier.

The danger in not going through a retirement readiness checklist is falling into the “one-more-year” trap and continuing to work when you don’t have to, or being fixed on an early retirement date even though you won’t have enough resources to sustain your needs in retirement.