“I don’t invest in my RRSP anymore because I’ll have to pay tax on the withdrawals.” This type of thinking around RRSPs has become increasingly common since the TFSA was introduced in 2009.

The anti-RRSP crowd must come from one of two schools of thought:

- They believe their tax rate will be higher in the withdrawal phase than in the contribution phase, or;

- They forgot about the deduction they received when they made the contribution in the first place.

No other options prior to TFSA

RRSPs are misunderstood today for several reasons. For one thing, older investors had no other options prior to the TFSA, so they might have contributed to their RRSP in their lower-income earning years without realizing this wasn’t the optimal approach.

Related: The beginner’s guide to RRSPs

RRSPs are meant to work as a tax-deferral strategy, meaning you get a tax-deduction on your contributions today and your investments grow tax-free until it’s time to withdraw the funds in retirement, a time when you’ll hopefully be taxed at a lower rate. So contributing to your RRSP makes more sense during your high-income working years rather than when you’re just starting out in an entry-level position.

Taxing withdrawals

A second reason why RRSPs are misunderstood is because of the concept of taxing withdrawals. The TFSA is easy to understand. Contribute $6,000 today, let your investment grow tax-free, and withdraw the money tax-free whenever you so choose.

With RRSPs you have to consider what is going to benefit you most from a tax perspective. Are you in your highest income earning years today? Will you be in a lower tax bracket in retirement? The same? Higher?

The RRSP and TFSA work out to be the same if you’re in the same tax bracket when you withdraw from your RRSP as you were when you made the contributions. An important caveat is that you have to invest the tax refund for RRSPs to work out as designed.

Future federal tax rates

Another reason why investors might think RRSPs are a bum-deal? They believe federal tax rates are higher today, or will be higher in the future when it’s time to withdraw from their RRSP.

Is this true? Not so far. I checked historical federal tax rates from 1998-2000 and compared them to the tax rates for 2018 and 2019.

The charts show that tax rates have actually decreased significantly for the middle class over the last two decades.

Someone who made $40,000 in 1998 would have paid $6,639 in federal taxes, or 16.6 percent. After adjusting the income for inflation, someone who earned $59,759 in 2019 would pay $7,820 in federal taxes, or just 13.1 percent.

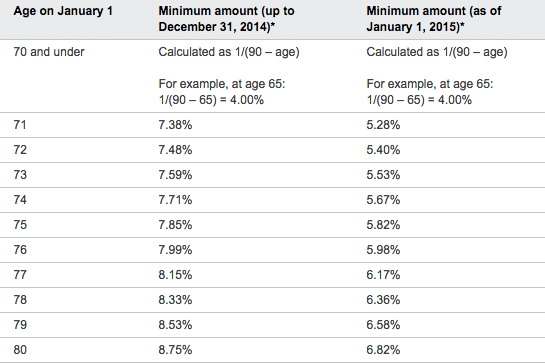

Minimum RRIF withdrawals

It became clear over the last decade that the minimum RRIF withdrawal rules needed an overhaul. No one liked being forced to withdraw a certain percentage of their nest egg every year, especially when that percentage didn’t jive with today’s lower return environment and longer lifespans.

In 2015 the federal government made changes to the minimum RRIF withdrawal table, bringing it more in-line with today’s reality:

The dreaded OAS clawback

Canadians who receive Old Age Security and have annual income between $75,910 and $123,386 will have all or part of their OAS pension reduced. This clawback is especially concerning for retirees whose minimum RRIF withdrawals push them over the income threshold.

Canada Revenue Agency uses the following example on its website:

The threshold for 2018 is $75,910.

If your income in 2018 was $86,000, then your repayment would be 15% of the difference between $86,000 and $75,910:

$86,000 – $75,910 = $10,090

$10,090 x 0.15 = $1,513.50

You would have to repay $1,513.50 for the July 2019 to June 2020 period.

This is a legitimate concern for retirees. No one wants to lose out on benefits that they’re entitled to receive. An advisor or tax accountant can help you determine a strategy that best optimizes your retirement withdrawals.

One such strategy is to make small withdrawals from your RRSP between the ages of 60-70 and delay taking CPP and OAS until age 70. This reduces the size of your RRSP for when you are forced to convert it into an RRIF and make mandatory withdrawals. It also increases your CPP and OAS benefits by 42 percent and 36 percent, respectively.

Related: CPP Payments – How Much Will You Receive From Canada Pension Plan

Canada Child Benefit

Parents with children aged 17 and under can be eligible to receive a tax-free monthly payment from the Canada Child Benefit. The CCB is a means-tested program, so the more income your household earns the less money you receive from this government program.

The Canada Child Benefit is completely phased out when your income is between ~$157,000 and ~$206,000, depending on the number of eligible children in your family.

The government uses adjusted net family income to determine how much you’ll receive from the program. Since RRSP contributions reduce your net income, it could be wise for young families to prioritize RRSP contributions ahead of TFSA contributions to reduce their net family income and help them receive more from the Canada Child Benefit the following year.

RRSP Matching

Some lucky employees work for companies that offer a matching program for your RRSP contributions. This is the best deal out there for savers. A guaranteed 100% return on your contributions. In fact, one could argue that contributing up to the maximum of your company’s RRSP matching program could be prioritized over paying off a credit card balance at 19% interest. It’s that valuable.

A company match will typically have some limits or restrictions. For example, your employer could match contributions up to 5% of your salary with the caveat that you must contribute to a group RRSP plan at a particular bank or investment firm.

It’s important to note that, even if the investment options are terrible high fee mutual funds, you should still contribute the maximum and take advantage of these generous matching dollars. You can always transfer the money over to a low fee indexing portfolio at some point in the future.

Final thoughts on RRSPs

RRSPs aren’t a scam; they’re a still a critical tool for Canadians to save for retirement. They’ve just got a bad rap over the years because of some misguided thinking around withdrawals, taxes, plus the introduction of a new and seemingly better (re: tax-free) savings vehicle.

RRSP contributions are still a key component of my financial plan. I’ve caught up on all of my unused contribution room and so now my goal each year is to max out my contribution limit (which is reduced by my pension contributions).

Related: TFSA Contribution Limit and Overview

TFSAs are great, and they get filled up next. In fact, when we paid off our car loan a few years ago we started catching up on our unused room and maxing out our TFSAs.

Both accounts are valuable parts of our financial plan and, along with my pension, will make up the bulk of our income in retirement.

Savers rejoice! We’re in the midst of a high interest savings war. The battle for your business isn’t being fought by the big banks, but by upstart FinTech companies looking to build up deposits. Indeed, the big five have mostly ignored the high interest savings account market. Why bother, when they’re hauling in record profits elsewhere?

That meant savvy savers had to look elsewhere to stash their cash and keep ahead of inflation.

LBC Digital

The first shot was fired several months ago when the relatively unknown LBC Digital (an offshoot of Laurentian Bank) started promoting its high interest savings account that pays 3.3 percent with no minimum balance required and no monthly fees.

That kind of interest rate was sure to draw wide-spread attention, but the sign-up process and user experience has been clunky at best. LBC also must have been getting some high-roller deposits because they recently changed to a tiered structure that pays 3.3 percent on balances up to $500,000 and 1.25 percent on balances above that threshold.

Time will tell whether the 3.3 percent interest rate is here to stay. Colour me skeptical.

Shades of EQ Bank’s launch four years ago, I thought. Back in 2016, EQ Bank burst on the scene offering a chequing / savings account hybrid that paid a whopping 3 percent interest. Deposits flooded in, and EQ Bank had to temporarily halt new account sign ups until it sorted out its back-end procedures. The 3 percent rate didn’t last long, settling in at a still competitive 2.3 percent everyday interest.

Wealthsimple Cash

Next to make a splash was the always creative and customer-centric Wealthsimple. Last week, the company best known as Canada’s top robo advisor announced a new product – Wealthsimple Cash – a saving and spending account that pays an eye-opening 2.4 percent interest.

Wealthsimple Cash has no monthly account fees or low balance fees. But it’s the ‘coming soon’ features that have people talking. A prepaid Visa card called the Wealthsimple Cash card will allow clients to make purchases from their account like a debit card (anywhere Visa is accepted). Clients will also soon be able to withdraw cash from ATMs across Canada, send e-Transfers, and pay bills. There’s also a promise of no foreign exchange transaction fees coming soon. The Cash card will even be made out of Tungsten metal.

I noticed a lot of confusion about whether Wealthsimple Cash deposits were covered by CDIC (they’re not). Funds are actually protected by CIPF (Canadian Investor Protection Fund) coverage through ShareOwner, Wealthsimple’s custodial broker.

I’m getting lots of questions from readers about the new Wealthsimple Cash account (hybrid chequing / savings with 2.4% interest) and its lack of CDIC coverage. I reached out to clarify what this means, and here’s what I found out:

— Boomer and Echo (@BoomerandEcho) January 23, 2020

EQ Bank

Not to be outdone, EQ Bank surprised everyone when it announced that its everyday rate of 2.3 percent got bumped up to 2.45 percent. The EQ Bank Savings Plus Account has no minimum balance, no banking fees, plus unlimited e-Transfers, bill payments, and EFTs.

Accounts are limited to a $200,000 maximum per customer. All deposits at EQ Bank are also eligible for CDIC deposit insurance.

Tangerine and Simplii

Once thought of as the pioneers of no-fee banking and high interest savings, Tangerine and Simplii (formerly PC Financial) have fallen behind these young upstarts. Both offer a pathetic 1.05 percent on their high interest savings accounts.

Their go-to acquisition strategy is to offer teaser rates for 3-6 months before the interest rate drops back down to 1.05 percent. The current promotion has Tangerine offering 2.75 percent for five months, while Simplii is offering 2.8 percent until May 20.

The Globe and Mail’s Rob Carrick also weighed in on the savings account interest rate war, led by these feisty FinTech upstarts.

This Week’s Recap:

I made a big move with my portfolio this week, switching to Wealthsimple Trade – Canada’s first and only zero-commission trading platform.

WestJet just (temporarily) deposited $50 into my WestJet Dollars account. I wrote about WestJet’s clever marketing trick over on the Rewards Cards Canada blog.

I’m finally getting into a groove after my third full week working from home this year. I’ve been doing a lot more financial planning than I expected – which has been a pleasant surprise. Freelance work has also picked up, so I find my days just fly by.

My wife and I joined a gym nearby and visit there three times a week before lunch to break up the day. I’ve stuck (for the most part) to not working during the evenings or weekends. It’s a tough habit to break when you’ve been used to doing that for a number of years.

We’ve also slowly switched to a plant-based diet (my last taste of beef was an Irish Stew in Dublin last summer). Our reasons are primarily health, environmental, and ethical. The jury is still out on whether this diet is actually saving us money. We tend to buy lots of fresh fruit and vegetables, which are not exactly cheap – especially in the winter.

I’m tracking our food budget more closely and hope to report on any significant difference in our spending. In the meantime, here’s a great post on the How To Save Money blog on cheap vegan food and how much you can save by going vegan.

Weekend Reading:

Our friends at Credit Card Genius have updated the best gas credit cards in Canada for 2020.

The brilliant Morgan Housel uses a weight-loss analogy to explain why wealth is what you don’t spend:

Food “compensation” seduced its way into 90% of the exercisers’ lives. Another study found that “people fresh from the gym overestimated their energy use by up to 400 percent and ate more than twice as many calories” as they had just burned off.

Something obvious but hard to deal with in real time is that exercise only works when its gains aren’t cashed in.

Are active managers really better in downside protection? It’s a common argument against passive investing, but the data doesn’t hold up.

Some good thoughts by Michael Batnick on the active vs. passive debate: Save more, stay invested, and avoid market timing.

Millionaire Teacher Andrew Hallam is such a prolific writer and with his latest post on how to be a great investor he channels his inner Norm Rothery to come up with some wild metaphors:

“The Russian stock market, for example, offers an intoxicating call. It grew faster than a crowd offered free vodka near the Kremlin. It swelled 53.2 percent in 2019, when measured in USD.”

Michael James reports on his 2019 investment returns. Not bad for a newly retired investor!

A great post by My Own Advisor blogger Mark Seed about staying invested even in the face of uncertainty.

In his latest Common Sense Investing video, Ben Felix looks at market forecasts and says there are two big problems with these forecasts – they often make investors nervous, and they are usually wrong:

PWL Capital’s Justin Bender must be the leading expert on foreign withholding taxes in Canada and in his latest blog post takes an in-depth look at FWT on equity ETFs.

Dale Roberts at Cut The Crap Investing says not to let foreign withholding taxes drive the ETF investing bus.

An interesting post by Nick Maggiulli debating whether big tech is taking over the stock market.

Bank of Canada governor Stephen Poloz shares an idea about how splitting home ownership with investors could make housing more affordable.

A Wealth of Common Sense blogger Ben Carlson explains why owning a home is not for everyone.

Preet Banerjee looks at the pain of paying – how the method of paying affects spending and happiness:

Global News updates its annual look at the best cellphone plans in Canada – including which deals are worth the money.

A detailed breakdown of ride sharing versus car ownership and why you might want to ditch your car.

Finally, the real challenge of the next decade is matching your retirement dreams with reality.

Have a great weekend, everyone!

2019 was a terrific year for stock market returns. This bull market has gone on for so long now that investors can’t help but wonder, are we due for a correction this year or in the near future?

It’s a question I get a lot from my clients these days, especially the soon-to-be-retired and the recently retired. Understandably, they want to take some risk off the table in preparation for an inevitable correction.

It makes sense. As we watch stocks continue to reach all-time highs, we want to believe we are “due for a correction”. This type of thinking has occurred several times in the past 10 years, and if you chose to pull money out of the market to avoid a potential correction you would have missed out on even more gains.

The truth is, nobody knows if or when a correction will take place. The best we can do is guess at a range of possible outcomes based on historical returns. As investment blogger Nick Maggiulli points out in the investor’s fallacy, markets are never “due” for anything:

Assume I flip a coin 5 times and get the following result (let H = heads and T = tails):

HHHHH

What is the probability that my sixth flip is also a heads (H)? Assuming the coin is fair (equal likelihood of heads and tails), you already know that the answer is 50%. Because coin flips are an independent process, prior flips have no bearing on future flips.

But it doesn’t feel that way does it?

What’s an investor to do? First of all, we know that any money invested in the stock market is money we won’t need to touch for at least five years. That means, for a retiree or soon-to-be-retiree, you have an appropriate amount of your spending needs in cash (1 year), another bucket of spending in short-term bonds or GICs (3 years), and the balance of your portfolio invested in an appropriate mix of stocks and bonds.

Since we know the long term trajectory of the stock market goes up, we’re not concerned about any short-term volatility. We have four years worth of spending available in easy-to-access cash or fixed income instruments – plenty of time to ride out any market crash and avoid tapping into our investments at an inopportune time.

For younger investors in the accumulation stage, a market correction represents an ideal time to buy stocks at a discount. Again, since you won’t need to touch these invested assets until retirement, a correction should be treated like a buying opportunity as opposed to a scary event.

What want to avoid is the notion that we have any predictive abilities whatsoever when it comes to market events. No one can correctly identify the ideal time to escape a correction, or to get back in to catch the ride up. Indeed, these events tend to happen close together, with the stock market’s worst days followed closely by its best days (and vice-versa).

That’s why it’s best to stay the course with a sensible long-term investment strategy – even at what could potentially be the tail end of a long bull market. The only time you should be worried about a correction is if you need the money within the next five years and haven’t made an appropriate plan to access the cash.

If that describes your situation then now might be a perfect time to consider trimming some of your portfolio gains from last year and building your two retirement income buckets (1 year of spending in cash, 3 years of spending cash in GICs).

This Week’s Recap:

I felt especially grateful that I get to work from home and that I didn’t have to venture out too much in the brutally cold temperatures this week.

Great day to work from home.

Who am I kidding? They’re all great! pic.twitter.com/1b3a3Qw3UW

— Boomer and Echo (@BoomerandEcho) January 13, 2020

Earlier this week I explained the difference between tax deductions and tax credits.

Next, we had a reader story from Kevin who wrote about his ‘mortgage gambit’ where he loaned himself a mortgage from his LIRA.

Promo of the Week:

To help kick-start your 2020 savings, Oaken Financial is giving away a GIC with an opening value of $500 to one lucky winner! How to participate? Simply fill out all required information on this link (takes 1 minute)

At Oaken, you’ll find some of the highest savings rates on the market. You’ll never be surprised with a hidden fee or have to search through fine print. And you’ll always sleep soundly knowing your deposits are eligible for CDIC coverage, up to applicable limits.

Oaken’s contest is open to legal residents of Canada (excluding Quebec) who are over the age of majority in their province/territory at the time of registration. Starts January 13, 2020, 12:01 a.m. ET and ends on January 31, 2020 at 11:59 p.m. ET. Prizes available to be won: 1 x Oaken Financial GIC with an opening value of $500.

Weekend Reading:

Millionaire Teacher Andrew Hallam explains why your financial advisor doesn’t deserve credit for your gains.

Rob Carrick offers some great advice in this column on whether to pay down the mortgage or set aside an emergency fund:

“When you own a home, the pilot light of anxiety about both expected and unexpected costs is never off. The best way to ease this worry is to have financial resources you can draw on.”

I was happy to contribute to this excellent piece by Jonathan Chevreau in MoneySense on mutual fund fees and the future of investment advice.

Dan Bortolotti updated the 2019 Couch Potato Portfolio returns for his model portfolios. Of note:

- Tangerine Balanced Portfolio – 14.06%

- TD e-Series (Balanced) – 14.79%

- 3-ETF Balanced Portfolio – 15.02%

How did your investments perform in 2019? Did your balanced portfolio come close to those returns? If not, maybe it’s time to switch to a passive indexing strategy.

David Aston delivers the definitive answer to the RRSP vs. TFSA debate.

Our friends at Credit Card Genius look at the best small business credit cards in Canada.

Air Miles has a Flight-A-Day Giveaway where you can earn a chance at a $25,000 flight voucher.

Travel expert Barry Choi answers the question: Is the American Express Platinum Card worth the $699 annual fee?

American Express Membership Rewards is arguably the most valuable travel rewards point ‘currency’. Barry Choi explains how the Amex Fixed Points Travel Program works.

Speaking of rewards programs, it’s time for Aeroplan to stop grabbing back the miles of their inactive customers.

Alyssa Davies at Mixed Up Money looks at how meal planning saves you money. Indeed, this budget friendly exercise has saved us thousands of dollars over the years.

Preet Banerjee shares his latest Money School video with a look at how to save money on term life insurance:

Finally, a long but important read on the topic of aging and how we’re using technology (a pacemaker is just one example) to extend our lives – yet what happens when the mind gives out before the machine?

Have a great weekend, everyone!