It’s generally not wise to voluntarily take up to a 36% reduction in income, especially if that income is paid for life. But that’s exactly what happens when retirees choose to take CPP at age 60.

I’m a big proponent of delaying CPP up to age 70 to help protect against longevity risk and enhance your monthly pension benefit in retirement. Only a small percentage of retirees do so, however, as many prefer to take CPP as soon as they’re eligible.

Why Take CPP at Age 60?

Taking CPP early may not be the most optimal financial decision but there are a few cases where it can make sense. Here are three reasons to take CPP at age 60:

1). You Need to Eat and Pay the Bills

Maybe you were laid off in the latter stages of your career and struggled to return to the workforce, or you had to retire early due to poor physical health. Whatever the case, you’re about to turn 60 and need to build an income stream.

Simply put, without sufficient income or personal savings to carry you through your 60s you may have no choice but to take CPP as early as possible.

The earliest you can take your CPP benefits is one month after your 60th birthday. Doing so means a 36% permanent reduction in your monthly benefit, but that’s still money in your pocket today.

The maximum payment amount for taking CPP at age 65 is $17,196 per year (2025). That amount would be reduced to $11,005.44 per year if you elect to take CPP at 60.

Taking that income of $11,000 at age 60 could mean the difference between meeting your retirement income goals or not, and that needs to be weighed against having to wait five years for an extra $6,200 (or so) a year.

Finally, if you’re sure that you will be eligible for the Guaranteed Income Supplement (GIS) once you reach 65, it’s generally a good idea to take CPP at age 60.

2). You Have a Reduced Life Expectancy

The biggest mystery in retirement planning is that we don’t know how long our money needs to last because we don’t know when we’ll die.

By age 60 you may have some idea. Whether it’s genetics, poor health, or the results from your 23andMe test, if you have any reason to suspect a shortened life expectancy then taking CPP at 60 can make good financial sense.

Understand your breakeven point for taking CPP early. For instance, you’ll be ahead financially if you take CPP at age 60 and don’t live past age 69. If you make it to 85, then the optimal age to take CPP is 69.

For context, a 60-year-old Canadian, on average, can expect to live another 25 years. So if you’re playing the averages then it’s best to delay CPP.

Lastly, if you’re thinking about taking CPP early because of poor health, you should apply for a CPP disability pension instead. If approved, the CPP disability amount will always be higher than a retirement pension and it will convert to a full retirement pension at 65.

3.) You Have No Contributions from age 55 to 60

Did you retire at age 55? Or maybe leave your career as a salaried employee to start a business in your fifties? Business owners can choose to pay themselves dividends rather than a salary, and therefore would not have to make CPP contributions. How do those years of zero contributions affect your CPP retirement benefit?

Related: When Should Early Retirees Take CPP?

When you take CPP at 60, your benefits are based on your best 35 years of earnings, rather than your best 39 years of earnings if you were to take it at 65. Depending on your earnings from age 18 to 54, your CPP payments might still be close to the maximum if you take it at age 60, but it will definitely be reduced if you wait until age 65.

Two reasons not to take CPP at age 60

Forget the notion of taking CPP early and investing. This idea, likely brought to you by your friendly neighbourhood financial sales person advisor, sounds compelling in theory but can be a disaster in practice.

Remember, the CPP is taxable income so you won’t be able to invest the full amount unless it’s in an RRSP. Then take investment fees into account and consider how much will you need to earn to beat the guaranteed 7.2% return that comes with delaying CPP by a year?

No, it’s better to defer and receive a larger pension that’s guaranteed and inflation protected for life.

Finally, if you’re concerned about whether CPP will be around when it’s time to collect, or whether the government of the day will raid the fund to pay its debts, let’s put that idea to rest.

The Canada Pension Plan Investment Board (CPPIB) is independent of the CPP and run at arms length of federal and provincial governments. The fund has been audited by an independent actuary and found to be sustainable for at least the next 75 years (using conservative projections).

CPP will be there for you in retirement. The question is when do you plan to collect your benefits?

One reason why retirement planning is so challenging to think about is because we often go from receiving one income stream (our T4 salary income) to juggling several different income streams throughout retirement.

Even more confusing is the fact that those retirement income streams often can (or should) arrive at different times and may have different tax treatments.

Why do you need a retirement plan?

Consider that you might draw an income from the following sources in retirement:

- Defined benefit pension

- RRSP or RRIF

- LIF

- TFSA

- Non-registered investments

- Non-registered savings

- Corporation

- CPP

- OAS

Let’s explore a potentially dizzying array of decisions.

Members of a defined benefit pension plan will have to make a tricky decision about when to retire (early and reduced, earliest unreduced, or normal retirement date). Then they’ll need to select from a menu of joint and survivor options (100%, 67%, 60%, 50%) with or without a 5, 10, or 15 year guarantee if you die early.

Those with a spouse are required to choose a joint life pension option that leaves their spouse a percentage of the monthly pension payments if they die first, however your spouse can sign a waiver giving up their rights to this benefit.

You can withdraw from an RRSP at any age before it must collapse at the end of the year you turn 71.

A RRIF conversion must be done at that time, but it can happen earlier and might make the most sense at 65 when RRIF income becomes eligible pension income and can be split with a spouse or common law partner.

A LIRA to LIF conversion has to wait until at least age 55 in most cases, and similarly must be done by the end of the year you turn 71. This conversion can also come with another decision around unlocking 50% to 100% of the LIF (depending on the jurisdiction) to move into a more flexible RRSP or RRIF.

TFSA withdrawals can be done at any time and for any reason, and withdrawals are completely tax free. The added bonus is that you get the contribution room back the following year after a withdrawal is made. But it might be wise to leave your TFSA funds intact to act as a margin of safety or tax-free pot of money for your beneficiaries.

Small business owners have the added complexity of winding-down their corporation by withdrawing funds personally via dividends.

Those with non-registered investments need to consider capital gains from the sale of stocks or funds that have appreciated in value over the years. Capital gains are taxed favourably, since only 50% (half) of the gain is considered taxable and added to your income (but only when sold). Investment income earned from dividends and interest are taxable in the year received.

Non-registered savings from a regular savings account is money that you have already paid tax on earlier, although as explained above the interest income earned is fully taxable in the year received.

Then there are your government benefits (CPP and OAS) to consider.

You can take your CPP as early as age 60, but it’s often a mistake to do so because of the permanent 36% early take-up penalty. Taking CPP at 65 would be considered your normal retirement age with no penalty. And those who can wait to take their CPP at 70 will see their benefits rise by 42% (plus inflation adjustments).

OAS, meanwhile, cannot be claimed earlier than 65 but will automatically start at that age unless you tell Service Canada otherwise. As long as you’ve lived in Canada for 40 years between 18 and 65 you’ll get 100% of your entitled OAS benefits (before clawback considerations). Subtract 2.5% for every year that you were not in Canada during that time. Delaying OAS to age 70 will lead to 36% more in benefits (plus inflation adjustments).

Putting the Puzzle Pieces Together

In my advice-only financial planning practice I explain to clients that I’m trying to help them fit their retirement income puzzle pieces together in the most tax efficient way to meet their retirement spending needs.

I liken it to trying to get your car out of the parking garage in one of those 3D puzzle games.

Some puzzle pieces need to be moved aside to make room for other income streams to come online.

For instance, it’s now widely accepted that most Canadians are going to get more lifetime income if they delay taking CPP until 70. But I don’t want you to delay living your best early retirement lifestyle until 70 when your benefits kick-in. We’re just going to get the income from somewhere else, like your RRSP or RRIF with perhaps a top-up from non-registered funds.

The result from shifting these puzzle pieces around is that you maximize your lifetime spending and minimize your lifetime taxes.

Indeed, we can fool ourselves into keeping our tax rate extremely low in our 60s by drawing from our non-registered savings and TFSA, only to discover we’ve kicked a major tax problem down the road when the inevitable collision of taxable income from our RRIF, CPP, and OAS begins in our 70s.

Our Retirement Income Plan

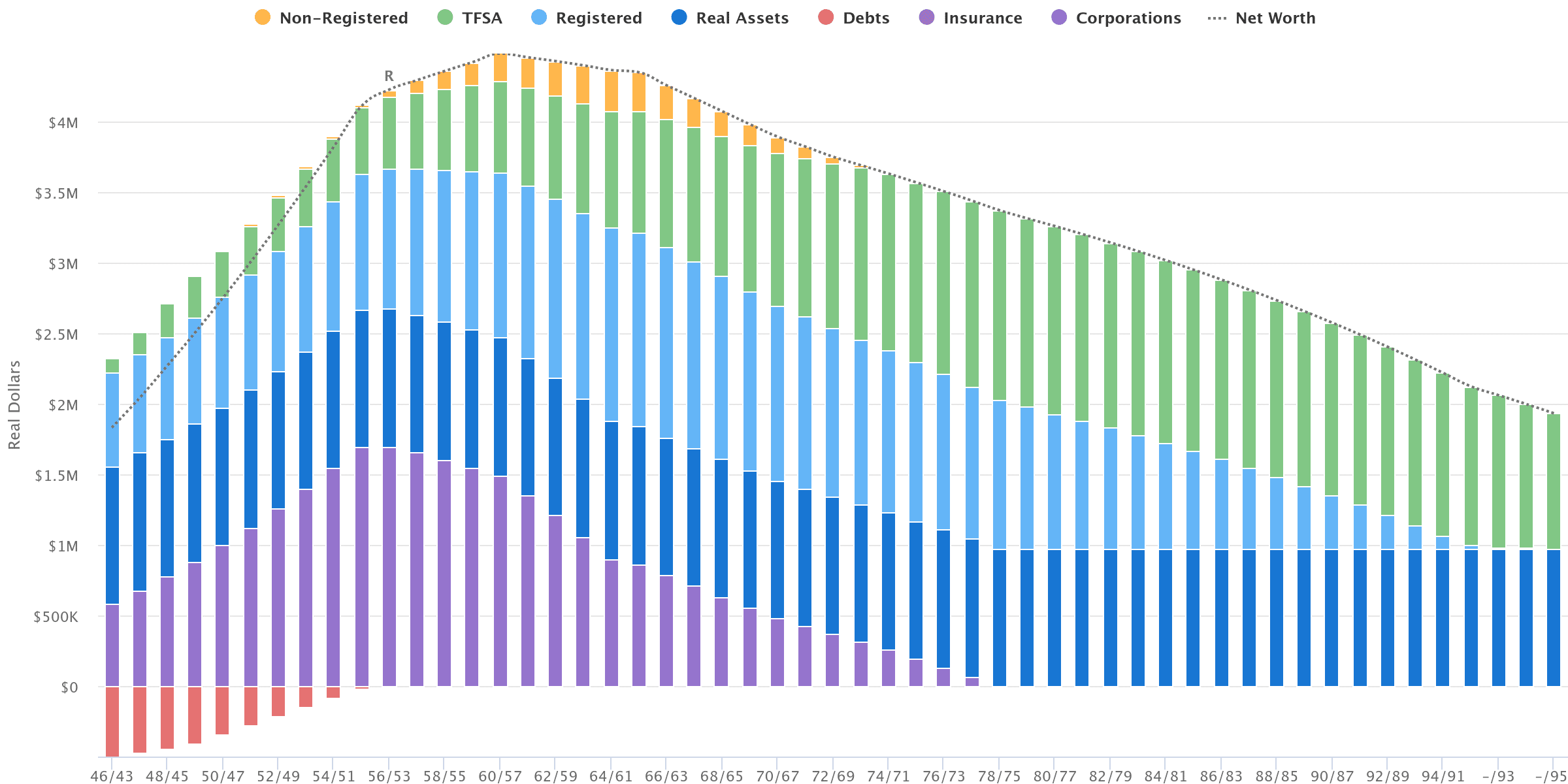

My wife and I have more complicated finances than most regular T4 salaried employees because we’re incorporated and have built up significant assets inside our corporation that will need to be withdrawn in retirement.

So we need to be extra careful designing our retirement income to meet our desired lifestyle spending while also keeping tax efficiency in mind.

This takes a delicate approach that is highly influenced by our retirement date, or when we stop earning an income.

Work too long, and the window shrinks to get funds out of the corporation before CPP and OAS and ever-increasing RRIF and LIF minimum withdrawal requirements kick-in.

Retire too early (and spend too much) and you risk exhausting your resources before CPP and OAS come to the rescue.

With that in mind, my idea is to stop working full-time in 10 years (55), work at 50% capacity for five years (60) and then at 25% capacity for five more years (65).

This gradual reduction in earnings while maintaining current spending means that the balance inside the corporation will start to decline as soon as age 56. Ideally, we’d exhaust our corporation before age 70 – but according to the chart shown above we’d still have corporate funds until 78.

That’s not as tax efficient as I’d like, but it’s a direct product of still working in some capacity until age 65. And I think my own sense of purpose and well-being is more important than having the most optimized and tax efficient retirement plan.

In summary: retire earlier if you want to optimize your tax efficiency.

I’d also convert my RRSP and LIRA to a RRIF and LIF at 65 to take advantage of pension income splitting. This means the amount of dividends we’d withdraw from the corporation will decrease to make room for the incoming RRIF and LIF income – allowing our average tax rates to remain smooth and consistent even as new puzzle pieces enter the fray.

CPP and OAS benefits will be moved out of the way (delayed to 70) to allow for these significant withdrawals, which is fine by me because I’ll take the enhanced and guaranteed income later in retirement.

Finally, there’s the TFSA. Unlike some people, we do not treat our TFSAs as an untouchable source of funds. Yes, it makes sense to keep our TFSAs intact as long as possible and take advantage of that tax free growth. But we also want to maximize our life enjoyment, and that will mean using the TFSA to top-up our spending once other income sources dry up.

We also need to consider one-time expenses that are more difficult to plan for such as vehicle replacement, home renovations or repairs, early financial gifts to kids, and bucket list type travel and experiences.

In my view, a TFSA is a great place to draw from to fund those one-time expenses in retirement as the withdrawal is tax-free, does not affect your OAS benefits, and you get the contribution room back the following year.

Final Thoughts on Retirement Income

My wife and I will go from receiving one income stream each in our working years to dealing with a combined 12 different income streams or sources in retirement.

- Corp (2)

- RRIF (2)

- LIF (1)

- CPP (2)

- OAS (2)

- Non-registered savings (1)

- TFSA (2)

Each of these puzzle pieces needs to be carefully placed to maximize growth, maximize income, and minimize taxes. And because life happens and goals change, nobody (and I mean nobody) is going to do this with absolute perfection.

But you can see why even the most financial literate person or the most sophisticated do-it-yourself investor might want to work with a financial planner to build a retirement plan, model out some scenarios to see what’s possible, and to stress-test their own ideas.

Clearly it’s not as straightforward as simply withdrawing 4% from your portfolio and adjusting for inflation. Which portfolio? We don’t have one bucket of money called retirement savings. You might have 8-12 different income sources to consider.

If you’re five years or less away from retirement, it’s worth reaching out to an advice-only planner to help fit all of your retirement income puzzle pieces together.

‘Our life is frittered away by detail… simplify, simplify.’ – Henry David Thoreau

I’ve fielded all types of questions from clients and readers over the years looking for that one magic hack or some shortcut to building wealth. Usually these half-baked ideas come from a friend, relative, colleague, or an unscrupulous advisor, or a random Reddit thread.

Should I buy a rental property? What about commercial real estate? Airbnb? Private credit?

Should I do the Smith Manoeuvre? Open a margin account? Trade options?

Should I buy a whole life insurance policy? Should I borrow from an existing insurance policy? Have you heard of infinite banking?

Should I invest in tech stocks? Crypto? This triple leveraged ETF? Covered calls?

My advice, in general, is that you need to have the basics looked after first before even considering a riskier or more complex strategy.

That includes having a simple money philosophy to follow:

- Utilize employer matching savings plans (contribute enough to max out the match, but no more).

- Optimize your RRSP (optimizing your RRSP can mean contributing enough to bring your taxable income down to the bottom of your highest marginal tax bracket. Or it can mean not contributing at all if you’re in a lower tax bracket).

- Maximize your TFSA (striving to contribute up to your lifetime limit and, once you’ve caught up, maxing out your annual room each year).

- Prioritize short-term goals (list all of your other goals such as a house down payment, funding a parental leave, a new car, a dream vacation, non-registered investments / early retirement fund, extra mortgage payments, etc. and then acknowledge that you can’t fund them all at once. Prioritize and direct any extra cash flow here).

Inside your RRSP and TFSA, know that investing has largely been solved with low-cost index funds. Buy the entire market for as cheap as possible and move on with your life.

Further to that, investing complexity has been solved with something called an asset allocation ETF (an all-in-one “single-ticket” solution).

These registered accounts are no place to speculate on individual stocks or the thematic fund-of-the-day. If you swing and miss on an investment, you lose that contribution room forever and don’t even get the benefit of claiming a capital loss for your misfortune.

Indeed, you’re going to have a great deal of financial success if you can simply take advantage of your workplace matching plans, optimize RRSP contributions, maximize TFSA contributions, prioritize short-term goals (including your own personal spending and happiness), and invest your retirement savings in low cost index funds.

This other stuff is something I call “what’s next?” money.

You have a preference for real estate and want to buy a second property? That’s what’s next, after the basics are fully funded.

Your advisor is pitching you on an investment loan? That’s what’s next, after the basics are fully funded.

You want to put some money into the latest thematic fad of the day (AI, psychedelics, clean energy, etc.)? That’s what’s next, after the basics are fully funded (and, please, in a non-registered account and not your TFSA).

I am fighting for simplicity in my financial life. I want all of my investment accounts in one brokerage platform. I invest in a single ETF in each of those accounts. I have a plan to pay off my mortgage within 10 years (and before I retire).

I have no interest in buying a rental property (worst nightmare).

I don’t use leverage. If you’re not satisfied with the investment returns from global equities then perhaps you need to increase your savings rate, not use leverage to try and amplify the gains.

Warren Buffett famously quipped

“You really don’t need leverage in this world much. If you’re smart, you’re going to make a lot of money without borrowing.”

It’s true. You can get rich by saving a good amount into your RRSP and TFSA and investing in simple low cost index funds.

Why needlessly complicate your life chasing extra dollars – potentially putting a good financial plan at risk if it doesn’t work out?

As Thoreau said, “simplify, simplify.”

This Week’s Recap:

It has been a while since my last weekend reading update. Since then I’ve published the following stand alone articles:

Your ultimate guide to RRIFs: Strategies, pitfalls, and the secret sauce to retirement income. That one was a big hit.

At the end of the year I updated my net worth and looked ahead to this year’s financial goals.

And I posted my 2024 investment returns along with the returns from Vanguard’s and iShares’ suite of asset allocation ETFs.

Weekend Reading:

A Wealth of Common Sense blogger Ben Carlson shows how good years in the stock market tend to cluster.

Welcome to the roaring 2020s, where every single year has seen a big stock market move (one way or another).

Morningstar shares six retirement financial myths to avoid.

For retirees, why amortization based withdrawal works better than safe withdrawal rates.

Christine Benz shares the best of the Long View 2024 – clips from interviews with financial planners, advisors, and retirement researchers over the past year.

If it’s possible to beat the market, as Warren Buffett has for longer than I’ve been alive, why would anyone settle for boring market returns with index funds?

What a massive cash windfall could mean for your retirement plans.

The Walmart effect: New research suggests that the company makes the communities it operates in poorer – even taking into account its famous low prices.

Finally, one of the top minds in financial planning Aaron Hector shares how he’s providing financial literacy for his kids.

Have a great weekend, everyone!